Currency Management Market Research, 2031

The global currency management market was valued at $331.5 billion in 2021, and is projected to reach $1631.3 billion by 2031, growing at a CAGR of 17.5% from 2022 to 2031.

Currency management is the process by which companies can capture the growth opportunities that result from buying and selling in multiple currencies. Currency management is therefore of strategic value to most firms. Moreover, currency management strategy provides foreign exchange execution and currency hedging solutions to help minimize risk, reduce costs and increase efficiency. In addition, this allows them to take control of their own competitiveness by capturing the growth opportunities resulting from buying and selling in multiple currencies. Effective currency risk management presupposes effective FX hedging. Depending on a company’s specific parameters, currency management solutions allow managers to design the hedging programs and combinations of hedging programs that best protect them for currency risk, in an automated manner. Moreover, as more money is allocated overseas, investors are carefully evaluating their exposure to foreign exchange risk and looking for custom currency management solutions from an experienced and independent firm.

There has been a significant growth in international trade, which is very important for the currency management market, as they provide expert advice on the buying and selling of various currencies and record their fluctuations, which helps to minimize the risk factor involved in international trades. In addition, fluctuations in the foreign exchange due to various reasons such as inflation, war, and political turmoil in a country lead to various risks associated with companies dealing in foreign trade or buying and selling of currencies. Thus, currency management helps to manage these fluctuations by providing various services such as hedging. Therefore, these are some factors propelling the growth of the currency management market.

However, there are a number of countries becoming self-reliant and do not deal in foreign trade. These countries do not deal in foreign exchange and thus, do not require the services of currency management, which is a major factor limiting the growth of currency management market. On the contrary, increasing trade relation among various countries will increase the buying and selling of multiple currencies is expected to provide lucrative currency management market opportunity in the upcoming years.

The report focuses on growth prospects, restraints, and trends of the currency management market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the currency management market size.

Segment Review

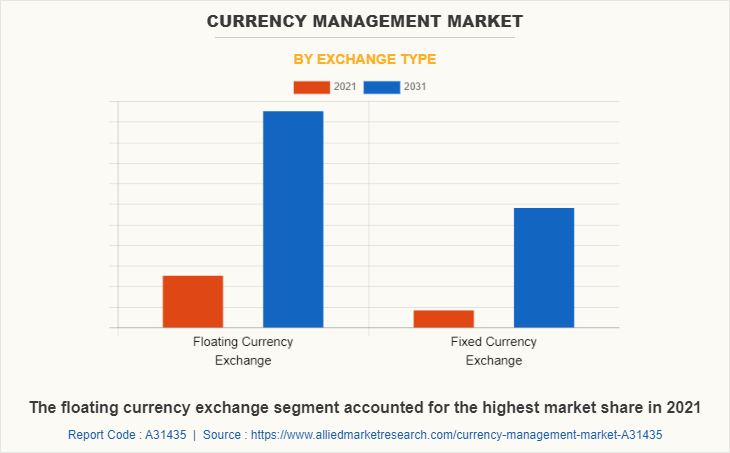

The currency management market is segmented on the basis of exchange type, hedge type, application, and region. By exchange type, it is segmented into floating currency exchange, and fixed currency exchange. By hedge type, it is classified into benchmark hedging, portfolio hedging, and share class hedging. The bench market hedging is further divided into benchmark weight hedging, and currency-hedged benchmark replication. By application, the currency management market is categorized into commercial and investment banks, central banks, multinational corporations, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By exchange type, the floating currency exchange segment attained the highest growth in 2021 for the currency management market share. This is attributed to the fact that most of the world’s currencies participate to some degree in a floating currency exchange system. In a floating system, the prices of currencies move relative to one another based on market demand for the currencies' foreign exchange.

By region, North America attained the highest growth in 2021. This is attributed to the fact that rise in exponential growth of foreign currency holders across North America. Moreover, a significant increase in international trade activities is catalyzing the demand for forex reserve as it provides numerous benefits, such as minimal trading costs, high liquidity and transactional transparency, and vast trading volume.

The report focuses on growth prospects, restraints, and trends of the currency management market trends. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the currency management market size.

COVID-19 Impact Analysis

The COVID-19 pandemic had a negative impact on the market as the international trade was at an all-time low. Moreover, the foreign currency fluctuated because of the economic conditions during the lockdown period, for which the demand for currency management services decreased. Therefore, the COVID-19 had a negative impact on the currency management industry.

Top Impacting Factors

Growth in International Trade

There has been a significant growth in the international trade which is very important for the currency management market, as they provide expert advice on the buying and selling of various currencies and record their fluctuations that help to minimize the risk factor involved in international trades. Furthermore, as various countries have started doing trade internationally, the demand for currency management services are rapidly growing. Therefore, this is one of the major driving factors for the currency management market growth.

Fluctuations in the Foreign Exchange

Fluctuations in the foreign exchange due to various reasons such as inflation, war, and political turmoil in a country lead to various risk associated with companies dealing in foreign trade or buying and selling of currencies. Thus, currency management helps to manage these fluctuations by providing various services such as hedging. Moreover, as these fluctuations keeps on growing, the demand for currency management is also increasing as firms have a constant requirement for currency management services to avoid any risk. Therefore, this is the major propelling factor for the currency management market outlook.

Increase in Number of Self-producing Countries

There are a number of countries becoming self-reliant and do not deal in foreign trade. These countries do not deal in foreign exchange and thus, do not require the services of currency management, which is a major factor limiting the growth of currency management market. In addition, as countries are becoming self-reliant or producing their own products without dealing in foreign trades, the demand for foreign currency reduces, which further decreases the demand for currency management services. Therefore, this is a major factor hampering the currency management market growth.

Increase in Trade Relations Among Countries

Increase in trade relation among various countries will increase the buying and selling of multiple currencies and is expected to provide lucrative growth opportunities in the upcoming years. Moreover, as the trade relations among countries witness growth, there will be an increase in the buying and selling of currencies among countries. Furthermore, the demand for foreign currency is growing, which will further increase the demand for currency management. Therefore, this factor is expected to provide major lucrative opportunities for the currency management market forecast in the upcoming years.

Currency Management Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1631.3 billion |

| Growth Rate | CAGR of 17.5% |

| Forecast period | 2021 - 2031 |

| Report Pages | 285 |

| By Exchange Type |

|

| By Hedge Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Mesirow, ECOUNT, Rhicon, Northern Trust Corporation., State Street Corporation, Metzler, Kantox, Aston, Record, CIBC, Acumatica, Adrian Lee & Partners, Castle Currency, Russell Investments Group, LLC., United Advisers |

Analyst Review

There has been a significant growth in the international trade which is very important for the currency management market, as they provide expert advice on the buying and selling of various currencies and record their fluctuations, that helps to minimize the risk factor involved in international trades. Furthermore, as various countries have started doing trade internationally, the demand for currency management services are rapidly growing. Moreover, fluctuations in the foreign exchange due to various reasons such as inflation, war, political turmoil in a country lead to various risk associated with companies dealing in foreign trade or buying and selling of currencies. Thus, currency management helps to manage these fluctuations by providing various services such as hedging. Moreover, as these fluctuations keep on growing, the demand for currency management is also increasing as firms have a constant requirement for currency management services to avoid any risk.

Furthermore, market players are adopting various strategies for enhancing their services in the market and improving customer satisfaction. For instance, in April 2022, Infinity Partnership unveiled a second strategic partnership that significantly broadens its service offering to clients. Infinity has teamed up with Aston Currency Management to offer treasury management and foreign exchange (FX) services. Aston CM supports clients of all sizes from SMEs to multinationals with the delivery of services including multi-currency accounts, spot FX, forward contracts, and FX strategy. Companies with an international focus are open to the risk of adverse currency movements. By implementing an FX strategy and improving their rates of exchange, companies will reduce currency risk and ultimately improve their balance sheet position. Thus, these factors will further help the market growth.

Some of the key players profiled in the report include Acumatica, LEE OVERLAY PARTNERS LIMITED, Aston, Castle Currency Management Inc., CIBC, ECOUNT Inc., Kantox.com, Mesirow Financial Holdings, Inc., Bankhaus Metzler, Northern Trust Corporation, Record, Rhicon, Russell Investments Group, LLC, State Street Corporation, United Advisors, HedgeFlows Ltd., AND Tripalti Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

There has been a significant growth in the international trade which is very important for the currency management market, as currency managers provide expert advice on the buying and selling of various currencies and record their fluctuations, that helps to minimize the risk factor involved in international trades. In addition, fluctuations in the foreign exchange due to various reasons such as inflation, war, political turmoil in a country lead to various risk associated with companies dealing in foreign trade or buying and selling of currencies.

Based on application, the currency management market is bifurcated into commercial and investment banks, central banks, multinational corporations, and others.

North America is the largest regional market for currency management

The estimated industry size of Currency Management is reach $1,631.25 billion by 2031

Acumatica, LEE OVERLAY PARTNERS LIMITED, Aston, Castle Currency Management Inc., CIBC, ECOUNT Inc., Kantox.com, Mesirow Financial Holdings, Inc., Bankhaus Metzler, Northern Trust Corporation, Record, Rhicon, Russell Investments Group, LLC, State Street Corporation, United Advisors, HedgeFlows Ltd., and Tripalti Inc.

Loading Table Of Content...