Cosmetic Packaging Market Overview

The global cosmetic packaging market size was valued at $34.3 billion in 2020, and is projected to reach $55.9 billion by 2030, growing at a CAGR of 4.8% from 2021 to 2030. The cosmetic packaging market has experienced notable growth in recent years, driven by increased consumer spending on skincare products in both developed and developing countries. Advancements in 3D printing technology have enabled the production of intricate and innovative packaging designs. To strengthen their global presence, many industry players are actively expanding their operations.

Market Dynamics & Insights

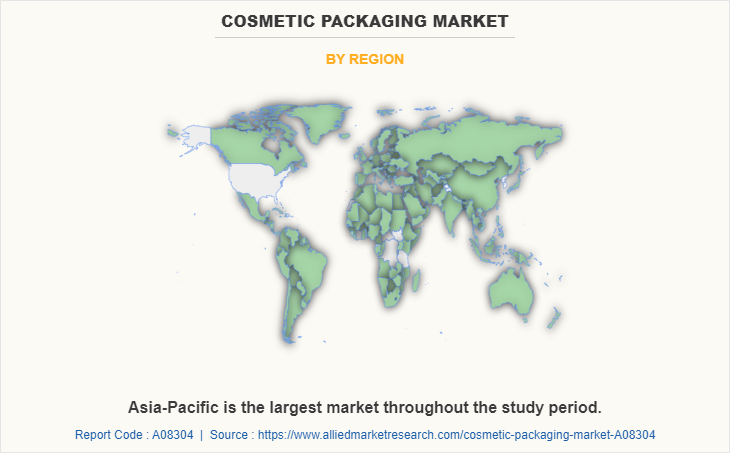

- The cosmetic packaging industry in Asia-Pacific held a significant share of over 31.2% in 2020.

- The cosmetic packaging industry in India is expected to grow significantly at a CAGR of 6.2% from 2021 to 2030.

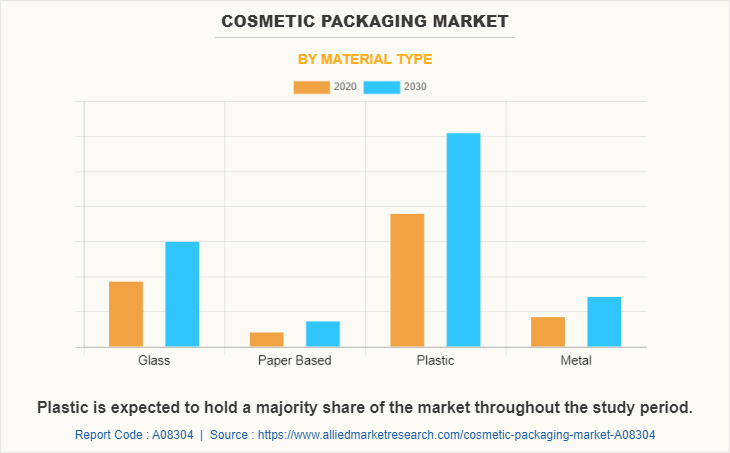

- By type, plastic is one of the dominating segments in the market and accounted for the revenue share of over 55% in 2020.

- By application, makeup segment is the fastest growing segment in the market.

Market Size & Future Outlook

- 2020 Market Size: $34.3 Billion

- 2030 Projected Market Size: $55.9 Billion

- CAGR (2021-2030): 4.8%

- Asia Pacific: Largest market in 2020

- Asia Pacific: Fastest growing market

What is meant by Cosmetic Packaging

Cosmetic packaging includes packaging solutions such as containers, pouches, boxes, and tubes that are used for packing cosmetic products. Cosmetic packaging is to prevent contamination and physical damage of cosmetic products. In addition, also it is required to be attractive and unique to trigger impulse buying in the consumer.

Cosmetic Packaging Market Dynamics

Personal care products such as skin creams and hair products are essential to maintain hygiene. Makeup enhances the appearance of an individual, thereby boosting their self-esteem and confidence. Furthermore, cosmetics are extensively used in the film industry and during wedding and festive season. Thus, continuous demand for cosmetics products fuels the growth of the cosmetics packaging market. In addition, availability of a wide range of cosmetic packaging products in various capacities, designs, and shapes make them suitable for packing a wide range of cosmetics products in various forms, including powder, liquid, and cream. Cosmetic packaging further serves as a tool for marketing of cosmetics products. Attractive packaging helps in enhancing product appearance, thereby boosting sales. In addition, advancements in 3D technologies have enabled cosmetic packaging manufacturers to make complex shapes and designs of packaging containers.

Major players in the industry have focused on development of sustainable cosmetic packaging products. For instance, in May 2021, Albea SA., a leading provider of a wide range of cosmetics packaging products, introduced a new polyethylene (PE) cap for oral care products. This new PE cap replaces traditional polypropylene (PP) caps. This PE cap will be coupled with the sleave made with the same material as of the cap. This allows the creation of a mono-material packaging product, which can easily be recycled with the existing high-density polyethylene (HDPE) streams. Further, advancements in 3D printing technology is playing a key role in development of new cosmetic packaging products. For instance, Albea SA, in partnership with Erpro 3D Factory and HP Inc. to develop new applications for HP’s Multi Jet Fusion 3D printing technology. The yet to be developed applications are expected to create lucrative opportunities for the cosmetic packaging market growth.

Furthermore, the developments in e-commerce industry has significantly boosted the demand in cosmetics product, owing to their easy availability. In addition, e-commerce platforms offer a wide range of cosmetic products to choose from. Moreover, rise in the usage of social media platforms such as Instagram and Facebook has positively influenced the cosmetic product packaging market.

The novel coronavirus has rapidly spread across various countries and regions, causing an enormous impact on the lives of people and the overall community. It began as a human health condition and has now become a significant threat to global trade, economy, and finance. The COVID-19 pandemic has halted the production of many components of cosmetic packaging due to lockdown. The economic slowdown initially resulted in reduced spending on beauty products from individuals across the world. Furthermore, the number of COVID-19 cases is expected to reduce in the near future as the vaccine for COVID-19 is introduced in the market. This has led to the reopening of cosmetic packaging product manufacturing companies at their full-scale capacities. This is expected to help the market to recover by the start of 2022.After COVID-19 infection cases begin to decline, cosmetic packaging products manufacturers must focus on protecting their staff, operations, and supply networks to respond to urgent emergencies and establish new methods of working.

Cosmetic Packaging Market Segment Overview

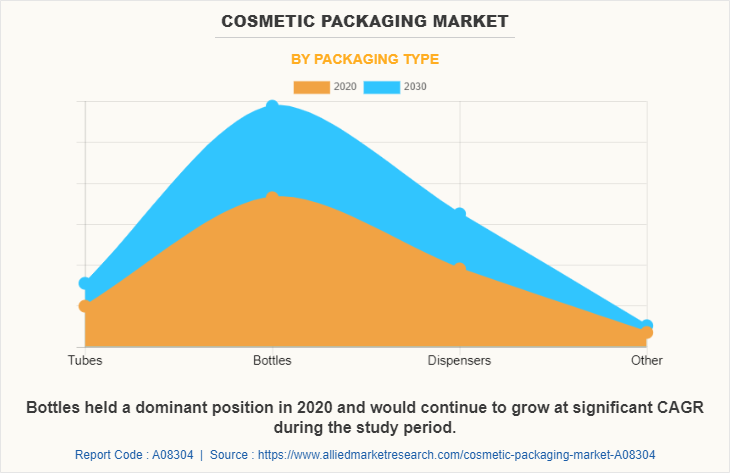

The cosmetic packaging market is segmented into Material Type, Packaging Type and Application. By material type, the market is categorized into glass, paper based, plastic, and metal. On the basis of packaging type, it is categorized into tubes, bottles, dispenser, and other. Depending on application, the market is categorized into oral care, skin care, hair care, makeup, and perfume. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific held the largest cosmetic packaging market share in 2020, accounting for the highest share, and is anticipated to maintain this trend throughout the forecast period.

Cosmetic Packaging MarketCompetition Analysis

Key companies profiled in the cosmetic packaging market analysis include Albea SA, Amcor PLC, Aptargroup Inc., Big Sky Packaging, Berlin Packaging, Berry Global, Inc., DS Smith PLC, HCP Packaging Co. Ltd., Huhtamaki Oyj, and Sonoco Products Company.

What are the Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cosmetic packaging market forecast analysis from 2020 to 2030 to identify the prevailing cosmetic packaging market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cosmetic packaging industry segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cosmetic packaging market trends, key players, market segments, application areas, and market growth strategies.

Cosmetic Packaging Market Report Highlights

| Aspects | Details |

| By Material |

|

| By Packaging Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | BambooVision, Moso International BV, Bamboo Village Company Limited, Kerala State Bamboo Corporation Limited, EcoPlanet Bamboo, Simply Bamboo Pty Ltd, Anji Tianzhen Bamboo Flooring Co. Ltd., Smith & Fong Company, Bamboo Australia, Dasso Group |

Analyst Review

The cosmetic packaging market has witnessed significant growth in past few years, owing to surge in spending on cosmetic products.

Rise in expenditure on personal care products, especially on the skin care products, in high income countries such as the U.S., Canada, UK, and Germany has fueled the growth of the cosmetic packaging market. Furthermore, packaging style of any cosmetic product has profound impact on the demand and sales of that particular cosmetic product, which positively influences the cosmetic packaging market. Cosmetic packaging made of plastic is widely used by beauty products manufacturers, owing to its durability. In addition, advancements in plastics that are eco-friendly have helped cosmetic packaging manufacturers to comply with the latest statutory guidelines related to environment safety, established by their respective governments.

Moreover, advancements in 3D printing technologies have helped cosmetic packaging manufacturers to experiment with the new and unconventional packaging products, thereby providing lucrative opportunities for the growth for the market.

Product launch is a major upcoming trend of Cosmetic Packaging Market in the world.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Asia-Pacific is the largest regional market for Cosmetic Packaging.

$34,322.7 Million is the estimated industry size of Cosmetic Packaging in 2020.

Albea SA, Amcor PLC, Aptargroup Inc., Big Sky Packaging, Berlin Packaging, Berry Global, Inc. and DS Smith PLC are some of the top companies to hold the market share in Cosmetic Packaging

Loading Table Of Content...