Critical Illness Insurance Market Research, 2031

The Global Critical Illness Insurance Market was valued at $124.7 billion in 2021, and is projected to reach $354 billion by 2031, growing at a CAGR of 11.2% from 2022 to 2031.

Critical illness insurance provides additional coverage for medical emergencies like heart attacks, strokes, or cancer. Because these emergencies or illnesses often incur greater than average medical costs, these policies pay out cash to help cover those overruns when traditional health insurance may fall short. Moreover, critical illness insurance pays for a lump sum if the insured is diagnosed with a covered illness. This payout can be used to pay for anything from mortgage payments to medical expenses. In addition, critical illness insurance can pay for costs not covered by health insurance, such as deductible or out-of-network doctor costs.

The rising number of health issues due to unhealthy lifestyle of people causes serious illness such as kidney failures, heart attack, cancer and other such serious illness is propelling consumers to take critical illness insurance coverage. In addition, rising awareness about the benefits of a critical illness insurance coverage among consumers is a major driving factor for the market. Moreover, the cost of treatment without having a insurance coverage may lead to huge medical bills for which customers opt for the critical illness insurance. Therefore, these are some of the factors propelling the growth of critical illness insurance market.

However high amount of premium for the critical illness insurance is a major factor limiting the growth of the market. On the contrary, the smooth experience offered by the insurance coverage pertaining to reimbursement of medical bills and cashless treatments at best hospitals without the worry of high fees charged for operation and treatments is expected to provide lucrative growth opportunities in the coming years.

The report focuses on growth prospects, restraints, and trends of the critical illness insurance market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the critical illness insurance market share.

Segment Review

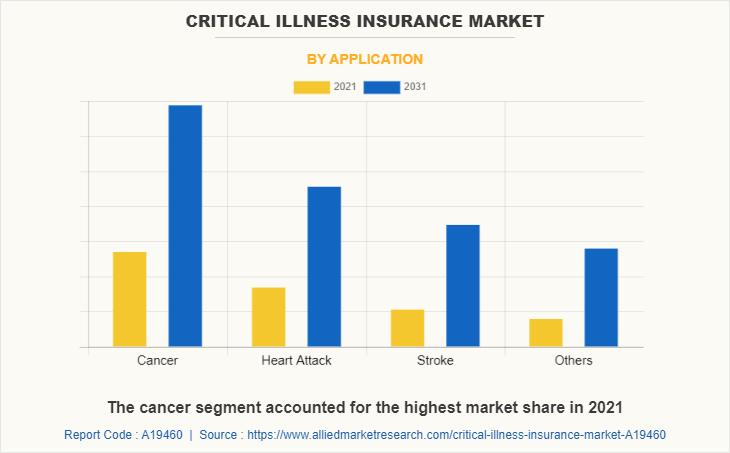

The critical illness insurance market is segmented on the basis of application, premium mode, end user, and region. By application, it is segmented into cancer, heart attack, stroke, and others. By premium mode, it is bifurcated into monthly, quarterly, half yearly, and yearly. Based on application, the critical illness insurance market is bifurcated into individual, and businesses. The businesses segment is further sub segmented into group policies and individual policies. The group policies segment is further divided into simplified issue policies, and fully underwritten policies. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By application, the cancer segment attained the highest growth in 2021. This is attributed to the fact that critical illness insurance plans usually tend to cover cancer, which is severe or terminal, and many types of cancer that are generally treatable are included. Moreover, the critical illness insurance covers the patient even if they have pre-existing ailments, including cancer. Moreover, a critical illness insurance policy is specifically designed to protect the insured financially from the perils involved with cancer.

By Region

North America accounted for the highest market share in 2021

By region, North America attained the highest growth in 2021. This is attributed to the rise in the number of cases for patients suffering from life-threatening diseases such as kidney failure, cancer, heart attack, strokes, and modern lifestyle and increasing prevalence of these diseases in the region. In addition, the critical illness plan supports coverage across specific life-threatening disorders, increasing the risk of falling prey to lifestyle diseases, augmenting the middle class, increasing life expectancy, and population growth is also propelling the critical illness insurance market growth.

The report analyzes the profiles of key players operating in the critical illness insurance market such as Aegon, AFLAC INCORPORATED, Allianz Care, American International Group, Inc., Aviva, AXA Hong Kong, Bajaj Allianz General Insurance Co. Ltd., Cigna, Future Generali India Insurance Company Ltd., Legal & General Group plc, Liberty Mutual Insurance, MetLife Services and Solutions, LLC., Royal London, Sun Life Assurance Company of Canada, United HealthCare Services, Inc., Modern Insurance Agency, Inc., and Plum Benefits Private Limited. These critical Illness Insurance companies have adopted various strategies to increase their market penetration and strengthen their position in the critical illness insurance industry.

Top Impacting Factors

Rising Number of Critical Health Issues

With the rising number of health issues among people due to unhealthy lifestyle, there is an increase in the serious critical illness such as cancer, heart attacks and others. However, health insurance does not cover a range of such critical illness for which consumers are showing interest in critical health insurance adoption for covering the cost of medical bills, hospitalization fees and other related costs. In addition, rise in number of instances of several diseases, such as brain tumor and cardiovascular diseases, is further increasing the demand for critical illness policy. Therefore, rising number of critical health issues among people is one of the major driving factor of the critical illness insurance market and also increasing demand for critical illness insurance service.

Higher Premium Cost for Critical Illness Coverage

Companies providing critical illness insurance policy have increased the insurance premium cost, owing to surge in healthcare expenses such as cost of medicines, hospital admission charges, and cost of various other treatments. In addition, most consumers across the globe have been infected with several chronic diseases such as heart disease, cancer, Alzheimer’s, and diabetes. Healthcare professionals have been imposing huge cost for the treatment of chronic diseases. Thus, insurance companies are responsible to address massive claim settlement cost, which hinders the market growth in the critical illness insurance domain.

Smooth Process of Reimbursement for the Coverage

Critical illness coverage provides a smooth experience to the insured in terms of cashless medical treatment for their illness. In addition, it offers peace of mind to the insured without having to worry about paying the high cost of medical bills out of their pockets these factors leads to critical Illness Insurance challenge. Moreover, the reimbursement process is very smooth and can the insured can even be eligible for a cashless treatment at the best hospital and receive the best possible treatment. Therefore, the peace of mind and the smooth process of reimbursement and cashless treatment offered under the critical illness insurance coverage will provide major lucrative opportunities for the growth of the market in the upcoming years.

Report Coverage & Deliverables

Type Insights

The report provides an in-depth analysis of critical illness insurance, focusing on various types of coverage such as cancer, heart disease, and stroke, highlighting the features and benefits of each type.

Technology Insights

Examines the critical illness insurance growth driven by technological advancements, including digital platforms for policy management, AI-driven risk assessment tools, and telemedicine integration.

Application Insights

Analyzes the critical illness insurance share across different applications, such as individual policies, group policies, and corporate health plans, identifying key trends and preferences.

Regional Insights

Offers a comprehensive view of critical illness insurance value across regions, highlighting market size, growth rates, and key drivers in North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

Key Companies & Market Share Insights

Provides an overview of leading critical illness insurance companies in the market, their market share, competitive positioning, and strategic initiatives impacting the critical illness insurance industry.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the critical illness insurance market forecast analysis from 2021 to 2031 to identify the prevailing critical illness insurance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the critical illness insurance market size segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global critical illness insurance market trends, key players, market segments, application areas, and market growth strategies.

Critical Illness Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 354 billion |

| Growth Rate | CAGR of 11.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 345 |

| By Application |

|

| By Premium Mode |

|

| By End User |

|

| By Region |

|

| Key Market Players | Royal London, Aviva, Cigna, Plum Benefits Private Limited, Modern Insurance Agency, Inc., AFLAC INCORPORATED, United HealthCare Services, Inc., MetLife Services and Solutions, LLC., Bajaj Allianz General Insurance Co. Ltd., Future Generali India Insurance Company Ltd., Allianz Care, Sun Life Assurance Company of Canada, Aegon, American International Group, Inc., Liberty Mutual Insurance, Legal & General Group plc, AXA |

Analyst Review

Life-threatening health ailments such as cancer, stroke, heart attacks and paralysis are categorized as critical illnesses. When diagnosed with a critical illness, patients require intensive care and continuous monitoring, which, in turn, can put much pressure on their finances. Therefore, a critical illness insurance offers coverage against various life-threatening diseases like heart attacks, cancer, renal failure, and stroke. Moreover, critical illness covers can help in paying off costly medical expenses for a particular set of diseases. If any illness gets diagnosed and meets policy requirements, the insured receives a lump sum or staggered payout to meet the medical condition.

Furthermore, market players are adopting various strategies for enhancing their services in the market and improving customer satisfaction. For instance, on April 2021, Bajaj Allianz General Insurance launched a Criti-Care critical illness policy that allows customers to design their coverage by selecting any or all the five plans within the policy, waiting period as well as survival period. The policy offers cancer care, cardiovascular care, kidney care, neuro care and transplant and sensory organ care. In addition, this policy covers 43 critical illnesses, which include both initial and advanced stages mentioned in the policy. The idea behind this product is to not only give customers the freedom to structure the policy as per their needs, but also provide them with much needed financial support in crucial times to recover faster.

Some of the key players profiled in the report include Aegon, AFLAC INCORPORATED, Allianz Care, American International Group, Inc., Aviva, AXA Hong Kong, Bajaj Allianz General Insurance Co. Ltd., Cigna, Future Generali India Insurance Company Ltd., Legal & General Group plc, Liberty Mutual Insurance, MetLife Services and Solutions, LLC., Royal London, Sun Life Assurance Company of Canada, United HealthCare Services, Inc., Modern Insurance Agency, Inc., and Plum Benefits Private Limited. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The rising number of health issues due to unhealthy lifestyle of people causes serious illness such as kidney failures, heart attack, cancer and other such serious illness is propelling consumers to take critical illness insurance coverage. In addition, rising awareness about the benefits of a critical illness insurance coverage among consumers is a major driving factor for the market. Moreover, the cost of treatment without having a insurance coverage may lead to huge medical bills for which customers opt for the critical illness insurance. Therefore, these are some of the factors propelling the growth of critical illness insurance market.

Based on application, the critical illness insurance market is bifurcated into individual, and businesses. The businesses segment is further sub segmented into group policies and individual policies. The group policies segment is further divided into simplified issue policies, and fully underwritten policies.

North America is the leading regional market for critical illness insurance market

The critical illness insurance market is estimated to reach $353.99 billion by 2031

Aegon, AFLAC INCORPORATED, Allianz Care, American International Group, Inc., Aviva, AXA Hong Kong, Bajaj Allianz General Insurance Co. Ltd., Cigna, Future Generali India Insurance Company Ltd., Legal & General Group plc, Liberty Mutual Insurance, MetLife Services and Solutions, LLC., Royal London, Sun Life Assurance Company of Canada, United HealthCare Services, Inc., Modern Insurance Agency, Inc., and Plum Benefits Private Limited.

Loading Table Of Content...