Data Center Chip Market Summary

The global data center chip market was valued at $11.7 billion in 2022, and is projected to reach $45.3 billion by 2032, growing at a CAGR of 14.6% from 2023 to 2032. This is fueled by the rapid expansion of cloud computing services, continuous advancements in chip technology, and supportive government regulations promoting data center localization. These factors are driving increased demand for high-performance, energy-efficient chips to support modern data processing and storage requirements.

Market Dynamics & Insights

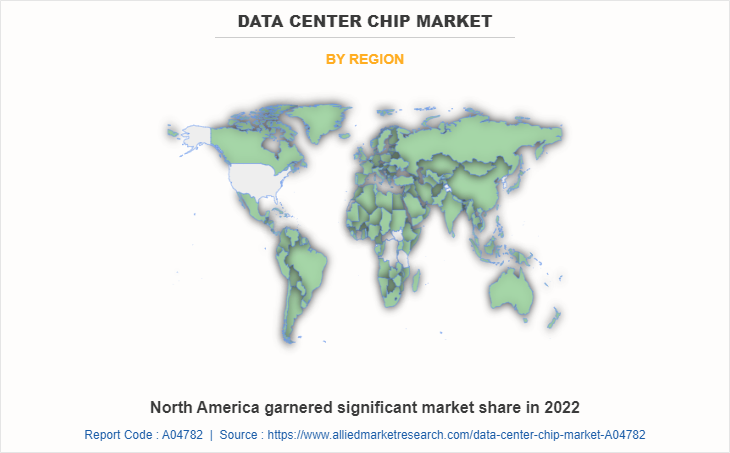

The data center chip industry in North America held a significant share of over 36.6% in 2022.

The data center chip industry in Germany is expected to grow significantly at a CAGR of 15.7% from 2023 to 2032.

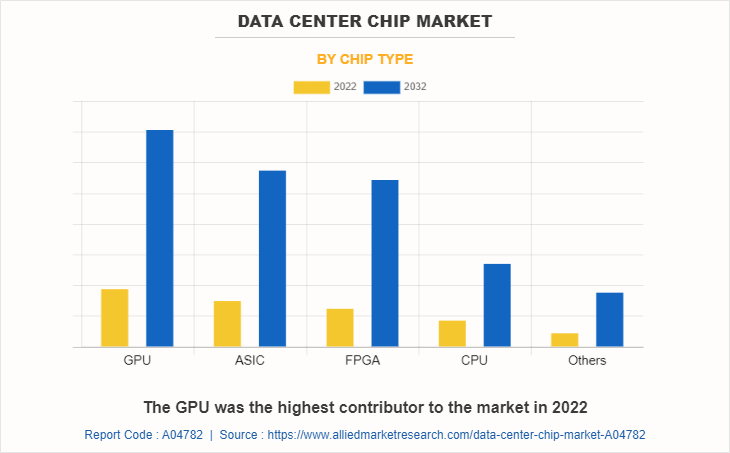

By chip type, GPU segment is one of the dominating segments in the market and accounted for the revenue share of over 31.9% in 2022.

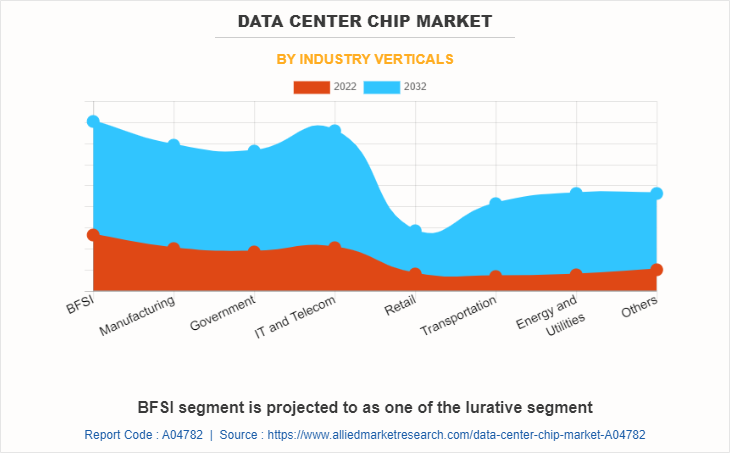

By industry vertical, the Energy and Utilities segment is the fastest growing segment in the market.Market Size & Future Outlook

2022 Market Size: $11.7 Billion

2032 Projected Market Size: $45.3 Billion

CAGR (2023-2032): 14.6%

North America: Largest market in 2022

Asia-Pacific: Fastest growing market

The global data center chip market growth is driven by cloud computing and advancements in chip technology. In addition, government regulations regarding localization of data centers fuel the market growth. However, high data center operations impede market growth. Furthermore, an increase in smart computing devices is expected to present enormous opportunities for the market in the coming years.

Data center chips are used in a variety of applications within a data center, including running web applications, managing databases, processing big data analytics, and enabling AI and machine learning algorithms.

Segment Overview

The market is segmented into Chip Type, Data Center Size and Industry Verticals.

By chip type, the market is classified into GPU, ASIC, FPGA, CPU, and others.

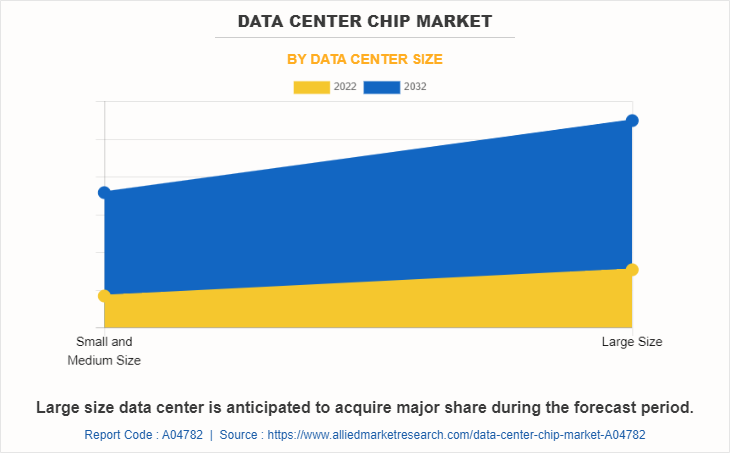

By data center size, the market is divided into small & medium size and large size.

By industry vertical, the data center chip industry is categorized into BFSI, manufacturing, government, IT & telecom, retail, transportation, energy & utilities, and others.

Region-wise, the data center chip market trends are analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

Competitive Analysis

The key players profiled in the report include Intel Corporation, GlobalFoundries, Advanced Micro Devices Inc., Taiwan Semiconductor Manufacturing Co. Ltd., Samsung Electronics Co. Ltd., Arm Limited (SoftBank Group Corp.), Broadcom, Xilinx, Inc., Huawei Technologies Co. Ltd. and Nvidia Corporation. These key players have adopted strategies such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations to increase their data center chip market share.

Top Impacting Factors

The market size is anticipated to expand significantly during the forecast period owing to the increase in cloud computing and advancements in chip technology. In addition, government regulations regarding localization of data centers fuel the market growth. Additionally, the data center chip is anticipated to benefit owing to an increase in smart computing devices and is expected to present enormous opportunities for the market over the forecast period. On the other hand, high data center operations are anticipated to restrain the market growth during the forecast period.

Growth in Cloud Computing

The key trend that is helping the world of data center is the cloud and its connectivity to billions of connected devices such as PCs, autonomous vehicles, virtual reality systems, and others. When smart devices are connected to the cloud, the data generated can be analyzed in real time, enabling these devices to be more useful data center products. The emergence of artificial intelligence, virtual reality systems, and 5G network has given rise to the number of data centers, which in turn is driving the growth of the market.

Advancement in Chip Technology

Technological advancements in memory chips and programmable solutions such as FPGAs, ASICs among others, enhance their performance in connected devices and data centers. For instance, Intels 3D XPoint technology significantly improves access to large amounts of data. Next generation chip such as FPGA and ASIC, can efficiently meet the change in demands for data centers and speed up the performance in other applications. The combination of FPGAs, ASICs with cloud products helps in enhancing the overall performance of data centers. Hence, advancement in technology is driving the global data center chip market.

Government Regulations Regarding Localization of Data Centers

Several countries across the globe have passed data localization laws. This is primarily due to the regulatory and security reasons. Industry verticals, especially BFSI, are stringent regarding hosting its data in a data center out of the country. Therefore, these industries prefer having a local data center.

For instance, Oracle, a technology giant in the U.S. proposed to set up a local data center in India for expanding its cloud services. Also, IBM and NTT Communications have two and three data centers respectively in India. Similarly, the Chinese regulatory, Ministry of Industry and Information Technology (MIIT), has also largely favored the issuance of Internet data center (IDC) licenses to local vendors. Furthermore, the Indonesian government Regulation No. 82 mandates Indonesian businesses conducting electronic transactions to store personal data in data centers in the country. Hence, favorable government initiatives to setup local data centers is in turn driving the global data center chip market.

Increase in Smart Computing Devices

Mobile networks are being used to connect all sorts of devices such as automated reading of utility meters, intelligent connectivity of cars, and commercial vehicles to enable drivers to access navigation, infotainment or breakdown services, traffic lights, home security, and assisted living among others.

Technological advancements in several mobile computing devices and products, such as smartphones and smart TV, are driving the demand for sophisticated connectivity and enhanced networking solutions. A rise in the adoption of IoT & cloud computing is expected to drive the integration of the chips in the data center servers, which is expected to provide lucrative growth opportunities for the global data center chip market.

Historical Data & Information

The global data center chip market outlook is highly competitive, owing to the strong presence of existing vendors. Vendors of the data center chip market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to increase owing to technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies

Intel Corporation, GlobalFoundries, Advanced Micro Devices Inc., Taiwan Semiconductor Manufacturing Co. Ltd., Samsung Electronics Co. Ltd., Arm Limited (SoftBank Group Corp.), Broadcom, Qualcomm Technologies, Inc., Huawei Technologies Co. Ltd., and NVIDIA Corporation are the top companies holding a prime share in the data center chip market. Top market players have adopted various strategies, such as product launch and product development to expand their foothold in the data center chip market.

In April 2023, Broadcom Inc. launched a new chip designed to connect artificial intelligence (AI) supercomputers, which can boost the performance and efficiency of AI systems. This chip called the Unified Wire Engine, integrates high-speed communication capabilities into a single component, enabling faster data transfer and improved coordination between AI processors. The development is expected to enhance the capabilities of AI applications across various industries.

In September 2022, ARM launched its next generation of data center chip technology called Neoverse V2 to meet the explosive growth of data from 5G and internet-connected gadgets.

In August 2022, Intel launched Intel Data Center GPU Flex Series which helps free customers from the constraints of siloed and proprietary environments and reduces the need for data centers to use separate, discrete solutions. This Flex Series GPU provides five times media transcode throughput performance and two times decode throughput performance at half the power of competitive solutions.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the data center chip market share analysis from 2022 to 2032 to identify the prevailing data center chip market opportunities.

The market research is offered along with information related to key drivers, restraints, and data center chip market opportunity

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the data center chip market segmentation assists to determine the prevailing data center chip market opportunity.

Major countries in each region are mapped according to their revenue contribution to the global data center chip market share.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the data center chip market analysis of the regional as well as global data center chip market forecast, trends, key players, market segments, application areas, and market growth strategies.

Data Center Chip Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 45.3 billion |

| Growth Rate | CAGR of 14.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 281 |

| By Chip Type |

|

| By Data Center Size |

|

| By Industry Verticals |

|

| By Region |

|

| Key Market Players | Intel Corporation, Advanced Micro Devices, Inc., Qualcomm Technologies, Inc. , NVIDIA Corporation, Taiwan Semiconductor Manufacturing Company Limited, ARM LIMITED (SOFTBANK GROUP CORP.), Broadcom Inc., Samsung Electronics Co. Ltd., GlobalFoundries Inc., Huawei Technologies Co., Ltd. |

Analyst Review

The global data center chip market holds high potential for the semiconductor industry. The business scenario witnesses an increase in the demand for data center chips, particularly in developing regions, such as China and India. Companies in this industry have adopted various innovative techniques to provide customers with advanced and innovative product offerings.

Growth in cloud computing, advancement in chip technology, and government regulations regarding localizations of data centers drive market expansion. However, high data center operational costs impede this growth. During the forecast period, it is anticipated to witness an increase in the usage of smart computing devices, which is expected to create lucrative opportunities for the key players operating in this market.

The market participants are expected to introduce technologically advanced products to remain competitive in the market. Product launch and collaboration are the prominent strategies adopted by the market players. By region, North America exhibits the highest adoption of data center chips. On the other hand, LAMEA is expected to grow at a faster pace during the forecast period.

The global data center chip market growth is driven by cloud computing and advancements in chip technology. In addition, government regulations regarding localization of data centers fuel the market growth.

Intel Corporation, GlobalFoundries, Advanced Micro Devices Inc., Taiwan Semiconductor Manufacturing Co. Ltd., Samsung Electronics Co. Ltd., Arm Limited (SoftBank Group Corp.), Broadcom, Qualcomm Technologies, Inc., Huawei Technologies Co. Ltd., and NVIDIA Corporation are the top companies holding a prime share in the global data center chip market.

North America is the largest regional market for data center chip market.

The global data center chip market to grow at a CAGR of 14.6% from 2023 to 2032.

The global data center chip market was valued at $11.7 billion in 2022, and is projected to reach $45.3 billion by 2032.

Loading Table Of Content...

Loading Research Methodology...