Corneal Implants Market Research, 2031

The global corneal implants market size was valued at $1,264.18 million in 2021, and is projected to reach $2,124.44 million by 2031, growing at a CAGR of 5.3% from 2022 to 2031.Cornea is replaced using donor cornea or artificial cornea during corneal transplantation. In this procedure, the cornea is replaced with donor cornea or artificial cornea. At eye banks, the donor corneas used in transplants are preserved in storage medium. Moreover, individuals undergoing transplantation who are unable to tolerate a human donor cornea can choose an artificial cornea. Protecting internal eye tissues, assisting with refractive power, and concentrating light on the retina with the least amount of scatter and optical deterioration are the important roles played by the cornea in the eye. Various diseases such as keratoconus, fuch's dystrophy, keratitis, corneal scarring, corneal ulcers, and corneal edema need corneal transplantation based on severity of the diseases.

Market dynamics

The surge in prevalence of corneal disorders is the main driver for the corneal implants market. The need for corneal transplantation is caused by conditions such as keratoconus, fuch's dystrophy, keratitis, corneal scarring, corneal ulcers, and corneal edema. For instance, according to the Corneal Research Foundation of America, approximately 50 to 200 of every 100,000 people are afflicted with keratoconus. In the U.S., a study found a prevalence of 54.5 per 100,000 people. Thus, the increase in prevalence of corneal disorders drives the growth of the corneal implants industry. Moreover, the rise in corneal blindness in emerging economies and increase in demand for corneal transplantation also drive the market growth. For instance, according to the National library of Medicine, in India, approximately 6.8 million people are having vision less than 6/60 in at least one eye due to corneal diseases and both eyes are involved in approximately one million individuals. Thus, high incidence of corneal disorders drives the corneal implants market size.

In addition, in recent years, there has been an increase in healthcare expenditure which also propels the corneal implant market growth. For instance, according to the Centers for Medicare & Medicaid Services, stated that National Health Expenditure (NHE) grew 2.7% in 2021, or $12,914 per person, and accounted for 18.3% of Gross Domestic Product (GDP). Thus, increases in healthcare expenditure and infrastructure, change in government policy in healthcare sector, rise in disposable income and development of pharmaceutical industry are expected to drive the growth of the of the global corneal implant market during the corneal implants market forecast period.

Moreover, the safety and efficacy of corneal implant surgery have been enhanced in recent years by a number of technical developments. The creation of corneal implants from living cells using tissue engineering methods is known as bioengineered corneal implants. Compared to conventional synthetic implants, these may offer better biocompatibility, a lower risk of complications, and better visual results. Thus, introduction of advanced technologies is expected to propel the corneal implants market growth during the forecast period.

Ina addition, increased demand for corneal transplants and the availability of improved healthcare sector infrastructure, opportunities in developing economies are anticipated to fuel growth of the corneal implant market. Moreover, there has been a significant rise in awareness among individuals regarding corneal transplantation, which boosts the growth of the market.

However, shortage of donor cornea is anticipated to restrain the growth of the corneal implant market. According to the Cornea Research Foundation of America, around 10 million individuals worldwide need corneal transplants, so there is a huge demand for corneal donors. Only 100,000 corneal transplants are performed each year worldwide due to the lack of access to donor tissue, which has been described as an international crisis in public health. People with corneal blindness have to wait more than six months for corneal transplantation in densely populated nations like India due to a severe shortage of donor corneas. Thus, the corneal implants industry is expected to impede due to the high prevalence of corneal blindness and scarcity of corneal donors.

Segmental Overview

The Corneal Implant market is segmented into procedure type, disease type end user, and region. On the basis of procedure type, the market is categorized into penetrating keratoplasty, endothelial keratoplasty and others. On the basis of disease type, the market is segregated into keratoconus, Fuchs’ dystrophy, infectious keratitis and others. On the basis of end user, the market is classified into hospitals, ophthalmic centers and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

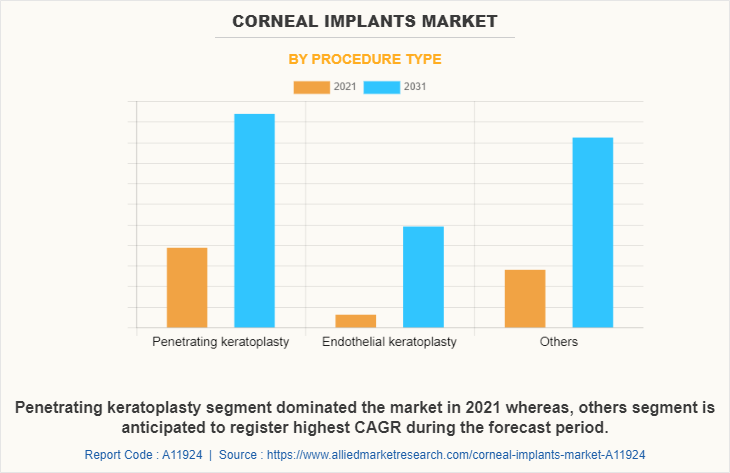

By Procedure Type

On the basis of procedure type, the market is classified into penetrating keratoplasty, endothelial keratoplasty and others. The penetrating keratoplasty segment dominated the market in 2021. This is attributed to the high survival rate of all indications for corneal transplantation, and good visual outcomes. In addition, penetrating keratoplasty is the widely used procedure for corneal transplantation. For instance, according to the Eye Bank Association of America, 46% of cornea produced by eye banks were used for penetrating keratoplasty. Moreover, the others segment is projected to register a CAGR during the forecast period, owing to advances in development of artificial cornea, lack of availability of human cornea donors has influenced adoption of artificial cornea and faster recovery.

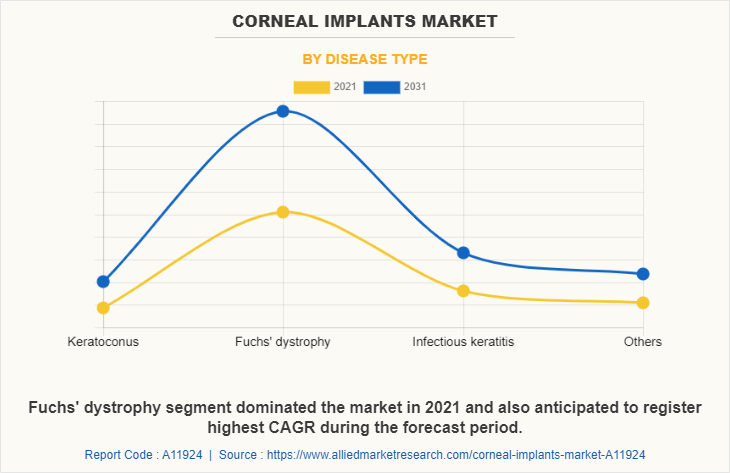

By Disease Type

On the basis of disease type, the market is classified into keratoconus, Fuchs’ dystrophy, infectious keratitis and others. The Fuchs’ dystrophy segment dominated the market in 2021 and is projected to register a CAGR during the forecast period, owing to rise in awareness regarding ocular health, high prevalence of Fuchs’ dystrophy. For instance, according to the National Library of Medicine, the late-onset form of Fuchs’ endothelial dystrophy is a common condition, affecting approximately 4% of people over the age of 40 in the U.S.

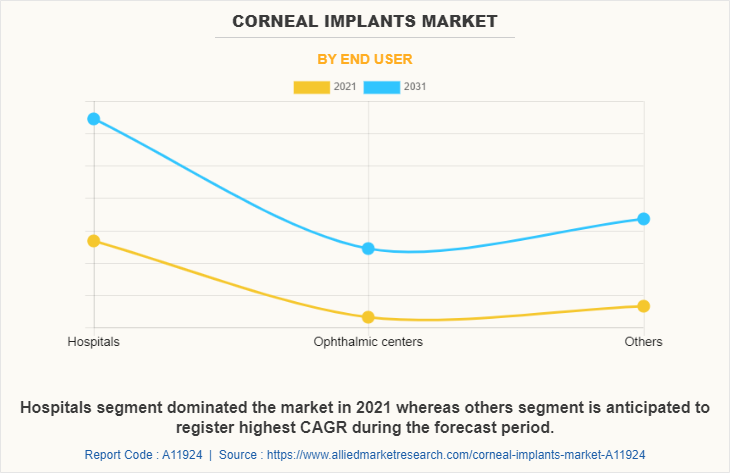

By End User

On the basis of end user, the market is categorized into hospitals ophthalmic centers and others. The hospital segment occupied highest corneal implants market share in 2021 owing to availability of highly qualified healthcare practitioners and increase in health coverage for hospital-based healthcare services from several private & group insurance programs. In addition, hospitals are equipped with specialized facilities and equipment, including operating rooms, intensive care units, and specialized eye surgery units. Moreover, the others segment is projected to register the highest CAGR owing to a rise in outpatient surgeries for corneal transplantation as it offers cost effective benefits.

By Region

The corneal Implant market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America had the highest corneal implants market share share in 2021 and is expected to maintain its lead during the forecast period, owing to an increase in prevalence of corneal diseases and a rise in healthcare infrastructure. In addition, the rise in the number of key players manufacturing artificial corneal implant and increase in awareness regarding health and well-being further drives the market growth in this region. However, Asia-Pacific is expected to witness highest growth during the forecast period, owing to factors such as rise in investments for manufacturing of high-quality corneal implant and increase in awareness about cornea donation. In addition, the increase in healthcare infrastructure in this region further propels the market growth.

In addition, the surge in corneal blindness in North America is ехреÑtеd to Ñ€rореl the growth of the corneal implant market. Furthermore, the presence of well-established healthcare infrastructure and high purchasing power are expected to drive the market growth. Moreover, supportive reimbursement policies in healthcare systems, rise in awareness regarding cornea donation, and innovations of artificial cornea across the region are expected to support dominance of the region during the forecast period. Furthermore, technological advancement, high purchasing power, and rise in awareness about corneal donation in this region boost the growth of the market.

Asia-Pacific is expected to grow at the highest rate during the forecast period. The market growth in this region is attributable to presence of pharmaceutical companies in the region as well as growth in the purchasing power of populated countries, such as China and India. Moreover, Asia-Pacific offers profitable opportunities for key players operating in the corneal implant market, thereby registering the fastest growth rate during the forecast period, owing to the growing infrastructure of industries and rising disposable incomes. In addition, the rise in corneal diseases within the region is aniticipatesd as corneal implants market opportunity during the forecast period.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the corneal implants market analysis from 2021 to 2031 to identify the prevailing corneal implants market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the corneal implants market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global corneal implants market trends, key players, market segments, application areas, and market growth strategies.

Corneal implants Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 2.1 billion |

| Growth Rate | CAGR of 5.3% |

| Forecast period | 2021 - 2031 |

| Report Pages | 330 |

| By Procedure Type |

|

| By Disease Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Aurolab, Presbia Plc, DIOPTEX, LinkoCare Life Sciences AB, KeraMed, Inc, AJL Opthalmic SA, CorNeat Vision, EyeYon Medical, Mediphacos, CorneaGen |

Analyst Review

This section provides various opinions of top-level CXOs in the global corneal implant market. According to the CXOs, market growth is largely driven by the rise in geriatric population and increase in prevalence of ophthalmic diseases, such as keratoconus, fuchs' dystrophy, and infectious keratitis, are the major drivers for the corneal implants market. However, low availability of the donor cornea is expected to restrain the growth of the market during the forecast period.

According to the perspectives of CXOs of leading companies in the market, rise in prevalence of eye diseases along with the technological advancements in corneal implant devices are the key contributors to the market growth.

In addition, increase in government initiatives to control visual impairment are anticipated to increase awareness regarding availability of advanced technologies among patients suffering from eye-associated disorders. Conversely, less accessibility to eye care in low-income countries poses a restrain to the market. Whereas development of advanced artificial cornea by the key manufacturers is expected to open up new avenues for the expansion of the corneal implant market.

Corneal implants market is estimated at $1,264.18 million in 2021.

Top companies such as Corneagen, Presbia Plc, Presbia Plc, mediphacos, Aurolab, AJL Opthalmic SA, LinkoCare Life Sciences AB, DIOPTEX, EyeYon Medical, and KeraMed, Inc. These key players held a high market postion owing to the strong geographical foothold in different regions.

The major factors driving the growth of the corneal implants market are rise in prevalence of corneal disorder and technological advancements in the field of cornea.

The forecast period for corneal implants market is 2022 to 2031.

The market value for corneal implants market in 2031 is $2,124.44 million.

North America is the largest regional market for corneal implants.

The base year is 2021 in corneal implants market.

Loading Table Of Content...

Loading Research Methodology...