Contraceptives Market Research, 2030

The global contraceptives market size was valued at $26,321.5 million in 2020 and is projected to reach $50,595.8 million by 2030, growing at a CAGR of 6.5% from 2020 to 2030. Contraception is a method of preventing pregnancy using drugs or a device. It is also known as birth control and fertility control. The devices or drugs used in contraception interfere with the normal process of sperm-ovum fertilization to prevent pregnancy. Rise in focus towards the need of family planning and preventing unintended pregnancy fuels the market growth. In addition, increase in use of contraception in young women and rise in higher educational attainment propels the market growth. Moreover, health issues associated with teenage pregnancies, increase in awareness of modern contraception, and rise in use of oral pills as a key method to avoid unplanned pregnancy further drive the contraceptives market growth.

High absorption rate, and rise in participation of reproductive women in labor force, and high awareness about contraceptive products among population, which drives the growth of the global contraceptive market. In addition, rise in disposable income of population in developing countries such as India, Brazil, Africa, and others, which in turn, rise in adoption of contraceptives products, boost the growth of the global contraceptives market. For instance, the disposable income of Indian population grew by 1.8% from 2019 to 2021. However, health risks associated with the use of contraceptives, availability of alternate contraceptive methods, and lack of social acceptance might adversely affect the contraceptives market growth. Contraceptives market forecast from 2020 to 2030.

Major players such as Cooper Companies, Veru Inc., Pfizer Inc. and others are adopting the acquisition strategy to improve their product portfolio to maintain competition in the market. For instance, in March 2021, Cooper completed the acquisition of a privately-held medical device company that designed and developed an innovative obstetric product for use in urgent obstetrics to reduce risks associated with childbirth, which is expected to provide contraceptives market opportunity.

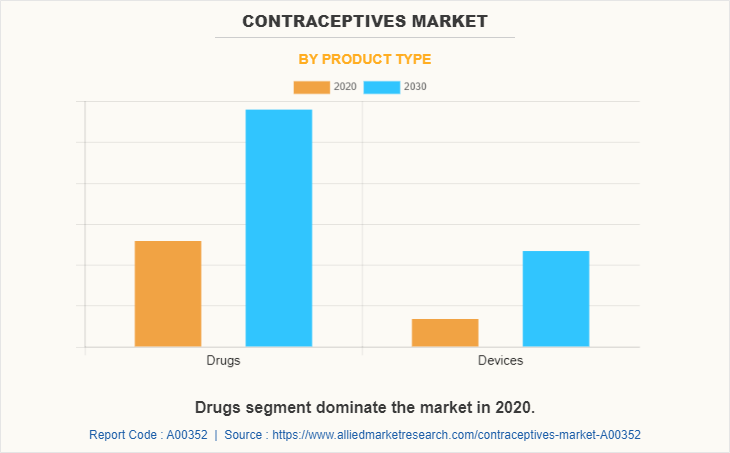

The contraceptives market is segmented on the basis of product, age group, end user, and geography. Contraceptive drugs and devices are two major product categories of the contraceptives market. Contraceptive drugs are further categorized into oral (pills), injectable, and topical contraceptives. The oral contraceptives industry is the largest within the contraceptive drug market owing to the widespread use of oral pills by women. This is mainly because they are proven to be highly effective, up to 99% in preventing pregnancy. Drugs segment have highest contraceptives market size.

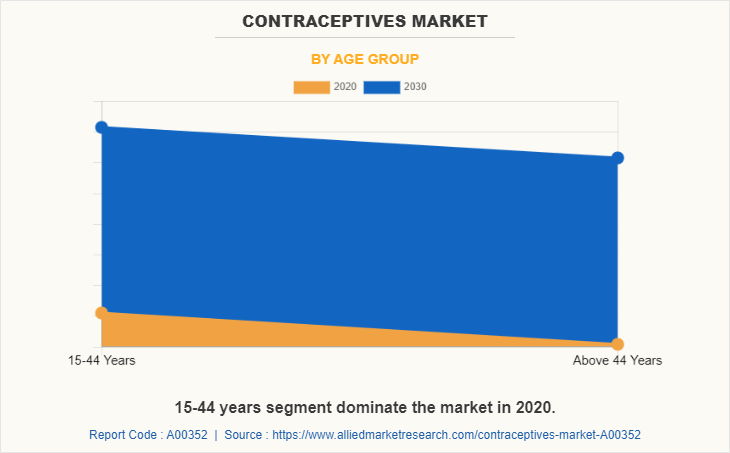

In addition, contraceptive devices are further categorized into condoms, IUDs, diaphragms, sponges, patches, implants, and vaginal rings. In terms of revenue, condoms are the most commonly used contraceptive devices, accounting for around two-thirds of the contraceptives market share in 2020. However, IUDs’ gain momentum and are expected to grow at a faster pace during the forecasting period. By age group, the market is divided into 15-44 years, and above 44 years. 15-44 years segment has contraceptives market share in 2020.

On the basis of end user, the market is segmented into households, clinics, and hospitals. Households segment has highest contraceptives market share in 2020.

The COVID-19 pandemic forced many companies in the global contraceptives industry to halt business operations for a short term to comply with new government regulations to curb the spread of the disease. This halt in operations directly impacts revenue flow of the global contraceptives market. In addition, halt in manufacturing of industrial products was witnessed due to lack of raw materials and manpower das lockdowns were imposed during the COVID-19 pandemic. Further, no new consignments were received by companies operating in this sector. Hence, halt in industrial activities and lockdowns for several months affected the global contraceptives industry and the market is anticipated to witness a slow recovery during the forecast period.

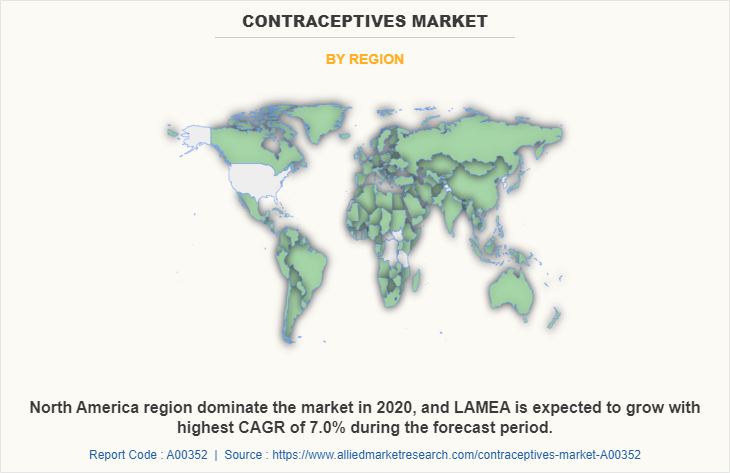

By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA. The North America region is expected to hold the highest contraceptives market share during the forecast period.

COMPETITION ANALYSIS

The report provides a comprehensive analysis of the key players that operate in the contraceptives market, namely, Veru Inc., Teva Pharmaceutical Industries Limited, Abbvie Inc., Bayer AG, Pfizer, Inc., Cooper Companies, Inc., Ansell LTD., Mayer Laboratories, Merck & Co., Inc., and Church & Dwight, Co., Inc.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the contraceptives market analysis from 2020 to 2030 to identify the prevailing contraceptives market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the contraceptives market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global contraceptives market trends, key players, market segments, application areas, and market growth strategies.

Contraceptives Market Report Highlights

| Aspects | Details |

| By Product Type |

|

| By Age Group |

|

| By End User |

|

| By Region |

|

| Key Market Players | Veru Inc, The Cooper Companies Inc, Church & Dwight Co Inc, Bayer AG, Ansell Ltd, Mayer Laboratories Inc, Merck & Co Inc, Abbvie Inc, Pfizer Inc, Teva Pharmaceutical Industries Limited |

Analyst Review

Utilization rate of contraceptive drug and devices is expected to increase due to rise in incidence of sexually transmitted diseases (STDs) and need for birth control. The contraceptives market has piqued the interest of healthcare providers due to benefits offered by these devices to prevent unwanted pregnancy.

The household segment dominated the market in 2020, due to the use of user-friendly contraceptive methods such as pills, condoms, and patches among others. Contraceptive manufacturers have focused on marketing novel contraceptives for household users through various media, such as television, internet, and others.

Technological advancements in contraceptives have led to the introduction of advanced contraceptive options for population control, transmission of STDs, and prevention of unwanted pregnancy. Rise in incidence of sexually transmitted diseases (STDs), growing numbers of unwanted pregnancies, technological advancements, and increasing emphasis on the prevention of immature pregnancy and abortions are some of the driving factors of the market. However, lack of reimbursement policies and high cost of new contraceptive devices hamper the market growth. Currently, the oral contraceptive or pill segment has the largest revenue share in the contraceptives market, followed by condoms. Novel contraceptive solutions, such as implants, vaginal rings, and others are in high demand across developed countries due to high disposable incomes and rise in awareness about these products.

North America is the most promising regional market for contraceptive drugs and devices. Government organizations and NGOs have taken initiatives towards population control, prevention of unintentional pregnancies, and transmission of sexually transmitted diseases among low-income groups, which have led to upsurge in demand for contraceptives in Asia-Pacific.

The households segment is the most attractive market, owing to increase in need for these devices during emergency and high effectiveness in women undergoing family planning. In addition, emerging markets gain importance due the growing population in these regions. Rapid growth in shipments of these devices and drugs was observed to provide improved healthcare services in the emerging nations, especially in Japan. This is expected to offset the challenging conditions in mature markets, such as North America and Europe.

A rise in need for abortion are the upcoming trends in the contraceptives market.

A contraceptive drugs are the leading application of contraceptive market.

North America region holds the largest market share for contraceptives market.

The market size for contraceptives market was $26,321.5 million in 2020 and is expected to reach $50,595.8 million by 2030.

Bayer AG, Abbvie Inc are some of the companies holds the largest share for contraceptives market.

Loading Table Of Content...