Data Center Robotics Market Overview

The global data center robotics market was valued at $9.2 billion in 2021, and is projected to reach $56 billion by 2031, growing at a CAGR of 20% from 2022 to 2031.

The advancement of smart data centers through robotic process automation and increase in adoption of data center services boosts the growth of the global data center robotics market. In addition, the increase in adoption of robotics, AI, ML, and IoT technologies by various end users fuels the data center robotics market growth. However, a lack of technical proficiency and awareness and an increase in security privacy concerns of data center robotics are expected to impede data center robotics market growth.

Robotics in data center is a part of data center management. It creates the potential for a robot-driven, fully automated data center environment. In addition, data center robotics has virtually unlimited computing resources continue to grow enterprises, and consumers are able to do things that were not possible until a few years ago. Social, mobility, and analytics trends are powered by robotics and cloud technologies. The data center robotics market is segmented into Component, Enterprise Size and Industry Vertical.

Segment Review

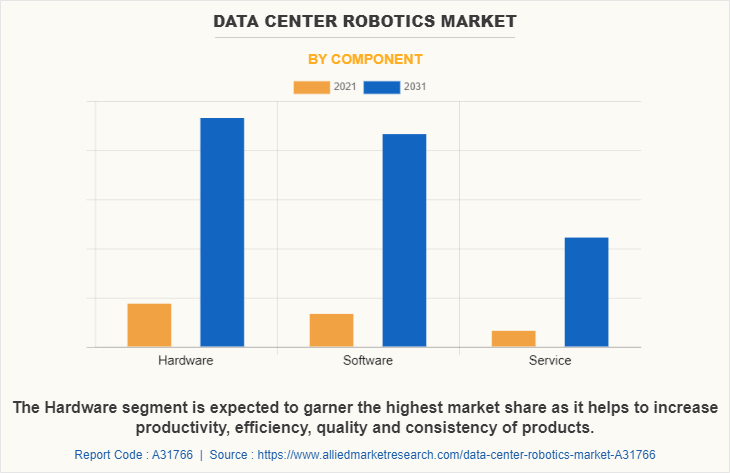

The global data center robotics industry is segmented on the basis ofcomponent, enterprise size, industry vertical, and region. On the basis of component, it is divided into hardware, software, and service. On the basis of enterprise size, it is segregated intolarge enterprise size and SMEs. On the basis of industry vertical, it is classified into BFSI, healthcare, education, IT& telecom, real estate, government, and others. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of component, the hardware segment holds the highest data center robotics market size as it provides secure and high-performance computing. However, theservice segment is expected to grow at the highest rate during the forecast period. Data center robotics services reduce time and costs associated with optimizing systems.

On the basis of region, the data center robotics market share was dominated by North America in 2021.The region is expected to retain its position during the forecast period, owing to surge in demand for RPA, IoT technology, and faster network accessibility.However, Asia-Pacific is expected to witness significant growth during the forecast period,owing torise in adoption of data center robotic solutions for various benefits such as ease of implementation, centralization of customer support, and increasein customer services such as order management and network inventory management.

Major players operating in the data center robotics market industry include ABB, BMC Software, Inc., Cisco Systems, Inc., ConnectWise LLC,Hewlett Packard Enterprise Development LP, Huawei Technologies Co., Ltd., Microsoft Corporation, NTT Communications, Siemens, and Rockwell Automation, Inc. These market players have adopted various strategies to increase their market penetration and strengthen their position in the data center robotics industry.

Top Impacting Factors

Advancement of smart data centers through robotics process automation

Robotic process automation (RPA) for smart data center robotics provides innovation that combines knowledge and execution with scripting. In addition, it is a blend of technological abilities that boost back-office tasks. Furthermore, RPA provides smart solutions that leverage AI and ML to boost productivity and minimize physical work. The concern of job losses and decrease in workers has an exceptionally human component, which leads to unjustified presumptions about robots.

In addition, industries are looking for smart solutions like bot services, which can be deployed to screen network traffic and trained to make a step dependent on accomplishing a threshold. Another advantage of robotics is standardizing processes and strategies. Datacenter robots can predict a higher degree of standardization for much more unsurprising performance and help to identify patterns of use, structured traffic, CPU cycles, and cooling systems by vacating people’s variable behaviors from a process. This drives the growth of the market.

Increase in adoption of robotics across various end users

Several companies across the globe are undergoing digital transformation with the help of automation owing to better productivity and correct investments. This fuels the demand for the adoption of robotics to improve performance and productivity. Businesses are integrating robotic software to maximize the automation impact. Many individuals demand personalized services in investment management, strategic planning, and others. For instance, in August 2022, Cogniteam partnered with AAEON, a designer and manufacturer of industrial IoT and Edge AI solutions, to develop “ready-to-build” robotic hardware. Such demands drive the growth of the market.

Digital Capabilities

Data center robotics is defined as a set of technologies, techniques, and applications required to design and implement a new automation process based on self-learning and artificial intelligence technologies, with the aim of increasing the productivity and efficiency of business processes. In addition, the data center robotics framework includes both robotic process automation (RPA), as well as intelligent process automation (IPA) tools with the consolidation of robotics and machine learning techniques, facilitating the introduction and integration of automation into organizational processes.

Furthermore, in co-existence with robots, modern artificial intelligence (AI) and machine learning (ML) enabled technology enables the monitoring and management of IT processes in the data center. Users of this technology, such as site reliability engineers, are able to interact and communicate with the given platform through natural language. These platforms are capable of learning from past situations to improve efficiency in future instances.

End-user Adoption

The global data center robotics market is expected to register high growth due to rapid centralization and digitization of business processes to streamline all operations into a single platform. Various companies have established alliances to increasetheir capabilities due tothe surge indemand for data center robotics. For instance, in October 2022, SoftBank Robotics America (SBRA), global leader in robotics solutions, partnered with Gausium, a leading solutions provider of autonomous cleaning and service robots, to deploy indoor automated robotic solutions to the U.S. market. The partnership will focus on helping companies successfully adopt, integrate, and scale robotic solutions within their organizations.

For instance, in March 2021, Aegis9 partnered with Australian Data Centres (ADC) to provide customers access to a shared or dedicated cyber security operation center and to deliver Aegis9’s cyber security operations and platform hosted and managed by Australian Data Centres within its secure data center facility in Canberra.In May 2022,MetaVerse Green Exchange partnered with Red Dot Analytics to measure its carbon footprint and improve its operational efficiencies toward greater sustainability. The partnership is touted to include services, powered by artificial intelligence (AI) and machine learning, to track and forecast greenhouse gas emissions of critical data center systems.

In addition, Various companies have expanded their current product portfolio with increased diversification among customers due to thegrowth in investment across the world and the rise in demand for data center robotics. For instance, in October 2020, Huawei Technologies Co., Ltd. launched the iCooling@AI solution. The smart cooling solution for data centers is powered by AI and big data and helps reduce energy consumption along with cutting down PUE. The advent of data center cooling automation solutions is expected to open new avenues for robotics in the coming years.

For instance, in May 2022, NTT launched a new hyperscale data center campus in Navi Mumbai with the first data center, NAV1A. Moreover, in December 2021, the leading cloud-based infrastructure monitoring and observability platform LogicMonitor launched its first Australian data center, located in Sydney and locally hosted by cloud provider Amazon Web Services. The data center comes in response to strong customer demand for local hosting capabilities and already boasts cornerstone LogicMonitor customers, such as Nine, IOOF, and AC3.

Moreover, major market players have started acquiring companies to expand their market penetration and reach due to the increase in competition. For instance, in August 2021,Ondas Holdings, Inc. acquired American Robotics, Inc.to provide users in rail, agriculture, utilities, and critical infrastructure markets with improved connectivity and data collection capabilities.

For instance, in March 2021, Accenture acquired Pollux, a provider of industrial robotics and automation solutions to help expand Accenture’s capabilities for clients in consumer goods, pharmaceutical, and automotive industries, seeking to make their factories, plants, and supply chains more productive, safe, and sustainable. In July 2021, Zebra Technologies Corporation acquired Fetch Robotics, a pioneer in on-demand automation, to accelerate Enterprise Asset Intelligence vision and growth in intelligent industrial automation by embracing new modes of empowering workflows and helping customers operate more efficiently in increasingly automated, data-powered environments

Government Initiatives

Governments of many countries support end users to innovate new technologies in data center robotics. For instance, in December 2020, the Government of Canada committed to supporting innovative companies that are creating highly skilled jobs and developing new technology for the digital economy of the future. The government announced a contribution of $34 million to Attabotics, Inc., a robotics supply chain company headquartered in Calgary, Alberta. This investment will help the company further develop and bring to market its robotics warehouse technologies and will continue to build on western Canada’s substantial strengths in transformative technologies, including clean technology, digital industries, and precision agriculture.

For instance, in November 2021, the government formulated a scheme to incentivize investments to set up hyper-scale data centers in India to boost the capacity of existing data center ecosystems like drones and robotics and develop manufacturing ecosystems in India.

Key Benefits for Stakeholders

The study provides an in-depth analysis of the global data center robotics market forecast, along with current trends & future estimations to explain the imminent investment pockets.

Information about key drivers, restraints, and opportunities and their impact analysis on the global data center robotics market trends is provided in the report.

Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

The data center robotics market analysis from 2022 to 2031 is provided to determine the market potential.

Data Center Robotics Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 56 billion |

| Growth Rate | CAGR of 20% |

| Forecast period | 2021 - 2031 |

| Report Pages | 236 |

| By Component |

|

| By Enterprise Size |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Microsoft Corporation, Cisco Systems, Inc., Rockwell Automation Inc., ConnectWise, LLC, Huawei Technologies Co., Ltd., Hewlett Packard Enterprise Development LP, ntt communications, BMC Software, Inc, ABB, Siemens AG |

Analyst Review

The data centers robotics are the important enablers for the digital world as it works like operators and workers. In addition, it helps organizations from new challenges such as long working hours to meet the skyrocketing demand of cloud, gaming, video streaming, etc. data center automated robots can take over a load of menial tasks such as monitoring, scheduling, maintenance and application delivery, leaving human employees to deliver value on more strategic and mission-critical tasks.

The global data center robotics market is expected to register high growth owing to, surge in demand for AI, ML and IoT technologies among enterprises to provide higher data analytics services among industries and data-intensive, latency-sensitive application, and that will drive growth in data center robotics, With surge in demand for data center robotics, various companies have established product development to increase their capabilities. For instance, in February 2022, NTT Communications is developing a robot to help manage data centers. NTT claims that the robot has been upgraded to help spot issues with product quality, and cleaning, but did not give much more details. The system can also be remotely controlled by humans elsewhere.

In addition, with further growth in investment across the world and the rise in demand for data center robotics, various companies have expanded their current product portfolio with increased diversification among customers. For instance, in June 2021, a hyperscale data center is a facility that makes it easier for online platforms to store and move massive amounts of data. Moreover, they are required to sustain the global web, social media, streaming media, AI/ML, cloud gaming, and cloud providers' scalable infrastructures. As more hyper scale data centers appear, the need to automate the processes within them will grow as well.

Moreover, with increase in competition, major market players have started partnership companies to expand their market penetration and reach. For instance, August 2022, ABB partnered with ATS Global to extend the reach of the ABB Ability™ Data Center Automation (DCA) business. ABB and ATS Global will jointly strengthen their distribution channels, improve industry knowledge and increase lead generation. ABB will gain representatives familiar to local standards, laws and regulations where it does not always have a presence. Over the long term, the two parties intend to explore new business opportunities for data center robotics customers across a wide range of industries.

The data center robotics market is estimated to grow at a CAGR of 20.0% from 2022 to 2031.

The data center robotics market is projected to reach $55956.26 million by 2031.

The advancement of smart data centers through robotic process automation and increase in adoption of data center services boosts the growth of the global data center robotics market. In addition, the increase in adoption of robotics, AI, ML, and IoT technologies by various end users fuels the data center robotics market growth.

The key players profiled in the report include ABB, BMC Software, Inc., Cisco Systems, Inc., ConnectWise LLC,Hewlett Packard Enterprise Development LP, Huawei Technologies Co., Ltd., Microsoft Corporation, NTT Communications, Siemens, and Rockwell Automation, Inc.

The key growth strategies of data center robotics market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...