Corporate Training Market Research, 2035

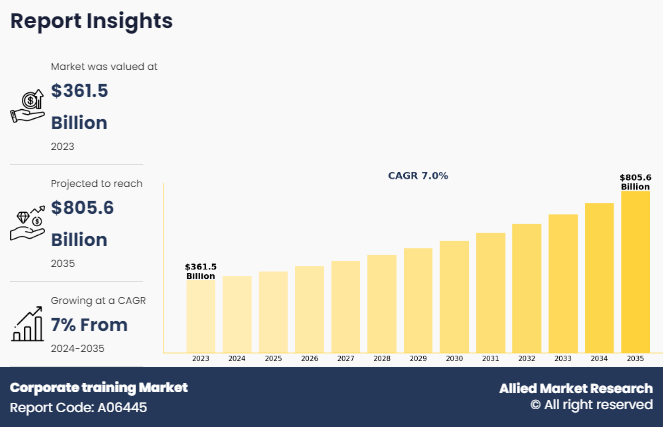

The global corporate training market size was valued at $361.5 billion in 2023, and is projected to reach $805.6 billion by 2035, growing at a CAGR of 7% from 2024 to 2035. The growth of the corporate training market is driven by rapid technological advancements, emphasizing the need for upskilling and reskilling, alongside the increasing focus on talent development, regulatory compliance, and remote work. Moreover, the rising importance of soft skills and diversity initiatives further boosts the demand for specialized training programs, promotes a dynamic and expanding market landscape.

Corporate training, which is also known as workplace learning, is a system of learning activities that are designed to train employees to perform better on the job. Corporate training enhances an employee’s productivity, motivation, performance, and their retention which in turn helps corporates to achieve their business goals. There are two types of training methods which includes virtual training method and face-to-face training method.

Key Takeaways

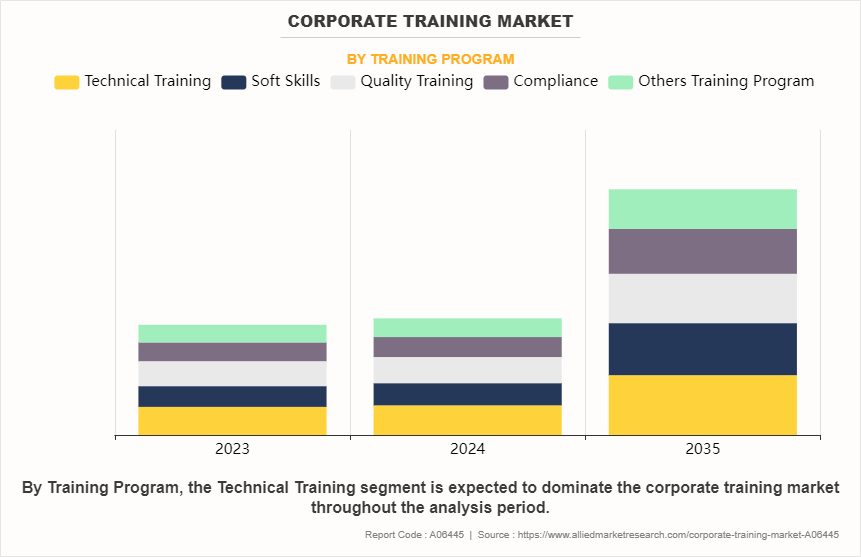

- By training program, the quality training segment was the highest revenue contributor to the corporate training market in 2023.

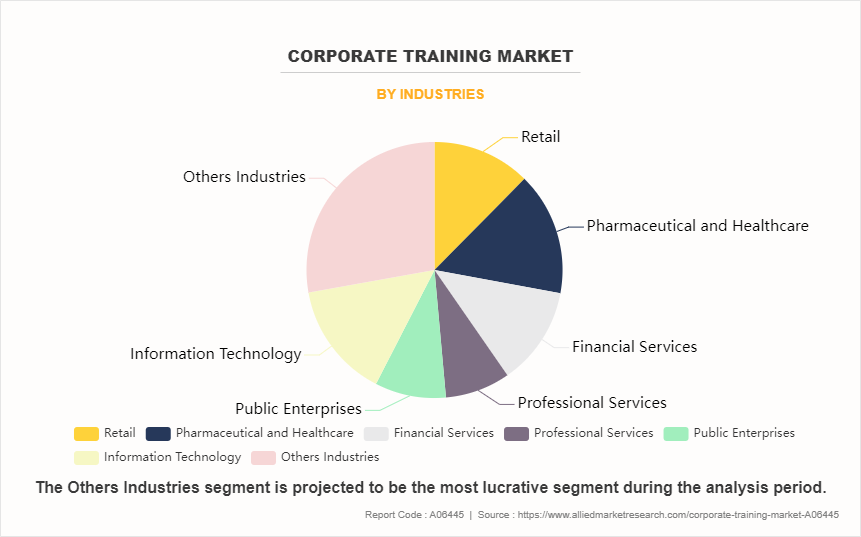

- By industries, FMCG industry segment was the largest segment in the global corporate training market during the forecast period.

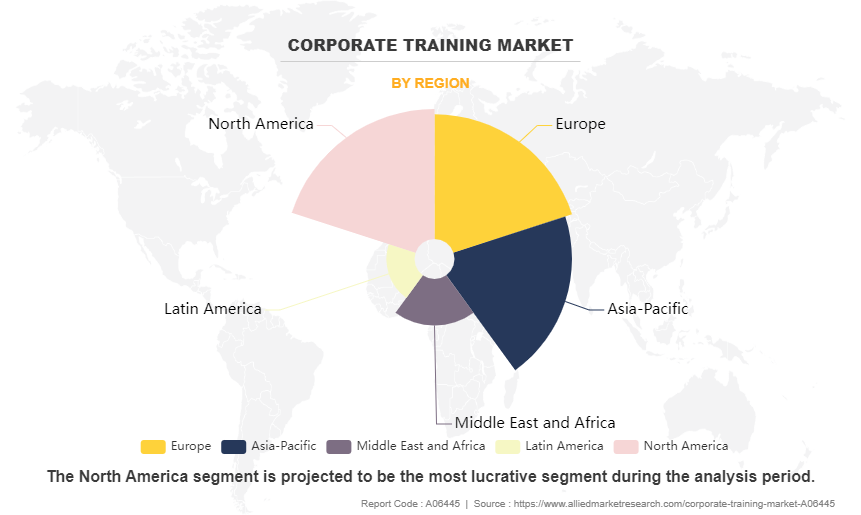

- Region-wise, North America was the highest revenue contributor in 2023.

Market Dynamics

The emphasis on continuous learning and development significantly drives the demand for corporate training solutions by addressing the evolving needs of businesses and the workforce. In today's knowledge-based economy, where skills become outdated at an accelerating pace, companies are increasingly recognizing the importance of promoting a culture of lifelong learning. This recognition stems from the realization that a well-trained and adaptable workforce is crucial for maintaining competitiveness, driving innovation, and achieving sustainable growth. As industries undergo rapid transformations due to technological advancements, globalization, and changing market dynamics, the demand for new skills and competencies intensifies. Moreover, corporate training programs play a vital role in enabling employees to acquire the knowledge and capabilities required to navigate these changes effectively.

In addition, the emphasis on continuous learning and development serves as a strategic imperative for talent retention and attraction. In a competitive labor market where skilled workers are in high demand, offering opportunities for professional growth and advancement is essential for employee engagement and satisfaction. Furthermore, companies that invest in robust training and development initiatives signal their commitment to supporting employees' career progression and enhance their marketability. Thus, all these factors contribute in the corporate training market growth.

Digital transformation and technological adoption are major drivers fueling the demand for corporate training solutions as organizations strive to keep pace with evolving technologies and remain competitive in today's digital economy. With the rapid advancement of digital tools, automation, artificial intelligence, and other emerging technologies, there's a pressing need for employees to acquire new digital skills and literacy. Corporate training programs play a crucial role in ensuring that employees are proficient in leveraging these technologies effectively to drive innovation, improve productivity, and meet evolving business needs. Whether it's mastering data analytics, cybersecurity protocols, cloud computing, or other digital competencies, organizations recognize the importance of investing in comprehensive training initiatives to upskill and reskill their workforce.

Moreover, as businesses undergo digital transformation initiatives, there's a growing demand for specialized training programs tailored to specific technology implementations and organizational requirements. Whether it's transitioning to new software platforms, implementing enterprise-wide systems, or adopting active methodologies, employees need targeted training to navigate these changes successfully. Corporate training providers are well-positioned to offer customized solutions that address the unique challenges and objectives of each organization, helping them maximize the return on their technology investments. Furthermore, as companies embrace virtual learning platforms, webinars, and online courses, the demand for digital-centric corporate training solutions is expected to rise and further drive the corporate training market share.

Budget constraints pose as a significant restraint on the corporate training market as organizations may reduce or reallocate funds allocated for training and development initiatives during times of economic uncertainty or when facing financial constraints. When businesses face budgetary limitations, training programs are often seen as discretionary expenses rather than critical investments which often leads to decreased demand for corporate training services. This reduction in demand may result in lower revenues for training providers, as companies prioritize essential operational expenditures over employee development activities. Moreover, budget constraints may lead organizations to opt for cost-cutting measures, such as scaling back on external training programs or replacing them with cheaper alternatives, such as self-paced online courses or in-house training resources.

Furthermore, training providers may experience decreased demand for their services, particularly for higher-cost offerings such as instructor-led workshops or customized training solutions. Budget constraints may also impact the quality and scope of training programs, with organizations opting for more basic or generic training content to minimize costs. Thus, all these factors limit the growth of the corporate training market.

The lack of time is expected to limit the demand for the corporate training market as employees face competing demands and time constraints in their busy work schedules. With heavy workloads and pressing deadlines, employees may struggle to find the time to participate in training programs which leads to reduced demand for corporate training services. Moreover, the need to balance professional responsibilities with personal commitments further exacerbates the challenge of allocating time for training and development activities. As a result, employees may prioritize immediate tasks over long-term skill development, resulting in lower engagement and participation rates in training initiatives.

In addition, the fast-paced nature of business operations and constant demands for productivity may discourage employees from taking time away from their work responsibilities to engage in training activities. This reluctance to invest time in training programs hinder market demand for corporate training services, as organizations may perceive low employee participation rates as a lack of interest or commitment to professional development and limit the growth of the corporate training market demand.

Data analytics and artificial intelligence (AI) present significant opportunities in the corporate training market by revolutionizing the way training programs are delivered, personalized, and optimized for effectiveness. By utilizing data analytics, training providers might gain valuable insights into learners' behavior, preferences, and performance which might allow them to adapt training content and delivery methods to meet individual needs. AI-powered algorithms analyze large volumes of learner data to identify patterns, predict learning outcomes, and recommend personalized learning paths, enabling training providers to offer more targeted and impactful training experiences. Moreover, AI-driven chatbots and virtual assistants provide real-time support and feedback to learners, enhance engagement, and facilitating continuous learning.

In addition, data analytics and AI offer opportunities for training providers to optimize training programs and improve learning outcomes through continuous measurement and feedback. By leveraging data analytics, training providers may track the effectiveness of training interventions, identify areas for improvement, and iterate on training content and delivery methods in real-time. AI-powered assessment tools provide adaptive testing and competency-based assessments which allows learners to demonstrate mastery of skills and competencies more effectively. Furthermore, the integration of data analytics and AI in training offers training providers the opportunity to deliver more personalized, efficient, and impactful training experiences which drives the market demand and promotes innovation in the corporate training industry.

Segmental Overview

The corporate training market is segmented into training programs, industries, and region. By training program, the market is classified into technical training, soft skills, quality training, compliance, and other training programs. As per industries, the market is classified into retail, pharmaceutical and healthcare, financial services, professional services, public enterprises, information technology, and other industries. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (France, Germany, the UK, Italy, Spain, Russia, and the Rest of Europe), Asia-Pacific (China, Japan, India, Australia, South Korea and the rest of Asia-Pacific), and Latin America (Brazil, Argentina, Colombia, and Rest of Latin America) and Middle East & Africa (South Africa, Saudi Arabia, UAE and Rest of MEA).

By Training Program

By training program, the quality training segment dominated the global corporate training market in 2023 and is anticipated to maintain its dominance during the corporate training market forecast period. Quality training enhances employee skills, encouraging higher productivity and efficiency within organizations and cultivates a culture of continuous learning which is vital in today's fast-paced business model where adaptation acts as a key. Quality training boosts employee morale and satisfaction which leads to reduced turnover rates and higher retention. Moreover, it contributes to a company's competitive edge by ensuring that employees are up to date with industry standards and best practices. Quality training addresses specific needs and challenges within the organization, tailored to its goals and objectives.

By Industries

By industries, FMCG industry segment dominated the global corporate training market in 2023 and is anticipated to maintain its dominance during the forecast period. FMCG industry operates in a highly competitive and dynamic environment, where rapid innovation and adaptation are essential for success. FMCG companies often have large and geographically dispersed teams, requiring comprehensive training programs to ensure consistency and alignment across regions. Moreover, the dominance of FMCG in the corporate training market is driven by its necessity for staying competitive, ensuring operational efficiency, and delivering superior customer experiences.

By Region

Region-wise, North America is anticipated to dominate the market with the largest share during the forecast period. North America hosts a large number of multinational corporations across various industries which drives the demand for comprehensive training programs to maintain competitiveness and innovation. Moreover, the region has a robust economy and a culture that values continuous learning and professional development, leading companies to invest significantly in employee training initiatives. North America boasts advanced technological infrastructure and digital learning platforms, facilitating the delivery of high-quality training content to a wide audience efficiently. These factors contribute to North America's dominance in the corporate training market, as it continues to prioritize skill development and knowledge enhancement in the workplace.

Competitive Analysis

Key players profiled in this report include Bizlibrary, GP Strategies Corporation, Franklin Covey Co., City & Guilds Group, D2L Corporation, Cornerstone Ondemand Inc., Wilson Learning Worldwide Inc., Allen Communications Learning Services, Simplilearn Solutions, and Skill Soft.

Several upcoming brands are vying for market dominance in the expanding corporate training industry. Smaller, niche firms are more well-known for catering to consumer demands and tastes. Private label brands created by merchants and e-commerce platforms are another aspect of the competitive market. While they provide more affordable options, they have different recognition or range of training programs than well-known companies. Brands that are able to change the tastes of their target market and align with their ethical & environmental values have an advantage over rivals.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the corporate training market analysis from 2023 to 2035 to identify the prevailing corporate training market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the corporate training market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global corporate training market trends, key players, market segments, application areas, and market growth strategies.

Corporate training Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2035 |

| Report Pages | 288 |

| By Training Program |

|

| By Industries |

|

| By Region |

|

| Key Market Players | Skill Soft, Allen Communications Learning Services, Bizlibrary, Simplilearn Solutions, City & Guilds Group, Franklin Covey Co., GP Strategies Corporation, Wilson Learning Worldwide Inc., D2L Corporation, Cornerstone Ondemand Inc. |

Analyst Review

According to CXOs of leading companies, the global corporate training market is growing at a considerable pace owing to several factors such as introduction of new training methods, and different training programs to strengthen their foothold in the market, in terms of value sales. They emphasize continuous innovation to formulate new training methods and gain a competitive edge in the global market and to boost the demand for corporate training in various industries. All these factors fuel the increase in growth of the corporate training market.

According to the key market players, growing demand for micro-learning and use of gamification across the corporate sectors will boost the growth of the corporate training market. These players are focused on investing in R&D activities to offer easy and effective ways to train employees of corporate sectors and maintain their position in the market. Moreover, according to some key corporate training players, the emergence of cost-effective e-learning training modules is anticipated to fuel the growth of the market across the globe. The key manufacturers are providing training programs including soft skills, sales training, compliance training, technical training, and others, to enhance trainees’ skill sets and making them more efficient and productive at the workplace. However, budget concern of corporate sectors is expected to hamper the market growth in terms of value sales.

The global corporate training market was valued at $ 361.5 Billion in 2023 and is projected to reach $ 805.6 Billion by 2035

The global corporate training market is projected to grow at a compound annual growth rate of 7% from 2024 to 2035 $805.6 billion by 2035

The top key players analyzed for global corporate training market report are include Bizlibrary, GP Strategies Corporation, Franklin Covey Co., City & Guilds Group, D2L Corporation, Cornerstone Ondemand Inc., Wilson Learning Worldwide Inc., Allen Communications Learning Services, Simplilearn Solutions, and Skill Soft.

North America holds the maximum market share of the corporate training market.

Digital transformation and technological adoption are major drivers fueling the demand for corporate training solutions.

Loading Table Of Content...

Loading Research Methodology...