Cosmetic Pigments Market Research - 2032

The global cosmetic pigments market size was valued at $2.1 billion in 2022, and is projected to reach $4.5 billion by 2032, growing at a CAGR of 7.8% from 2023 to 2032. Cosmetic pigments are used as coloring agent in cosmetic products to provide a range of color, texture, and look. Variety of colors, white pigments, metallic shades, and others falls under the broad category of cosmetic pigments. They are used in manufacturing of personal care products such as lip care, nail improvement, hair color, and skin care. Based on composition, cosmetics pigments are of two types namely organic and inorganic pigments. Organic pigments are based on carbon chains that give brighter color in comparison with inorganic pigments. Whereas inorganic pigments are generally metallic compounds and salts such as chromates and metallic oxides that are generally resistant to solvents. Organic pigments are costly as compared to inorganic pigments.

Cosmetic pigments provide various advantages, including color stability, opacity & transparency, and safety. In order to preserve their intended color over time, cosmetic pigments must be stable in a variety of conditions, including exposure to light, heat, and chemicals. These pigments need to adhere to safety standards and have their usage approved. The products can be made of both organic or inorganic materials, as their primary motive is to improve the appearance of the nails, skin, or hair by enhancing glow or shine. The cosmetic pigments are mostly used in products like tinted skincare, eye makeup & under-eye care, lip & nail products, and hair care. The personal care sector has been undergoing constant change, with trends moving in the direction of more creative and varied product offers. This covers the use of diverse pigment kinds to make distinctive and individualized cosmetic goods. The goal of developing new pigment technology is to offer innovative effects, increased longevity, and better compatibility with formulations. In addition, there is a growing interest in makeup and beauty trends due to the expansion of social media platforms and the diversity of influencers. Because of this, more customers are experimenting with different effects and colors, which is increasing demand for more distinctive pigments.

Different regulations apply to the cosmetic industry that comprises the regulation related to substance use, labeling, and safety assessments. In order for the sector to develop, regulations, including those accepted by organizations like the U.S. Food and Drug Administration (FDA) and EU Cosmetic Regulation, must be adhered to. Regulatory organizations like the European Commission and the U.S. FDA create standards for the toxicity and safety of cosmetic products, including pigments. Cosmetic pigment makers have to ensure that their goods meet specific safety requirements in order to have them approved for use in cosmetics. Cosmetic pigments need special permission in order to be used in cosmetics as they are often considered as color additives. The usage of the pigments in cosmetics must be authorized by the relevant regulatory organizations. The safe use of cosmetic products and informed purchasing decisions depend on accurate cosmetic product labeling, which must also include information about the ingredients used in pigments. In order to comply with regulations, product packaging must accurately list ingredients.

The ability to create cosmetic pigments from organic, biodegradable, or recycled materials is increasing in line with consumer desire for goods that are environmentally friendly and sustainable. This deals with the need for unique items in the cosmetics sector as well as environmental concerns. Cosmetic businesses are sourcing their colors from natural sources like plant extracts, minerals, and even microorganisms. Without using synthetic chemicals, these natural pigments can provide lovely hues. The production of biodegradable and ecologically friendly pigments is also being done by a number of businesses. These pigments have a lower overall environmental impact since they degrade more quickly.

Natural pigments that come from mineral, plant, and animal sources are frequently considered as safer substitutes. Customers are looking for products with a lesser environmental effect as the importance of sustainability increases. Natural pigments are often biodegradable and can be sourced sustainably, making them more attractive to environmentally conscious consumers. This is anticipated to boost the demand for organic pigment during the forecast period. As customers place a greater importance on sustainability, they are seeking out goods that have a lower environmental impact. Natural pigments are more desirable to those who care about the environment as they are frequently biodegradable and can be sourced responsibly.

The key players profiled in the cosmetic pigments market report include Merck, BASF SE, Koel Colors, Sudarshan Chemical, DIC Corporation, Sun Chemical, SENSIENT COSMETIC TECHNOLOGIES, NEELIKON, Lanxess, and Clariant. Acquisition and strategic partnership are common strategies followed by major market players. For instance, Sun Chemical, a subsidiary of DIC Corporation, is expected to present new effect pigments and highlight its natural ingredients and colorants at In-cosmetics Global 2023. The company would launch SunPRIZMA, a new range of 11 silica-based color travel effect pigments. The product would be offered in two particle size ranges. This innovative line would offer multi-chrome effects, and high coverage for intense glittering color travel and bold looks for striking sparkle finishes. With the SunPRIZMA line of effect pigments, cosmetic product manufacturers will be able to develop chromatic color shifts with special effects in color cosmetics. Sun Chemical is also expected to present its new Reflecks Dimensions Platinum G13CD, a sparkling, silver, metallic-like effect pigment based on borosilicate.

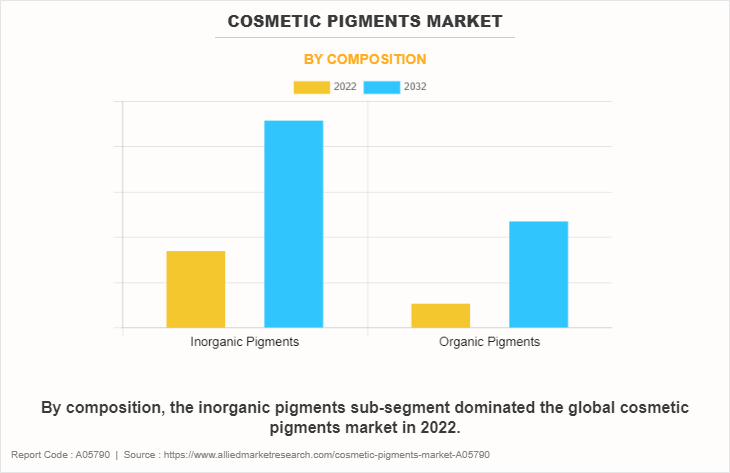

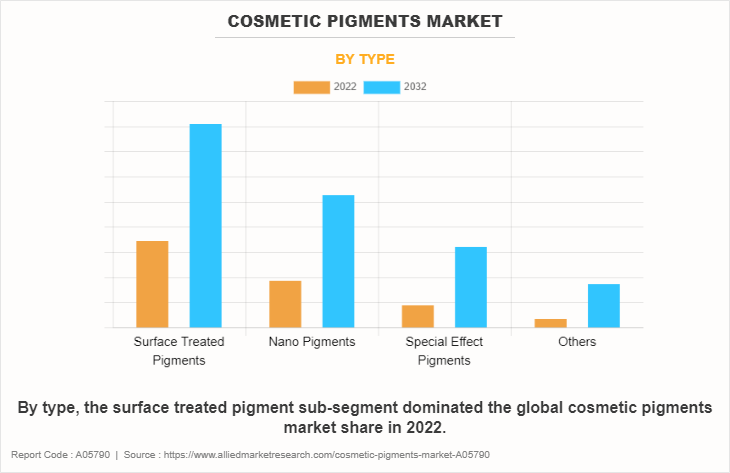

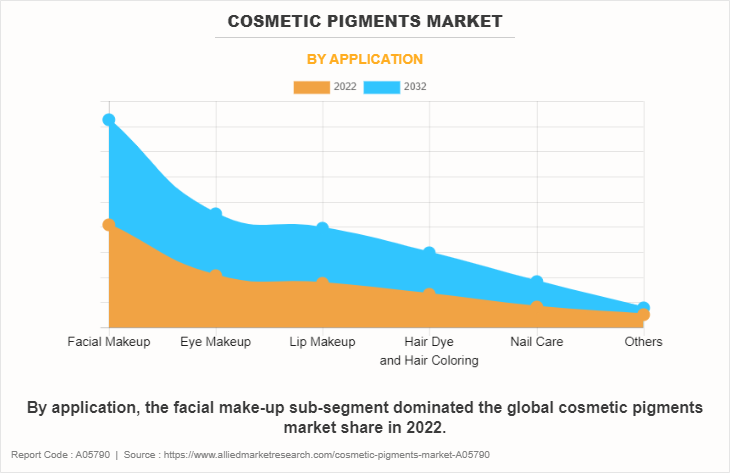

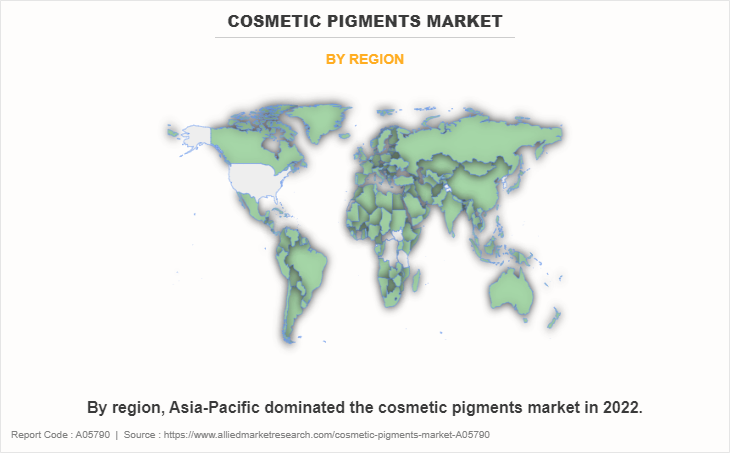

The cosmetic pigments market is segmented on the basis of composition, type, application, and region. By composition, the market is divided into inorganic pigments and organic pigments. By type, the market is bifurcated into surface treated pigment, nano pigment, special effect pigment, and others. By application, the market is classified into facial makeup, eye makeup, lip makeup, hair dye & hair coloring, nail care, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The cosmetic pigments market is segmented into Composition, Type and Application.

By composition, the inorganic pigments sub-segment dominated the global cosmetic pigments market in 2022. Inorganic pigments are majorly adopted for cosmetic products where color stability and safety is crucial. They are known for their longevity, resistance to fading, and outstanding color possibilities. Iron oxides, titanium oxide, chromium oxide, ultramarines, zinc oxide, chromium hydroxide green, manganese violet, and other inorganic pigments are the most widely used ones. Manufacturers using titanium dioxide as a pigment choose to use it to give skin-care and cosmetic products that are applied topically a whiter hue. These include applications like lips, nails, and eyes. The transparency of a product's formula can be reduced with the help of titanium dioxide, which also makes it opaquer.

Red, yellow, and black are the three fundamental colors of iron oxides. They can be found in many cosmetic goods including talcum powder and eye makeup. Despite the fact that synthetic iron oxide is utilized in cosmetics, they are safe to use. They are manufactured in laboratories due to the frequent imperfections in naturally occurring iron oxides. Inorganic pigment is a popular type of pigment due to various features including durability, resistance to fading, and a variety of bright colors.

By type, the surface treated pigment sub-segment dominated the global cosmetic pigments market share in 2022. Foundation, nail polish, blush, lipstick, and eyeshadow are just a few examples of cosmetics that contain surface-treated pigments. Surface treated pigments are essential because they offer variety in achieving different cosmetic effects, which is necessary for producing high-quality, long-lasting, and aesthetic products. In addition, advantages including increased UV protection, greater stability, improved color performance, regulated particle size, less skin irritation, and ease of formulation are increasing its popularity.

Surface treatment aids in preventing pigment deterioration brought on by factors including light, heat, moisture, and chemical interactions. The stability and shelf life of cosmetic goods are improved as a result, as undesirable color changes or degeneration are prevented. By increasing color intensity, vibrancy, and opacity, surface treatments can improve the color characteristics of pigments. This makes it possible for cosmetic makers to produce products with brilliant, uniform colors. In addition, surface treatments can modify the pigment particle size, which influences the feel and texture of cosmetic products when applied to the skin. This control aids in obtaining desirable product attributes including smoothness and application simplicity.

By application, the facial make-up sub-segment dominated the global cosmetic pigments market share in 2022. The market for cosmetic pigments does include a major portion for facial makeup. Cosmetic pigments are substances that impart color to a wide range of cosmetic goods, including blush, foundation, lipstick, eyeshadow, and other items used for facial makeup.

Customers use these products to draw attention to their facial features, create different looks, and achieve the desired aesthetics. The necessary color and visual effects in cosmetics can be produced using these pigments. The beauty sector also frequently debuts new makeup formulations, tools, and technologies that can facilitate the application of makeup and improve its versatility and durability.

By region, Asia-Pacific dominated the cosmetic pigments market in 2022. Asia-Pacific has experienced rapid expansion in the personal care and cosmetics industry. In countries like South Korea, China, Japan, and India, there has been an apparent increase in consumer demand for cosmetics and skincare products. The demand for cosmetic pigments increased concurrently and steadily as they are used into numerous formulas, including skincare, cosmetics, and hair care products.

In the field of color cosmetics, South Korea has led the way in terms of innovation, coming up with new designs and concepts that have been widely embraced on a global scale. The desire for a wide variety of cosmetic pigments has been driven by K-beauty trends including cushion foundations, gradient lips, and unusual color palettes. Due to the widespread usage of skin-whitening treatments in the region, there is now a strong demand for the pigments used in cosmetic products. For these goods to provide the desired results, specific pigments are frequently needed. In order to reach the region's expanding consumer base, many international cosmetic manufacturers have also increased their presence there. As a result of this increase, there is now a greater need for cosmetic pigments to satisfy regional market demand and legal specifications.

Highlights of the Report

- The report provides exclusive and comprehensive analysis of the global cosmetic pigments market trends along with the cosmetic pigments market forecast.

- The report elucidates the cosmetic pigments market opportunity along with key drivers, and restraints of the market. It is a compilation of detailed information, inputs from industry participants and industry experts across the value chain, and quantitative and qualitative assessment by industry analysts.

- Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the market for strategy building.

- The report entailing the cosmetic pigments market analysis maps the qualitative sway of various industry factors on market segments as well as geographies.

- The data in this report aims on market dynamics, trends, and developments affecting the cosmetic pigments market growth.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cosmetic pigments market analysis from 2022 to 2032 to identify the prevailing cosmetic pigments market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cosmetic pigments market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cosmetic pigments market trends, key players, market segments, application areas, and market growth strategies.

Cosmetic Pigments Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 4.5 billion |

| Growth Rate | CAGR of 7.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 295 |

| By Composition |

|

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | NEELIKON, Sun Chemical, Clariant, SENSIENT COSMETIC TECHNOLOGIES, Lanxess, Koel Colors, DIC Corporation, Merck, BASF SE, Sudarshan Chemical |

The cosmetic pigments market size is expected to grow due to an increase in demand for cosmetic products globally. In addition, the market is driven by growth in the development of new and more effective cosmetic and personal care products.

The major growth strategies adopted by the cosmetic pigments market players are product launches and partnership agreements.

Asia-Pacific will provide more business opportunities for the global cosmetic pigments market in the future.

Merck, BASF SE, Koel Colors, Sudarshan Chemical, DIC Corporation, Sun Chemical, SENSIENT COSMETIC TECHNOLOGIES, NEELIKON, Lanxess, and Clariant are the major players in the cosmetic pigments market.

The inorganic sub-segment of the composition acquired the maximum share of the global cosmetic pigments market in 2022.

Cosmetic product companies are the major customers in the global cosmetic pigments market.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global cosmetic pigments market from 2022 to 2032 to determine the prevailing opportunities.

There is expected to be a rise in the adoption of facial makeup, as customers use these products to draw attention to their facial features, create different looks, and achieve the desired aesthetics. The necessary color and visual effects in cosmetics are provided using cosmetic pigments.

Customers are looking for products with a lesser environmental effect as the importance of sustainability increases. Natural pigments are often biodegradable and can be sourced sustainably, making them more attractive to environmentally conscious consumers.

Loading Table Of Content...

Loading Research Methodology...