Database Monitoring Software Market Insights, 2031

The global database monitoring software market was valued at $5.3 billion in 2021, and is projected to reach $20.5 billion by 2031, growing at a CAGR of 14.7% from 2022 to 2031.

Rise in the amount of data generated by industries accelerates the demand for database monitoring tools and increase in deployment of cloud computing technologies boosts the growth of the global database monitoring software market. In addition, surge in government & private investments in database monitoring software market is positively impacts the growth of the market. However, increase in laws and regulations associated with software development tools hampers the market growth. On the contrary, need to optimize and enhance database performance is expected to offer remunerative opportunities for expansion of the market during the forecast period.

Database monitoring is a vital activity for the maintenance of the performance and health of the database management system. To facilitate monitoring, the database management system collects information from the database manager, its databases, and any connected applications. In addition, it helps to forecast hardware requirements based on database usage patterns and analyze the performance of individual applications or SQL queries. Furthermore, it helps track the usage of indexes and tables. The database monitoring software market is segmented into Database Model, Deployment Model, Organization Size and End Use Vertical.

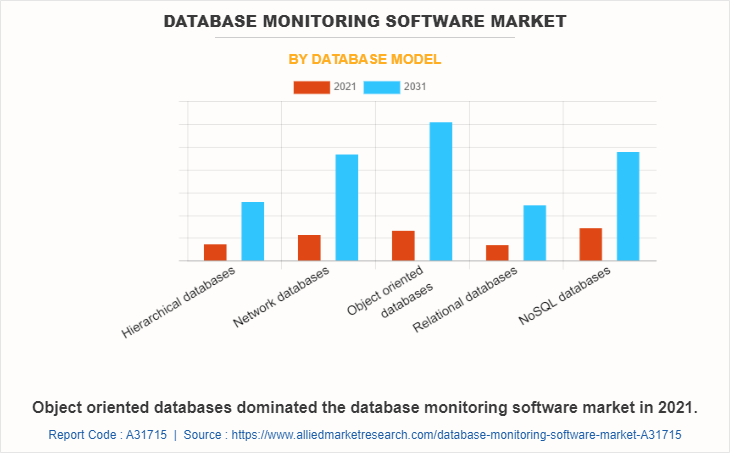

By database model, the market is bifurcated into hierarchical databases, network databases, object-oriented databases, relational databases, and NoSQL databases. The growing ubiquitous environment across the IT sectors and rising amount of data generated are driving the growth of the database monitoring software market. This is attributed to the growing trend of embedding computational capability (generally in the form of microprocessors) into everyday requirements. It helps to enable computational capabilities effectively communicate and perform useful tasks in a way that minimizes the end user's need to interact with computers as computers. Ubiquitous computing devices are network-connected and constantly available. In addition, it can be accessed with any device, at any time, in any place, and in data format.

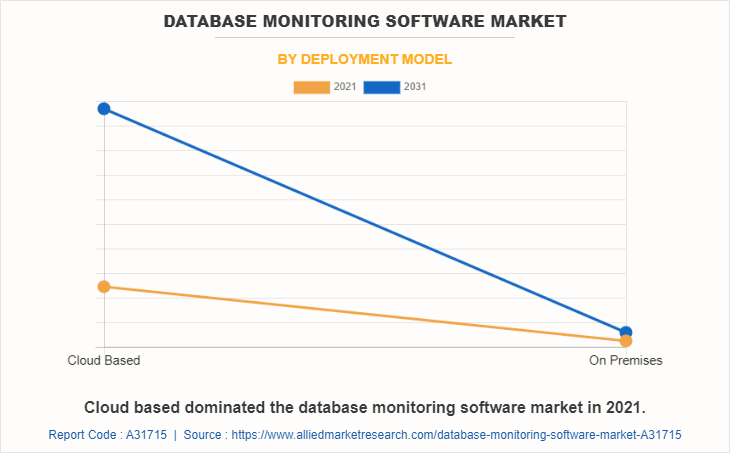

By deployment model, the market is segmented into on-premise and cloud based. Database monitoring software industry is capable of collecting, processing, and communicating huge amounts of data, they can adapt to the data's context and activity. This helps to reduce the time and resources spent hunting down hidden issues in the database and IT infrastructure and improve end-user experience. Thus, this is further expected to create lucrative opportunities for the expansion of the database monitoring software market.

Increasing adoption of cloud-based database monitoring software as helps in scaling the database as it does not require the acquisition of more resources such as servers or storage. In the cloud, the user can scale the database usage by acquiring more cloud services. This comes with an additional cost that must be managed. It also offers backup services which are handled by a cloud service provider. Furthermore, increase in demand due to availability of access to database because the cloud storage can replicate on premise databases across multiple geographical locations.

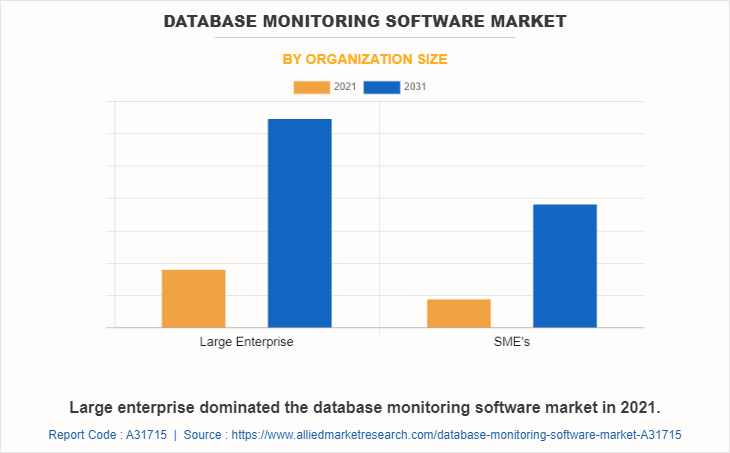

In terms of organization size, the large enterprise segment holds the largest share of the database monitoring system market, owing to high growth rate of urbanization and industrialization. However, the SMEs segment is expected to grow at the highest rate during the forecast period, owing to the used by small businesses to store and manage data relevant to their operations in an organized format.

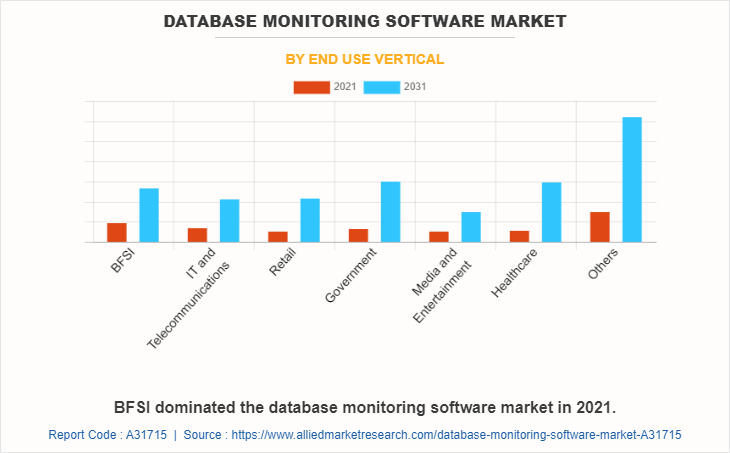

By industry vertical, the market is divided into BFSI, healthcare, government, manufacturing, retail, and others.In addition, the increase in data on the digital platform owing to the digitization of various industries such as healthcare, banking, and others boost the demand for database monitoring software industry. Thus, the pandemic had a positive impact on the database monitoring software market Share.

Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America, specifically U.S. and Canada, remains a significant participant in the global database monitoring software industry. Major organizations and government institutions in the country have been actively using application servers.

In addition, several market players are investing in cloud base products to improve application and database performance, which in turn is driving the growth of the market. For instance, in April 2022, Quest Software, a global systems management, data protection, and security software provider, launched Foglight 6.1, monitoring and optimization platform for the hybrid enterprise. It enabled businesses to confidently manage their IT infrastructure and databases by providing them with the tools for deep-dive database workload optimization and cloud cost management. These benefits are expected to escalate the demand for database monitoring software in the coming years.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the global Database Monitoring Software Market Forecast forecast along with current & future trends to explain the imminent investment pockets as well as Database Monitoring Software Market Size.

- Information about key drivers, restraints, & opportunities and their impact analysis on Database Monitoring Software Market Trends is provided in the report.

- Porter's five forces analysis illustrates the potency of the buyers and suppliers operating in the industry and how it impacts Database Monitoring Software Market Growth is also stated in the report.

- Database Monitoring Software Market Analysis in terms of qualitative data is also provided in the study.

Database Monitoring Software Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 20.5 billion |

| Growth Rate | CAGR of 14.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 207 |

| By Database Model |

|

| By Deployment Model |

|

| By Organization Size |

|

| By End Use Vertical |

|

| By Region |

|

| Key Market Players | Quest Software, Inc., VirtualMetric, SolarWinds Worldwide, LLC, Nagios Enterprises, LLC, eG Innovations, Paessler AG, dbWatch AS, Heroix Corporation, Red Gate Software Ltd, Sematext Group |

Analyst Review

The adoption of database monitoring software has increased owing to a suite of tools that can be used to support the ability to identify and report fraudulent, illegal, or other undesirable behavior, with minimal impact on user operations and productivity. The tools have evolved from basic analysis of user activity in and around relational database management systems (RDBMSs) to encompass a more comprehensive set of capabilities, such as discovery and classification, vulnerability management, application-level analysis, intrusion prevention, support for unstructured data security, identity and access management integration, and risk management support.

Key providers of database monitoring software market such as SolarWinds Worldwide, LLC, Nagios Enterprises, LLC, and Quest Software Inc. account for a significant share in the market. With the larger requirement from the corporate culture, various brands are introducing software to automate and simplify data management. For instance, in February 2021, SolarWinds Worldwide enhanced database performance monitoring products such as SolarWinds database performance analyzer (DPA), SolarWinds SQL Sentry, and SolarWinds database insights for SQL server availability by making them available at Microsoft Azure Marketplace.

In addition, with the increasing demand for getting instant solutions to the problem with all the resourceful insights companies such as Nagios Enterprises, LLC has performed strategic product development and launch to help the end users. For instance, in January 2021, Nagios Enterprises enhanced its product Nagios XI 5.8 with new features. These features included better windows monitoring, easier monitoring for Linux, and moving Nagios Core data to XI with a few clicks. For instance, in November 2021, Nagios Enterprises enhanced its product Nagios XI 5.8 with new features. These features included better windows monitoring, easier monitoring for Linux, and moving Nagios Core data to XI with a few clicks.

Rise in the amount of data generated by industries accelerates demand for database monitoring tools

The global database management system market size was valued at $5.29 billion in 2021.

North America is the largest regional market for Database Monitoring Software.

The database Monitoring Software market is projected to reach $20.52 billion by 2031, growing at a CAGR of 14.7 % from 2022 to 2031.

The key players holding the market share in Database Monitoring Software are dbWatch AS, eG Innovations, Heroix Corporation, Nagios Enterprises, LLC, Paessler AG, Quest Software Inc., Red Gate Software Ltd., Sematext Group, SolarWinds Worldwide, LLC, and VirtualMetric.

Loading Table Of Content...

Loading Research Methodology...