Cream Liqueur Market Research, 2029

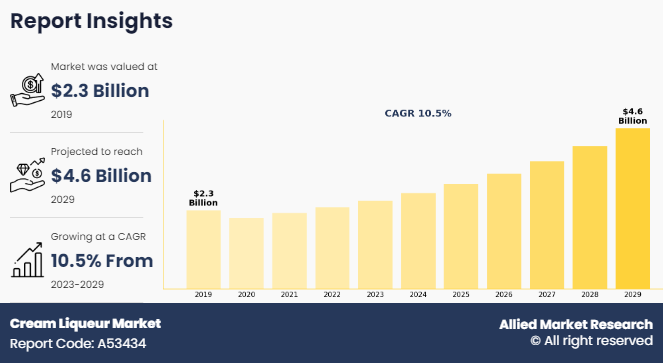

The global cream liqueur market size was valued at $2.3 billion in 2019, and is projected to reach $4.6 billion by 2029, growing at a CAGR of 10.5% from 2023 to 2029. The increased change in consumer lifestyle, innovation in flavors along the rise in sustainable and ethical consumption have driven the demand for the cream liqueur market. Cream liqueur is a type of beverage characterized by its smooth and creamy texture. It is typically made by blending a distilled spirit base, such as whiskey, rum, or brandy, with dairy cream or a cream substitute, sweeteners, and flavorings. Moreover, the combination of these ingredients results in a rich and indulgent liqueur with a sweet and flavorful profile. Cream liqueurs often feature a wide range of flavors, including classic options such as chocolate, vanilla, and caramel, as well as more exotic variations such as coconut, coffee, and hazelnut. The versatile beverage is enjoyed on its own, over ice, or as a component in cocktails and desserts. In addition, cream liqueur is popular for its luxurious taste and smooth texture, making it a favored choice for special occasions and social gatherings. According to Drinks International’s The Millionaires’ Club, the Irish cream liqueur sold 8.8 million 9-litre cases in 2021, which was a 23% increase on the previous year.

Key Takeaways

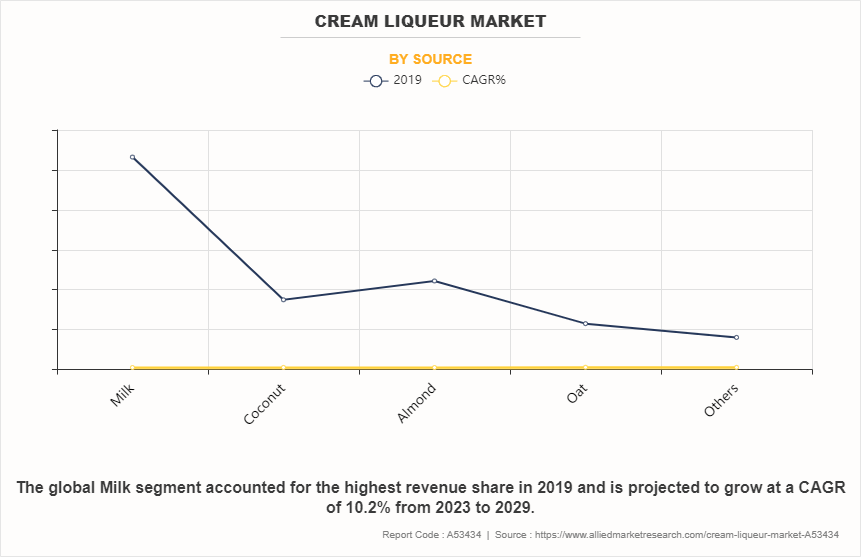

By source, milk dominated the global market in 2022.

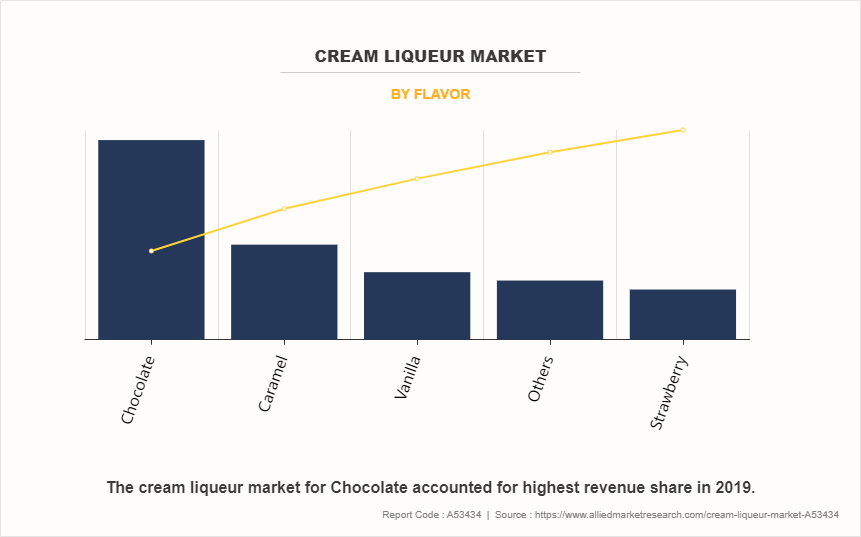

By flavor, chocolate dominated the global market in 2022.

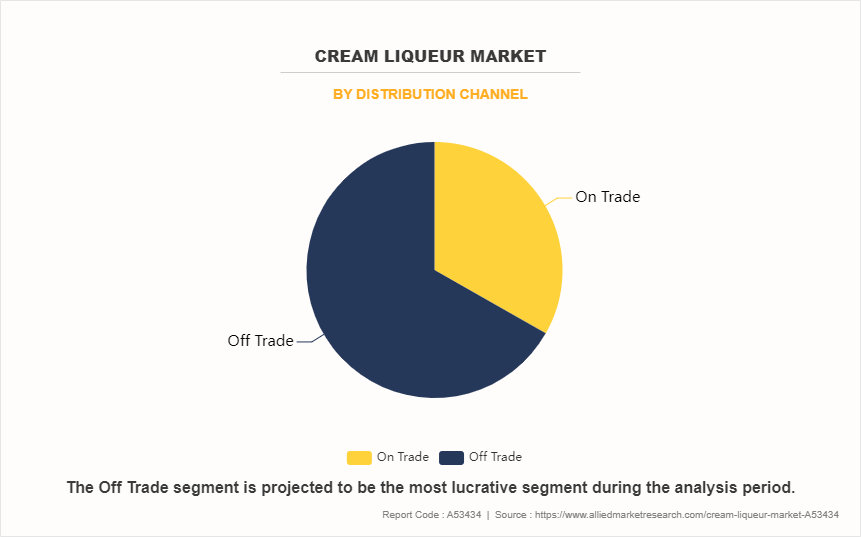

By distribution channel, off trade dominated the global market in 2022.

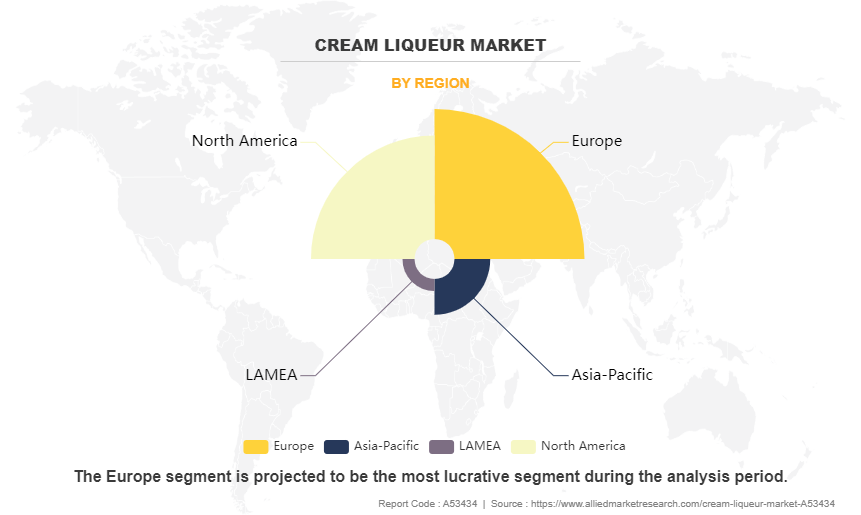

By region, Europe dominated the global market in 2022.

Market Dynamics

Growing shifts in consumer lifestyles and tastes

The market for cream liqueurs is largely shaped by consumer tastes. Customer’s tastes have shifted over time to favor luxurious, premium, and immersive beverages. Furthermore, cream liqueurs' opulent and rich flavors are a wonderful fit for the changing consumer tastes. Moreover, cream liqueurs have become a popular option owing to their adaptability in cocktails, desserts, and on their own as customers seek items that provide distinctive flavor experiences and diversity in consumption.

The market for cream liqueurs has also expanded as a result of shifting lifestyle trends, such as an increase in social drinking events, especially among younger generations and millennials. As cream liqueurs are associated with conviviality and enjoyment, they are frequently preferred during social gatherings, festivities, and festive occasions. This has boosted the demand for the cream liqueur market.

Artistic Approaches to Product Development and Promotion

The market for cream liqueurs has been pushed by industry player’s constant innovation in product development and marketing tactics. Brands aim to set themselves apart in a highly competitive market by providing distinctive flavors, premium ingredients, and eye-catching packaging designs that speak to the tastes and aspirations of consumers. Furthermore, bringing in new customers and keeping hold of current ones have been made possible by product innovation. Companies are also involved in frequent experiments with a broad variety of flavor profiles, ranging from traditional choices such as chocolate and vanilla to more unusual ones like salted caramel, coconut, and espresso.

In addition, working with well-known mixologists, chefs, and influencers has increased the authenticity and legitimacy of the product, which in turn has increased its attractiveness to consumers. According to IWSR data, it is observed that in the four years to the end of 2020, premium and above cream liqueurs (£22/$25-plus) have been growing much faster than the rest of the category in Europe and the US. Moreover, this trend is set to continue, with premium-and-above spirits forecast to increase global cream liqueur market share to 13% (from 9%) by 2024.

Increasing Challenges with Regulation and Compliance

The market operates within a framework of strict regulatory oversight governing every aspect of production, distribution, and advertising within the industry. Compliance with these regulations presents notable challenges for manufacturers, particularly concerning adherence to labeling requirements, alcohol content restrictions, and advertising guidelines. Moreover, navigating the divergent regulatory standards across different regions and countries adds further complexity to the compliance process, necessitating brands to meticulously navigate a labyrinth of legal requirements to ensure market access and uphold consumer safety.

Furthermore, heightened concerns regarding issues such as underage drinking, alcohol abuse, and impaired driving have compelled policymakers to enact more stringent regulations aimed at mitigating alcohol-related harm and promoting responsible consumption behaviors. These regulations are anticipated to encompass measures such as increased taxation on alcoholic beverages, restricted availability in certain establishments, and mandatory inclusion of health warnings on packaging. Compliance with these regulatory mandates not only amplifies operational costs for manufacturers but also imposes constraints on promotional activities and limits the market reach of cream liqueur brands, thereby curbing their potential for cream liqueur market growth.

Expansion of health-consciousness and dietary preferences

The market is facing hurdles due to the increasing focus on health-consciousness and dietary trends. Concerns about health issues such as obesity and diabetes have led consumers to scrutinize the sugar and calorie content of cream liqueurs, which are often seen as indulgent treats. Additionally, the use of dairy-based ingredients in cream liqueurs presents challenges for consumers adhering to vegan, lactose-free, or plant-based diets, limiting the market appeal of traditional offerings. Furthermore, heightened awareness of the negative health impacts of excessive alcohol consumption has prompted shifts in consumer behavior towards lower-alcohol or alcohol-free alternatives. This trend, particularly prominent among younger demographics prioritizing wellness and moderation, presents obstacles for cream liqueur brands in attracting and retaining health-conscious consumers. Consequently, manufacturers are compelled to innovate in product formulations and marketing strategies to address evolving dietary preferences and lifestyle trends.

Exploration of Niche Flavors and Experiences

The exploration of niche flavors and experiences presents a significant opportunity for innovation and differentiation within the market. With the introduction of unique and unconventional flavor combinations, cream liqueur brands can cater to the diverse preferences of consumers and stand out in a crowded market landscape. For instance, brands are able to experiment with exotic spices, botanicals, or regional ingredients to create distinctive flavor profiles that offer a memorable and indulgent drinking experience. In addition, exploring niche experiences such as limited-edition releases, themed collections, or interactive tasting events can engage consumers and drive excitement around the brand. By embracing creativity and innovation in flavor development and marketing strategies, cream liqueur brands can captivate consumers' imaginations and cultivate a loyal customer base, ultimately driving growth and success in the market.

Segment Overview

The cream liqueur market is analyzed on the basis of source, flavor, distribution channel and region. By source, it is divided into milk, coconut, almond, oats and others. By flavor, it is categorized into chocolate, caramel, vanilla, strawberry, and others. By distribution channel, it is bifurcated into on trade and off trade. By region, it is divided into North America, Europe, Asia-Pacific and LAMEA.

By Source

By source, the milk segment dominated the global market, registering a CAGR of 9.4% in 2022 and is anticipated to maintain its dominance during the forecast period. The milk-based cream liqueurs offer a creamy and luxurious texture that is highly desirable among consumers. The addition of milk imparts a smooth and velvety mouthfeel to the liqueur, enhancing its indulgent appeal and creating a satisfying drinking experience. Moreover, milk serves as an excellent carrier for flavors, allowing cream liqueur manufacturers to create a wide range of rich and complex flavor profiles. It is infused with chocolate, caramel, coffee, or other indulgent flavors, milk-based cream liqueurs to offer a depth of taste that appeals to a broad audience. The aforementioned factors have positively influenced the demand for market.

By Flavor

By flavor, the chocolate segment dominated the global cream liqueur market, registering a CAGR of 9.5% in 2022 and is anticipated to maintain its dominance during the cream liqueur market forecast period. Chocolate is universally loved for its rich, decadent taste, making it an irresistible flavor choice for cream liqueurs. The combination of creamy liqueur and chocolate creates a luxurious and indulgent drinking experience that appeals to a wide range of consumers with a sweet tooth. Chocolate-flavored cream liqueurs are incredibly versatile and can be enjoyed in various ways. They can be sipped neat, served over ice, or used as a key ingredient in cocktails, desserts, and other culinary creations. This versatility makes chocolate cream liqueurs a popular choice for both casual and sophisticated drinking occasions.

By Distribution Channel

By distribution channel, the off-trade segment dominated the global cream liqueur market, registering a CAGR of 9.6% in 2022 and is anticipated to maintain its dominance during the cream liqueur market forecast period. The Off-trade channels offer convenience and accessibility to consumers, allowing them to purchase cream liqueurs conveniently during their routine shopping trips or from the comfort of their homes via online platforms. This ease of access encourages impulse purchases and facilitates regular consumption, driving sales volumes within the off-trade segment. Off-trade channels typically have a broader distribution network compared to on-trade establishments such as bars and restaurants. This wider reach enables cream liqueur brands to penetrate diverse geographic markets, including rural areas and regions where on-trade establishments may be limited, thus expanding their consumer base and driving overall market growth.

By Region

By region, Europe dominated the global cream liqueur market, registering a CAGR of 9.9% in 2022 and is anticipated to maintain its dominance during the forecast period. Europe has a long-standing cultural tradition of consuming cream liqueurs, dating back centuries. Countries like Ireland, the United Kingdom, and Belgium have deep-rooted traditions of producing and enjoying cream liqueurs as part of their culinary and social customs. This cultural heritage has established a strong consumer base for cream liqueurs in Europe, contributing to the region's dominance in the global market. European cream liqueur producers are renowned for their innovation and diversity in product offerings. They continually introduce new flavors, variations, and packaging formats to cater to evolving consumer preferences and trends. European cream liqueurs often incorporate traditional ingredients with modern twists, appealing to a broad spectrum of consumers both domestically and internationally.

Competitive Analysis

Competitive analysis and profiles of the major players in the cream liqueur market, such as Diageo, E. And J. Gallo Winery, Heaven Hill, McCormick, Grupo Zamora, DeKuyper Royal Distillers, BEHN, Buzzballz, Sazerac, Lucas Bols, Pernod Ricard, Terra. and DISTELL are provided in the report.

The market for cream liqueur market is anticipated to expand due to a rise due to increasing disposable income, expanding occasions for consumption, innovation & product development and globalization and market expansion. In addition, factors such as innovation, collaboration, product launch, partnership and expansion are opportunistic for market growth.

Recent Developments in Cream Liqueur Industry

In September 2022, Diageo has launched a limited-edition s’mores-flavored Irish cream liqueur under its Baileys brand. This has expanded the product line of the company to cater diverse range of consumers.

In February 2021, has launched a ‘lighter’ version of its Baileys cream liqueur, which is 40% lower in calories and sugar than the flagship variant. This strategy is expected to increase the product reach of the company.

In January 2024, Heaven Hills brands has announced the launch Carolans Peanut Butter which is latest Carolans Irish Cream extension.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the cream liqueur market analysis from 2019 to 2029 to identify the prevailing cream liqueur market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the cream liqueur market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global cream liqueur market trends, key players, market segments, application areas, and market growth strategies.

Cream Liqueur Market Report Highlights

| Aspects | Details |

| Market Size By 2029 | USD 4.6 billion |

| Growth Rate | CAGR of 10.5% |

| Forecast period | 2019 - 2029 |

| Report Pages | 250 |

| By Source |

|

| By Flavor |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Distell Group Limited, McCormick, E. & J. Gallo Winery, Terra Spirits & Liqueurs, BEHN, Grupo Zamora, Diageo plc., Buzzballz, Heaven Hill Distilleries, Inc., DeKuyper Royal Distillers, Sazerac Company, Inc, Pernod Ricard, Lucas Bols B.V |

Analyst Review

The cream liqueur market represents a dynamic landscape filled with both opportunities and challenges. As the consumers are increasingly seeking indulgent and premium experiences, there is significant potential for innovation and differentiation within the market. However, regulatory compliance, intense competition, and sustainability concerns present notable hurdles that require careful navigation.

On the other hand, consumer preferences are evolving, with a growing demand for premium and indulgent experiences. This presents an opportunity for the key players to introduce new flavors, packaging formats, and marketing strategies that resonate with discerning consumers. Moreover, the globalization of food and beverage trends has expanded the reach of cream liqueurs into new geographic markets, providing avenues for market expansion and increased sales.

By leveraging consumer insights, fostering innovation, and maintaining a focus on operational excellence, manufacturers will be able to position their companies to capitalize on emerging trends, expand market share, and drive sustainable growth in this ever-evolving industry.

The global cream liqueur market size was valued at USD 2.3 billion in 2019, and is projected to reach USD 4.6 billion by 2029

The global cream liqueur market is projected to grow at a compound annual growth rate of 10.5% from 2023-2029 to reach USD 4.6 billion by 2029

The key players profiled in the reports includes Diageo, E. And J. Gallo Winery, Heaven Hill, McCormick, Grupo Zamora, DeKuyper Royal Distillers, BEHN, Buzzballz, Sazerac, Lucas Bols, Pernod Ricard, Terra. and DISTELL

Europe dominated in 2022 and is projected to maintain its leading position throughout the forecast period.

Growing shifts in consumer lifestyles and tastes, Artistic Approaches to Product Development and Promotion, Increasing Challenges with Regulation and Compliance, Expansion of health-consciousness and dietary preferences, Exploration of Niche Flavors and Experiences majorly contribute toward the growth of the market.

Loading Table Of Content...

Loading Research Methodology...