Data Virtualization Market Overview

The global data virtualization market was valued at USD 3.2 billion in 2021, and is projected to reach USD 22.2 billion by 2031, growing at a CAGR of 21.7% from 2022 to 2031.

Major growth drivers of the market include enterprises' increase in demand for advanced visualization technology, production of enormous volumes of data, and increase in investments in visualization platforms and business collaborations.

Introduction

Data virtualization is a technique that enables a system to compile data from several sources and convert it to produce a virtual, logical, and unified customer picture. It can be accessed through front-end solutions such as apps, displays, and portals, and it is not necessary to know technical details about the data, such as where it is physically situated or how it has been formatted. The National Institute of Standards and Technology (NIST) reports that the use of complete virtualization products and services has recently increased, due to a number of benefits. Organizations from a variety of industries are heavily using this solution, particularly those in the manufacturing, banking, and telecommunications sectors.

For example, global pharma and biotechnology company Pfizer adopted data virtualization solution from Tibco to improve data delivery speed to its researchers. Retail company city furniture, uses data virtualization solution from Denodo to manage all critical business data in its marketing, operation, supply chain, and other departments. One of the main factors anticipated to propel data virtualization market growth during the projected period is the expanding volume of data from various sources across enterprises and the rising requirement for data integration tools. In addition, increase in cloud-based solution demand and increased business intelligence software usage are anticipated to boost industry expansion and data virtualization industry revenue growth.

Segment Overview

The data virtualization market is segmented into Component, Deployment Model, Enterprise size and End User.By component, it is segmented into standalone software, data integration solution, and application tool solution. By data integration solution, it is segmented into BI tools, enterprise application, mobile and web application. Based on deployment model, the market is categorized into on-premise and cloud. Based on enterprise size, the market is categorized into SMEs and large enterprises. Based on end user, the market is categorized into IT and telecom, BFSI, government and defense, healthcare and life science, retail, manufacturing, education, others. Region wise, it is analyzed across North America, Europe, Asia-Pacific and LAMEA.

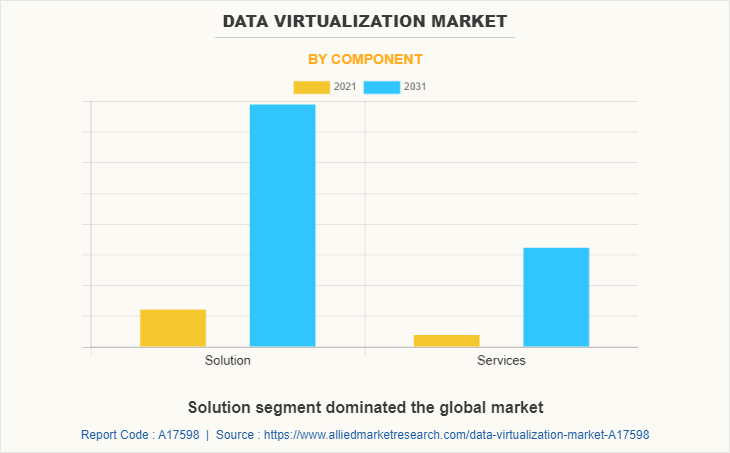

On the basis of component, the solution segment dominated the Data Virtualization Industry in 2021, and is expected to maintain the dominance in the upcoming years, owing to restrict and maintain internal cyber threats and risks, such as unauthorized access, data theft, and more. However, the services is expected to witness the highest growth rate during the data virtualization market forecast period. Data virtualization services mechanisms manage and secure accounts that have system access beyond that of a standard user to secure the confidentiality of data servers.

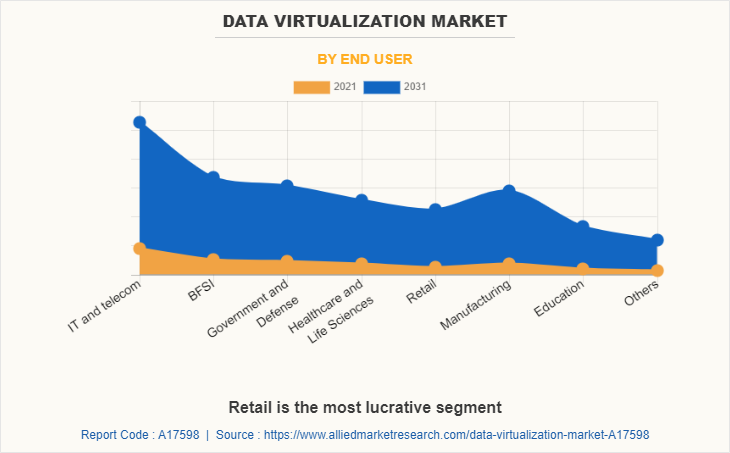

On the basis end user, the IT and telecom segment dominated the data virtualization market share in 2021, and is expected to maintain its dominance in the upcoming years. It is because, it helps the organizations to optimize their artificial intelligence-powered IT infrastructure resource utilization core competency and save operating costs. However, the retail segment is expected to witness the highest growth rate during the forecast period, as to reduce the price of document generation, printing, and dissemination. In addition, a variety of printing and mailroom concerns can be resolved with data virtualization software.

North America is a rapidly growing region in the global data virtualization market, in terms of technological advancements and adoption. It possesses well-equipped infrastructure and the ability to afford data virtualization solutions. Furthermore, owing to rise in competition between cloud-based service providers in North America, key players are providing more data management for data by ensuring quick access and greater outreach of their services to the clients, which drives the growth of the data virtualization market in this region.

In addition, the major factors that are contribute toward the growth of data virtualization in North America are increase in usage of mobile & web. In addition, increase in dependency on internet and social media platforms is another major factor fueling the market growth in this region.

Top Impacting Factors

Enterprises' increasing demand for advanced visualization technology

The amount of data produced during the last few years by various technologies, including the Internet of Things (IoT) and other data sources, is growing dramatically. Both structured and unstructured data are present in this enormous data set. To manage massive volumes of data and produce a better and more informed interpretation of statistics, businesses are increasingly choosing business intelligence software with cutting-edge technology like artificial intelligence (AI).

In addition, visualization technologies provide a high degree of customization and specificity to comprehend complex data. For instance, one of the major players in the advisory services market, Deloitte Touche Tohmatsu Ltd., introduced an advanced public data visualization tool in September 2019. This tool offers insights based on coding algorithms, visualization techniques, and further refines them with technologies like artificial intelligence (AI), machine learning (ML), blockchain, and big data analytics, among others. Such cutting-edge technology integration is supporting market expansion.

Production of enormous volumes of data

Organizations have generated more data over the past few years for a variety of reasons, including digitalization, the Internet of Things, and improvements in older technology. In addition, one of the key contributors to the production of enormous volumes of data is the use of devices that are connected to the internet. Quick access to data has grown challenging since the data generated by these sources is kept in diverse formats at distinct physical locations.

In addition, the development of numerous applications, including cloud, software as a service (SaaS), and internet of things (IoT), is adding to the massive volume of data collected. As a result, managing and integrating data from diverse sources is essential for real-time data availability. In addition, data virtualization solutions have advantages including better data management, a quicker time to market, and increased data quality. These are a few of the important variables propelling the data virtualization market's overall expansion.

COVID-19 Impact Analysis

This is due to the fact that the implementation of COVID-19 will make it possible for businesses to handle security concerns and provide secured information access when conducting remote operations. In addition, the data virtualization market has seen a huge surge in demand for a secure and flexible cloud computing environment solution. However, lack of skill workforce availability across the world, halted, due to the economic slowdown and global lockdown. Subsequently, affecting the growth of data virtualization market during 2020.

Countries across the globe have suffered major loss of business and revenue, owing to shutdown of manufacturing or type units. But the rise in adoption of cloud computing or application container major enterprises across prime economies is expected to offer significant opportunities for the growth of Data Virtualization Software market. This is expected to hamper the growth of market in by the end of 2021

Key Benefits For Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the data virtualization market analysis from 2021 to 2031 to identify the prevailing data virtualization market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the data virtualization market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global data virtualization market trends, key players, market segments, application areas, and market growth strategies.

Data Virtualization Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Deployment Model |

|

| By Enterprise size |

|

| By End User |

|

| By Region |

|

| Key Market Players | QlikTech International AB, IBM, Denodo Technologies Inc., Oracle Corporation, SAP SE, Tableau Software Inc, Microsoft Corporation, ChartBlocks ltd., OpenLink Software Inc., Cluvio GmbH, Domo Inc., SAS Institute Inc., Cisco Systems, Inc., Adaptive Insights, Informatica Inc., Alteryx Inc. |

Analyst Review

Data virtualization solutions provide a common platform for data consumers to access massive amounts of data in the format of their choice, regardless of the server or source location. The amount of data generated in businesses has grown recently owing to a number of causes, including digitalization, IoT, and improvements in traditional technology. In addition, a significant factor in the production of enormous amounts of data is linked devices that are connected to the internet. Getting timely access to the data produced by various sources has grown challenging due to the fact that it is kept in a variety of physical locations and forms. Multiple applications, such as the cloud, Software as a Service (SaaS), and the Internet of Things (IoT), are advancing, contributing to the massive volume of data collected. As a result, the requirement to manage and integrate data from several sources has become critical in order to achieve real-time data availability.

In addition, the benefits of data virtualization include better data management, a quicker time to market, and superior data quality. These are a few of the main factors propelling the data virtualization market's expansion overall. The planning and management at the enterprise level have a significant impact on business strategies. A key component of this planning is the use of data in accordance with company strategies. Companies must take into account different data protection and privacy rules imposed by the country in order to access the information because this process necessitates the transmission of significant amounts of data from diverse sources. Organizations need diverse data types, such as customer details, transaction data, and healthcare data, to implement these strategies.

The CXOs continued by stating that there are numerous regional and international suppliers competing in the data virtualization industry on grounds like price, dependability, features, and support services. Rapid developments in data virtualization offerings have an impact on market expansion, whereas COVID-19 conditions and industry development have an impact on vendor performance. Due to rivalry, industry players are providing improved application security products and services to enhance the client experience.

The data virtualization market size is estimated to grow from $3,170 million in 2021, and is projected to reach $22224.7 million by 2031, registering a CAGR of 21.7%.

North America dominated the global market

On the basis end user, the IT and telecom segment dominated the data virtualization market in 2021.

Increase in cloud-based solution demand and increased business intelligence software usage are anticipated to boost industry expansion and market revenue growth

Key players operating in the market include Adaptive Insights, Alteryx Inc., ChartBlocks Ltd., Cisco Systems, Cluvio GmbH, Denodo Technologies, Domo Inc., International Business Machine (IBM), Informatica, Microsoft Corporation, OpenLink Software, Oracle Corporation, QlikTech International AB, SAP SE, SAS Institute, Tableau Software, and Visually Inc.

Loading Table Of Content...