Credit Card Issuance Services Market Research, 2031

The global credit card issuance services market was valued at $443.7 billion in 2021, and is projected to reach $952.2 billion by 2031, growing at a CAGR of 8.2% from 2022 to 2031.

The credit card issuer issues a credit card to a customer at the time or after an account has been approved by the credit provider, which need not be the same entity as the card issuer. The cardholders can then use it to make purchases at merchants accepting that card. Moreover, a credit card is a payment card issued to cardholders to enable the cardholder to pay a merchant for goods and services based on the cardholder's accrued debt. Credit card provides high security features for transferring payment from one account to another, which increases the demand for credit card among its users.

Rise in demand for credit card services in emerging countries driving the credit card issuance services market growth. The credit card business has also evolved with simplified and online credit card applications, multiple forms of credit cards that cater to specific needs, virtual cards with more controls on spending and personalized offers and rewards. In addition, rise in contactless and digital credit card services and increased demand for cash alternatives and availability low-cost credit cards.

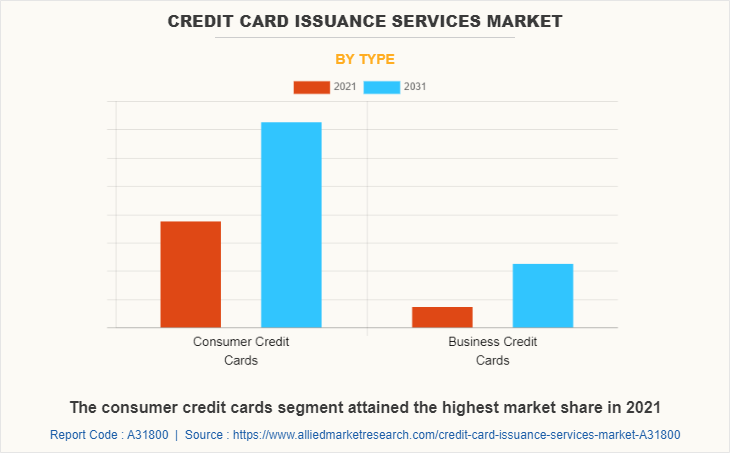

Thus, these factors drive the credit card issuance services market size growth. However, rise in credit card frauds across the globe and higher interest rates on credit cards hampering the growth of the credit card issuance market size. On the contrary, technological innovation in product offering will provide major lucrative opportunities for growth of the credit card issuance services market. Based on type, the consumer credit cards segment attained the highest growth in 2021. This is attributed to the fact that in recent days there has been a huge rise in consumer credit card segment as people were preferring credit card for their daily transactions and credit needs for personal use.

The report focuses on growth prospects, restraints, and trends of the credit card issuance services market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the credit card issuance services market size.

Segment Review

The credit card issuance services market is segmented on the basis of type, issuers and end user. By type, it is segmented into life consumer credit cards and business credit cards. Based on issuers, it is bifurcated into banks, credit unions and NBFC’s. On the basis of end user, it is segmented into personal and business. By region, it is analysed across North America, Europe, Asia-Pacific, and LAMEA.

Based on type, the consumer credit cards segment attained the highest growth in 2021. This is attributed to the fact that in recent days there has been a huge rise in consumer credit card segment as people were preferring credit card for their daily transactions and credit needs for personal use. Furthermore, the business credit card segment is forecasted to grow at a significant growth rate attributing to the fact that business credit cards come with bundled offers that encourage users to use them often. Some business cards offer air miles that can be redeemed for each air ticket purchase. These are some of the factors expected to provide lucrative opportunities for the market in the upcoming years.

Based on region, North America attained the highest growth in 2021. The credit card industry has a big business in the region owing to the presence of four major companies such as Visa, MasterCard, American Express, and Discover. Furthermore, Americans are hugely dependent on credit cards as nearly 47% of the U.S. adults or about 120 million people have credit card debt. These factors propel the market growth in the region.

Furthermore, Asia-Pacific is attributed to grow at a significant growth rate pertaining to the fact that developing countries such as India and others are using cash payments, owing to which many credit card providers are taking this as an opportunity to increase their market share in the developing countries by providing various offers which enhances the growth of the market. In addition, developments in e-commerce and rise in credit card awareness among the developing nations as well as surge in preference for contactless payments propel the market growth.

The report analyzes the profiles of key players operating in the credit card issuance services market such as American Express Company, Entrust Corporation., FIS, Fiserv, Inc., Giesecke+Devrient GmbH, GPUK LLP., Marqeta, Inc., Nium Pte. Ltd., Stripe, Inc. and Thales. These players have adopted various strategies to increase their market penetration and strengthen their position in the credit card issuance services market share.

Market Landscape and Trends

A credit card is a card issued by a financial institution, typically a bank, and it enables the cardholder to borrow funds from that institution. Cardholders agree to pay the money back with interest, according to the institution's terms. Moreover, a credit card can help business build a better credit history for purchase of equipment, supplies, or inventory that are needed for the business, which helps businesses to easily get loan based on their credit score. In addition, technologies such as blockchain and artificial intelligence in credit card issuance services market is major growth factor.

Furthermore, the rising demand for cash alternatives for emergency and down payment funds represents one of the key factors driving the market. Moreover, there is an increase in the utilization of credit cards for purchasing televisions, laptops, smartphones, travel packages, and jewelry. This, along with the availability of affordable credit cards worldwide, is propelling the market growth of credit card issuance services market.

Top Impacting Factors

Credit Card Demand Continues to Rise in Emerging Countries

Developing countries with large working populations, such as India, Hong Kong, and others, drive the growth of the credit card issuance services sector. Moreover, several countries were working on expanding the adoption of digital payments for their end customers during COVID in order to minimize the spread of the corona virus, which boosts market growth. For instance, according to a research report published by MasterCard in 2020, around 42% of Indians increased the use of digital payment systems, which mainly include contactless credit cards, and others, which fuel the growth of the market. Additionally, many companies offer beneficial points, rewards, and cashbacks to their customers for increasing their market share in the developing nations, which propels the growth of the credit card issuance services market.

Rise in Contactless and Digital Credit Card Services

The main benefit of contactless is that it’s fast and that means no line ups. In addition, transaction charges are the same so there’s no cost benefit, but it makes it faster, bringing a better consumer experience for the customers which drives the market. Furthermore, experience of not having to enter your PIN is generally a welcome change for customers. Sometimes called “tap and go” or “tap to pay,” contactless payments are up to ten times faster than other forms of payment. Moreover, many companies are offering credit cards services which are connected to devices like smartphones and provides alternative form of contactless payment using the same technology as contactless credit cards. For instance, Apple Pay, securely stores personal information and credit card numbers on an iPhone or Apple Watch therefore, by doing this users can then use their devices to tap and go at participating stores.

Increased Demand for Cash Alternatives and Availability Low Cost Credit Cards

There is an increase in the demand for credit cards as it is easy to carry and is also a good alternative for cash. Additionally, the wake of COVID-19 pandemic majority of the people are trying to avoid cash and have been increasing the use of contactless credit cards. Furthermore, companies are trying to increase the awareness of credit cards for daily purchases. For instance, MasterCard initiated tap-and-go at subway stations and Fareback Friday, which allows the credit card holder to tap their contactless card at any participating New York City subway. Moreover, the increase in popularity of digital-first credit cards at the point of sale for those with poor or fair credit like Apple card. In addition, by doing this the Apple cardholders receive their rewards by using the mobile version of the card versus the physical titanium card.

Rise in Credit Card Frauds Across the Globe

Credit card fraud is the most common type of identity theft. It is growing at a tremendous pace which is attributed to the COVID-19 pandemic. In addition, increase in Phishing emails, texts and phone calls attacks have become harder to realize the scam, which limits the growth of the market. According to research report 2020, payment card fraud losses reached around USD 28.65 billion worldwide. In addition, the U.S. is most prone to credit card fraud with around one-third of total global loss; it was estimated to reach around USD 11 billion till the end of 2020. Furthermore, there is rise in the number of new payment app scams owing to developments in e-commerce. In these cases, the product is either not received or cannot be tracked by the customer. These factors hinder the growth of the credit card issuance services market outlook.

It is Difficult for the Banks for Cross Selling of Insurance Products

The bank staff is in immense pressure of providing the banking services to the customers along with selling the policies of the insurance companies to the same customer. Many a time it becomes difficult for the bank staff to cross sell both the products at the same time which may create confusion in the mind of the customer, which may end up receiving bad customer service from the bank. Moreover, the bank staff is already occupied with doing other essential work of the bank and may ignore or give less priority towards selling the policies of the credit card issuance services. Therefore, difficulty in cross selling of insurance products and services by the bank staff is a major factor limiting the growth of the credit card issuance services market forecast.

Higher Interest Rates on Credit Cards

The most of the credit card issuances companies have the higher interest rate which is one of the retrain of credit card issuance services market. The major drawback is that if the customers do not clear their dues before billing due date, the amount is carried forward and interest is charged on it. In addition, this interest is accrued over a period of time on purchases that are made after the interest-free period. Moreover, credit card interest rates are quite high, with the average rate being 3% per month, which would amount to 36% per annum. Therefore, such factor is restraining the growth of the credit card issuance services market.

Technological Advancement in Product Offering

Credit card issuance services has experienced a drastic change over decades, owing to the emergence of disruptive technologies. Moreover, credit card holders are facing frauds across the globe and majority of the companies are trying to innovate advance analytical solutions to provide safe and easy transactions to its customers. For instance, in October 2020, Paytm a global provider of online payment application announced that it is coming up with credit cards to make it easier for new users to join the credit market. Additionally, these new credit card will provide users a special feature that would allow users to manage their transactions and have full control over the card usage. Thus, increase in number of such developments across the globe provides lucrative opportunity for the growth of the market.

Furthermore, card issuers are investing in NFC technology, which allows credit card firms to offer contactless payment with a single tap. Which is an effective tool against online banking fraud as it uses tokenization, which helps to complete the transaction without sharing the merchant’s actual credit card information, therefore, such new technology and innovations provide lucrative opportunity for the credit card issuance services industry.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the credit card issuance services market analysis from 2021 to 2031 to identify the prevailing credit card issuance services market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the credit card issuance services market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global credit card issuance services market trends, key players, market segments, application areas, and market growth strategies.

Credit Card Issuance Services Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 952.2 billion |

| Growth Rate | CAGR of 8.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 183 |

| By Type |

|

| By Issuers |

|

| By End User |

|

| By Region |

|

| Key Market Players | American Express Company, Thales, Nium Pte. Ltd., Entrust Corporation., Giesecke+Devrient GmbH, Stripe, Inc., Fiserv, Inc., fis, GPUK LLP., Marqeta, Inc. |

Analyst Review

Credit cards offer high security features for transferring funds across accounts; there is a greater demand for them among cardholders. Moreover, credit cards provide users with a host of advantages, such as rapid loans, increased transaction security, and the ability to receive cashback based on their purchases and various credit scores.

Furthermore, market players are adopting partnership strategies for enhancing their services in the market and improving customer satisfaction. For instance, on June 2022, the global modern card issuing platform, announced a partnership that it is working with Klarna, a leading global retail bank, payments and shopping service, to power its new Klarna Card. The Klarna Card will bring the company's popular "Pay in 4" service to a physical Visa card, empowering consumers to pay over time in four equal, interest-free payments for any in-store or online purchase.

Some of the key players profiled in the report include American Express Company, Entrust Corporation., FIS, Fiserv, Inc., Giesecke+Devrient GmbH, GPUK LLP., Marqeta, Inc., Nium Pte. Ltd., Stripe, Inc. and Thales. These players have adopted various strategies to increase their market penetration and strengthen their position in the credit card issuance services market.

technological innovation in product offering in credit card issuance services will further give major opportunity for the credit card issuance services service market growth.

Based on region, North America attained the highest growth in 2021. The credit card industry has a big business in the region owing to the presence of four major companies such as Visa, MasterCard, American Express, and Discover. Furthermore, Americans are hugely dependent on credit cards as nearly 47% of the U.S. adults or about 120 million people have credit card debt. These factors propel the market growth in the region.

The global credit card issuance services market was valued at $443.67 billion in 2021, and is projected to reach $952.19 million by 2031, growing at a CAGR of 8.2% from 2022 to 2031.

American Express Company, Entrust Corporation., FIS, Fiserv, Inc., Giesecke+Devrient GmbH, GPUK LLP., Marqeta, Inc., Nium Pte. Ltd., Stripe, Inc. and Thales.

Loading Table Of Content...