CubeSat Market Research, 2032

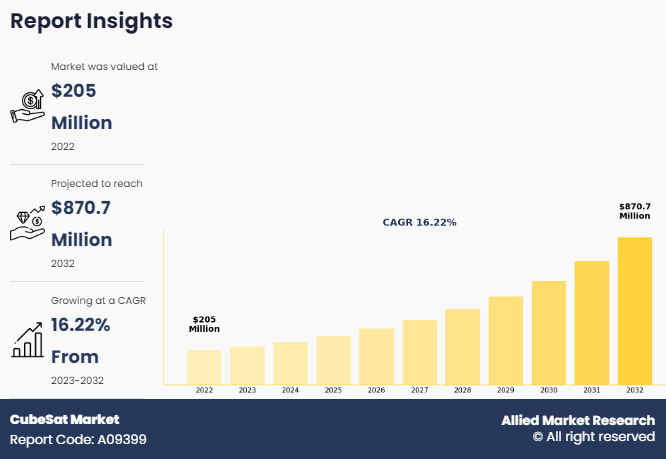

The global cubeSat market size was valued at $205 million in 2022, and is projected to reach $870.7 million by 2032, growing at a CAGR of 16.2% from 2023 to 2032.

Report Key Highlighters

• The cubeSat market studies more than 16 countries. The analysis includes a country-by-country breakdown analysis in terms of value ($million) available from 2022 to 2032.

• The research combined high-quality data, professional opinion, and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

• The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the market.

• The cubeSat market share is marginally fragmented, with players such as Planet Labs Inc., GomSpace, AAC Clyde Space, Endurosat, Tyvak Nano-Satellite Systems, Inc., Surrey Satellite Technology Limited, Innovative Solutions in Space B.V., Space Inventor, Pumpkin Space Systems, and CU Aerospace, L.L.C. Major strategies such as contracts, partnerships, expansion, and other strategies of players operating in the market are tracked and monitored.

The CubeSats are small in size and weight, which does not diminish their capabilities and are used across several commercial applications. Rise in use of CubeSats has laid the foundations for increased deployment of the Internet of Things (IoT) on a global scale, enabling the interconnection of areas of the Earth without ground communication through the setups in space.

There is rise in the number of sensor-driven devices globally that require global communications and connections. Detection and monitoring of assets such as ships, aircraft, vehicles, and others, can be quite hard to manage on land cover.

Segmental Analysis

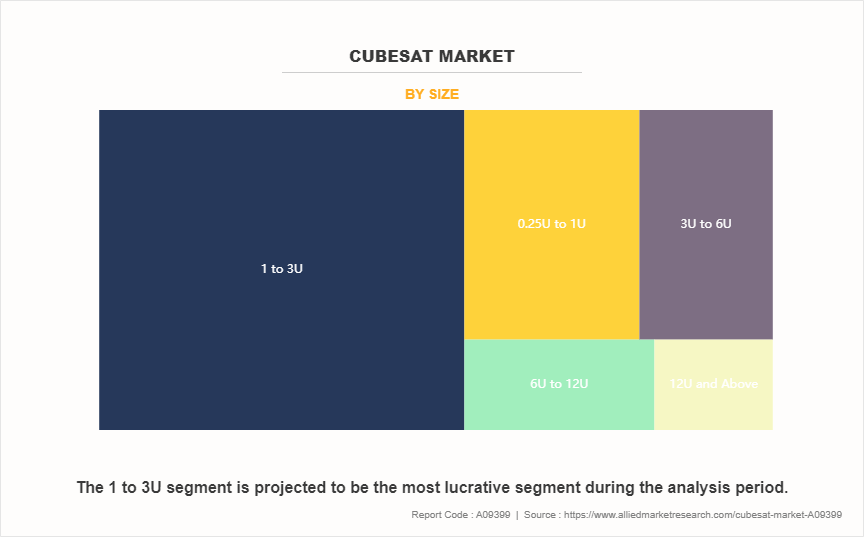

The cubeSat industry is segmented into size, application, end user, subsystem, and region. By size, the market is divided into 0.25U to 1U, 1 to 3U, 3U to 6U, 6U to 12U, and 12U and above. By application, the market is segmented into earth observation & traffic monitoring, science & technology, and education, space observation, communication, and others. On the basis of end user, the market is segmented into government & military, commercial, and non-profit organizations. Depending on subsystem, the market is classified into payloads, structures, electrical power systems, command & data handling, propulsion systems, attitude determination & control systems, and others.

Region-wise, the cubeSat industry is analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, Russia, and rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East and Africa).

By Size

By size, the market is divided into 0.25U to 1U, 1 to 3U, 3U to 6U, 6U to 12U, and 12U and above.The growing usage of CubeSats has laid the foundation for increased deployment of the Internet of Things (IoT) on a worldwide scale, enabling the interconnection of areas of the Earth without ground communication through the setups in space. The world is witnessing an increasing number of sensor-driven devices that require global communications and connections.

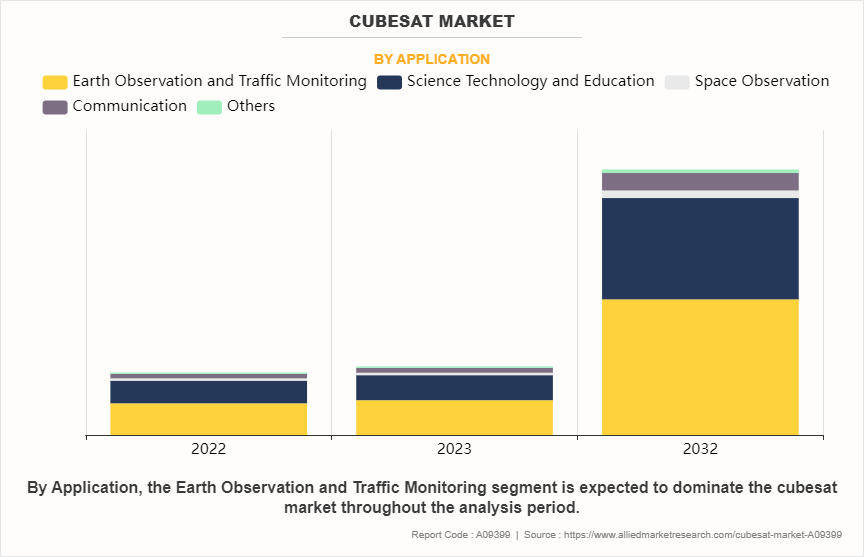

By Application

By application, the market is segmented into earth observation & traffic monitoring, science & technology, and education, space observation, communication, and others.CubeSat constellations, located in space and providing access to images across the globe, give access to real-time information of various assets anywhere on the Earth. CubeSats can aid the present network technologies by offering intricate logistics administration solutions.

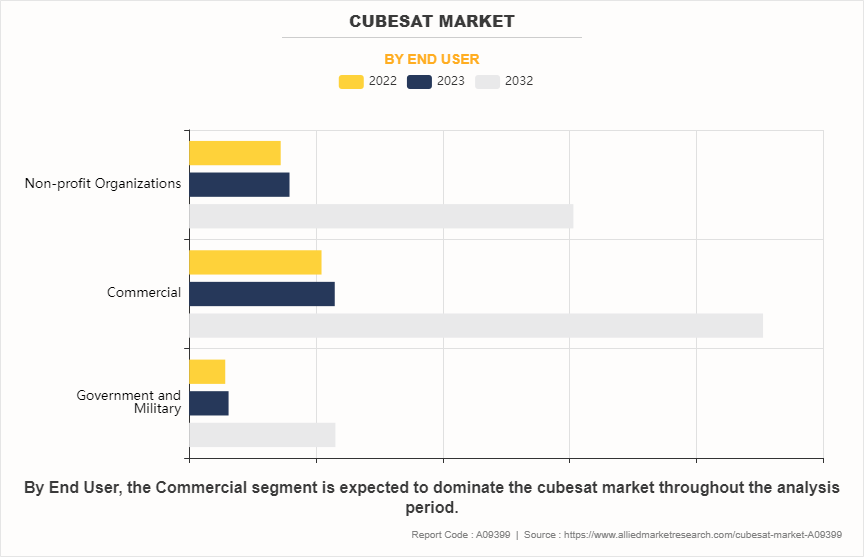

By End User

On the basis of end user, the market is segmented into government & military, commercial, and non-profit organizations.Commercial applications in the CubeSat market are rapidly expanding, driven by trends such as the increasing need for global connectivity, Earth observation, and data analytics. One prominent trend is the deployment of CubeSat constellations for broadband internet services, aiming to provide global coverage, especially in remote and underserved areas.

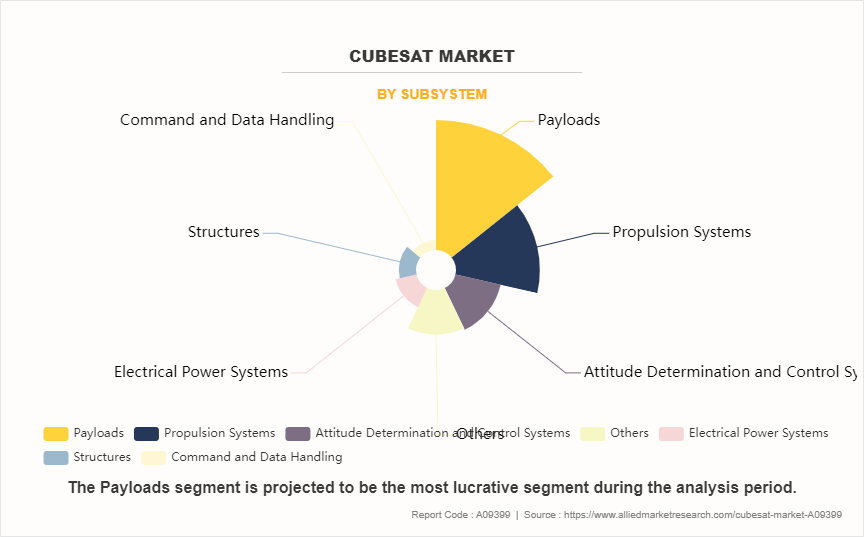

By Subsystem

Depending on subsystem, the market is classified into payloads, structures, electrical power systems, command & data handling, propulsion systems, attitude determination & control systems, and others.The payload subsystem in the CubeSat market is a critical component that determines the mission's objectives and capabilities. This subsystem includes all the instruments and technology necessary for the CubeSat to perform its designated functions, such as cameras for Earth observation, sensors for scientific measurements, communication equipment for data transmission, and experimental hardware for technology demonstrations.

By Region

North America is expected to be the largest market shareholder with a CAGR of 15.9% from 2022 to 2032 owing to the consistent demand for advanced cubesat across several countries.he National Aeronautics and Space Administration (NASA) and the Department of Defense (DoD) are key players, funding a variety of CubeSat missions for scientific research, space exploration, and defense applications. The commercial sector is also rapidly expanding, with companies like SpaceX, Planet Labs, and Rocket Lab leading efforts in satellite deployment, Earth observation, and space-based communication networks.

Market Dynamics

Rise in demand for CubeSats from Several Commercial Applications

CubeSats are capable of monitoring radio signals transmitted from the ground stations. This offers an advantage in the event of a disaster when they can provide prior information with respect to the degree of impact and the most adversely affected areas, permitting efficient planning for relief and rescue operations. For instance, in September 2022, Airbus and In-Space Missions collaborated on the design and development of the Prometheus 2 satellites. It has passed environmental and vibration testing. The Defense Science and Technology Laboratory (Dstl) owns the Prometheus 2 cubesats on behalf of the Ministry of Defense (MOD). Airbus Defence and Space co-funded them, with In-Space Missions Ltd. leading the construction.

Limitations of CubeSats Regarding Payload Accommodation

CubeSats are cost-effective solutions that are sent into space for doing science experiments or for business reasons. CubeSats are built in relatively less time and cost as compared to conventional satellites, which minimizes dependency on deployable structures and complex mechanisms and allows mission disaggregation. One of the main problems with respect to the range of missions that Cubesats can perform is the accommodation of payloads. The small size of CubeSats leads to strict restrictions on the volumes of propulsion, payload, and other subsystems. The higher ΔV (impulse required to perform a maneuver) missions need more propellant that results in less volume for any scientific instrument or payload intended to fly onboard the CubeSat.

Lack of space in CubeSat also limits its capability of carrying important subsystems that CubeSats require to execute a complex mission. Another limitation observed owing to the small volumes of CubeSats is its low power generation. CubeSats come in multiples of the standard U (equivalent to roughly 4 x 4 x 4 in.) cube. Several researchers are making use of CubeSats to perform several biological, multidisciplinary research, and planetary science missions. The possibility of the capacities or information that can be acquired is quite limited owing to lack of propulsion system for on-orbit maneuvering, robust attitude determination and control systems, and power generation by the CubeSats.

Increase in Demand for Space Data

The range and scope of services that could be provided by satellites are limitless. The demand for the services, for instance, surveillance for military, environmental or public safety applications, navigation and positioning, tracking vehicles, and telecommunication offered by the satellites is growing rapidly across the world. The largest demand is anticipated to arise from the telecommunications industry, which has been making use of space for its services for several years now and is a crucial part of the global infrastructure for communications and commercial & government data transfer and applications. Moreover, the demand for Earth observation (EO) data is increasing for different applications, and has increased requirements for the environment & scientific research, and metrology. The demand for space data is also growing for guaranteeing security in military operations and in money transfer applications. The rising demand for space data is anticipated to propel the demand for cost-effective cubeSat market growth over the forecast timeframe.

Impact of Russia-Ukraine War

The Russia-Ukraine war has the potential to significantly impact various industries such as space, military, and government. Geopolitical tensions have introduced uncertainties, potentially hindering international collaboration and investment in CubeSat initiatives. Disruptions in the supply chain due to economic sanctions or trade restrictions are expected to lead to delays and increased costs for CubeSat projects globally. However, amidst these challenges, there emerge opportunities for alternative providers to step in and meet the demand for CubeSat manufacturing, launch services, and satellite data provision. Moreover, the conflict is expected to increase the demand for CubeSats focused on surveillance and communication, as nations seek to bolster their capabilities in monitoring and connectivity. Thus, while the Russia-Ukraine conflict poses challenges, it also opens avenues for innovation and adaptation within the CubeSat market.

Competitive Analysis

Competitive analysis and profiles of the major global cubeSat market players that have been provided in the report include Planet Labs Inc., GomSpace, AAC Clyde Space, Endurosat, Tyvak Nano-Satellite Systems, Inc., Surrey Satellite Technology Limited, Innovative Solutions in Space B.V., Space Inventor, Pumpkin Space Systems, and CU Aerospace, L.L.C. The key strategies adopted by the major players of the global market are product launch and mergers & acquisitions.

Top Impacting Factors

The global cubeSat market is expected to witness notable growth registering a CAGR of 16.22%, owing to rise in demand for Cubesats from several commercial applications. Shift in solar energy to cut carbon emissions creates lucrative cubeSat market opportunity. However, competing energy sources are projected to hinder market growth.

The global cubeSat market trends is fragmented, owing to strong presence of existing vendors such as Planet Labs Inc., GomSpace, AAC Clyde Space, Endurosat, Tyvak Nano-Satellite Systems, Inc., Surrey Satellite Technology Limited, Innovative Solutions in Space B.V., Space Inventor, Pumpkin Space Systems, and CU Aerospace, L.L.C. Vendors of the global market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors as they cater to market demands, which are higher than the supply. The competitive environment in this market is expected to increase owing to technological innovations, product extensions, and different strategies adopted by key vendors.

Key Developments/Strategies in CubeSat

- In August 2021, The Lockheed Martin In-space Upgrade Satellite System (LINUSS) successfully completed environmental testing, demonstrating how small CubeSats can regularly upgrade satellite constellations to add timely new capabilities and extend spacecraft design lives.

- In April 2022, Planet Labs PBC (NYSE: PL), a leading provider of daily data and insights about Earth, announced that Planet’s PlanetScope and SkySat data joined the European Space Agency (ESA) Third Party Missions portfolio, enabling ESA to utilize Planet data for scientific, research, and pre-operational Earth Observation based applications development.

- In July 2020, RHEA Group and GomSpace signed a Memorandum of Understanding (MOU) to combine their expertise on Security for Space and the development and operations of large constellations of SmallSats.

Key Benefits for Stakeholders

- This study comprises analytical depiction of the global cubeSat market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall global cubeSat market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current global cubeSat market forecast is quantitatively analyzed from 2022 to 2032 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in cubeSat.

- The report includes the market share of key vendors and the global cubeSat market.

CubeSat Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 870.7 million |

| Growth Rate | CAGR of 16.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 324 |

| By Application |

|

| By End User |

|

| By Subsystem |

|

| By Size |

|

| By Region |

|

| Key Market Players | Endurosat GmbH, Millennium Space Systems, GomSpace ApS, Clyde Space, Surrey Satellite Technology, Tyvak, Adcole Maryland Aerospace, Innovative Solutions In Space B.V., G.A.U.S.S. Srl , Planet Labs Inc. |

Earth Observation and Traffic Monitoring is the leading application of CubeSat market.

The upcoming trends of CubeSat market include rise in demand for cubesats from several commercial applications. and shift in solar energy to cut carbon emissions.

North America is the largest regional market for CubeSat.

The global CubeSat market was valued at $205.0 million in 2022.

Planet Labs Inc., GomSpace, AAC Clyde Space, Endurosat, Tyvak Nano-Satellite Systems, Inc., Surrey Satellite Technology Limited are the top companies to hold the market share in CubeSat.

Loading Table Of Content...

Loading Research Methodology...