Conveyor Belt Market Overview

The Global Conveyor Belt Market size was valued at $5.1 billion in 2022, and is projected to reach $8.3 billion by 2032, growing at a CAGR of 4.9% from 2023 to 2032. The market is driven by increasing industrial automation, rising demand in manufacturing and logistics sectors, and the need for efficient material handling systems. Growth in e-commerce, expansion of mining activities, and advancements in belt materials and technology further contribute to the market’s steady expansion across various industries worldwide.

Market Dynamics & Insights

- The conveyor belt industry in Asia-Pacific held a significant share of over 35.4% in 2022.

- The conveyor belt industry in U.S. is expected to grow significantly at a CAGR of 4.5% from 2023 to 2032.

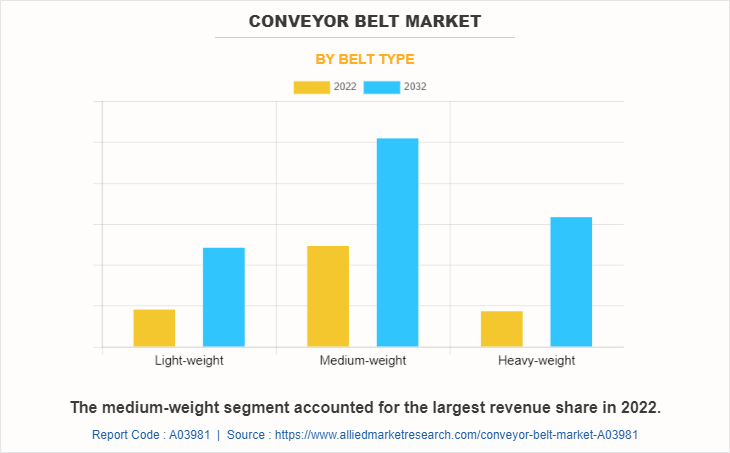

- By belt type, medium-weight segment is one of the dominating segments in the market and accounted for the revenue share of over 43.68% in 2022.

- By end-user, others segment is the fastest growing segment in the market.

Market Size & Future Outlook

- 2022 Market Size: $5.1 Billion

- 2032 Projected Market Size: $8.3 Billion

- CAGR (2023-2032): 4.9%

- Asia-Pacific: Largest market in 2022

- LAMEA: Fastest growing market

What is Meant by Conveyor Belt

A conveyor system is part of a production line where it moves unfinished products from one process to another. In addition, in facilities such as warehouses as well as baggage handling units, and also others which include the mining industry, the conveyor belt is used for transporting material from one place to another.

Market Dynamics

A conveyor belt is an indistinguishable component in most manufacturing facilities across the world. Pharmaceutical industries as well as consumer products manufacturers, and also the manufacturers of electronic products, including various other industries have witnessed a notable rise in the past few years, which has positively affected the market for conveyor belts. In addition, the rising demand for mined products, for energy generation, for use in construction, or various other uses in the manufacturing sector has positively affected the mining industry. Additionally, rising number of automated warehouses, driven by the growing e-commerce sector is also positively affecting the conveyor belts market.

Governments across the world are introducing various policies for the growth of their domestic industrial sector to eventually propel the countries’ economy. For instance, the Indian government has introduced various schemes, such as ‘Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE)’, ‘Pradhan Mantri Mudra Yojna’ and others to support small-scale industries. Such programs have been successful in driving the growth of the small- and medium-scale industrial sector in the last decade; thereby boosting the manufacturing sector in the country.

Moreover, manufacturing and process industries are also witnessing a rise in demand for products such as consumer durables, fast-moving consumer goods, food and beverages, and others. This is due to the rise in population and disposable income of the public. Conveyor belts are one of the most inseparable components of any manufacturing and process industry. Additionally, the mining industry is also witnessing a significant rise. For instance, in May 2022, Indian government eased environmental approvals for coal mining, to tackle fuel shortage.

Furthermore, in November 2021, Nigeria updated its mining act known as ‘Nigeria Minerals and Mining Act’, to prevent illegal mining. In August 2020, Ethiopia launched its online mining application portal for easing the process. Conveyor belts are widely used in mining sites to transport debris, or useful material from one place to another. Thus, the rise in the mining industry is anticipated to positively affect the conveyor belt market outlook during the forecast period.

However, the fluctuating cost of raw materials used for manufacturing conveyor belts is expected to restrain the market growth. Even if the manufacturer does not increase the price, it is expected to affect the profitability of the company involved in making conveyor belts and their components. In addition, government in various countries including India, and European Union have increased tariffs on or restricted the import of rubber and rubber products for different reasons.

This is also anticipated to increase the process of conveyor belts, which are primarily manufactured using rubber, eventually restraining the market growth. Another factor limiting the growth potential of the market is health safety concerns associated with conveyor belts. Conveyor belts are manufactured using various hazardous chemicals. These components include primary amine-based sulfenamides, such as N-cyclohexyl-2-benzothiazole sulfenamide, and thiazoles, such as 2-mercaptobenzothiazole. These substances of very high concern’ (SVHC’s) can have an effect on humans and the environment.

Moreover, technological and other developments in the conveyor belt industry are expected to provide lucrative opportunities for the key market players. Various companies have launched fire resistant conveyor belts, which prevent the propagation of fire in different parts of the facilities.

The COVID-19 has subsided, and the major manufacturers in 2023 are performing well. Contrarily, the rise in global inflation is a new major obstructing factor for the entire industry. The inflation, which is a direct result of the Ukraine-Russia war and few long-term impacts of the coronavirus pandemic, has introduced volatility in the prices of raw materials used for manufacturing conveyor belts. In addition, the cost of oil & gas has also increased, and many countries; especially, the countries in Europe, Latin America, North America, and Sub-Saharan Africa experience severe negative impacts in industrial production, including the production of conveyor belt. However, India and China are performing relatively well, and the demand for conveyor belts is not witnessing any substantial decline. In addition, inflation is expected to worsen in the coming years, as the possibility of the ending of the war between Ukraine and Russia is less. Moreover, the cost of construction has risen substantially, discouraging builders from initiating new projects, which is also expected to negatively affect the conveyor belt market growth. However, with the continued talks between different countries, a peace agreement between Ukraine and Russia can be devised, which is expected to end the war between them and reduce the global inflation.

Conveyor Belt Market Segmental Overview

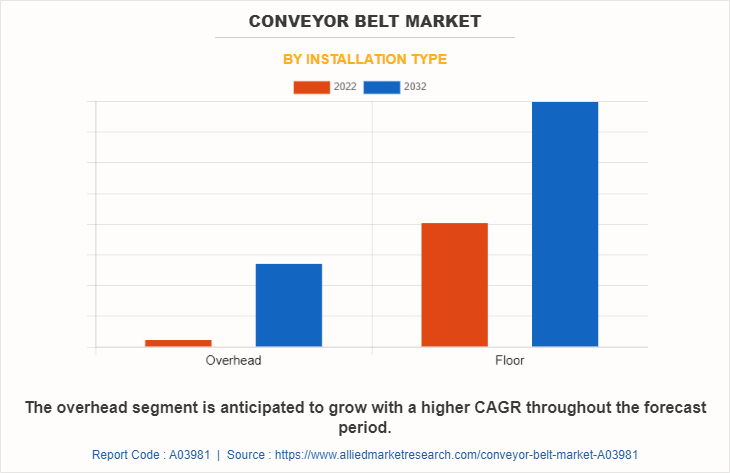

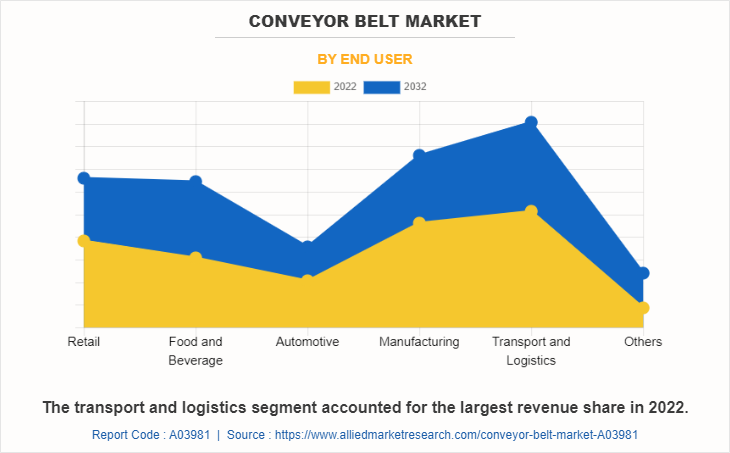

The conveyor belt market is segmented on the basis of belt type, installation type, end user, and region. By belt type, the market is divided into lightweight, medium-weight, and heavy-weight. Depending upon the type, the market is categorized into overhead, and floor. On the basis of end user, it is divided retail, food and beverage, automotive, manufacturing, transport and logistics, and others. Region-wise, it is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, Italy, UK, and rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

By Belt Type:

In the market there are various types of conveyor belts available, few are designed to carry lighter weight while others are meant for carrying medium to heavy weight between two locations. Light-weight conveyor belts are mostly preferred by the food and drinks processing facility for the movement of products such as snacks, bottles, meat, and other products in various processes. Pharmaceutical industries, and also the electronic products manufacturing industries are also the primary users of light weight conveyor belts.

Simultaneously, the other types of conveyor belts which are medium- and heavy-weight belts are used in many industries for the movement of heavy objects such as large pallets, and cartons. Aggregates and mined materials in a quarry or mining sites are also transferred using heavy-wight conveyor belts. The medium-weight conveyor belt were sold the most in the year 2022. And the heavy-weight belts are determined to grow with a higher CAGR during the forecast period.

By Installation Type:

The conveyor belt market is divided into overhead, and floor. In 2022, the floor segment dominated the conveyor belt market share in terms of revenue, and the overhead segment is expected to dominate the conveyor belt market forecast by growing with a higher CAGR during the forecast period. The floor conveyor belt system is mounted just above the floor surface on an elevated platform. It utilizes a continuous belt to transport goods, products, or materials from one location to another within a facility. Conveyor belts are highly efficient industrial machinery that is used for the smooth movement of items along the designated path. Industrial users such as manufacturing, distribution, warehouses, airports, and retail make extensive use of this system owing to its ease of use and easy installation.

By End User:

The conveyor belt market is divided into retail, food and beverage, automotive, manufacturing, transport and logistics, and others. The transport and logistics segment accounted for the highest market share in 2022. However, the others segment is anticipated to register a higher growth rate during the forecast period. By automating the movement of materials and products, conveyor belts improve the overall efficiency of manufacturing processes. They can handle large volumes of materials and maintain a consistent speed, which helps optimize production output. Automated material handling through conveyor belts reduces labor costs and minimizes production downtime caused by manual material transport. Moreover, conveyor belts can be seamlessly integrated with other manufacturing machinery and equipment, such as robotic arms, packaging machines, and inspection systems.

By Region:

Asia-Pacific accounted for the highest market share in 2022 and LAMEA is expected to grow with the highest CAGR during the forecast period. Asia-Pacific is a highly developing region with the fastest growing population. According to the United Nations, nearly two-thirds of the world population resides in Asia-Pacific, with China and India alone accounting for one-third of the global population. In addition, the rate of urbanization in Asia-Pacific is also high. Thus, owing to high population growth and urbanization in the region, the industrial, construction and agriculture sector witness a rapid rise, thereby, demand for conveyor belt, which are extensively used in these sectors is anticipated to rise in the coming years. However, the manufacturing sector in LAMEA has a greater potential for growth, which is anticipated to be a major reason for the rise in demand for conveyor belts.

Competition Analysis

Competitive analysis and profiles of the major players in the conveyor belt market are provided in the report. Major companies in the report include THE YOKOHAMA RUBBER CO., LTD., Bridgestone Corporation, Continental Belting Pvt. Ltd., Volta Belting Technology, Bando Chemical Industries, Ltd., SIG Societ Italiana Gomma S.p.A., Trenn- und Sortiertechnik GmbH, HUANAN XINHAI (SHENZHEN) TECHNOLOGY CO., LTD., Elcon Elastomers Pvt. Ltd., and Michelin Group (Fenner Conveyors). Major players to remain competitive adopt development strategies such as product launches, and business expansion.

What are the Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging conveyor belt market trends.

- In-depth conveyor belt market analysis is conducted by constructing market estimations for key market segments between 2022 and 2032.

- Extensive analysis of the conveyor belt market is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The conveyor belt market revenue and volume forecast analysis from 2023 to 2032 is included in the report.

- The key players within the conveyor belt market are profiled in this report and their strategies are analyzed thoroughly, which helps understand the competitive outlook of the conveyor belt industry.

Conveyor Belt Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 8.3 billion |

| Growth Rate | CAGR of 4.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 213 |

| By Belt Type |

|

| By Installation Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Trenn- und Sortiertechnik GmbH, Elcon Elastomers Pvt. Ltd., Bando Chemical Industries, Ltd., Bridgestone Corporation, HUANAN XINHAI (SHENZHEN) TECHNOLOGY CO., LTD., Michelin Group (Fenner Conveyors), SIG Societ Italiana Gomma S.p.A., Continental Belting Pvt. Ltd., Volta Belting Technology, THE YOKOHAMA RUBBER CO., LTD. |

Analyst Review

The conveyor belt market has witnessed significant growth in the past few years. Investments to develop more efficient conveyor belts to transport rocks and minerals are growing. According to André de Ruyter, CEO of Eskom Hld SOC Ltd, trucking coal is becoming more and more expensive due to rising fuel prices. However, he promoted the use of railroads in addition to conveyor belts for the quick and less expensive delivery of coal. Similar to this, Coal India, a state-owned business in India, is investing important resources in erecting conveyor belts in order to transport coal over kilometers. Additionally, Continental, a significant player in the conveyor belts sector, purchased WCCO Belting, a family-run business with headquarters in Wahpeton, North Dakota, in order to supply the food industry with conveyor belts. The business added that this acquisition will provide it with a competitive advantage in the market since the food and beverage sector is expected to expand significantly in the years to come.

Moreover, India and China are predicted to be the fastest growing major economies in the next five years. The government of both countries are initiating campaigns such as ‘Atmanirbhar Bharat‘ to boost the domestic manufacturing sector. India is one of the major automotive manufacturers in the region. Further, the government of India and Indian Automotive Industry mutually started an initiative called ‘Automotive Mission Plan 2016-26’ to lay down the roadmap for the development of the industry. Furthermore, India has a huge mining industry. This drives growth in the conveyor belt manufacturing sector. Thus, rapid rise in the manufacturing and mining sector boosts the market growth.

The global conveyor belt market is a mix of concentrated as well as divided manufacturing. The steel, and plastic conveyor belt market is consolidated into a few major global players, however, other rubber conveyor belt market are relatively fragmented. Furthermore, the demand for composite conveyor belts is anticipated to increase with the introduction of new materials and advancements in conveyor belt manufacturing technologies.

Key factors driving the growth of the conveyor belts market include growth in manufacturing sector, growth of mining industry, and rise in number of automated warehouses.

The latest version of the global conveyor belt market report can be obtained on demand from the website.

The global conveyor belt market size was valued at $5,107.4 million in 2022.

The global conveyor belt market size is estimated to reach $8,334.3 million by 2032, exhibiting a CAGR of 4.9% from 2023 to 2032.

The forecast period considered for the global conveyor belt market is 2023 to 2032, wherein, 2022 is the base year, and 2023-2032 is the forecast year.

Asia-Pacific is the largest regional market for conveyor belt market.

Key companies profiled in the tire recycling market report include THE YOKOHAMA RUBBER CO., LTD., Bridgestone Corporation, Continental Belting Pvt. Ltd., Volta Belting Technology, Bando Chemical Industries, Ltd., SIG Societ Italiana Gomma S.p.A., Trenn- und Sortiertechnik GmbH, HUANAN XINHAI (SHENZHEN) TECHNOLOGY CO., LTD., Elcon Elastomers Pvt. Ltd., and Michelin Group (Fenner Conveyors).

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Loading Table Of Content...

Loading Research Methodology...