Data Analytics In Banking Market Research, 2031

The global data analytics in banking market was valued at $4.93 billion in 2021, and is projected to reach $28.11 billion by 2031, growing at a CAGR of 19.4% from 2022 to 2031.

The banking industry and consumers who utilize finance products generate an enormous amount of data on a daily basis. In addition, banking analytics has changed the way this information is processed, making it possible to identify trends and patterns, which can then be used to inform business decisions at scale. This data can be used to understand or recognize multiple customer patterns and can help to promote sales and marketing strategies in banking analytics.

Data analytics have been helping the bank and financial institutions to know the customers and their buying patterns and behaviors, which is driving the growth of the market. In addition, significant increase in fraudulent activities such as accounting fraud, money laundering, and payment card fraud are the major factors that drive the global data analytics in banking market growth. However, issues associated with implementation and integration among banks and financial institutions hamper the growth of the market. Conversely, integration of artificial intelligence in mobile banking apps and a rise in demand from developing economies are expected to provide major opportunities for the growth of the data analytics in banking market during the forecast period.

The report focuses on growth prospects, restraints, and trends of the data analytics in banking market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the data analytics in banking market outlook.

The Data Analytics in Banking Market is Segmented into Application, Component, Deployment Model, Organization Size and Type

Segment Review

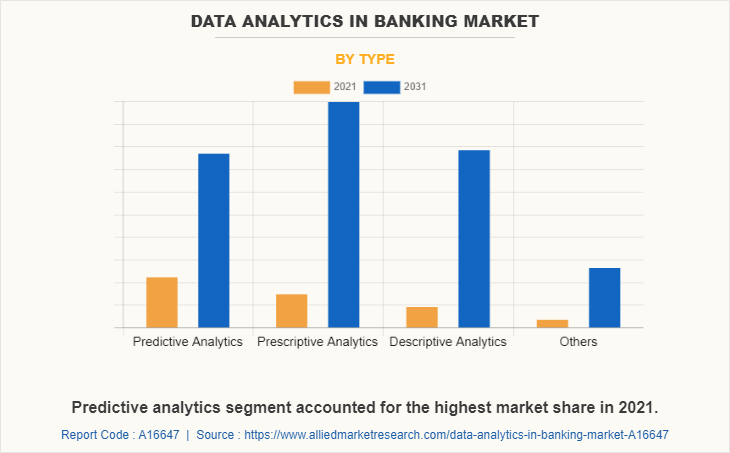

The data analytics in banking market is segmented into component, deployment mode, type, application, organization size, and region. By component, the market is differentiated into solution and services. The services segment is further segregated into implementation and integration services training & support service, and consulting service. By deployment model, it is fragmented into on-premise and cloud. By organization size, it is fragmented into large enterprise and small & medium sized enterprises. By type, the market is differentiated into predictive analytics, prescriptive analytics, descriptive analytics, and others. The applications covered in the study include fraud detection & prevention, customer management, sales & marketing, workforce management, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By type, predictive analysis attained the highest share in data analytics in banking market size 2021. This is attributed to the fact that it is increasingly aiding banks in determining which specific items should be marketed to whom and in channeling their sales and marketing efforts. All of this leads to more successful cross-selling, resulting in increased profitability and a stronger customer connection.

By region, Asia-Pacific is expected to be the fastest growing region in data analytics in banking market share. This is attributed to the fact that many financial institutions in Asia-Pacific have adopted predictive analytics for increasing the revenue of the organizations and improving decision making capabilities of the organization.

The key players that operate in the global data analytics in banking market include as Adobe Inc., Alteryx, Inc., Amazon Web Services, Inc., Aspire systems, Dell Inc., Google, IBM, Microsoft Corporation, Mu Sigma, Oracle, SAP SE, SAS Institute Inc., Sisense Inc., Tableau Software, LLC (Salesforce), Zoho Corporation Pvt. Ltd, KNIME AG, and TIBCO Software Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the data analytics in banking industry.

COVID-19 Impact Analysis

COVID-19 pandemic has a significant impact on the data analytics in banking industry, owing to increase in usage and adoption in banking sectors to study and research the consumer data to implement effective strategies. Data analytics in banking has experienced massive growth as there is increase in technological advancements in the market. Moreover, banks and fintech industries provide their customers with useful and appropriate insights to predict the future positions and situations. This, in turn, has become one of the major growth factors for the data analytics in banking market during the global health crisis.

Top Impacting Factors

Risk Management and Internal Controls

Banks can lower credit risk and make better judgments based on numerous of risk characteristics with the incorporation of innovative technologies. The platform for big data and analytics enables banks to regulate credit risk and avoid default scenarios. Detecting fraud in real-time with the aid of data and analytics tools helps avoid credit and liquidity risk by allowing for close monitoring of borrowers with ability to predict loan failure. The implementation of Big Data analytics within the credit risk management domain of the retail bank is a clear indicator. Applying credit risk indicators based on behavioral patterns in payment transactions has proven to detect credit events significantly earlier than traditional indicators based on overdrawn accounts and late payments. Decisions based only on risk assessment and transparency can be made with the assistance of analytics tools. The Bank of America is an excellent illustration of how high-risk account can be identified utilizing big data. The Corporate Investment Group is liable for determining the probability of default on 9.5 million mortgages, which assisted Bank of America in predicting losses due to loan defaults. The bank was able to boost its efficiency by reducing the time required to calculate loan defaults from 96 to 4 hours.

Increase in use of Data Analytics in Customer Support

Customer support services is another area where data analysts contribute. Continuous data collection delivers knowledge and insight regarding customer issues. If data indicates that a certain service department routinely receives similar questions, a knowledge base can be developed to facilitate self-service. Using information gained from previous interactions, the user experience could be enhanced by quickly resolving their difficulties. Customers generate the great majority of big data in banking, either through interacting with sales teams as well as service representatives or via transactions. While both types of customer data are extremely valuable, transactional data provide banks with a clear sight of their customer's spending habits or, over time, larger behavioral patterns.

Adoption of Cloud Technology in Banking Sector

Cloud computing is among the fastest-growing technologies currently available. Cloud computing provides banks with nearly limitless hardware and software resources, allowing them to adapt changes according to their needs. Despite banks' seeming reluctance to adopt such technologies for security reasons, they may adopt cloud technology in the near future as the benefits outweigh the costs and hazards. Cloud technology can drastically reduce the infrastructure expenses of a bank, improve its flexibility, boost its efficiency, and expedite customer service, hence enhancing the bank's customer relationships.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the data analytics in banking market forecast from 2021 to 2031 to identify the prevailing data analytics in banking market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the data analytics in banking market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global data analytics in banking market trends, key players, market segments, application areas, and market growth strategies.

Data Analytics in Banking Market Report Highlights

| Aspects | Details |

| By Application |

|

| By Component |

|

| By Deployment Model |

|

| By Organization Size |

|

| By Type |

|

| By Region |

|

| Key Market Players | Amazon Web Services, Inc., Sisense Inc., Google, Adobe Inc., Aspire Systems, Oracle Corporation, KNIME AG, Zoho Corporation Pvt. Ltd, Mu Sigma, IBM, Tableau software, LLC (Salesforce), Microsoft Corporation, Alteryx, Inc., SAP SE, Dell Inc., TIBCO Software Inc., SAS Institute Inc. |

Analyst Review

Owing to the sheer enormous economic value provided by data analytics models, banks are anticipated to play an increasingly important part in company operations in the future. Organizations can use data analytics to take preventative action across a number of roles. Some of the profitable potential prospects attainable with data analytics models are fraud prevention in banks, catastrophe protection for governments, and magnificent marketing efforts. Surge in internet access and increased smart device usage in Europe and Asia-Pacific fuel demand for data analytics in these regions. Moreover, the data analytics industry is likely to benefit from increased cloud use and rise in investment in big data analytics in upcoming years.

The COVID-19 outbreak has a significant impact on the data analytics in banking market. Furthermore, the breakout of the COVID-19 pandemic in 2020 has prompted the development of data analytics solutions to battle the issue and assist the banking industry in working successfully and continuing all financial activities in the event of a crisis. This, as a result promoted the demand for data analytics, thereby accelerating the revenue growth.

The data analytics in banking market is fragmented with the presence of regional vendors such as Adobe Inc., Alteryx, Inc., Amazon Web Services, Inc., Aspire systems, Dell Inc., Google, IBM, Microsoft Corporation, Mu Sigma, Oracle, SAP SE, SAS Institute Inc., Sisense Inc., Tableau Software, LLC (Salesforce), Zoho Corporation Pvt. Ltd, KNIME AG, and TIBCO Software Inc. Major players that operate in this market have witnessed significant adoption of strategies, which include business expansion and partnership to reduce supply and demand gap. With increase in awareness & demand for data analytics in banking across the globe, major players have collaborated their product portfolio to provide differentiated and innovative products.

The data analytics in banking market is estimated to grow at a CAGR of 19.4% from 2022 to 2031.

The data analytics in banking market is projected to reach $28.11 billion by 2031.

The key players profiled in the report include Adobe Inc., Alteryx, Inc., Amazon Web Services, Inc., Aspire systems, Dell Inc., Google, IBM, Microsoft Corporation, Mu Sigma, Oracle, SAP SE, SAS Institute Inc., Sisense Inc., Tableau Software, LLC (Salesforce), Zoho Corporation Pvt. Ltd, KNIME AG, and TIBCO Software Inc.

The key growth strategies of Data analytics in banking market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Increase in adoption of advanced technologies for fraud detection, better risk management and internal controls through data analytics, and increasing use of data analytics in customer support majorly contribute toward the growth of the market.

Loading Table Of Content...