Data Center Construction Market Research, 2032

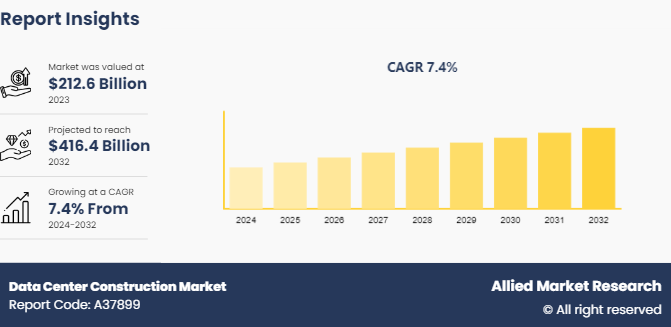

The global data center construction market was valued at $212.6 billion in 2023, and is projected to reach $416.4 billion by 2032, growing at a CAGR of 7.4% from 2024 to 2032. Data center construction is the process of making specialized centers for the constantly growing computer systems, IT equipment and other storage systems required for data storage and processing across industries.

Due to the constantly increasing data consumption across industries and the rise in importance of data security of customers across all industries, protecting and storing data has become the most important aspect of all businesses. Reliable power supply, cooling systems, and physical security are the three most important things to consider while constructing a data center across a region. Additionally, rapidly growing industries and global investments to expand businesses is further propelling the growth of the global data center construction industry.

Key Takeaways

The data center construction market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2032.

Several product literatures, industry releases, annual reports, and other such documents of major energy storage system industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Industry Trends:

In August 2023, the Communications, Space and Technology Commission (CST) of Saudi Arabia announced the new data center services regulation focused on energy management registration mandates, and data security requirements. This rule came into effect across the country from January 2024.

In November 2020, The Ministry of Electronics, and Information Technology (MEITY) of India announced the draft of new data center policies. The policy underlies the regulations for authorization, construction and operation of new data centers.

In December 2023, the European Commission announced its initiative to implement sustainability measures across data centers for studying energy consumptions across newly constructed and old data centers.

Key market dynamics

Rise in adoption of cloud computing and edge computing is driving the data center construction market growth across the globe. In response to the growing digitalization efforts and expanding internet connectivity, businesses are turning to cloud solutions to optimize operations, enhance flexibility, and drive innovation. Cloud computing offers scalability, cost-efficiency, and accessibility, allowing organizations to rapidly deploy applications and services without the need for extensive on-premises infrastructure.

Moreover, rise in edge computing, driven by the proliferation of IoT devices and the need for low-latency processing, is fueling demand for localized data processing and storage capabilities closer to end-users. This trend is particularly relevant in urban centers in Southeast Asia countries such as Singapore, Vietnam, Thailand, and others. In addition, with dense population and emerging smart city initiatives, created the need for real-time data processing and analysis. As a result, data center construction providers are experiencing substantial growth across the globe. For instance, in April 2024, Google LLC announced the construction of new data center in Fort Wayne with an investment of US$ 3 billion. This rise in investment in data center construction indicated the growing demand for data storage across industries. Similarly, AWS in 2024 announced its plan for new data center infrastructure in Saudi Arabia which is expected to be completed by 2026. These factors thereby are propelling the growth of the global data center construction industry.

Russia-Ukraine War Impact on the Data Center Construction Market

The major impact of Russia-Ukraine war is the rise of energy prices. Data centers across the globe require constant energy to operate seamlessly. The energy prices were experiencing a rise in 2021 as an impact of COVID-19. The outbreak of the Russia-Ukraine war further propelled the prices not only in Europe but also globally. The energy prices in Europe experienced as high as Euro 400 in some European markets. These rises in energy prices have directly impacted data center construction decisions across the globe. Additionally, the war has also impacted the availability of all materials and hardware required for the data center construction, thereby further negatively impacting the data center construction market share.

Market Segmentation

The data center construction market size is segmented into construction type, tier, data center size, industry vertical, and region. On the basis of construction type, the market is divided into general construction, electrical design, and mechanical design. As per tier, the market is segregated into tier 1, tier 2, tier 3, and tier 4. On the basis of data center size, the market is classified into small data center, medium data center, and large data center. Based on industry vertical, the region is classified into BFSI, IT and telecommunications, healthcare, government, manufacturing, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The Asia-Pacific region is expected to grow with the highest CAGR in the global data center construction market forecast. Rapid digitalization and the proliferation of internet-enabled devices are driving demand for data storage and processing capabilities. As businesses adopt cloud computing, big data analytics, and IoT solutions, the need for reliable and scalable data center services becomes paramount. In addition, government initiatives and investments in infrastructure development are bolstering the Asia-Pacific region’s digital economy. Countries such as Singapore and Malaysia are positioning themselves as regional hubs for data center, attracting multinational corporations and tech giants to establish their presence. For instance, in November 2023, OVHcloud, a European cloud leader, launched the second data center in Singapore. The expansion is expected to boost regional availability of open, trusted, and sovereign cloud solutions for customers to meet their increasing digital needs.

Similarly, the data center industry in China has continued its rapid pace of growth, owing to surge in demand for solid-state drives coupled with a rise in investment from prime vendors in this region. For instance, on June 18, 2021, tech giant Microsoft, announced its plans to launch four Chinese data centers. These data centers became operational in 2022. The company announced plans to expand its data center network with a greater presence in the northern region around Beijing. The significant development of data centers across the China region is projected to boost the growth of the data center construction market size.

Competitive Landscape

The major players operating in the data center construction market include Cisco Systems Inc, IBM Corporation, Oracle Corporation, ABB, Hitachi Ltd, Equinix, Inc., and Schneider Electric.

Other players in the data center construction market include Huawei Technologies Co., Ltd., Fujitsu, and Hewlett Packard Enterprise Development LP. and so on.

Recent Key Strategies and Developments

In March 2024, Amazon Web Services (AWS) , announced a major stake in Saudi Arabia’s rising technology industry, investing more than $5.3 billion in the Middle East Kingdom to construct data centers and establish a significant cloud presence in the region.

In February 2023, Singtel along with GULF and AIS started with the construction of new data center in Bangkok. The same is expected to start its operations in 2025.

In April 2024, AdaniConneX announced its investment of US$ 1.44 Billion for the construction of data centers across India. Similarly, Maincubes, a German colocation firm launched its second data center in Frankfurt.

Key Sources Referred

Data Centre Dynamics Ltd

American National Standards Institute (ANSI) & Telecommunications Industry Association (TIA)

Green Grid Association

Uptime Institute

Data Center Coalition

Informa PLC

European Commission

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the data center construction market analysis from 2024 to 2032 to identify the prevailing data center construction market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the data center construction market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global data center construction market trends, key players, market segments, application areas, and market growth strategies.

Data Center Construction Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 416.4 Billion |

| Growth Rate | CAGR of 7.4% |

| Forecast period | 2024 - 2032 |

| Report Pages | 250 |

| By Construction Type |

|

| By Tier |

|

| By Data Center Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Hitachi Ltd., Schneider Electric, Oracle Corporation, Hewlett Packard Enterprise, ABB Ltd., Fujitsu, IBM Corporation, Cisco Systems Inc., Huawei Technologies Co., Ltd., Equinix, Inc. |

Loading Table Of Content...