Copper Fungicides Market Size & Insights: 2032

The global copper fungicides market size was valued at $484.6 million in 2022 and is projected to reach $872.9 million by 2032, growing at a CAGR of 6.1% from 2023 to 2032. Rise in demand for organic farming practices, driven by increase in consumer preference for chemical-free and environmentally friendly produce, is significantly boosting the growth of the copper fungicides market. Copper fungicides, widely accepted in organic agriculture, are valued for their effectiveness in controlling fungal diseases while adhering to organic certification standards. Furthermore, advancements in fungicide formulation technology have enhanced the efficiency, stability, and environmental safety of copper fungicides, making them more appealing to modern farmers.

Introduction

Copper fungicides are a class of agricultural chemicals that utilize copper as an active ingredient to prevent and manage fungal diseases in crops. These fungicides operate by disrupting the metabolic processes of fungal spores, inhibiting their growth and reproduction. Copper ions released by these compounds react with proteins and enzymes in fungal cells, causing structural and functional damage, effectively controlling a broad spectrum of fungal pathogens. Due to their versatility, copper fungicides are widely used in protecting fruits, vegetables, cereals, and ornamental plants from diseases such as blights, rusts, and downy mildew.

Report Key Highlighters:

- The copper fungicides market study covers 20 countries. The research includes a segment analysis of each country in terms of both value ($million) and volume (kilotons) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The copper fungicides market is highly fragmented, with several players including Albaugh, LLC, Nufarm Limited, UPL, Certis USA L.L.C., Bayer AG, Cinkarna Celje dd Quimetal Industrial Sa, Cosaco GmbH, Corteva, and IQV Matholding Group.

Copper fungicide is a type of pesticide that is specifically formulated to control and prevent fungal diseases in plants. It is widely used in agriculture, horticulture, and gardening to protect crops, trees, and ornamental plants from various fungal infections. Copper fungicides contain copper compounds as the active ingredient, typically in the form of copper sulfate or copper oxychloride.

The mode of action of copper fungicides involves the release of copper ions, which are toxic to fungal cells. These ions interfere with several vital processes in the fungi, including enzyme activity, protein synthesis, and cell wall formation. By disrupting these essential functions, copper fungicides effectively inhibit fungal growth, reproduction, and the spread of diseases.

Copper fungicides offer several advantages that make them popular among growers and gardeners. Firstly, copper is a broad-spectrum fungicide, meaning it can control a wide range of fungal pathogens, including powdery mildew, downy mildew, leaf spots, blights, and rust. This versatility makes it a valuable tool for disease management in many different crops and plants. Secondly, copper fungicides have a long-lasting residual effect. Once applied, the copper ions remain active on the plant surface, providing continued protection against fungal infections. This is particularly useful in regions or seasons with high humidity or frequent rain, as it helps prevent the rapid development and spread of diseases under such favorable conditions.

Increased demand from the agricultural sector

The rise in agriculture and crop production has created a high demand for copper fungicides and growth opportunities for the global market. Copper fungicides have significant applications in the food and agriculture industries as fungicides. Copper fungicides play an important role in crop protection and disease prevention for a variety of plants, including citrus, grapes, celery, tea, tomato, and others. The market for copper fungicides has been propelled by a rise in dietary preferences and increased agricultural production. Copper fungicide kills pathogen cells to be effective. However, it is essential to reduce copper's toxicity as it can also affect plants. In addition, the government's initiative to increase the level of global agricultural production has created a demand for the copper fungicides market.

For instance, the Indian government introduced the Production Linked Incentive (PLI) in 2020 to encourage the domestic production of agrochemicals. The Organization for Economic Cooperation and Development (OECD) estimates that global agricultural production is expected to increase by approximately 1.5% annually. Consequently, during the forecast period, the copper fungicides industry is anticipated to develop and be driven by the expanding agriculture and food sectors globally.

Climate change has resulted in shifts in weather patterns, temperature fluctuations, and increased incidence of extreme weather events. These changes can create favorable conditions for the spread and proliferation of fungal diseases. According to Frontiers Organization, it is estimated that plant diseases annually cause losses between 10% and 15% of the major crops, out of which 70-80% of diseases are the result of pathogenic fungi. Recently it has been observed that fungal diseases have affected crops terribly and have increased the demand for copper fungicides.

In addition, according to the United Nations organization, in mid-November 2022, there were 8.0 billion people across the globe, up from an estimated 2.5 billion in 1950. Copper fungicides, with their broad-spectrum activity and residual efficacy, help farmers mitigate the increased disease pressure associated with climate change. Thus, the surge in plant diseases drives the demand for copper fungicides.

The upsurge in global population increases the demand for food, which in turn boosts the demand for copper fungicides to protect food crops.

According to the United Nations, the global population may reach 9.7 billion by 2050. According to the Harvard Business Review, the demand for food worldwide is expected to reach approximately 98% by 2050. As per the Food & Agriculture Organization, the demand for cereals for both animal feed and human food is projected to reach 3 billion tons by 2050. Copper fungicides play a crucial role in disease management, protecting crops from fungal infections and ensuring higher yields and quality. As the demand for food production increases, so does the need for effective disease control measures such as copper fungicides.

Copper fungicides are subject to fluctuations in copper prices, as copper is a globally traded commodity. Variations in copper prices can impact the production costs of copper fungicides, potentially affecting their affordability and market competitiveness. Price volatility can create uncertainty for manufacturers, distributors, and users of copper fungicides. Thus, the volatility in copper prices may restrain the market for copper fungicides.

Copper fungicides face competition from alternative disease management methods, such as biological controls, plant breeding for disease resistance, and cultural practices. The availability and effectiveness of these alternatives can influence the demand for copper fungicides, as some growers may opt for integrated pest management approaches that rely less on chemical inputs. Thus, the availability of substitutes restrict the copper fungicides market.

Furthermore, an increase in research and development of the product and an upsurge in need for soil replenishment are the factors that create major market opportunities. Manufacturers can focus on developing new formulations, enhancing compatibility with different crops, and optimizing application techniques to increase the effectiveness and efficiency of copper fungicides. R&D efforts can explore the synergistic effects of combining copper fungicides with other disease management tools, expanding their potential applications.

Protected agriculture, including greenhouse and tunnel farming, has experienced significant growth due to its ability to control environmental conditions and optimize crop production. Copper fungicides find extensive use in protected agriculture systems to combat fungal diseases in a controlled environment. As the adoption of protected agriculture expands, the demand for copper fungicides is expected to increase. This is anticipated to provide lucrative opportunities to the copper fungicides market.

Segments Overview

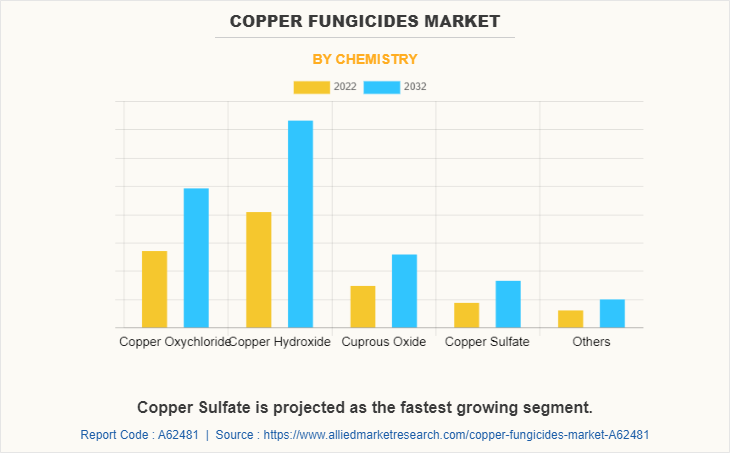

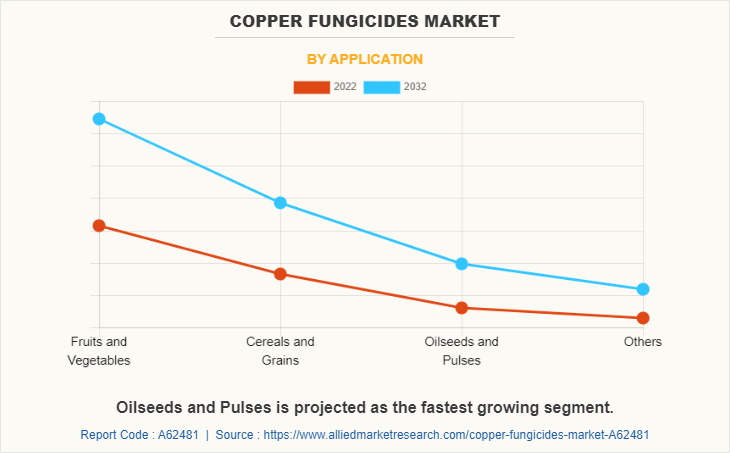

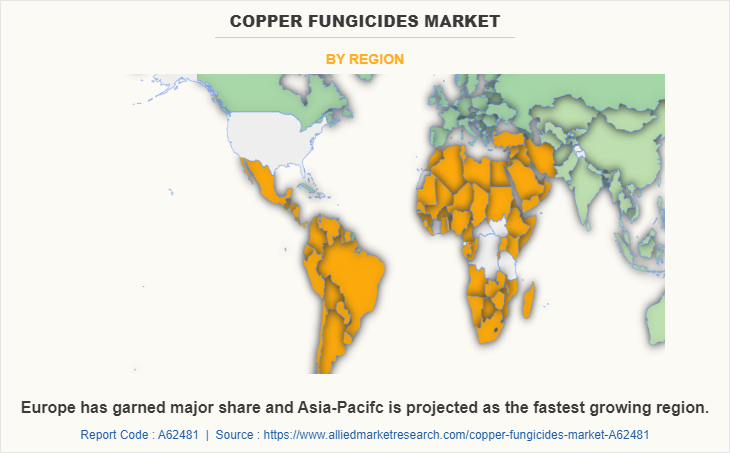

The copper fungicides market is segmented on the basis of chemistry, application, and region. By chemistry, the market is divided into copper oxychloride, copper hydroxide, cuprous oxide, copper sulfate, and others. On the basis of application, it is categorized into fruits & vegetables, cereals & grains, oilseeds & pulses, and others. Region-wise, the copper fungicides market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Copper Fungicides Market, By Chemistry

The Copper Hydroxide segment accounted for the largest share, this growth is due to their fungicidal application in main fruit and vegetable crops, as they are more effective than their competitors at controlling fungal diseases. Due to the growing demand for copper hydroxide, companies are developing new product lines to meet the demand. For instance, Bayer AG, a prominent manufacturer of copper fungicides, produces copper hydroxide under the brand name "Blue Shield", which protects the crop from peppery leaf spots, downy mildew, black rot, and ring spot in pears, apples, and citrous fruit, as well as anthracnose and bacterial black spot in mangoes.

The Copper Sulfate segment is the fastest-growing segment with a CAGR of 6.5%. This expansion can be attributed to the use of these products to control fungal and bacterial diseases in vegetables, roses, fruits, nuts, herbs, ornamentals, and turf. It is the oldest and most efficacious form of copper fungicide. It adheres to the proteins of fungi and algae, ultimately causing their demise. Copper deficiency is also treated with foliar sprays of diluted copper sulfate. Copper sulfate is combined with lime and water to create a Bordeaux mixture, which is an effective fungicide for all varieties of crops. All of these factors contribute to the expansion of the segment.

Copper Fungicides Market, By Application

The Fruits and Vegetables segment accounted for the largest share. The expansion of this segment can be attributed to the growing health consciousness of consumers worldwide, which in turn increases the demand for fresh fruits and vegetables due to their nutritional value.

The Oilseeds and Pulses segment is the fastest-growing segment with a CAGR of 6.5%. Oilseeds and pulses consist of a variety of seeds, including sunflower seeds, soybeans, and leguminous seeds (pulses). According to a report published by the USDA, global oilseed production is projected to reach 644.4 million tons in 2022/23 as a result of an expected increase in cotton seed and soybean production. Thus, this rising production of oilseeds and pulses is anticipated to further stimulate the product market.

Copper Fungicides Market, By Region

Europe garnered the largest share. Due to the convenient and adequate availability of raw materials, such as copper sulfate, the majority of important chemical manufacturers are located in Europe. Cuprous oxide, copper oxychloride, and copper hydroxide are additional copper-based compounds manufactured in this region. Germany is one of the world's top 10 agricultural producers. Due to their increased yields, sugar, wheat, grapes, vegetables, and fruits are among the most important commodities that require pesticides. The International Grains Council (IGC) estimates that Germany's cereal crop production will be on the order of 42.5 million tons in 2022–2023, compared to the 42.5 million tons reported in the previous year.

Competitive Analysis

The major players operating in the global copper fungicides market are Albaugh, LLC, Nufarm Limited, UPL, Certis USA L.L.C., Bayer AG, Cinkarna Celje dd Quimetal Industrial Sa, Cosaco GmbH, Corteva and IQV Matholding Group. Other players operating in the market are Nordox AS, ADAMA Agricultural Solutions Ltd., Zhejiang Hisun, Jiangxi Heyi, and Synthos Agro.

Copper Fungicides Market Trends:

The demand for copper fungicides has been steadily growing due to the expansion of the agriculture and horticulture sectors globally. As the global population continues to rise, there is a greater need for increased food production, leading to higher demand for crop protection products such as copper fungicides.

With the surge in emphasis on sustainable and organic farming practices, copper fungicides have gained popularity as they are considered an acceptable option in organic agriculture. Copper-based products are approved for use in organic farming by many certification bodies, making them a preferred choice for farmers who want to adhere to organic farming standards.

The agricultural industry has witnessed technological advancements, including the development of improved formulations and application methods for copper fungicides. These advancements aim to enhance the efficacy of copper fungicides, reduce application rates, and minimize any negative impacts on the environment.

IMPACT OF RUSSIA UKRAINE WAR ON THE COPPER FUNGICIDES MARKET

The Russia-Ukraine war had an impact on the production and availability of copper fungicides. Copper fungicides, which are widely used in agriculture to control fungal diseases in crops, and the market was affected by the conflict.

The war disrupted the supply chain of copper fungicides. Ukraine, as one of the major global producers of copper, experienced disruptions in its mining and production capabilities, leading to an impact on the availability of copper-based products, including copper fungicides.

The closure of copper mines and the disruption of transportation routes during the conflict resulted in a shortage of copper fungicides in the market. As a consequence, farmers and agricultural industries that relied on these fungicides to protect their crops from fungal infections faced challenges in accessing sufficient supply.

Furthermore, the geopolitical tensions and uncertainty caused by the war also affected international trade and created disruptions in supply chains. Import and export restrictions, increased tariffs, and political instability further contributed to the limited availability or increased prices of copper fungicides.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the copper fungicides market segments, current trends, estimations, and dynamics of the copper fungicides market analysis from 2022 to 2032 to identify the prevailing copper fungicides market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the copper fungicides market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global copper fungicides market trends, key players, market segments, application areas, and copper fungicides market growth strategies.

Copper Fungicides Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 872.9 million |

| Growth Rate | CAGR of 6.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 460 |

| By Chemistry |

|

| By Application |

|

| By Region |

|

| Key Market Players | Certis USA L.L.C., Nufarm Limited, Corteva, Bayer AG, UPL, IQV Matholding Group, Quimetal Industrial S.A., Cinkarna Celje, d. d., Cosaco GmbH, Albaugh, LLC |

Analyst Review

According to the insights of the CXOs of leading companies, the growth of the copper fungicides market is being boosted by a surge in the number of fungal diseases and the rise in the adoption of organic farming. Fungal diseases are one of the most significant biotic stresses encountered by the global agricultural industry. The prevalence of fungal infections such as powdery mildew, Septoria leaf spot, and Anthracnose in crops has increased as a result of a shift in climatic conditions and a rise in insect resistance. Fungal infections affect several high-value commodities, including bananas, coffee, cacao, spices, mangoes, and nuts. These occurrences have increased, particularly in tropical regions. The rise in prevalence has led to an increase in the demand for fungicides, which has stimulated the expansion of the global copper fungicides market.

However, phytotoxicity hazards are projected to hinder market expansion. Owing to a rise in emphasis on product innovation, market participants can anticipate lucrative opportunities in the market over the next few years.

The copper fungicides market attained $484.6 million in 2022 and is projected to reach $872.9 million by 2032, growing at a CAGR of 6.1% from 2023 to 2032.

Europe is the largest regional market for Copper Fungicides.

Fruits and vegetables is the leading application of Copper Fungicides Market.

Surge in demand for fungicides and increased demand from the agricultural sector are the driving factor of Copper Fungicides Market.

Albaugh, LLC, Nufarm Limited, UPL, Certis USA L.L.C., Bayer AG, Cinkarna Celje dd Quimetal Industrial Sa, Cosaco GmbH, Corteva and IQV Matholding Group are the top companies to hold the market share in Copper Fungicides.

Copper Fungicides Market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Growth in demand from emerging markets and Sustainable agriculture practices is the upcoming trends of Copper Fungicides Market in the world.

Loading Table Of Content...

Loading Research Methodology...