Cresols Market Research - 2030

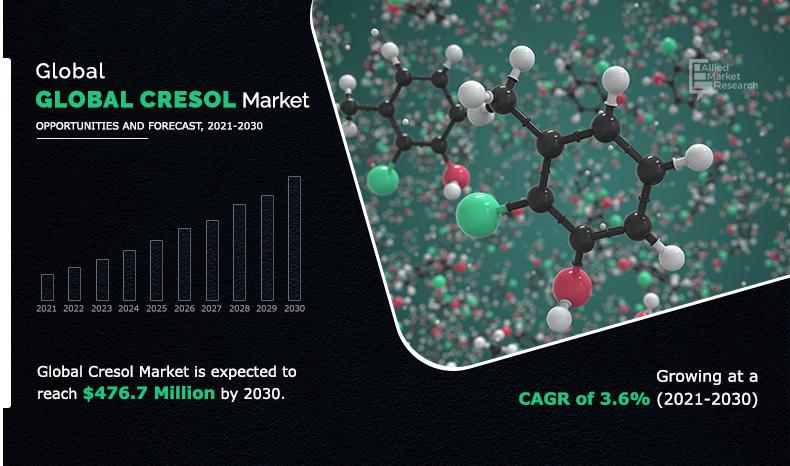

The global cresols market size was valued at $334.8 million in 2020, and is projected to reach $476.7 million by 2030, with a CAGR of 3.6% from 2021 to 2030. Surge in demand for cresol-based polymers, driven by their key role in producing high-performance materials like phenolic resins, is significantly boosting the growth of the cresols market. These polymers are widely used in various industries, including automotive, construction, and electronics, due to their excellent durability, heat resistance, and electrical insulating properties.

Introduction

Cresols are a group of three isomeric organic compounds derived from the methylation of phenol, with the chemical formula C7H8O. The isomers include ortho-cresol, meta-cresol, and para-cresol, each differing in the position of the methyl group on the benzene ring. These compounds are colorless to pale yellow liquids with a characteristic phenolic odor and are widely used in various industrial applications. Cresols serve as key intermediates in the production of phenolic resins, pesticides, disinfectants, and other chemicals, owing to their strong antimicrobial properties and versatility. They are also important in the synthesis of cresol-based polymers, which find applications in the automotive, construction, and electronics sectors.

Market Dynamics:

Technological advancements in cresol production have significantly driven the demand for the cresols market by improving efficiency, scalability, and sustainability. Innovative production techniques, such as catalytic processes and advanced separation technologies, have enhanced the yield and purity of cresols, reducing production costs and environmental impact. These advancements enable manufacturers to meet the growing demand from industries such as automotive, construction, and healthcare, where cresols are key intermediates in high-performance materials, disinfectants, and pharmaceuticals. All these factors are expected to drive the demand for the cresols market.

Volatility in raw material prices poses a significant challenge to the growth of the cresols market, as it directly impacts production costs and profitability for manufacturers. Cresols are derived from petrochemical feedstocks, whose prices are influenced by fluctuations in crude oil markets, geopolitical tensions, and global supply-demand dynamics. However, sudden price hikes or shortages in raw materials disrupt the production process and lead to increased costs, which are often passed on to end-users. Thus, hampering the growth of the market.

Cresol is also known as hydroxytoluene and it is a group of aromatic organic compounds. Cresols are widely-occurring phenols, which may be either natural or manufactured. It is a methyl phenol with para meta and ortho isomers. It is used as a disinfectant and antiseptic and have the best antioxidant properties. In addition, Creosote is a mixture of phenols consisting mainly of cresol and guiacol and are used as household remedy for cough. It is found in many proprietary preparations. Moreover, cresols can be used in phenol-formaldehyde resins and m-cresol is also used in development of photos and p-Cresol can be converted to butylated hydroxytoluene (BHT), an important antioxidant in foods. Furthermore, it is metabolized by conjugation and oxidation and has main toxicity due to denaturation and precipitation of cellular proteins and thus poisons all cells directly. Furthermore, it can be absorbed following inhalation, oral, or dermal exposure. Cresol is extremely corrosive and may cause cutaneous damage, and gastrointestinal corrosive injury.

The global cresols market is segmented on the basis of source, product, application, end use, and region.

On the basis of source, the global cresols market is segmented into natural and synthetic. By product type, it is divided into para-cresol, meta-cresol, and ortho-cresol. By application, it is divided into chemical intermediate, solvents, preservative, and antioxidants. On the basis of end use, the market is divided into pharmaceuticals, chemical, paint & coating, and others.

Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA. Presently, Asia-Pacific accounts for the largest share of the market, followed by North America and Europe.

By Source

By source, the synthetic segment dominated the global cresols market in 2020. Rise in the medical advancements increases demand for synthetic cresols in the pharmaceutical industry, which act as the major driving factor for the market. In addition, it is also used in polymerization of resins and rise in use of polymers leads to increase in demand for synthetic cresols and create wide opportunities for the market growth

By Source

Synthetic segment is projected as the most lucrative segment.

By Product Type

By application, the para cresol segment dominated the global cresols market in 2020. It is a colorless solid that is widely used intermediate in production of other chemicals. It is a derivative of phenol and an isomer of ortho-cresol and meta-cresol. Para-cresol is conventionally extracted from coal tar and volatilized materials obtained in roasting of coal to produce coke. This residue contains a few percent by weight of phenol and cresols.

By Product Type

Para Cresol segment is projected as the most lucrative segment.

By Application

By application, the chemical intermediate segment dominated the global cresols market in 2020. Rise in the chemical industry and chemical dependency leads to increase in demand of cresols. In addition, cresols are widely used in the production of whiskey, wine, and other alcohol components, which lead to rise in demand for such products. However, cresols are highly toxic in nature, which acts as the main restraining factor for the market.

By Application

Chemical Intermediate segment is projected as the most lucrative segment.

By End-use

By end use, the chemical segment dominated the global cresols market in 2020. Rise in demand for phenols in various industries increases demand for cresols and acts as the major driving factor for the market. In addition, cresols are also used in medical products such as spirits, sanitizers, and many other, which rises demand for such products. Moreover, rapid expansion of the chemical industry in developing countries and excessive rise in population also lead to increase in demand for cresols, which propels the cresols market growth.

By End-use

Chemical segment is projected as the most lucrative segment.

By Region

By region, Asia-Pacific dominated the global cresols market in 2020. The market in this region is increasing in demand at a rapid rate as developing countries have started various new farming technique projects, which increases demand of fertilizers, in turn, leading to rise in demand for cresols in the region

By Region

Asia-Pacific holds a dominant position in 2020

Key Benefits For Stakeholders

- This report provides a detailed quantitative analysis of the current global cresols market trends and estimations from 2020 to 2030, which assists to identify the prevailing opportunities.

- An in-depth global cresols market analysis of various countries in this region is anticipated to provide a detailed understanding of the current trends to enable stakeholders formulate specific plans.

- A comprehensive analysis of the factors that drive and restrain the growth of the global cresols market is provided.

- Europe region-wise and country-wise market conditions are comprehensively analysed in this report.

- The projections in this report are made by analysing the current trends and future market potential from 2020 to 2030 in terms of value and volume.

- An extensive analysis of various regions provides insights that are expected to allow companies to strategically plan their business moves.

- Key market players within the market are profiled in this report and their strategies are analysed thoroughly, which help to understand the competitive outlook of the global cresols industry.

Cresols Market Report Highlights

| Aspects | Details |

| By SOURCE |

|

| By Product Type |

|

| By APPLICATION |

|

| By END USE |

|

| By Region |

|

| Key Market Players | DAKOTA GASIFICATION COMPANY, SABIC, SASOL LIMITED, ANHUI HAIHUA CHEMICAL TECHNOLOGY CO., LTD., VDH CHEM TECH PVT. LTD, KONAN CHEMICAL MANUFACTURING CO., LTD., ATUL, MITSUI CHEMICALS, NANJING DATANG CHEMICAL CO., LTD., LANXESS AG |

Analyst Review

The global cresols market is expected to witness increased demand during the forecast period, owing to rapidly growing para-cresol and packaging industry throughout the forecast period.

Several health and environmental concerns associated with cresols-based products are anticipated to hinder growth of the cresols market during the upcoming years. However, increase in demand for cresols in the agriculture sector and increase in demand for cresols in several end-use applications such as pharmaceuticals, chemical, and paints & coatings are some of the key factors expected to boost demand for the cresols market during the forecast period. In addition, rapidly increasing per capita income and high urbanization growth across the globe are expected to drive the global cresols market demand during the forecast period.

The COVID-19 pandemic has positively impacted the global cresols market as cresols play a vital in the manufacturing of sanitizers, which are part of basic needs presently. In addition, owing to shutdown of various industry production facilities such as construction and other chemical sectors have led to decline in demand for cresol compounds, thereby hampering the global cresols market for a short span of time.

Moreover, companies are inheriting acquisition strategies to boost growth of the cresols market throughout the forecast period.

Increase in demand in agriculture engineering and increase in applications in paint & coating may create wide opportunities in the cresols market.

Asia-Pacific will provide more business opportunities for Cresols in future

Anhui Haihua Chemical Technology Co., Ltd., ATUL Dakota Gasification Company, Lanxess AG, Konan Chemical Manufacturing Co., Ltd, Mitsui Chemicals, Nanjing Datang Chemical Co., Ltd., SABIC Sasol Limited, and VDH CHEM TECH PVT. LTD.

Chemical segment holds the maximum share of the Cresols Market

Pharmaceuticals, chemical, paint & coating, and others are the potential customers of Cresols industry

Use of cresols in pharmaceuticals and combustion engines is the current trend expected to influence the Cresols Market in the next few years

The global cresols market is segmented on the basis of source, product, application, end use, and region. On the basis of source, the global cresols market is segmented into natural and synthetic. By product type, it is divided into para-cresol, meta-cresol, and ortho-cresol. By application, it is divided into chemical intermediate, solvents, preservative, and antioxidants. On the basis of end use, the market is divided into pharmaceuticals, chemical, paint & coating, and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Loading Table Of Content...