Contract Packaging Market Overview

The Global Contract Packaging Market Size was valued at $52.1 billion in 2021, and is projected to reach $102.8 billion by 2031, growing at a CAGR of 6.9% from 2022 to 2031. The contract packaging market has experienced strong growth, driven by rising manufacturing activities and the increasing presence of small and medium-sized manufacturers. Expanding global and domestic trade, along with growing consumer demand, has further boosted the market. Additionally, population growth and rising disposable incomes continue to create new opportunities for contract packaging across various industries.

Market Dynamics & Insights

- The contract packaging industry in Asia-Pacific held a significant share of over 45.7% in 2021.

- The contract packaging industry in China is expected to grow significantly at a CAGR of 7.1% from 2022 to 2031.

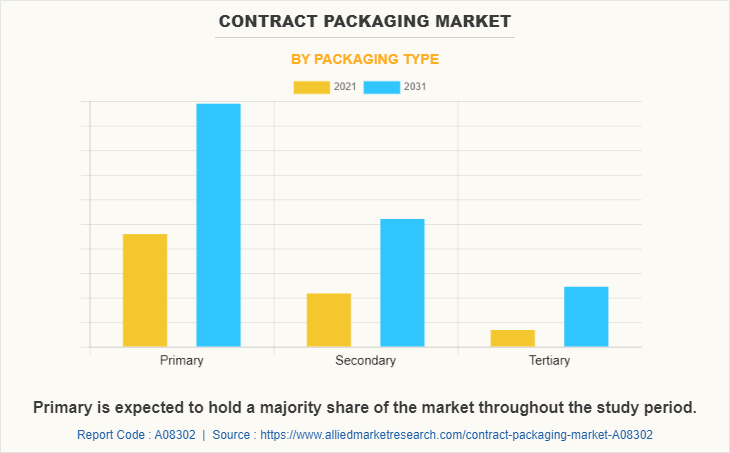

- By packaging type, primary type is one of the dominating segments in the market and accounted for the revenue share of over 53.6% in 2021.

- By end-user, the personal care segment is the fastest growing segment in the market.

Market Size & Future Outlook

- 2021 Market Size: $52.1 Billion

- 2031 Projected Market Size: $102.8 Billion

- CAGR (2022-2031): 6.9%

- Asia-Pacific: Largest market in 2021

- LAMEA: Fastest growing market

What is meant by Contract Packaging

Contract packaging, also known as co-packaging, is a packaging service offered by packaging firms to various manufacturers. The contract packaging services broadly include package design, product packaging and can also include storage and distribution of the products.

Contract Packaging Market Dynamics

Packaging is necessary for keeping the product safe during transportation and during its shelf life. Packaging is an important aspect of any tangible product. However, packaging of a product involves a large number of resources and initial investments. Therefore, to address this issue, third-party packaging firms, also known as contract packaging firms, are hired by manufacturers to carry out the packaging of their products. Moreover, contract packaging offers expertise and resources required for packaging. Hence, increase in number of small and medium scale businesses across the world and benefits offered by the contract packaging firms are anticipated to drive the demand in the contract packaging market.

Rise in e-commerce industry has also been instrumental in surging the demand for tertiary packaging across the world; thereby positively influencing the contract packaging market. In addition, various packaging intensive industries such as pharmaceutical, consumer goods, food & beverages and electronics, are witnessing a surge in demand owing to various factors such as rise in disposable income, rise in population, and favorable government guidelines toward businesses in many countries. Thus, rise in above industries is anticipated to positively influence contract packaging market growth.

Major players in the contract packaging industry are aligning with other companies to serve customer better and sustain the competition. For instance, in March 2022, Nulogy Corporation a provider of supply chain collaboration solutions, partnered with The Blackrock Group, a global supply chain consulting services provider. This partnership is aimed towards providing a accelerate speed-to-market service for contract manufacturers and contract packers via their complementary digital platforms. Furthermore, on October 2021, Silgan Holdings Inc. a manufacturer of triggers and pumps to sprayers and closures, acquired Unicep Packaging, a filling and packaging services provider. The name of the merger is Silgan Unicep. This acquisition is accepted to enhance the market position of Silgan Holdings Inc.

The novel coronavirus rapidly spread across various countries and regions, causing an enormous impact on the lives of people and the overall community. It began as a human health condition and later became a significant threat to global trade, economy, and finance. The COVID-19 pandemic halted the business of contract packaging firms due to restrictions on manufacturing activities. The economic slowdown initially resulted in reduced production in various end-user industries of contract packaging firms. However, owing to the introduction of various vaccines, the severity of COVID-19 pandemic has significantly reduced. As of mid-2022, the number of COVID-19 cases have reduced significantly. This has led to reopening of manufacturing and contract packaging companies at their full-scale capacities. Furthermore, it has been more than two years since the outbreak of this pandemic, and many companies have already shown notable signs of recovery.

Furthermore, there have been many advancements in packaging technology such as smart packaging, anti-microbial packaging, water soluble packaging, and corn starch-based packaging. These advancements in packaging media have low-carbon foot-print and feature sustainability. Such advancements in packaging technology are anticipated to provide lucrative opportunities for the contract packaging firms to witness growth during the forecast period.

Contract Packaging Market Segment Overview

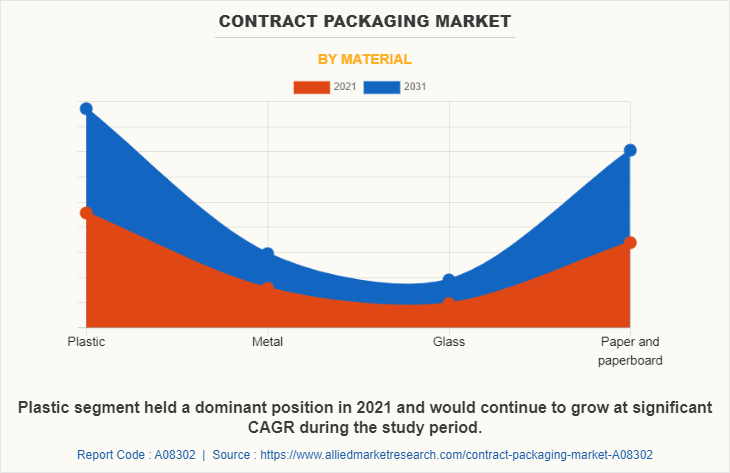

The contract packaging market is segmented into Packaging Type, Material and End-User Industry. By type, the market is categorized into primary, secondary, and tertiary. On the basis of material, it is categorized into plastic, glass, metal, and paper & paperboard. And on the basis on end user, the market is categorized into food & beverage, pharmaceutical, electronics, personal care, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific held the majority contract packaging market share in 2021, accounting for the highest share, and is anticipated to maintain this trend throughout the forecast period. This is attributed to increase in its demand in consumer goods and food and beverages sectors.

Contract Packaging Market Competition Analysis

Key companies profiled in the contract packaging market forecast report include Aaron Thomas Company Inc., AmeriPac Inc., Assemblies Unlimited Inc., Co-Pak Packaging, Assured Edge Solutions, Deufol, DHL, Hollingsworth, Green Packaging Asia, Jones Packaging, Kelly Products Inc., Sharp Packaging, Sonic Packaging Industries, Stamar Packaging, Sterling Contract Packaging Inc., Silgan Holdings Inc., and Wepackit Inc.

What are the Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the contract packaging market analysis from 2021 to 2031 to identify the prevailing contract packaging market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the contract packaging market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global contract packaging market trends, key players, market segments, application areas, and market growth strategies.

Contract Packaging Market Report Highlights

| Aspects | Details |

| By Packaging Type |

|

| By Material |

|

| By End-User Industry |

|

| By Region |

|

| Key Market Players | Green Packaging Asia, Assemblies Unlimited Inc., Sonic Packaging Industries, Wepackit Inc., Jones Packaging, AmeriPac Inc., Aaron Thomas Company Inc., Kelly Products Inc., Deufol, Stamar Packaging, Sharp Packaging, DHL, Silgan Holdings Inc., co-pak packaging corp., Assured Edge Solutions, Hollingsworth, Sterling Contract Packaging Inc. |

Analyst Review

The contract packaging market has witnessed significant growth in the past few years, owing to surge in manufacturing of consumer goods.

The rise in food and beverage industry, especially in high income countries such as the U.S., Canada, the UK, and Germany, has fueled the demand for contract packaging services. Furthermore, rise in pharmaceutical industry in countries such as China and India, has increased the demand for medical related contract packaging services. The services of contract packaging are extensively utilized by a wide range of manufacturers, to enhance their efficiency and reduce operating costs.

In addition, advancements in IT technologies that have enabled efficient work flow in the packaging process have significantly reduced the turnaround time. Also, introduction of eco-friendly packaging has opened new opportunities for the growth of the market

Development of cost-effective and attractive packaging is a major trend in the market.

Contract packaging is extensively used by food processing, pharmaceutical, electronics and personal care products manufacturing companies.

Asia-Pacific is the largest regional market for Contract Packaging.

$52,091.8 Million is the estimated industry size of Contract Packaging market in 2021.

include Aaron Thomas Company Inc., AmeriPac Inc., Assemblies Unlimited Inc., Co-Pak Packaging, Assured Edge Solutions and Deufol are some of the top companies to hold the market share in Contract Packaging.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Based on type, the primary segment held the maximum market share of the Contract Packaging market in 2021.

$1,02,760.2 Million will be Contract Packaging market size in 2030.

Loading Table Of Content...