Crude Oil Flow Improvers Market Overview:

Global Crude Oil Flow Improvers Market was valued at $1,282 million in 2016, and is anticipated to reach $1,920 million, growing at a CAGR of 5.7% from 2017 to 2023. Crude oil is one of the most actively traded commodities with a stable growth rate globally. It is extracted from remote locations and needs to be transported through pipelines. Transportation of crude oil via pipeline is relatively difficult, owing to its viscosity and requirement of economical and efficient mode of transferring the oil. Thus, control over viscosity of the heavy oil is important for long distance transport without affecting the quality or state. Crude oil flow improvers maintains the viscosity of crude oil during processing and transportation. Moreover, it acts as additives that deliver apt solutions in all the stages of crude oil extraction from reservoir to refinery and maximize the production. These improvers are also known as drag reducing agents, which are injected into pipeline fluids to reduce turbulence. Moreover, these are employed on a wide scale among oil pipelines to increase the flow capacity and reduce the energy loss in pipelines.

The market is driven by the increase in crude oil production globally, to cater to the high demand, and rise in demand for crude oil flow improvers from the developing markets such as Middle East and Africa. Moreover, growth in hydraulic fracturing is expected to increase the demand for crude oil flow improvers. However, steady decline in crude oil prices and environmental concerns are expected to hamper the market growth in the near future. Furthermore, the production of crude oil flow improvers from renewable resources is expected to provide a substantial growth opportunity in the near future.

The global crude oil flow improvers market is segmented into type, application, and geography. On the basis of type, it is categorized into paraffin inhibitors, asphaltene inhibitors, scale inhibitors, and hydrate inhibitors. Based on application, it is classified into extraction, pipeline, and refinery. Geographically, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In addition, the report highlights various factors that impact the growth of the global market, such as key drivers, restraints, growth opportunities, and the role of different key players. It presents the quantitative data, in terms of both value and volume, which is obtained from secondary sources, such as company publications, Factiva, Hoovers, OneSource, and others.

Global Crude Oil Flow Improvers Market Segmentation

In 2016, North America dominated the global crude oil flow improvers market, in terms of both value and volume. Moreover, Asia-Pacific is expected to witness the highest growth rate from 2017 to 2023, owing to increase in crude oil demand in China and India, rise in disposable income, and growth in urbanization boosting the demand for crude oil flow improvers.

Crude Oil Flow Improvers Market Share, by Geography, 2016 (%)

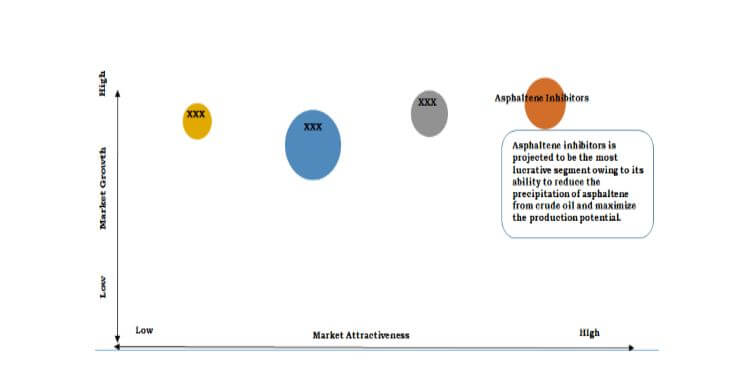

Top Investment Pockets

The asphaltene inhibitors segment is the most lucrative market, followed by the scale inhibitors segment. Asphaltene molecules, present in most of the liquid & gas streams, can block pipelines, reduce production flow, and lead to production losses. Asphaltene inhibitors reduce the precipitation of asphaltene from crude oil and increases the production potential to avoid deposition in flowlines.

Top Investment Pocket

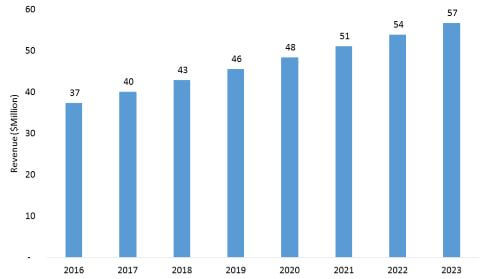

North America Crude Oil Flow Improvers Market Size

In 2016, North America witnessed the highest demand for crude oil flow improver, owing to the increase in adoption of nontraditional oil extraction techniques such as hydraulic fracturing and horizontal drilling. In addition, it increases the need for flow improvers to reduce viscosity of oil and improve the movement through pipes.

Mexico Crude Oil Flow Improvers Market Growth, 2016-2023 ($Million)

The key players profiled in the report are Halliburton Company, Baker Hughes, Nalco Champion, BASF SE, Schlumberger, Clariant, Dorf Ketal, Lubrizol Specialty Products, Inc., Infineum, and Evonik Industries.

The other major players (not profiled in report) in the market include WRT BV, Production Chemical Group, Rodanco, Partow Ideh Pars, and Phillips Specialty Products Inc.

Key Benefits

- This report provides an extensive analysis of the current and emerging market trends & dynamics of the global crude oil flow improvers market.

- The crude oil flow improvers market trend analysis for all the regions is provided by constructing estimations for key segments from 2017 to 2023 to identify the prevailing opportunities.

- The report assists to understand the strategies adopted by the leading companies in the industry.

- It evaluates competitive landscape of the crude oil flow improvers industry to understand the market scenario globally.

- Extensive analysis is conducted by key player positioning and monitoring the top competitors within the global market.

Crude Oil Flow Improvers Market Key Segments:

By Type

- Paraffin Inhibitors

- Asphaltene Inhibitors

- Scale Inhibitors

- Hydrate Inhibitors

By Application

- Extraction

- Pipeline

- Refinery

By Geography

- North America

- U.S.

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Denmark

- Italy

- Rest of Europe

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia-Pacific

- LAMEA

- Brazil

- Argentina

- Saudi Arabia

- Rest of LAMEA

Crude Oil Flow Improvers Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Application |

|

| By Geography |

|

| Key Market Players | HALLIBURTON COMPANY, BASF SE, INFINEUM, SCHLUMBERGER, DORF KETAL, EVONIK INDUSTRIES, CLARIANT, LUBRIZOL SPECIALTY PRODUCTS, INC., NALCO CHAMPION, BAKER HUGHES |

Analyst Review

Crude oil flow improvers, also known as drag reducing agents, are specifically injected into the pipeline to reduce turbulence. Crude oil is extracted from remote locations and require to be transported to the desired destinations. The demand for crude oil has maintained a stable growth rate during the past few years. Transportation of crude oil via pipeline is relatively difficult specifically in cold regions, owing to its high viscosity. Thus, crude oil flow improvers are widely employed to maintain the viscosity of crude oil for long distance transport without affecting its quality.

The asphaltene inhibitors segment is expected to witness the highest growth rate, registering a CAGR of 6.3% during the forecast period. Furthermore, in 2016, the paraffin inhibitors segment accounted for more than one-third of the total market share. Paraffin inhibitors are used to minimize or prevent paraffin deposition. Paraffin compounds in crude oil can damage plug production and transport equipment. It also causes poor flowability or lead to flow-restricting deposits. The pipeline segment is expected to witness the highest growth rate, registering a CAGR of 6.2% during the forecast period.

North America is expected to be the most significant market for crude oil flow improver from 2017 to 2023. U.S. dominated the North America crude oil flow improver market in 2016. North America witnessed the highest demand for crude oil flow improver, owing to the increase in adoption of nontraditional oil extraction techniques, such as hydraulic fracturing and horizontal drilling, which increases the need for flow improvers to reduce viscosity of oil and to improve the movement through pipes. In addition, Asia-Pacific is expected to witness the highest CAGR of 6.9% during the forecast period.

Loading Table Of Content...