Crop Insurance Market Overview

The global crop insurance market was valued at $39.1 billion in 2022, and is projected to reach $88 billion by 2032, growing at a CAGR of 8.7% from 2023 to 2032. Rising extreme weather events due to climate change and increase in awareness of climate-related risks leading to the demand for risk management tools contribute toward the growth of the market.

Market Dynamics & Insights

- The crop insurance industry in North America held a significant share of 44% in 2022.

- The crop insurance industry in Japan is expected to grow significantly at a CAGR of 17.3% from 2023 to 2032.

- By coverage type, the multiple peril crop insurance (MPCI) segment is one of the dominating segment in the market, accounting for the revenue share of 69% in 2022.

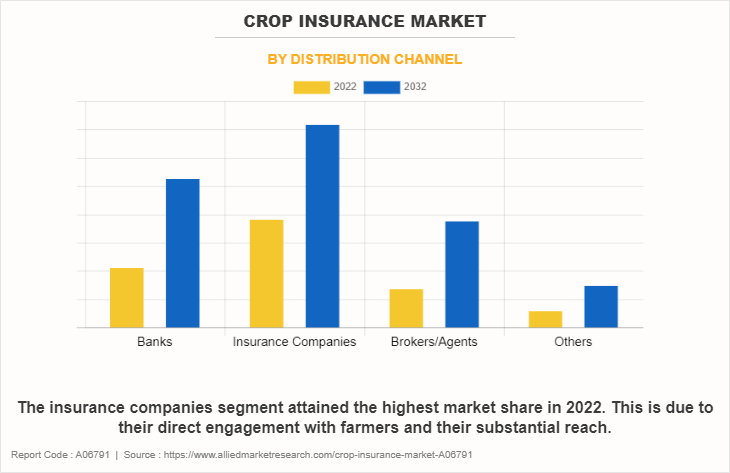

- By distribution channel, the insurance companies segment dominated the industry in 2022 and accounted for the largest revenue share of 49%.

Market Size & Future Outlook

- 2022 Market Size: $39.1 Billion

- 2032 Projected Market Size: $88 Billion

- CAGR (2023-2032): 8.7%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

What is Meant by Crop Insurance

Crop insurance is a type of protection policy, which covers agricultural producers against unexpected loss of projected crop yields. Although crop insurance can be expensive, it provides flexible coverages based on type of crop, size of land, and seasonal imbalances in the particular region. Crop insurance providers are enhancing the awareness & benefits of crop insurance plan and educating the buyers about available products and services, which fuel the growth of the crop insurance market.

The surge in digital initiatives transforming risk assessment with technologies like satellite imaging and data analytics is a major driving factor in the crop insurance market. In addition, government support, notably through subsidies, plays a pivotal role, encouraging farmer participation and stabilizing agricultural incomes.

However, substantial restraints persist, such as low farmer awareness about insurance benefits and the perceived high premiums, particularly affecting smallholders. On the contrary, a significant opportunity lies for the crop insurance market in diversifying crop insurance offerings, going beyond traditional coverage to address varied farmer risks. This expansion, embracing innovative options like revenue-based or index-based insurance, could counter market volatility and climate change impacts, ensuring comprehensive risk management and safeguarding farmers' livelihoods in the long term.

The report analyzes the profiles of key players operating in the crop insurance market share such as Agriculture Insurance Company of India Limited (AIC), American Financial Group, Inc., Chubb, Fairfax Financial Holdings Limited, ICICI Lombard General Insurance Company Limited, PICC, QBE Insurance Group Limited, Sompo International Holdings Ltd, Tokio Marine HCC, and Zurich. These players have adopted various strategies to increase their market penetration and strengthen their position in the crop insurance market.

Crop Insurance Market Segment Review

The crop insurance market outlook is segmented into coverage type, distribution channel, and region. In terms of coverage type, it is classified into multi-peril crop insurance (MPCI) and crop-hail insurance. Depending on distribution channel, it is fragmented into banks, insurance companies, brokers/agents, and others. Region wise, the crop insurance market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By distribution channel, the insurance company segment attained the highest market share in the crop insurance industry. This is due to their direct engagement with farmers and their substantial reach. These companies offer diverse insurance products tailored to farmers' needs, providing direct access to coverage options and services. On the other hand, the brokers and agents' segment is attributed to be the fastest-growing segment during the forecast period for the crop insurance market. This is owing to its personalized approach and increasing reliance on intermediaries for insurance guidance. Brokers and agents often work closely with farmers, offering personalized advice, explaining policy details, and helping them navigate through various insurance options. This personalized assistance fosters trust and enables farmers, especially in regions with lower awareness, to better understand and access suitable insurance products, thus driving the projected growth in this segment for the crop insurance market.

Region-wise, North America attained the highest growth in 2022 for the crop insurance market, due to its well-established agricultural practices and robust insurance infrastructure. The region has a long history of offering extensive crop insurance programs, backed by advanced technologies and strong government support, which encourages farmers to opt for insurance coverage. On the other hand, Asia-Pacific is expected to be the fastest growing segment during the forecast period for the crop insurance market. This is due to increasing awareness about the significance of agriculture insurance, particularly in emerging economies where agriculture plays a vital role. With farmers facing heightened risks from climate variability and natural disasters, governments and insurers are focusing more on expanding insurance coverage, utilizing technological advancements, and providing subsidies, all of which contribute to the projected swift growth in Asia-Pacific during the forecast period.

The report focuses on growth prospects, restraints, and trends of the crop insurance market analysis. The study provides Porter's five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the crop insurance market size.

Competition Analysis

What are the Recent Partnerships in the Crop Insurance Market

- On July 2023, Agi3 Risk Services (ARS) partnered with Definity Financial Corporation to launch an AI-powered crop insurance solution called AgriEnhance. The new product represents the first crop insurance offering on ARS Agi3 platform. Its capabilities were made possible through Definity company Economical Insurance and are aimed at aiding farmers find innovative ways to protect their crops. ARS designed its Agi3 platform to combine state-of-the-art machine learning algorithms with extensive data sources to enable precise assessment of field-level opportunities and risks, including factors such as yield potential and vulnerability to environmental hazards.

- On August 28, 2023, the International Rice Research Institute (IRRI), the Philippine Rice Research Institute (DA-PhilRice), and the Philippine Crop Insurance Corporation (PCIC) are collaborating on the development of an area-based yield index insurance for rice based on satellite data. This will help improve Filipino farmers resilience to climatic risks. This partnership builds upon an earlier collaboration between IRRI and PhilRice that developed and operationalized a satellite-based rice mapping and monitoring system called PRISM (Philippine Rice Information System). Operational since 2018, PRISM uses Synthetic Aperture Radar (SAR) satellite images and a smart detection system to map rice planting areas and planting dates. Using crop growth simulation modeling, it provides timely yield forecasts and end-of-season rice yields.

Which New Products have Been Launched in the Crop Insurance Market

- On August 28, 2023, Hyderabad-based Kshema General Insurance, the first company to receive a license from Insurance Regulatory and Development Authority of India (IRDAI) after a gap of five years in May this year, is introducing products for farmers that protect them from losses caused by pest attacks. The company has started providing insurance to farmers under the Pradhan Mantri Fasal Bima Yojana (PMFBY) in the current kharif season in Uttarakhand, Himachal Pradesh and parts of Rajasthan and Puducherry. It aims to achieve a premium income of Rs 1,000 crore by the end of FY24, its very first year of operation. It has received around 400 crore worth of premium so far with an operation spanning across 10 states.

What are the Top Impacting Factors in Crop Insurance Market

Increase in Digital Initiatives in Crop Insurance

The integration of digital technologies has been a major driving factor in the crop insurance market growth. Advanced tools like satellite imagery, drones, remote sensing, and data analytics are transforming how risks are assessed and managed in agriculture. These technologies provide invaluable insights into crop health, soil conditions, weather patterns, and potential risks, enabling more accurate risk assessment and underwriting.

Furthermore, digital initiatives offer real-time or near-real-time data, allowing insurers to monitor crop conditions, identify risks, and validate claims more efficiently. For instance, satellite imagery can provide detailed information on crop growth, detect anomalies, and assess the extent of damage caused by natural disasters like floods or droughts. Drones equipped with sensors can capture high-resolution images of fields, aiding in crop health analysis and early identification of potential threats.

Moreover, data analytics plays a pivotal role in processing vast amounts of information collected from various sources, enabling the development of predictive models. These models assess the likelihood of crop failure or damage due to specific factors, enhancing risk modeling and enabling insurers to price policies more accurately. As a result, farmers benefit from more tailored insurance products that address their specific risks while insurers mitigate their exposure to uncertainties. The continued advancement and adoption of digital technologies in crop insurance not only improve risk assessment but also streamline administrative processes, reducing operational costs and improving overall efficiency in delivering insurance services to farmers.

Low Awareness of Insurance & High Cost of Premiums

Many farmers, particularly in developing regions, lack knowledge about insurance products tailored to agriculture and remain unaware of how insurance can mitigate risks and protect their livelihoods. Moreover, the perception of high insurance premiums acts as a deterrent for farmers, particularly smallholders with limited financial resources. The cost of premiums is often considered an additional financial burden, leading many farmers to forego insurance coverage altogether, leaving them vulnerable to substantial financial losses in the event of crop failures or natural disasters. Addressing the low awareness of insurance requires extensive educational initiatives aimed at improving farmers' understanding of the benefits of crop insurance.

Effective communication strategies, farmer training programs, and collaborations between insurers, government agencies, and agricultural extension services are essential to increase awareness and promote the uptake of insurance among farmers. Simultaneously, tackling the challenge of high premium costs necessitates innovative approaches such as risk-pooling mechanisms, where farmers collectively share risks, thereby reducing individual premiums. Governments and insurers can also explore alternative pricing models, index-based insurance, or revenue-based insurance to make premiums more affordable and aligned with farmers' risk capacities.

Expansion of Crop Insurance Product Line

A lucrative opportunity in the crop insurance industry lies in diversifying and expanding the range of insurance products available to farmers. Traditionally, agriculture insurance has primarily focused on protecting against yield losses caused by natural disasters. However, there is immense potential to introduce new products that cover additional risks faced by farmers, including price volatility, market fluctuations, or emerging risks due to climate change. By expanding the crop insurance product line, insurers can offer more comprehensive coverage options that cater to the diverse needs of farmers across different regions and crop types.

For instance, revenue-based insurance considers both yield and price risks, providing farmers with protection against fluctuations in market prices along with crop losses. Index-based insurance relies on predetermined indices such as rainfall or temperature levels to trigger payouts, simplifying the claims process and reducing administrative complexities. Introducing innovative insurance products that address specific risks beyond crop failure not only enhances the relevance of insurance but also contributes to greater resilience in agricultural communities. Tailored insurance solutions enable farmers to manage multiple risks, ensuring stability in income and promoting long-term sustainability in agriculture.

Expanding the crop insurance product line requires collaboration between insurers, policymakers, and agricultural experts to design and implement products that are affordable, accessible, and suitable for different farming contexts. It is an opportunity to enhance the effectiveness of crop insurance in safeguarding farmers' livelihoods while fostering agricultural resilience against evolving risks.

What are the Key Benefits for Stakeholders

- This crop insurance market report provides a quantitative analysis of the crop insurance market segments, current trends, estimations, and dynamics of the crop insurance market forecast from 2023 to 2032 to identify the prevailing crop insurance market opportunity.

- Crop insurance Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the crop insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region for the crop insurance market are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the crop insurance market players.

- The crop insurance market report includes an analysis of the regional as well as global crop insurance market trends, key players, crop insurance market segments, application areas, and crop insurance market growth strategies.

Crop Insurance Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 88 billion |

| Growth Rate | CAGR of 8.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 325 |

| By Distribution Channel |

|

| By Coverage |

|

| By Region |

|

| Key Market Players | Chubb, American Financial Group, QBE Insurance Group Limited, ICICI Lombard General Insurance Company Limited, Agriculture Insurance Company of India Limited (AIC), PICC, ZURICH, Tokio Marine HCC, Fairfax Financial Holdings Limited, Sompo International Holdings Ltd. |

Analyst Review

In the crop insurance market, several key trends are shaping its landscape and influencing its trajectory for the future. One significant trend is the increasing integration of technology, including satellite imaging, drones, and data analytics, transforming how risks are assessed and managed in agriculture. These technological advancements allow for more accurate and timely evaluation of crop health, weather patterns, and potential risks, aiding insurers in offering more tailored and precise coverage to farmers. Moreover, the adoption of parametric or index-based insurance, which uses predefined parameters like weather indices to trigger payouts, is gaining traction, streamlining the claims process and reducing administrative complexities. Furthermore, with the escalating impacts of climate change, there is a growing emphasis on promoting sustainable farming techniques and resilient crop varieties. Insurers are incentivizing farmers to adopt these practices by linking insurance premiums to environmentally friendly farming methods, encouraging the use of drought-resistant seeds or practices that mitigate climate-related risks.

In addition, partnerships and collaborations among insurers, governments, and technology firms are on the rise. These alliances aim to improve access to insurance for smallholder farmers, who often face barriers such as limited financial resources and lack of awareness. Government support, in the form of subsidies and policy frameworks that promote insurance adoption, is playing a pivotal role in expanding coverage to underserved agricultural regions, thereby fostering inclusive growth in the crop insurance market. Furthermore, the future growth prospects for the crop insurance market appear promising yet multifaceted. The market is expected to witness continued expansion, driven by various factors. Rising awareness among farmers about the importance of crop insurance, particularly in emerging economies across Asia-Pacific and Latin America, is set to drive increased adoption rates. Governments' continued commitment to supporting agricultural insurance through subsidies, risk-sharing mechanisms, and regulatory reforms will further fuel market growth, especially in regions with evolving agricultural landscapes. Moreover, the advent of innovative insurance products catering to evolving risks, such as price volatility and market fluctuations, will contribute to market expansion. The development of customizable insurance solutions that address specific needs of diverse crop types and regions is expected to attract more farmers to opt for coverage, enhancing the market's reach and relevance.

Some key players profiled in the report include Agriculture Insurance Company of India Limited (AIC), American Financial Group, Inc., Chubb, Fairfax Financial Holdings Limited, ICICI Lombard General Insurance Company Limited, PICC, QBE Insurance Group Limited, Sompo International Holdings Ltd, Tokio Marine HCC, and Zurich. These players have adopted various strategies to increase their market penetration and strengthen their position in the crop insurance market.

. One significant trend is the increasing integration of technology, including satellite imaging, drones, and data analytics, transforming how risks are assessed and managed in agriculture.

The crop insurance market plays a pivotal role in safeguarding the livelihoods of farmers and mitigating the risks associated with agricultural production. This market exists at the intersection of agriculture and finance, offering protection to farmers against losses caused by natural disasters, adverse weather conditions, pests, and other perils that can devastate crops.

North America is the largest regional market for Crop Insurance

The estimated industry size of Crop Insurance is projected to reach $88,017.71 billion by 2032, growing at a CAGR of 8.7% from 2023 to 2032.

The top companies to hold the market share in Crop Insurance are Agriculture Insurance Company of India Limited (AIC), American Financial Group, Inc., Chubb, Fairfax Financial Holdings Limited, ICICI Lombard General Insurance Company Limited, PICC, QBE Insurance Group Limited, Sompo International Holdings Ltd, Tokio Marine HCC, and Zurich.

Loading Table Of Content...

Loading Research Methodology...