Corrugated Packaging Market Overview:

The global corrugated packaging market size was valued at $134.5 billion in 2021, and is projected to reach $198.8 billion by 2031, growing at a CAGR of 4.1% from 2022 to 2031.

Key Market Insights

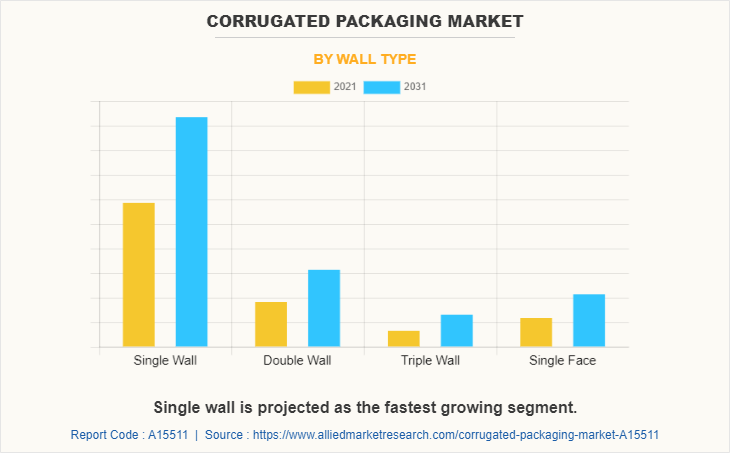

- By Wall Type: Single wall is projected as the fastest growing segment.

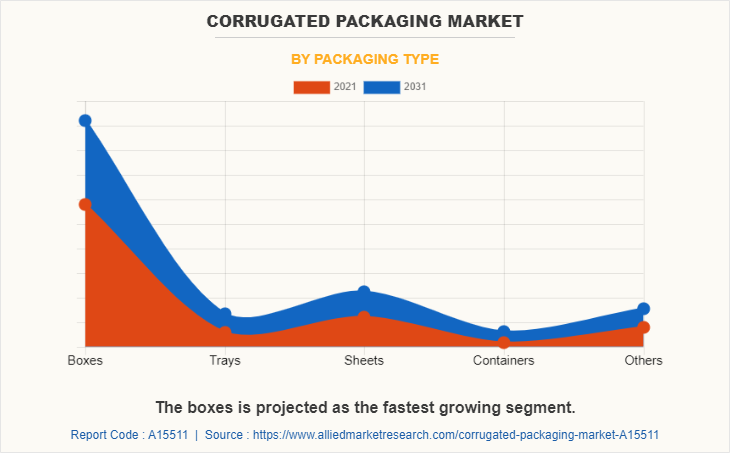

- By Packaging Type: The boxes is projected as the fastest growing segment.

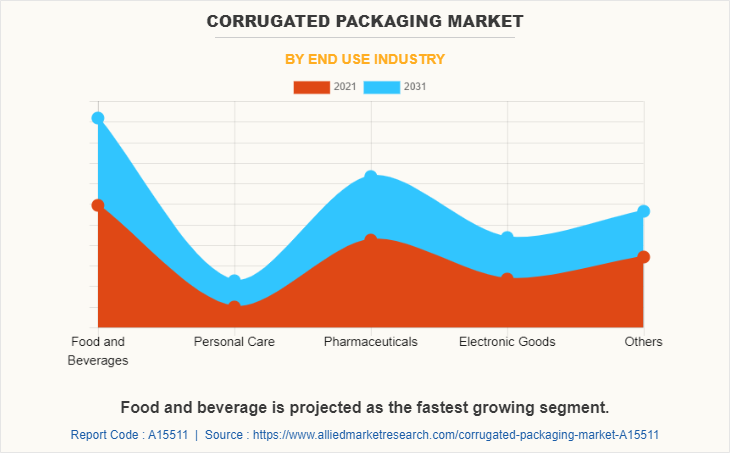

- By End-User Industry: Food and beverage segmented as the fastest growing segment.

- By Region: Asia-Pacific dominated the market in 2021

Market Size & Forecast

- 2031 Projected Market Size: USD 198.8 Billion

- 2022 Market Size: USD 134.5 Billion

- Compound Annual Growth Rate (CAGR) (2022-2031): 4.1%

How to Describe Corrugated Packaging:

Corrugated packaging is typically made of paperboard and is suitable for food, pharmaceuticals, equipment, and a variety of other products. Corrugated packaging is made by folding, cutting, and shaping sheets of high duty layered papers and can be used to produce food packaging boxes, cardboard boxes, juice boxes, milk cartons, and other objects. Corrugated cardboard is thicker and stronger and is commonly used to create shipping boxes and even furniture. Corrugated box packaging is a part of the recycling industry and is comprised of shredded and compressed recycled cardboard, paper, paper waste, and sawdust.

Corrugated packaging represents technological, design, material handling, and environmental advancements which act as a cushion for the product, keeping it safe throughout long-distance transit, shipping, and handling. It is also designed to withstand the wear and tear of usual daily transportation operations which make easier and faster to load products. Corrugated packaging is frequently combined to create double or triple wall boxes that are stronger and thicker than most other types of packaging. This enables corrugated boxes to be utilized in the shipping business, where large objects are transported. Corrugated boxes that are lighter and less expensive are utilized in retail packaging and food packaging. Pizza boxes, for instance, are composed of single-walled corrugated cardboard.

Report Key Highlighters:

The corrugated packaging market study covers 20 countries. The segment analysis of each country in both value ($million) and volume (kilotons) during the forecast period 2021-2031 is covered in the report.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global corrugated packaging markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

The key players in the corrugated packaging market are DS Smith Plc, Georgia-Pacific, LLC., International Paper, Mondi Group, Nine Dragons Worldwide (China) Investment Group Co., Ltd., Oji Holdings Corporation, Packaging Corporation of America, Rengo Co., Ltd., Smurfit Kappa, and WestRock Company. They have adopted strategies such as acquisition, product launch, merger, and expansion to gain an edge in the market.

Historical data and regulations are also covered in the report.

Market Dynamics

Growth in the packaged food & beverage industry is expected to drive the growth of the corrugated packaging market. As consumers increasingly shift toward ready-to-eat meals, convenience food, and online grocery shopping, there is a heightened emphasis on the need for packaging that ensures product safety, hygiene, and structural integrity. Corrugated packaging, with its robust and cushion-like structure, offers effective protection against physical damage during transit and handling, making it particularly suitable for the transportation of fragile or perishable food items. In October 2024, Mondi acquired Schumacher Packaging's assets in Germany, Benelux, and the UK for approximately $695 million (€634 million), strengthening its presence in Western Europe and enhancing its corrugated converting capacity. Moreover, food and beverage companies are under growing pressure to meet strict regulatory standards for hygiene and safety, especially in the wake of heightened awareness following global health concerns. Corrugated packaging, often designed for single-use and made from virgin or high-grade recycled fibers, reduces the risk of contamination. In April 2024, International Paper acquired European packaging firm DS Smith for $7.2 billion, focusing on custom corrugated solutions and expanding high-tech box plants in the U.S.

However, competition from alternative packaging is expected to restrain the growth of the corrugated packaging market. Competition from alternative packaging materials poses a significant challenge to the growth of the corrugated packaging market. Plastics, flexible packaging, and reusable containers often offer advantages such as lighter weight, better moisture resistance, and sometimes greater durability, which can make them more suitable for specific applications. Flexible packaging also appeals to sustainability-conscious consumers and companies. It generates up to 50% less landfill waste and 62% lower greenhouse gas emissions compared to rigid packaging, including corrugated boxes. Growing environmental advantages, cost efficiency, and changing consumer preferences for lightweight, portable, and resealable options are prompting competition in many alternatives to corrugated packaging.

Moreover, innovative packaging designs are expected to offer lucrative opportunities in the corrugated packaging market. Innovative packaging designs are transforming the corrugated packaging industry by introducing smart, reusable, and multi-functional solutions that add significant value for both manufacturers and consumers. As businesses strive to differentiate their products and enhance the customer experience, corrugated packaging is evolving beyond its traditional role as a protective container. Smart packaging technologies, such as embedded QR codes, sensors, and NFC tags integrated into corrugated boxes, enable brands to offer interactive experiences, track shipments in real time, and provide consumers with product information or authenticity verification directly through their smartphones. In May 2023, Austral Fisheries implemented QR codes on their seafood packaging, allowing consumers to trace the product's journey from sustainable fisheries to the market. This transparency builds consumer trust and supports sustainability goals.

Corrugated Packaging Market Segment Review:

The corrugated packaging market is segmented into wall type, packaging type, end-use industry, and region. On the basis of wall type, the market is categorized into single wall, double wall, triple wall, and single faced. On the basis of packaging type, it is divided into boxes, trays, sheets, container, and others. On the basis of end-use industry, the market is classified into food & beverages, personal care, pharmaceuticals, electronic goods, and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The single wall segment accounted for the largest share of the global corrugated packaging market in terms of revenue, in 2021. Single wall corrugated packaging is placed between two sheets of liners to produce single wall corrugated packaging. A fluted corrugated sheet separates an inner and outer liner in single wall corrugated packaging. Single wall board is used in shipping boxes that are less in weight. Single wall corrugated boxes provide a cost-effective packaging solution for general consumer use and for e-commerce or online businesses. It is designed for light to medium-duty usage, making it ideal for house removals for storing, organizing, and transferring items.

The boxes segment accounted for the largest share of the global corrugated packaging market in terms of revenue, in 2021. Corrugated boxes are provided as slotted boxes, telescope boxes, rigid boxes, and folded boxes. Slotted boxes are made of one solid piece with a stitched, taped, or glued manufacturer's junction with top and bottom flaps. It is perfect for usage as storage containers, retail packaging, and product packaging. Due to their manageable sizes, telescopic corrugated boxes are used for packing shoes, garments, kitchen ware, and many other products. Corrugated boxes are utilized for prestige, luxury, elegance, and quality packaging, and are ideal for small, high-end items such as jewelry or electronics. International Paper has been undergoing a strategic transformation under CEO Andy Silvernail since 2024. The company is shifting focus from traditional paper products to modern corrugated packaging solutions. This includes the closure of unprofitable mills, expansion of the sales force, and investment in high-tech box plants. Notably, International Paper is integrating European packaging firm DS Smith through a $7.2 billion acquisition, aiming to enhance its custom packaging capabilities and regional client base

Food and beverage segment dominated the global corrugated packaging market in 2021. Corrugated boxes are among the most cost-effective secondary packaging materials utilized in the food and beverage sectors. Corrugated packaging is essential for preserving food quality and providing food safety over a long shelf life, which is critical for cakes, candies, and frozen ready-to-eat bakery goods. Corrugated packaging is non-reactive, making it an excellent choice for packing, transporting, and keeping food over long periods of time. Corrugated food packaging requires the use of safe packaging materials that are acceptable to customers while also ensuring food safety. In October 2023, Visy Industries opened a $200 million corrugated box factory in the U.S., producing over 1 million boxes daily, and launched new plants in Australia to boost recycling and packaging capacities.

In Asia-Pacific corrugated packaging market share is projected to register a robust growth during the forecast period. In Asia-Pacific, corrugated packaging is mostly used for consumer goods, home appliances, medicinal products, and other. Corrugated packaging is used in the pharmaceutical industry to keep moisture out of the product and to make it resistant to external influences like moisture, biological contamination, oxygen, moisture, adulteration, mechanical damage, and to ensure the quality and effectiveness of pharmaceutical products. In Asia-Pacific, corrugated packaging is also utilized in the form of paper composite, which may be used in precision instruments, electromechanical equipment, household appliances, ceramic packing boxes, liners, and other products. The "Plastic Ban 2025" policy is phasing out single-use plastics, boosting demand for eco-friendly corrugated alternatives. Moreover, in March 2025, Oji India Packaging Pvt. Ltd., a subsidiary of Japan's Oji Group, inaugurated its fifth manufacturing facility in Sri City, Andhra Pradesh, specializing in corrugated boxes and packaging accessories.

Which are the Leading Companies in Corrugated Packaging:

Major players operating in the global corrugated packaging market forecast includes DS Smith Plc, Georgia-Pacific, LLC., International Paper, Mondi Group, Nine Dragons Worldwide (China) Investment Group Co., Ltd., Oji Holdings Corporation, Packaging Corporation of America, Rengo Co., Ltd., Smurfit Kappa, and WestRock Company. These players have adopted several growth strategies to strengthen their position in the corrugated packaging market.

In November 2023, Rengo acquired a 30% stake in Velvin Containers Private Limited, an Indian corrugated packaging manufacturer. The joint venture, renamed Velvin Rengo Containers Private Limited, is constructing a new plant in Cheyyar, Tamil Nadu, expected to commence partial operations in March 2024. This move aims to capitalize on India's growing packaging market.

In April 2022, DS Smith Plc introduced corrugated cardboard packaging for medical devices. This product launch intends to promote environmental protection across the supply chain. The packaging can be utilized for e-commerce delivery, with cardboard inserts storing various elements of the gadget. It is also claimed to reduce costs.

In November 2022, Smurfit Kappa expanded its business by investing 22 million USD in its manufacturing plants in Olomouc in the Czech Republic and Obaly Sturovo in Slovakia respectively. The two operations received extensive modifications, including the installation of cutting-edge technology to increase production and meet rising customer demand for paper-based packaging solutions. This growth will raise demand for corrugated packaging products.

Which key developments have shaped the market recently

In April 2024, International Paper agreed to acquire DS Smith for $7.2 billion. The European Commission granted conditional approval in February 2025, requiring International Paper to divest five plants in France, Portugal, and Spain to address competition concerns.

In July 2024, Smurfit Kappa and WestRock completed a merger, forming Smurfit WestRock, one of the largest paper and packaging companies in the world. The newly formed entity reported net sales of $7.7 billion in its first quarterly results post-merger, with significant growth in North America and Latin America.

In March 2024, Mondi, a UK-based packaging company, proposed a $6.53 billion (£5.14 billion) all-share bid to acquire London-based DS Smith. The acquisition is set to create a packaging giant valued at over $12.7 billion (£10 billion), with the combined entity becoming Europe's largest manufacturer of corrugated cardboard.

Key Regulations:

Feedback Energy Distribution Company Limited (FEFCO), Goods Manufacturing Practice (GMP) standard is developed for the manufacturing of packaging made of corrugated board in order to support companies to fulfil the legal requirements according to EU Regulations 1935/2004/EG for food contact materials and EU Regulation 2023/2006 on good manufacturing practices.

What are the Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the corrugated packaging market analysis from 2021 to 2031 to identify the prevailing corrugated packaging market opportunities.

- The corrugated packaging market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the corrugated packaging market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global corrugated packaging market trends, key players, market segments, application areas, and corrugated packaging market growth strategies.

Corrugated Packaging Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 198.8 billion |

| Growth Rate | CAGR of 4.1% |

| Forecast period | 2021 - 2031 |

| Report Pages | 380 |

| By Wall Type |

|

| By Packaging Type |

|

| By End Use Industry |

|

| By Region |

|

| Key Market Players | Nine Dragons Worldwide (China) Investment Group Co., Ltd., Oji Holdings Corporation, International Paper, DS Smith Plc, Smurfit Kappa, Mondi Group, Packaging Corporation of America, Georgia-Pacific, LLC., WestRock Company, Rengo Co., Ltd. |

Analyst Review

According to the opinions of various CXOs of leading companies, the corrugated packaging market is driven by the rise in demand from food & beverages industry. Corrugated boxes are among the most cost-effective secondary packaging materials utilize in the food and beverage industries. Corrugated packaging is essential for preserving food quality and providing food safety over a long shelf life, which is critical for cakes, candies, and frozen ready-to-eat bakery goods.

Increase in demand for corrugated packaging in e-commerce business drives the market growth during the forecast period. The corrugated industry is in high demand for packaging due to the increased use of electronic devices such as smartphones, laptops, and tablets to access e-commerce platforms. However, the availability of substitutes such as flexible plastic packaging hinders the market growth. Flexible plastic packaging provides the greatest advantage as similar to the corrugated packaging and is smaller and lighter, which is cost effective as compared to other form of packaging.

The Asia-Pacific region is projected to register a robust growth during the forecast period. Corrugated packaging in home appliances is used in Asia-Pacific to design and produce kitchen boxes, as well as home goods gift boxes and many other items. In Asia-Pacific, corrugated packaging is also employed in the form of paper composite, which may be found in mechanical devices, electromechanical equipment, household appliances, ceramic packing boxes, liners, and other products.

The corrugated packaging market is segmented into wall type, packaging type, end-use industry, and region. On the basis of wall type, the market is categorized into single wall, double wall, triple wall, and single faced. On the basis of packaging type, it is divided into boxes, trays, sheets, container, and others. On the basis of end-use industry, the market is classified into food & beverages, personal care, pharmaceuticals, electronic goods, and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The leading players operating in the corrugated packaging market include DS Smith Plc, Georgia-Pacific, LLC., International Paper, Mondi Group, Nine Dragons Worldwide (China) Investment, Oji Holdings Corporation, Packaging Corporation of America, Rengo Co., Ltd., Smurfit Kappa, and WestRock Company.

The global corrugated packaging market was valued at $134.5 billion in 2021, and is projected to reach $198.8 billion by 2031, growing at a CAGR of 4.1% from 2022 to 2031.

food & beverages, personal care, pharmaceuticals, electronic goods, and others are the leading applications of corrugated packaging market

Rise in demand from the food and beverage, personal care, pharmaceuticals, and consumer goods industries are the driving factors of corrugated packaging market.

Loading Table Of Content...