Credit Management Software Market Research, 2032

The global credit management software market was valued at $2.4 billion in 2022, and is projected to reach $8.7 billion by 2032, growing at a CAGR of 14.2% from 2023 to 2032.

Credit management software is a specialized kind of software created to assist corporations, financial institutions, and other organizations in managing their credit-related tasks, credit risk analysis, and collections procedures successfully. It gives users access to a wide range of tools and capabilities that be used to improve decision-making, streamline credit operations, and lower credit-related risks. Furthermore, organizations evaluate a person, company, or other entity's creditworthiness using credit management software market. It assesses elements including credit history, financial stability, payment behavior, and other relevant data using a variety of data sources, credit scoring models, and analytics.

Moreover, the software frequently uses credit scoring algorithms to assign applicants numerical ratings, assisting businesses in making consistent and impartial lending decisions. These ratings help in deciding whether to accept or reject credit applications and in establishing suitable loan terms. In addition, real-time monitoring of consumer credit profiles is a feature of most of the credit management software market. As a result, businesses keep track of changes in a customer's financial condition and act quickly to address any new credit risks or opportunities. Furthermore, automating repetitive credit-related procedures with credit management software market saves time and lowers the possibility of human error. As a result of this automation, operational efficiency has increased, and the staff devotes more time to strategic initiatives.

The increasing international trade is a significant driver the credit management software market growth. There are many different financial transactions involved in international trade, and each one entails a certain level of credit risk. With the use of credit management software market, it is possible to effectively evaluate the creditworthiness of foreign partners and clients. It analyzes elements such as currency risk, cross-border credit histories, and regional economic conditions to give businesses the information they need to make wise credit decisions. Furthermore, increasing awareness regarding automation and dedicated software is driving the demand of the credit management software market.

However, the increase in the number of cyber-attacks hampers the growth of the credit management software market. In credit management software market, data security is crucial, and breaches have grave consequences. Data breaches brought on by cyberattacks expose private financial records, credit card numbers, and consumer identities. Thus, it makes sense that businesses and financial institutions are hesitant to adopt or increase the use of credit management software market as they worry about possible security weaknesses that could be used by malicious users. Moreover, lack of skilled workforce are major factors that hamper the growth of credit management software market. On the contrary, customer relationship enhancement is an opportunity for credit management software market as strong customer relationships depend on openness and straightforward communication. Organizations give customers accurate insights into their credit status, payment history, and loan terms owing to credit management software market. Automated notifications and reminders inform clients of payment deadlines, fostering openness and confidence.

Segment Review

The credit management software market is segmented on the basis of component, deployment model, application, industry vertical, and region. By component, the market is segmented into software and service. By deployment model, it is segmented into on-premise, and cloud. By application, it is segmented into credit risk assessment, credit monitoring, debt collection, and others. On the basis of industry vertical, it is segmented into BFSI, healthcare, retail, IT and Telecommunication, government, and others. By region, it is analysed across North America, Europe, Asia-Pacific, and LAMEA.

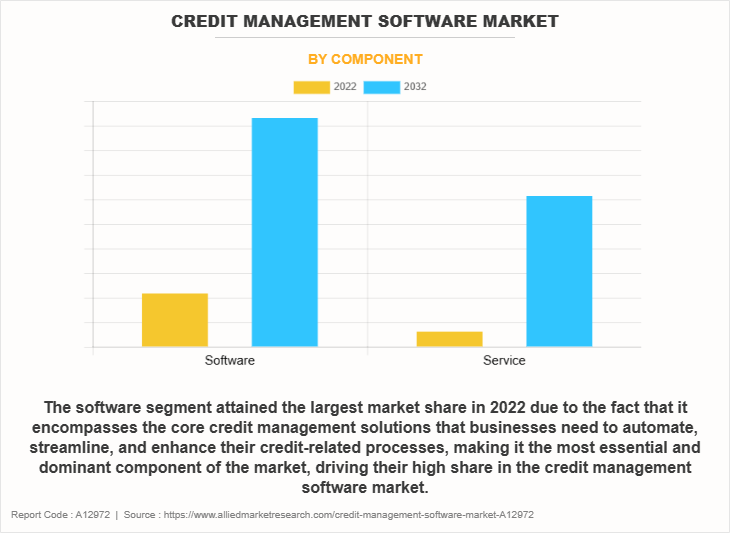

BY component, the software segment attained the highest credit management software market share in 2022 in the credit management software market. This be attributed to the fact that software solutions have revolutionized the credit management software market by offering automation and digitalization of complex financial processes. This automation significantly enhances efficiency, reduces human error, and streamlines the credit management workflow, making it more attractive to businesses across various industries, including finance, retail, entertainment, and hospitality. Meanwhile, the service segment is projected to be the fastest-growing segment during the forecast period. This is attributed to the fact that the service industry is increasingly adopting subscription-based and recurring revenue models, which require sophisticated credit management software market to handle ongoing payments and prevent mixture. This shift has heightened the demand for specialized software solutions that automate billing, invoicing, and credit monitoring, ultimately boosting the market share of credit management software market within this sector.

On the basis of region, North America attained the highest credit management software market size in 2022 and emerged as the leading region in the credit management software market. This is attributed to the fact that the North American region has a strong and diverse economy with a substantial presence of many different businesses, including banking, finance, retail, healthcare, and technology. Credit management software is in high demand since these industries depend largely on credit management procedures to evaluate credit risk, maximize collections and preserve financial stability. On the other hand, the Asia-Pacific region is projected to be the fastest-growing region for the travel credit market during the forecast period. This growth is attributed to the fact that the demand for advanced credit management systems has increased as a result of the changing financial services environment in Asia-Pacific. This includes the rise of fintech firms, online lending marketplaces, debt collection software, and online retailers who depend on credit management software to make prompt and informed credit decisions.

The report analyses the profiles of key players operating in the credit management software industry such as Aston University, Coface, CreditDevice, Creditsafe USA Inc., Equifax, Inc., Esker, Finastra, Onguard, Serrala, TransUnion. These players have adopted various strategies to increase their market penetration and strengthen their position in the credit management software industry.

Market Landscape and Trends

The use of credit management software is being driven by the rapid digital transformation occurring across all industries. Businesses are rapidly converting to automated, data-driven solutions instead of manual procedures and spreadsheet-based credit management software. Because of this tendency, software companies have a lot of room to expand and offer cutting-edge digital credit management software products. Furthermore, to improve credit risk assessment, artificial intelligence (AI) and machine learning (ML) are being included in credit management software. By enabling more precise predictive analytics, these technologies help businesses make more educated credit decisions. Lenders can now more precisely analyses risk due to the development of credit scoring models.

Moreover, it is becoming crucial to monitor credit portfolios and consumer creditworthiness in real time. Businesses may react rapidly to shifting credit risk variables by using credit management software that offers real-time alerts and updates, minimizing potential losses and enhancing overall financial stability. In addition, due to its scalability, accessibility, and affordability, cloud-based credit management software is becoming more and more popular. Organizations are using cloud solutions more frequently to simplify credit procedures and lower the cost of their IT infrastructure.

Top Impacting Factors

Increasing Awareness Regarding Automation and Dedication Software

Businesses are growing to realize that manual credit management processes are time-consuming and error-prone. Credit management software insustry automates tasks such as credit scoring, risk assessment, and collections, leading to increased efficiency and productivity. This automation allows employees to focus on more strategic and value-added activities. Furthermore, automation ensures greater accuracy and consistency in credit-related decisions and processes. This reduces the risk of human errors and ensures that credit decisions are made based on standardized criteria and data analysis. In addition, automation allows for better customer relationship management.

Businesses can use credit management software to set and manage credit limits, establish fair credit terms, and communicate effectively with customers about their credit status. This can lead to stronger and more positive customer relationships. Moreover, automated credit management software utilizes data analytics and predictive modeling to assess credit risk more accurately. It helps businesses identify high-risk customers and take proactive steps to mitigate credit losses, reducing bad debt and improving financial stability. Therefore, increased awareness regarding automation and dedication software are driving the growth of the credit management software Market.

Increasing International Trade

A greater number of transactions are involved in international trade, frequently involving customers and suppliers who are live in other nations. Without specialized software, it might be difficult to manage credit for a lot of overseas transactions. This procedure is streamlined by credit management software, which also guarantees that organizations can effectively manage the rising transaction volume. Moreover, due to variations in credit reporting systems, legal settings, and economic conditions, determining the creditworthiness of overseas clients and partners can be more difficult. Credit management software provides organizations the tools they need to analyze the credit risk posed by multinational entities and make wise decisions. In addition, multiple currencies and exchange rate changes are frequently present in international trade. Currency conversion, exchange rate monitoring, and foreign currency risk assessment can all be handled by credit management software, ensuring that credit terms are set appropriately. Therefore, higher transaction volumes, cross-border credit assessment, and currency and exchange rate management are increasing international trade for drive the demand for credit management software industry.

Increasing cyber Attacks

Credit reports, payment information, and other private financial and customer information are all handled by credit management software. Businesses are cautious to implement or grow their use of credit management software since concerns about data breaches and unauthorized access to this sensitive information are on the rise due to cyberattacks. Furthermore, businesses and financial institutions that suffer from data breaches or cyberattacks may lose consumers, partners, and other stakeholders' trust. This decline in confidence may cause businesses to adopt new software solutions more cautiously, particularly credit management software that could provide security problems. Moreover, financial losses from cyberattacks may be substantial and may include expenditures for data recovery, legal fees, regulatory fines, and customer compensation. Budget allocations for software investments, including credit management software, may be limited as a result of such financial failures. In addition, operations can be disrupted by ransomware attacks, which also encrypt data and then demand a ransom to unlock it. These attacks have a significant negative effect on the efficiency of credit management software systems and the capacity for making sound credit choices. Therefore, increasing of cyber attacks are hampering the growth of credit management software.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the credit management software market analysis from 2022 to 2032 to identify the prevailing credit management software market forecast.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the credit management software segmentation assists to determine the prevailing credit management software market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global credit management software market outlook.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global credit management software market trends, key players, market segments, application areas, and market growth strategies.

Credit Management Software Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 8.7 billion |

| Growth Rate | CAGR of 14.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 464 |

| By Component |

|

| By Deployment Model |

|

| By Application |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | TransUnion LLC., Aston University, Esker, CreditDevice, onguard, Serrala, Equifax, Inc., COFACE, Finastra, Creditsafe USA Inc. |

Analyst Review

The demand for credit management software solutions that handle cross-border credit assessments, compliance with various legislation, and risk management in many markets is rising as organizations expand worldwide. Furthermore, businesses improve their overall capacity for financial management by using credit management software that smoothly connects with other financial systems, such as electronic payment request (ERP), and accounting software. Moreover, a growing concern is that cybersecurity providers of credit management software might make investments in strong security features to shield sensitive financial data from online attacks. In addition, credit management software is undergoing a considerable trend toward automation. To cut down on manual labor and boost productivity, it includes robotic process automation (RPA), workflow automation, and automated decision-making. Moreover, alternative data sources, like social media activity and transaction data, are being included in credit management software to improve credit risk assessment, especially for people or firms with short credit histories.

Furthermore, market players have adopted various strategies for enhancing their services in the market and improving customer satisfaction. For instance, in July 2023, according to globe newswire Sidetrade acquired U.S.-based CreditPoint Software to disrupt the B2B credit management software market. This acquisition strengthened its B2B credit risk management solution, and they are well-positioned to benefit from the explosion in B2B e-commerce. Moreover, in June 2023, Coface launched ALYX, a digital trade credit risk management platform for its policyholders. It enables Coface's customers to centralize and automate their credit risk management from lead to cash. Furthermore, the platform was developed and is being offered in collaboration with CreditDevice, a Dutch software provider that specializes in managing commercial credit risk.

Some of the key players profiled in the report include Aston University, Coface, CreditDevice, Creditsafe USA Inc., Equifax, Inc., Esker, Finastra, Onguard, Serrala, TransUnion. These players have adopted various strategies to increase their market penetration and strengthen their position in the credit management software market.

The use of credit management software is being driven by the rapid digital transformation occurring across all industries. Businesses are rapidly converting to automated, data-driven solutions instead of manual procedures and spreadsheet-based credit management. Because of this tendency, software companies have a lot of room to expand and offer cutting-edge digital credit management software products. Furthermore, to improve credit risk assessment, artificial intelligence (AI) and machine learning (ML) are being included in credit management software. By enabling more precise predictive analytics, these technologies help businesses make more educated credit decisions. Lenders can now more precisely analyses risk due to the development of credit scoring models. Moreover, it is becoming crucial to monitor credit portfolios and consumer creditworthiness in real time. Businesses may react rapidly to shifting credit risk variables by using credit management software that offers real-time alerts and updates, minimizing potential losses and enhancing overall financial stability. In addition, due to its scalability, accessibility, and affordability, cloud-based credit management software is becoming more and more popular. Organizations are using cloud solutions more frequently to simplify credit procedures and lower the cost of their IT infrastructure.

Credit Risk Assessment is a leading application of credit management software market.

North America is the largest regional market for Credit Management Software.

$8,715.04 Million is the estimated industry size of Credit Management Software.

The report analyses the profiles of key players operating in the credit management software market such as Aston University, Coface, CreditDevice, Creditsafe USA Inc., Equifax, Inc., Esker, Finastra, Onguard, Serrala, TransUnion. These players have adopted various strategies to increase their market penetration and strengthen their position in the credit management software market.

Loading Table Of Content...

Loading Research Methodology...