Data Center Automation Market Insights:

The global data center automation market size was valued at USD 4.8 billion in 2020, and is projected to reach USD 32.5 billion by 2030, growing at a CAGR of 21.32% from 2021 to 2030.

Major growth factors of the data center automation market size include application of data centers across various industry domains and the demand for energy efficiency and business growth. In addition, the factors such asgrowing cloud computing, social media, online gaming, and big data applications boosts growth of the market. These factors have significantly contributed toward growth of the data center automation market share, and are anticipated to impact the market growth during forecast period.

A data center is a facility that comprises a network of computers and storage systems and is used to process, organize, store, and distribute large amounts of data for a business or an organization. Data center automation is the process of automating and managing processes and workflow of a data center facility. It helps in automating data center operations, monitoring, management, and maintenance tasks that are performed manually by human operators.

Segment Review:

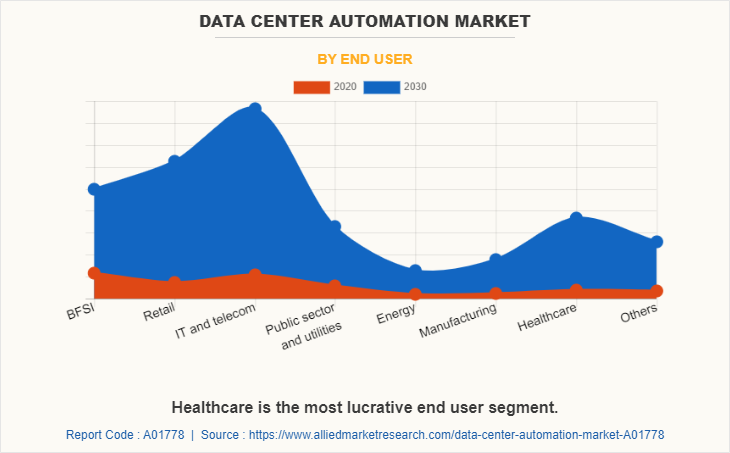

The data center automation market is segmented on the basis of component, operating environment, end user, and region. Depending on component, the market is divided into solution and services. On the basis of operating environment, it is divided into Windows OS, Unix OS, Linux & other OS. On the basis of industry vertical, it is divided into BFSI, retail, IT & telecom, public sector & utilities, energy, manufacturing, healthcare, and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

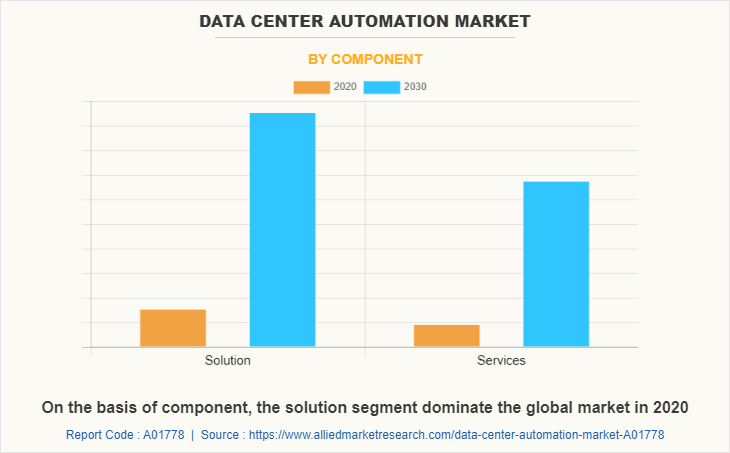

In 2020, on the basis of component, the solution segment dominated the data center automation market size, and is expected to maintain its dominance in the upcoming years. This is attributed to the demand for server automation solutions in data centers which enables organizations or users to quickly and securely provision, configure, patch, and maintain physical, virtual, and cloud servers. Server automation offers compliance with pre-configured policies as per requirements and it also increases IT efficiency by up to ~85% with an intelligent and closed loop for automated remediation. These factors aid in the data center automation market growth. However, the services segment is expected to witness highest growth rate during the data center automation market forecast period.

On the basis of end user, the BFSI segment dominated the global data center automation industry, and is projected to keep its hold on the market in the coming years. Moreover, the BFSI sector has been implementing data center automation as it eliminates faults from manual processes and improves the synchronization between IT operations and IT security. Analysis of customer developments, fraud detection, and other similar tasks can be achieved by efficiently managing data. Immense competition in the finance sector increases pressure on banks to become more responsive and efficient. Furthermore, banks need to augment their resources and infrastructure and improve their operational efficiency. Thus, to address the above issues, banks are implementing data center technology to offer services such as mobile banking, ATM services, online banking, and others.

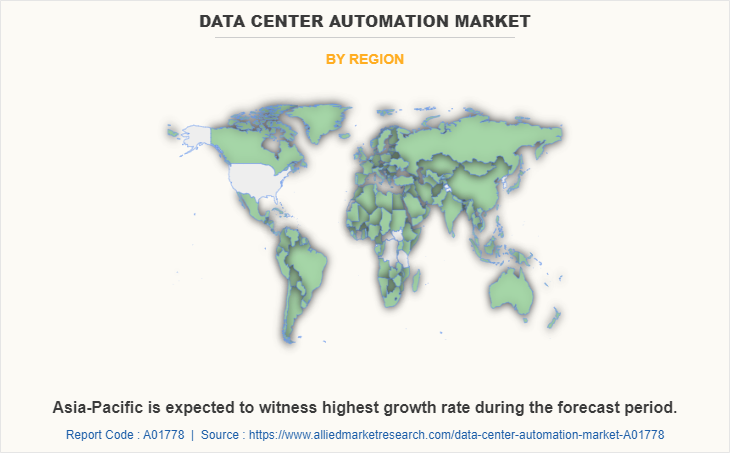

North America is the leading region, in terms of technological advancements and adoption. It possesses well-equipped infrastructure and the ability to afford data center automation software solutions. Furthermore, adoption of data center automation tools boosts efficiency and reduces costs for data center operations such as incident management and event management. It helps end-user industries to monitor infrastructure, applications, performance, and security features. Use of data center automation solutions in industries including BFSI, IT & telecom, and media & entertainment is growing at a fast pace in North America. However, Asia-Pacific is the dominant region in the global data center automation market, owing to the fact that large number of populations is active on social media and presence of developing countries such as India, China, and South Korea.

Top Impacting Factors:

Application of Data Centers Across Various Industry domains

Data centers offer enterprises with higher data storage capacity, more advanced servers, and faster computing capability. There is a rise in need for data centers from industries across all domains. Growth in dependence of businesses on data centers is one of the prime factors that propel the market for data center automation. Data centers have uniform application across various industries, namely IT & telecom, BFSI, public sector & utilities, healthcare, energy, manufacturing, retail, education, and others. Data center is used by organizations to host web applications, save, process, and access huge data, in addition to execute critical tasks.

Energy Efficiency

Energy efficiency is a prominent factor that propels the data center automation market as all enterprises aim at increasing overall energy efficiency. Data center automation helps organizations that operate with maximum energy efficiency while minimizing their impact on the environment are preferred by organizations. The desire to reduce electricity cost increases demand for energy-efficient automated data centers. High-density blade servers and storage solutions used in data centers offer increased compute capacity per Watt of energy consumed.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the data center automation market analysis from 2020 to 2030 to identify the prevailing data center automation market opportunities.

- The data center automation market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the data center automation market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global data center automation market trends, key players, market segments, application areas, and market growth strategies.

Data Center Automation Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Operating Environment |

|

| By End User |

|

| By Region |

|

| Key Market Players | VMWARE, BMC SOFTWARE, CHEF SOFTWARE, HEWLETT PACKARD ENTERPRISE COMPANY, CISCO SYSTEMS, BOXER PARENT COMPANY, PUPPET LABS, INC., MICROSOFT CORPORATION, ServiceNow, Inc., CITRIX SYSTEMS, IBM |

Analyst Review

The global data center automation market is expected to grow at a promising rate during the forecast period. Increase in applications of data centers across various industry domains have led to market growth. Data centers offer enterprises with higher data storage capacity and technologically advanced servers with faster computing capability. Enterprises prefer data centers that operate with maximum energy efficiency while minimizing their impact on the environment. Companies are providing innovative data center automation solutions to avoid harmful impact on the environment.

Key factors responsible for growth of the data center automation market include innovations in processing power and memory, increasing demand for resource pooling, increasing adoption of data centers across various industry domains, high energy efficiency, and secured data center management systems.

Generation of enormous heat, storage limitations, and frequent power failures are expected to restrain the growth of the market. With rise in cloud computing, social media, big data, online gaming, and other online applications, there is a constant need for enhanced IT infrastructure that caters to their ever-increasing demand for resources. North America is one of the largest markets in terms of market size and Asia-Pacific, which is expected to grow at the highest CAGR dung the forecast period for data center automation. Rapid development in the banking sector in major economies such as China, India, and Japan, the BFSI sector is expected to exhibit notable growth in Asia-Pacific.

According to the insights of CXOs of leading companies in the data center automation market, the global market is driven by enhanced productivity & reduced cycle time, advanced process analytics, improved quality, accuracy & compliance, and efficiency & cost reduction. However, the market growth for data center automation is restrained due to high monetary expenses for initial implementation in developed as well as developing countries. Many CXOs believe that automating data center has the potential to contribute significantly toward improved productivity, scalability, and provides faster executions of tasks as compared to traditional methods of data center automation and give better value for investments.

Asia-Pacific is the leading regional market, in terms of growth rate for data center automation, owing to major investments in IT infrastructure automation and business process automation in China, Japan, South Korea, and India.

The data center automation market was valued at $4,763.5 million in 2020.

The factors such as upsurge in adoption of cloud services by small & medium size enterprises (SMEs) and surge in demand for energy-efficient data centers positively impact the market. Moreover, rise in investments to develop advanced data centers during the COVID-19 pandemic has a considerably impact on the growth of the market.

BFSI followed by IT & telecom industry are the leading end users in Data Center Automation Market. This is due to the fact that the data centers have become a more strategic asset for IT companies and BFSI companies as well as telecom operators.

North America dominated the global Data Center Automation markt in 2020

The top companies holding the market share includes VMware, Inc., BMC Software, Cisco Systems, Inc., IBM Corp., Hewlett Packard Enterprise, and Microsoft Corp.

Loading Table Of Content...