Cryopump Market Research, 2032

The global cryopump market size was valued at $580.2 million in 2020, and is projected to reach $1.2 billion by 2032, growing at a CAGR of 6.4% from 2023 to 2032. A cryopump is a kind of vacuum pump used to acquire and keep extremely-high vacuum (UHV) in engineering and scientific research sectors, as well as manufacturing industry. A cryopump works at the principle of cryogenic cooling, condensing and receiving air from a vacuum chamber at very low temperatures.

Technological Aspect

Cryopumps are highly suitable for a wide range of applications requiring vacuum state ranging from 10-3 Pa to 10-9 Pa, especially in environments where oil-free and rapid gas extraction are paramount.

At the core of a cryopump lies a closed-loop refrigeration device, engineered to harness cryogenic fluids like liquid nitrogen, and helium. By circulating these fluids, cryopumps obtain temperatures nearing absolute 0 (-273.15°C or zero Kelvin), effectively developing an environment conducive to gas capture and condensation.

Upon activation, the cryopump's cold surfaces initiate a process wherein gas molecules from the vacuum chamber adhere to the surfaces and undergo phase transitions. Some gases may also without delay condense into solid or liquid shape (adsorption), while others freeze onto the surfaces (condensation). This selective capture successfully reduces the strain in the vacuum chamber, facilitating in achieving of ultra-high vacuum conditions.

Market dynamics

The growth of the cryopump market is being fueled by growth of industries such as electronics industry, pharmaceutical and medical industry, food and beverages, and others including R&D among all the mentioned industries. The semiconductor industry is witnessing a rapid rise, as the need for improved and innovative electronics components rises. Such components includes 5G, artificial intelligence, and IoT technology. In 2022, the Ministry of Electronics and Information Technology (MeitY) in India unveiled plans for a significant $10 billion investment in the India Semiconductor Mission (ISM), aimed at bolstering semiconductor research and development (R&D) within the country. This initiative underscores the government's commitment to establishing a strong presence in the semiconductor market. According to the Indian Brand Equity Foundation (IBEF), the Indian Semiconductor Market is anticipated to witness a robust compound annual growth rate (CAGR) of 17.1%. Concurrently, in the United States, semiconductor companies are consistently allocating approximately one-fifth of their annual revenue towards R&D efforts, reaching a milestone of $50.2 billion in investments in 2021 alone. Furthermore, the U.S. government has taken proactive measures by implementing the CHIPS Act, which includes substantial incentives totaling $52 billion for chip manufacturing, research, and related initiatives, demonstrating a concerted effort to strengthen the semiconductor industry domestically. Cryopumps help in achieving and maintaining smooth and high-vacuum environments vital for producing advanced digital components. Thus, increasing demand for semiconductors is expected to open growth opportunities for cryopumps manufacturers. For instance, in November 2022, Edwards Vacuum, a subsidiary of Atlas Copco commenced the construction a brand new, 15,000 square meter, factory in Asan City, in the Chungcheongnam-do province, South Korea. This new facility will fabricate dry vacuum pumps including cryopumps for the semiconductor industry.

Concurrently, investment in research and development activities in fields such as materials science and nanotechnology is a major cryopump market opportunity for growth, further boosting the demand for cryopumps in research laboratories and scientific institutions. For example, under the National Nanotechnology Initiative (NNI), the U.S. government has allocated $1.99 billion for research and development including nanoscience, device development, and addressing global challenges. Likewise, in Europe, the NANORIGO project, funded through the European Union's Horizon Europe program, has earmarked a budget of $4.8 million. Its objective is to develop a thorough Risk Governance Framework (RGF) and establish a corresponding Council (RGC) specifically for nanomaterials and nano-enabled products. Similarly, other parts of the world are also investing heavily into R&D of nanotechnology. Furthermore, cryopumps are used in aerospace and defense industries for space simulation chambers and vacuum testing of aerospace components. Technological improvements are enhancing the overall performance and efficiency of cryopumps and are expanding their market reach. Moreover, geographical growth, particularly in Asia-Pacific countries like China and India, is presenting new possibilities for growth of cryopump manufacturers. This growth is fueled by industrialization and infrastructure improvement in these countries. The increasing demand for extremely high vacuum conditions in the industrial sector is anticipated positively affect the cryopump market growth.

However, the high initial cost of acquiring cryopumps is a restraint for the market growth. The initial cost of acquiring cryopump systems, including the pump unit, ancillary equipment, and installation expenses, can substantially be high. On average the cost of cryopumps can range from $2,000.0 to $15,000.0. This high upfront investment may deter potential buyers, particularly smaller enterprises or research institutions with limited budgets, from adopting cryopump technology. In addition, cryopumps are sophisticated systems that require specialized knowledge for operation and maintenance which adds to the overall cost of operation of cryopumps.

Moreover, governments in the developed countries spend significantly on R&D in order to become leaders in different industrial aspects. In the recent years, as the value of having a robust R&D infrastructure in the country is understood, many developing countries have allocated significant resources for developing R&D infrastructure, eventually driving the demand for cryopumps. For example, India the Gross Expenditure on Research and Development (GERD) in the country has shown a consistent upward trend over the years from $133.7 billion in 2010–2011 to $155.34 billion in 2020–2021. A similar pattern is found in China, where research and improvement expenditure has continued to upward thrust regularly. In 2022, China's funding in research and development maintained its upward trajectory, surpassing $421 billion, marking an annual increase of over 10%, as pronounced through the National Bureau of Statistics. Cryopumps are used for many research activities in pharma, semiconductors, physics, and others facets of industry. In healthcare, cryopumps are employed in medical imaging equipment requiring vacuum environments. As these industries continue to evolve and spending on the R&D grows, the demand for cryopumps is anticipated to increase.

The Cryopump market is witnessing various obstructions in its regular operations due to the COVID-19 pandemic and inflation. Earlier, the global lockdowns resulted in reduced industrial activities, eventually leading to reduced demand for Cryopump from various sectors such as construction and industrial. However, COVID-19 has subsided, and the major manufacturers in 2023 are performing well. However, rise in global inflation is a new major obstructing factor for the entire industry. The inflation, that is an immediate result of the Ukraine-Russia war, and few long-term affects of the covid19 pandemic, have delivered volatility in the expenses incurred on raw materials used for production of cryopump. In addition, the price of oil and gas has also increased extensively, and many countries, mainly, the nations in Europe, Latin America, and developing economies in Asia-Pacific are experiencing intense negative effects on industrial production, consisting of the production of cryopump. However, India and China are performing relatively well. In addition, inflation is anticipated to worsen within the coming years, as the possibility of the ending of the conflict between Ukraine and Russia is much less. However, a peace agreement between Ukraine and Russia may be devised, with continued talks among the nations.

Segmental Overview

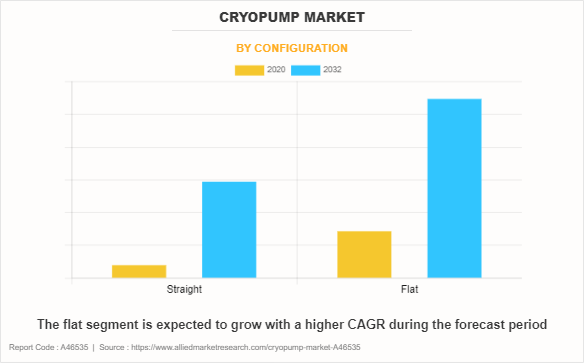

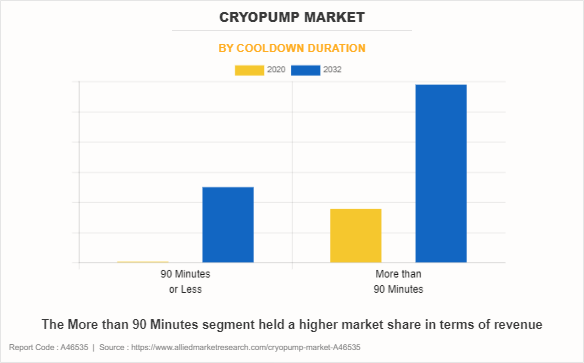

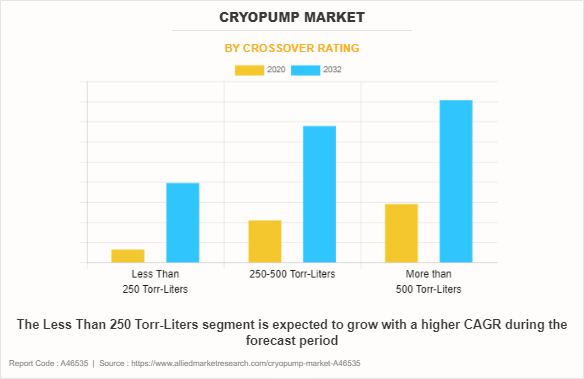

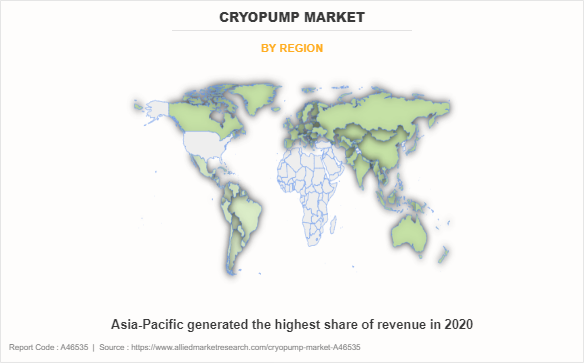

The Cryopump market analysis is segmented on the basis of configuration, cooldown duration, and crossover rating. By configuration, the market is categorized into straight and flat. On the basis of cooldown duration, it is bifurcated into 90 minutes and less, and More than 90 minutes. As per crossover rating, the market is categorized into less than 250 Torr-Liter, 250-500 Torr-Liter, and More than 500 Torr-Liter. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

By configuration, the cryopump market is divided into flat, and straight. In 2020, the segment encompassing flat cryopumps dominated the cryopump market share, in terms of revenue. Flat cryopumps, additionally referred to as cold traps have a compact, horizontal design with a flat surface area for cooling. Flat cryopumps are ideal for applications in which the space is constrained or where a compact footprint is desired. Witnessing the high demand for flat cryopumps, manufacturers are innovating and launching new cryopumps. For instance, in December 2021, Edwards Vacuum released a brand new flat cryopump for semiconductor industries.

By cooldown duration, the Cryopump market is categorized into 90 minutes and less, and more than 90 minutes. In 2020, the more than 90 minutes segment dominated the cryopump market, in terms of revenue, and is expected to maintain this trend during the forecast period. Cryopumps in this category are characterized by relatively shorter cooldown durations, typically taking 90 minutes or less to reach their optimal operating temperature. These cryopumps offer rapid cooldown times, allowing for quicker setup and operation in applications where time is of the essence. However, the 90 minutes and less segment is expected to grow with a higher CAGR during the forecast period. Cryopumps in this category have cooldown durations exceeding 90 minutes, requiring a longer period to reach their optimal operating temperature.

By crossover rating, the Cryopump market is categorized into less than 250 Torr-Liter, 250-500 Torr-Liter, and More than 500 Torr-Liter. In 2020, the More than 500 Torr-Liter segment dominated the cryopump market, in terms of revenue, and is expected to maintain this trend during the forecast period. Cryopumps with a crossover rating of more than 500 Torr-Liter provide efficient gas evacuation capabilities at elevated pressures, supporting faster down times and overall system performance. However, the less than 250 Torr-Liter segment is expected to grow with a higher CAGR during the forecast period. Cryopumps with a crossover rating of less than 250 Torr-Liter offer superior performance in maintaining clean and controlled vacuum environments essential for sensitive processes and measurements.

By region, the Cryopump market is analyzed throughout North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Asia-Pacific accounted for the highest market share in 2020 and Europe expected to maintain its dominance through the forecast period. Asia-Pacific is one of the world’s fastest growing region, increasing at a price of 5% annually. Rapid industrialization has led to expansion of the manufacturing industry, which eventually has boosted the economy's GDP. The manufacturing industry is likewise flourishing because of the lenient industrial regulations of the countries, which aim to attract foreign investment. The food processing and manufacturing industries are the fundamental contributors to the GDP of countries together with Japan, South Korea, and Australia; thus, these countries are anticipated to witness demand for cryopumps for the food and beverage sector. Furthermore, China is one of the most important providers of activated pharmaceutical ingredients, and the Indian pharmaceutical industry is witnessing high growth. These factors have pushed the demand for Cryopumps in Asia-Pacific. Moreover, various initiatives have boosted the manufacturing industry as well as R&D initiatives in Asia-Pacific. For instance, Make in India an initiative was launched by Indian government, and Made in China 2025 launched by the Chinese government to aid the manufacturing industry in China. These factors are expected to provide advantageous opportunities for the growth of the cryopump market.

Competition Analysis

Competitive analysis and profiles of the major players in the Cryopump market, such as SHI Cryogenics Group, Trillium, Leybold Products GmbH, Edward Vacuum (Atlas Copco), Ulvac Cryogenics, Inc., Pfeiffer Vacuum GmbH, Vacree Technologies Co.,Ltd, Ebra Corporation, Nikkiso, and Elliott Group, are provided in this report. Major players have adopted product launch and acquisition as key developmental strategies to improve the product portfolio of the Cryopump market. For example, in February 2023, Atlas Copco acquired service and sales distributor Zeus Co Ltd. in South Korea. This move will help Atlas to further expand its foothold in the country in a more efficient manner.

Key Benefits For Stakeholders

- The report provides an extensive analysis of the current and emerging Cryopump market trends and dynamics.

- In-depth market analysis is conducted by constructing market estimations for the key market segments between 2022 and 2032.

- Extensive analysis of the Cryopump market is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive analysis of all regions is provided to determine the prevailing opportunities.

- The Cryopump market forecast analysis from 2023 to 2032 is included in the report.

- The key market players within Cryopump market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the Cryopump industry.

Cryopump Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.2 billion |

| Growth Rate | CAGR of 6.4% |

| Forecast period | 2020 - 2032 |

| Report Pages | 211 |

| By Configuration |

|

| By Cooldown Duration |

|

| By Crossover Rating |

|

| By Region |

|

| Key Market Players | Ulvac Cryogenics, Inc., Leybold Products GmbH, Ebra Corporation, Nikkiso Co., Ltd, Vacree Technologies Co.,Ltd, Atlas Copco AB, SHI Cryogenics Group, Pfeiffer Vacuum GmbH, Elliott Group, LLC., Trillium, Nikkiso |

Analyst Review

The cryopump marketplace is witnessing robust increase propelled by various factors. Cryogenic technology is increasingly in demand throughout industries like semiconductor production, aerospace, and medical research, attributed to cryopumps' superior vacuum generation capabilities. These pumps enhance performance and reliability in critical approaches, thereby propelling market expansion. Moreover, continuous advancements in the cryogenic industry are broadening the scope of programs for cryopumps, further fueling their adoption. However, the industry faces demanding situations inclusive of the excessive cost of the cryogenic equipment and the complexity associated with cryopump installation and maintainance. Despite these restraints, considerable possibilities are emerging. As industries prioritize efficiency, sustainability, and precision, the demand for advanced cryopump solutions is predicted to surge. Top producers can capitalize on this by investing in research and development to innovate new cryopump technologies supplying superior performance, reliability, and cost-effectiveness. Additionally, forging strategic partnerships and collaborations with key enterprise players can help producers extend their market presence and tap into new boom avenues.

The cryopump market is growing owing to increasing demand for cryogenic technology in various industries, including semiconductor manufacturing, aerospace, and medical research. Cryopumps offer superior performance in vacuum generation, enabling efficient and reliable processes in these sectors. Additionally, advancements in cryogenic technology and expanding applications drive the market's growth further.

The latest version of the Cryopump market report can be obtained on demand from the website.

The Cryopump market size was valued at $580.2 million in 2020.

The Cryopump market size is estimated to reach $1,239.3 million by 2032, exhibiting a CAGR of 6.4% from 2023 to 2032.

The forecast period considered for the cryopump market is 2023 to 2032, wherein, 2022 is the base year, 2023 is the estimated year, and 2032 is the forecast year. The market is also analyzed historically between 2020 and 2021.

Flat segment is the largest market for Cryopump market.

Key companies profiled in the Cryopump market report include SHI Cryogenics Group, Trillium, Leybold Products GmbH, Edward Vacuum (Atlas Copco), Ulvac Cryogenics, Inc., Pfeiffer Vacuum GmbH, Vacree Technologies Co., Ltd., Ebra Corporation, Nikkiso, and Elliott Group.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Loading Table Of Content...

Loading Research Methodology...