Credit Card Payments Market Research, 2032

The global credit card payments market was valued at $524.9 billion in 2022, and is projected to reach $1.2 trillion by 2032, growing at a CAGR of 8.8% from 2023 to 2032.

A credit card is a piece of metal or plastic issued by a financial services company or banks, which allows cardholders to borrow funds to pay for goods and services with different types of merchants. Furthermore, credit cards provided by the banks and other fintech institutions help customer purchase different types of services on credit without having to put up cash at the point of sale. Instead, the charges accrue as a balance that must be paid off on a monthly billing cycle, giving the buyer more time to get the cash together.

Rise in demand for cash alternatives and availability of affordable credit cards across the globe boost the growth of the global credit card payments market. In addition, rise in demand for credit card among the developing nations positively impacts the growth of the market. However, increase in credit card frauds across the globe is expected to hamper the credit card payments market growth. On the contrary, technological advancements in product offering like using blockchain for increased security is expected to offer remunerative opportunities for the expansion of the market during the forecast period

Segment Review

The credit card payments market is segmented on the basis of product type, application, brand, and region. On the basis of product type, the market is categorized into general purpose credit cards, and specialty and other credit cards. On the basis of application, the market is fragmented into food and groceries, health and pharmacy, restaurants and bars, consumer electronics, media and entertainment, travel and tourism, and others. On the basis of the brand, the market is classified into visa, master card, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

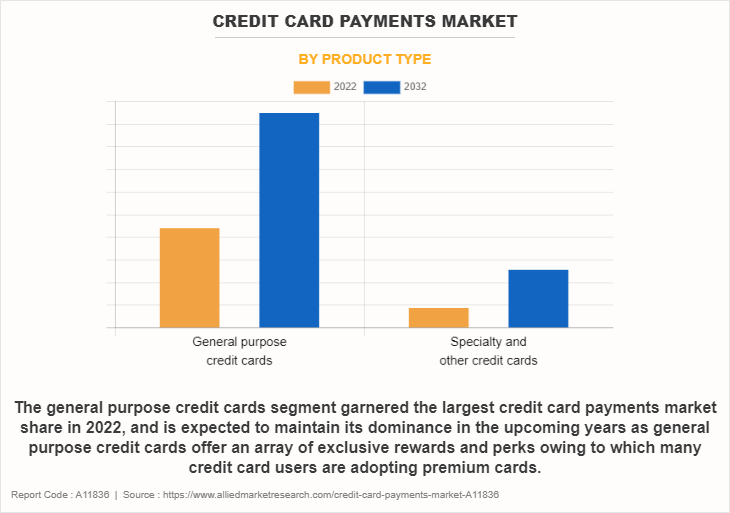

By product type, the general-purpose credit cards segment garnered the largest credit card payments market size in 2022, and is expected to maintain its dominance in the upcoming years as general purpose credit cards offer an array of exclusive rewards and perks owing to which many credit card users are adopting premium cards. However, the specialty & other credit cards segment is expected to witness highest growth, owing to higher credit or spending limits provided by the banks for this credit cards as compared to others. In addition, various organizations are providing special credit cards to their employees for keeping track on employee spending on travel, purchase of inventory or supplies, and other responsibilities, which propels the growth of the market.

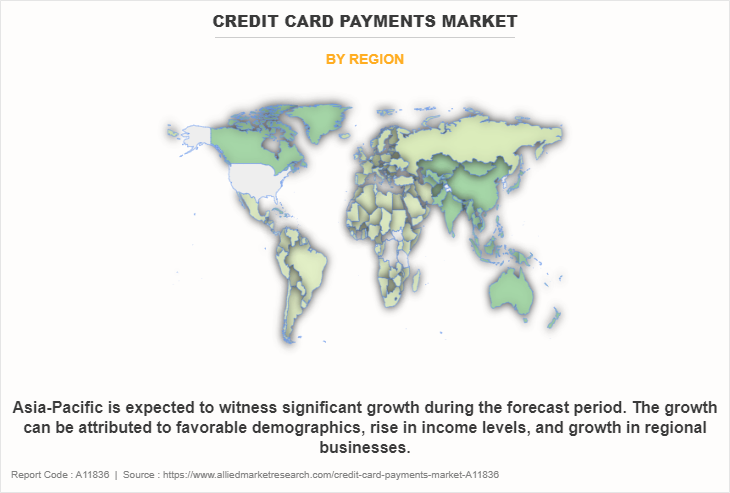

Region-wise, the credit card payments market share was dominated by North America in 2022 and is expected to retain its position during the forecast period, owing to the presence of prominent merchant banking service providers such as the U.S. Capital Advisors LLC; Bank of America Corporation; and JPMorgan Chase & Co across the region is anticipated to fuel the market’s growth. However, Asia-Pacific is expected to witness significant growth during the forecast period. The growth can be attributed to favorable demographics, rise in income levels, and growth in regional businesses.

The key players that operate in the credit card payments industry are American Express, Bank of America Corporation, Barclays PLC, Capital One, Citigroup Inc., JPMorgan Chase & Co, MasterCard, Synchrony, The PNC Financial Services Group, Inc., and USAA. These players have adopted various strategies to increase their market penetration and strengthen their position in the market.

Digital Capabilities

The growing adoption of digital payment methods, including credit card usage, is driven by the convenience, speed, and security they offer. This pervasive shift towards digital transactions, facilitated by advancements in technology and mobile applications, is accelerating the expansion of the market or credit card payment industry. Moreover, the rise of contactless payment technology has revolutionized the credit card payments landscape. Consumers appreciate the ease and safety of contactless transactions, especially considering the COVID-19 pandemic. Contactless-enabled credit cards have gained significant popularity, boosted consumer confidence, and contributed to credit card payments market growth.

Furthermore, credit card issuers have devised enticing reward programs, such as cashback, loyalty points, and travel benefits, to attract and retain customers. These incentives incentivize consumers to use credit cards for everyday purchases, further boosting transaction volumes and positively impacting market growth. In addition, many governments and regulatory authorities worldwide are promoting the adoption of digital payment methods to enhance financial inclusion, curb black-market activities, and reduce the reliance on cash transactions. Such initiatives and regulatory support have positively influenced the growth of market, as consumers and businesses increasingly shift towards digital payment methods.

Top Impacting Factors

Rise in Demand for Credit Cards in the Developing Nations

Developing countries such as India, Hong Kong, and others have a huge working population and growth in adoption of digital payments systems, and credit card payments adoption among the working populations drive the growth of the market. In addition, various countries are focusing on increasing the adoption of digital payments for their end users to reduce the spread of corona virus, which fosters the growth of the market. For instance, according to a research report published by MasterCard in 2020, around 42% of Indians increased the use of digital payment systems, which mainly include contactless credit cards, online payments, and others, which fuel the growth of the credit card payments market. Furthermore, many companies offer beneficial points, rewards, and cashbacks to their customers for increasing their market share in the developing nations, which propels the growth of the credit card payments market.

Rise in Demand for Cash Alternatives and Availability of Affordable Credit Cards

There is an increase in the demand for credit cards as it is easy to carry and is also a good alternative for cash. In the wake of COVID-19 pandemic majority of the people are trying to avoid cash and have been increasing the use of contactless credit cards. Furthermore, credit card payments companies are trying to increase the awareness of credit cards for daily purchases. For instance, MasterCard initiated tap-and-go at subway stations and Fareback Friday, which allows the card holder to tap their contactless card at any participating New York City subway. Moreover, the increase in popularity of digital-first credit cards at the point of sale for those with poor or fair credit like Apple card. The Apple cardholders receive their rewards by using the mobile version of the card versus the physical titanium card. Such factors drives the credit card payments market growth.

Restraint

Increase in Credit Card Frauds Across the Globe

Credit card fraud is the most common type of identity theft. It is growing at a tremendous pace which is attributed to the COVID-19 pandemic. In addition, increase in Phishing emails, texts and phone calls attacks have become harder to realize the scam, which limits the growth of the credit card payments market. According to research report 2020, payment card fraud losses reached around USD 28.65 billion worldwide. In addition, the U.S. is most prone to credit card fraud with around one-third of total global loss; it was estimated to reach around USD 11 billion till the end of 2020. Furthermore, there is rise in the number of new payment app scams owing to developments in e-commerce. In these cases, the product is either not received or cannot be tracked by the customer. These factors hinder the growth of the credit card payments market.

Opportunity

Technological Advancement in Product Offering

Credit card bill payment has experienced a drastic change over decades, owing to the emergence of disruptive technologies. Credit card holders are facing frauds across the globe and majority of the credit card payments companies are trying to innovate advance analytical solutions to provide safe and easy transactions to its customers. For instance, in October 2020, Paytm a global provider of online payment application announced that it is coming up with credit cards to make it easier for new users to join the credit market. The new credit card will provide users a special feature that would allow users to manage their transactions and have full control over the card usage. Thus, increase in number of such developments across the globe provides lucrative opportunity for the growth of the credit card payments market. Furthermore, card issuers are investing in NFC technology, which allows credit card reader companies to offer contactless payment at one tap. It is an effective tool against online banking fraud as it uses tokenization, which completes the transaction without sharing the merchant’s actual credit card information, which is anticipated to provide lucrative opportunity for the credit card payments market.

Regional Insights:

The Credit Card Payments Market is segmented into various regions, including North America, Europe, Asia-Pacific, and LAMEA. Here is a brief overview of North America and Asia-pacific region:

North America, In North America, the credit card payments size witnesses a rapid surge in contactless payments, fuelled by advanced payment technology and evolving consumer preferences as per credit card payments policy. Key market players such as Visa, Mastercard, American Express, and Discover Financial Services hold dominant positions, offering diverse credit card products and credit card payments service.

Asia-Pacific, The Asia-Pacific region sees a remarkable boom in mobile payments and digital platforms, driven by a large population of smartphone users. Mobile wallets like Alipay, WeChat Pay, and Paytm have gained immense popularity in the credit card payments domain. Local players like UnionPay, JCB, and Rakuten also contribute significantly to the credit card payments market in the region.

Solution Insight:

Visa is a leading global payment technology company that provides credit and debit card services. It operates a vast payment network, enabling secure and convenient transactions worldwide. Visa collaborates with financial institutions and merchants to offer a wide range of credit card products and innovative payment solutions.

Mastercard is a major multinational financial services corporation, specializing in payment processing and technology. It offers credit, debit, and prepaid card services, operating one of the world’s most extensive payment networks. Mastercard’s partnerships with banks and merchants facilitate seamless credit card payments across diverse industries, such factors drive the credit card payments market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the credit card payments market analysis from 2023 to 2032 to identify the prevailing credit card payments market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the credit card payments market segmentation assists to determine the prevailing credit card payments market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global credit card payments market forecast.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global credit card payments market trends, credit card payments market outlook, key players, credit card payments market segments, application areas, and market growth strategies.

Credit Card Payments Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.2 trillion |

| Growth Rate | CAGR of 8.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 286 |

| By Product Type |

|

| By Application |

|

| By Brand |

|

| By Region |

|

| Key Market Players | Mastercard Incorporated., American Express Company, Citigroup Inc., Synchrony Financial, JPMorgan Chase & Co, Capital One, USAA, Barclays PLC, The PNC Financial Services Group, Inc., Bank of America Corporation |

Analyst Review

Adoption of credit cards has increased over the years, owing to its various advantages such as enhanced security as compared with debit card, faster payment processing options, EMI facility, and others. In addition, rapid adoption of credit card among the end users for buying things on EMIs and increase in purchasing of different expensive goods is enhancing the growth of the market. Furthermore, it provides extended warranties and purchase protection for the end users, which also propels the growth of the market. In addition, many cards offer return protection, rental car insurance, and travel insurance, which drives the growth of the credit card payments market. Moreover, surge in adoption of NFC payment and eWallets across the globe is expected to drive growth of the market.

Key providers of credit card market such as American Express, Chase, Citi, and Bank of America account for a significant share in the market. For instance, in April 2021, American Express launched Cashback Credit Card. The new card provides card members the opportunity to earn uncapped cashback on every purchase, including when paying bills. According to the industry experts, the credit card market is expected to witness increased adoption in the coming years, owing to various benefits provided by the credit card companies and integration of advance technology among the credit cards, which include artificial intelligence (AI) and machine learning for providing enhanced security to the end users.

In addition, with further growth in investment across the world and the rise in demand for credit card payment, various companies have expanded their current product portfolio with increased diversification among customers. For instance, in January 2021, Discover launched Discover® Identity Theft Protection, a fee-based identity theft protection product that provides individuals with credit and identity monitoring, alerts and fraud resolution services.

Moreover, with the increase in competition, major market players have started acquisition companies to expand their market penetration and reach. For instance, January 2021, Synchrony acquired Allegro Credit to drive growth in health and wellness financing segment. The acquisition expands allegro credit cards at the point-of-sale for its providers, merchants and customers

The Credit card payments market is estimated to grow at a CAGR of 8.8% from 2023 to 2032.

The Credit card payments market is projected to reach $ 1,204.48 billion by 2032

Rise in demand for cash alternatives and availability of affordable credit cards across the globe boost the growth of the global credit card payments market. In addition, rise in demand for credit card among the developing nations positively impacts the growth of the market. However, increase in credit card frauds across the globe is expected to hamper the credit card payments market growth. On the contrary, technological advancements in product offering like using blockchain for increased security is expected to offer remunerative opportunities for the expansion of the market during the forecast period.

American Express, Bank of America Corporation, Barclays PLC, Capital One, Citigroup Inc., JPMorgan Chase & Co, MasterCard, Synchrony, The PNC Financial Services Group, Inc., and USAA.

The key growth strategies of Credit card payments market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...