Debt Security Market Research, 2032

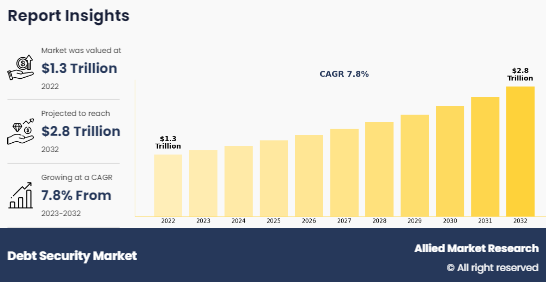

The global debt security market was valued at $1.3 trillion in 2022, and is projected to reach $2.8 trillion by 2032, growing at a CAGR of 7.8% from 2023 to 2032.

A debt security is a kind of wealth management and organization that services wealth clients. The organization is generally established by important wealthy families to manage their wealth and provide a range of services, including investment management, financial planning, tax management, estate planning, philanthropic activities, and other personalized services. The offices are basically formed to address the complex financial requirements and goals of wealthy families. The debt security might operate as a single-debt security, multiple debt security or even as a virtual debt security. The main aim of debt security is to provide financial support and guidance to family members.

The report focuses on growth prospects, restraints, and trends of the debt security market forecast. The study provides Porter‐™s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the debt security market outlook.

Segment Review

The debt security market is segmented into component, type, industry vertical and region. By component, the market is divided into secondary market trading, asset management, credit rating agencies, primary market trading and others. By type, the market is divided into treasury bonds, municipal bonds, agency bonds, international government bonds, and others. By industry vertical, the market is divided into government, corporate, BFSI and others. Region-wise, the debt security market growth is studied across North America, Europe, Asia-Pacific, Latin America, Middle East and Africa.

By type, the treasury bonds segment held the largest market share in 2022, as these bonds are issued by the government to finance the operations and to manage the national debt. Treasury bonds are liquid in nature and are used as benchmarks for pricing other debt security.

Based on component the secondary market trading segment held the largest market share in 2022. This is due to the fact that secondary market trading involves the buying and selling of previously issued debt security among investors. The secondary market trading helps in providing liquidity to debt security market thus allowing investors to buy and sell conveniently.

By industry vertical, the government segment held the largest market share in debt security market opportunity in 2022. This is due to the increasing debt security issued by governments that plays an important role in financing government operations and projects. The securities are safest investments that are backed by the taxing power of the issuing government.

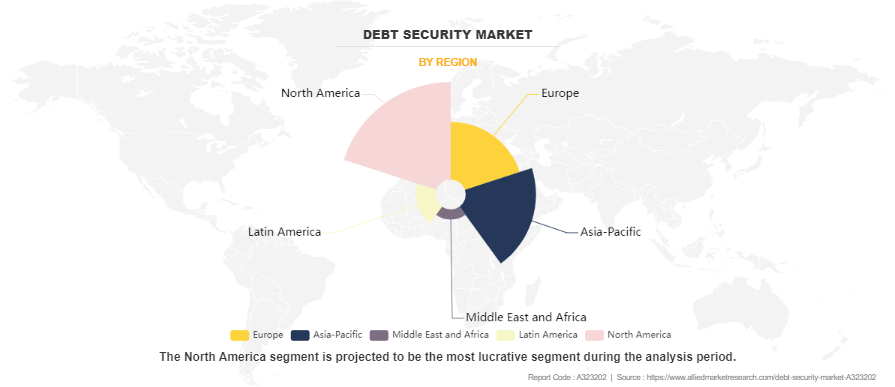

Based on region, North America held the largest market share in 2022 in the debt security market. This is due to the increasing growth of U.S. treasury market in the liquid government bond world. Furthermore, the substantial corporate bond markets and other debt instruments are also growing in the debt security market.

Key Takeaways

By component, the secondary market trading segment held the largest market share in debt security market size in 2022

By type, the treasury bonds segment held the largest market share in debt security market share in 2022.

Based on industry vertical, government segment held the largest market share in 2022.

Based on region, the North America segment held the largest market share in 2022.

Competition Analysis

Competitive analysis and profiles of the major players in the debt security market include Surety Bonds Direct, MG Surety Bonds, Bryant Surety Bonds, Great American Insurance Group, Chubb, AC Star Insurance Company, Allegheny Corporation, Allied Property and Casualty Insurance Company, Allied World Insurance Company, and European Investment Bank. These players have adopted product launch, partnership, collaboration, acquisition and agreement strategies to increase their market penetration and strengthen their position in the debt security industry.

Recent Product Launch in the Debt Security Market

In August 2023, Great American Insurance Group launched an embedded salesforce coverage solution for equipment finance companies. This technology makes insurance solutions available at any point in the leasing workflow. The salesforce component provides different benefits such as immediate quoting and enrollment, reducing data entry by using metadata, and providing flexible support for diverse workflows.

Recent Acquisition in the Debt Security Market

In July 2023, Allied Benefit Systems LLC acquired Medxoom. Medxoom is a industry leading digital benefits platform. Medxoom is mostly utilized by health plans, health benefits, consultants, empoyer groups and third-party administrators across the country to optimize experience of members and management of healthcare benefits. Through acquisition of Medxoom‐™s technology and its incorporation in the Allied Benefits Systems LLC the company aims to change customer experience and focuses on offering higher customer satisfaction Simultaneously the acquisition will also lower employer risk by offering its customers a completely compliant and reasonably priced solution. Allied is dedicated to helping Medxoom's present and potential customers, as well as to advancing the creation of cutting-edge member-focused goods and services that will surpass industry norms.

Market Landscape and Trends

Debt security is an important source for providing finance to the governments, corporations and other entities. There has been a global rise in the issuance of debt security, which is driven by factors such as infrastructure financing requirements, economic stimulus measurements, and corporate expansion plans. Furthermore, there are different economies in different regions such as U.S. and Europe that are facing long time periods of low interest rates. Interest rates are lower due to central bank monetary policies that helps in boosting economic development which will affect borrowing cost and investor demand for debt instruments. In addition, government bonds are considered as safe investments especially in case of nations with stable economies such as U.S., Germany and Japan. Investors are searching for liquidity and capital preservation which are acting as key drivers for the continuous stronger demand in relation to government bonds irrespective of lower returns. Moreover, due to increasing activities in the corporate bond market businesses are issuing debt instruments in relation to cheap borrowing costs. Investors are looking for income in a lower-rate environment that has been drawn to investment grade and high yield corporate bonds.

Top Impacting Factors

Growth in Financial Innovation

Financial innovations are resulting in creation of new debt security products in relation to meet specific needs and requirements. For instance, the development of structure products, hybrid securities and derivative bonds will provide investors with alternative investment opportunities beyond traditional bonds. The new products will expand the range of different available options in the debt security market by attracting large base of investors and driving highest market growth. Furthermore, financial innovations are facilitating securitization of different types of assets such as mortgages, loans and receivables. By using securitization the assets are packed into tradable securities which can be sold to investors. Issuers can obtain capital through securitization by monetizing their assets, while investors have access to a variety of investment options. The raises in issuance volumes and market liquidity is helping in the growth of debt security market expansion. In addition, the processes and infrastructure in the debt security market have changed due to advancements in financial technologies, making it more accessible, transparent and efficient in the debt security platform.

Furthermore, technologies such as blockchain technology, algorithm trading technology, and electronic trading technology assists in streamlining trading methods, decreasing transaction costs and increasing the liquidity of market which drives the growth of the debt security industry. Moreover, players that are entering debt security market are resulting in technological advancement, institutional advancement and retail trade advancement that is helpful in increasing trading volume and market activity. Therefore, all these factors are expected to propel the expansion of debt security market.

Rise in Unpredictability in Interest Rates and High Credit Risk

Rising uncertainty across potential profit rates, investors might select not to opt for debt security market due to high interest rapidity rate. Bond prices are changing rapidly in relation to large and sudden changes in the interest rates, therefore making it difficult for investors to effectively evaluate and manage risk. Moreover, elevated credit risk may diminish investor trust in debt assets, especially during economic downturns and financial crises. Market expansion may be hampered by worries about issuer solvency, default risk, and credit downgrades, which can raise borrowing costs for issuers and decreased investor demand.

Government Initiatives and Stimulus Programs

In case of economic crises and government often implement stimulating measures to support economic recovery and stability. These measures involve increased spending by government on infrastructure projects, healthcare, social welfare programs, debt security awareness programs, and tax cuttings. Therefore, to financially support these kind of initiatives governments are issuing debt security such as government bonds, treasury bills and treasury notes. For instance, in December 2022, Union Minister for road transport and highways, Nitin Gadkari launched India‐™s first ever surety bond insurance product from Bajaj Allianz. Surety bond insurance that will act as a security arrangement for infrastructure projects and will insulate the contractor as well as the principal. The product will cater to the requirements of a diversified group of contractors, debt security companies, and many of whom are operating in current increasingly volatile environment. The rising borrowing activities can lead to higher issuance of volumes in the debt security market.

Furthermore, the central banks can implement expansionary monetary policies such as low interest rates and can engage in quantitative easing to control economic growth and increase liquidity in the financial markets. The low interest rates can reduce the cost of borrowing for governments thus making it quite cheap for the government to issue debt security. In addition, quantitative easing programs involves the central banking purchasing government bonds and other securities from the market thus infusing liquidity and driving up prices that lower yields in the debt security sector. This also can motivate investors to search for higher yields in the different areas of debt security market further controlling issuance. . Therefore, all these factors are expected to propel the growth of debt security market opportunity for the forecast period.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the debt security market analysis from 2022 to 2032 to identify the prevailing debt security market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the debt security market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global debt security market trends, key players, market segments, application areas, and market growth strategies.

Debt Security Market Report Highlights

| Aspects | Details |

| Forecast period | 2022 - 2032 |

| Report Pages | 400 |

| By Type |

|

| By Component |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Great American Insurance Group, AC Star Insurance Company, Bryant Surety Bonds, Surety Bonds Direct, Allied Property and Casulaty Property Insurance Company, MG Surety Bonds, Chubb, Allegheny Corporation, european investment bank, Allied World Insurance Company |

Analyst Review

Debt security is an instrument that is purchased and sold between two parties. The instrument clearly defines the basic terms such as the amount borrowed, interest rate, maturity rate and renewable date. Government bond, corporate bond, deposit certificate, municipal bonds and preferred stock are some of the instances of debt security. Debt security also appears in the form of collateral security such as collateral debt obligations, collateral mortgage obligations, mortgage-backed securities that are issued by government national mortgage association and zero-coupon securities.

A debt security allows an institution to borrow money from investors and repay the loan with interest. Debt security include equity, equities are common stocks that represent the share of the investors in the ownership of the company. Debt security include bonds. Bonds are a kind of promise to make periodic interest payments until the value of the bond is fully repaid in the future date. Furthermore, there are different type of bonds available in the market such as government bonds, corporate bonds, zero coupon bonds, convertible bonds, mortgage bonds, puttable bonds, treasury bills, deposit certificate, commercial paper, and United States treasury security.

Key players in the debt security market adopted different strategies to sustain their growth in the market. For instance, in October 2022, Allegheny Corporation was acquired by Berkshire Hathaway. Berkshire Hathaway and its subsidiaries engage in diverse business activities including insurance and reinsurance, utilities and energy, freight rail transportation, manufacturing, retailing and services. Furthermore, Alleghany Corporation owns operating subsidiaries and manages investments, anchored by a core position in property and casualty reinsurance and insurance. Alleghany’s property and casualty subsidiaries include Transatlantic Holdings, Inc., a leading global reinsurer; RSUI Group, Inc., which underwrites wholesale specialty insurance coverages; and Cap Specialty, Inc., an underwriter of specialty casualty and surety insurance coverages. Alleghany’s subsidiary Alleghany Capital Corporation owns and supports a diverse portfolio of eight non-financial businesses. These players have adopted acquisition strategy to increase their market penetration and strengthen their position in the debt security industry.

There has been a global rise in the issuance of debt security, which is driven by factors such as infrastructure financing requirements, economic stimulus measurements, and corporate expansion plans.

Secondary market trading and treasury bonds are the leading application of debt security market.

North America is the largest regional market for debt security.

$1.3 trillion is the estimated industry size of the debt security market.

Surety Bonds Direct, MG Surety Bonds, Bryant Surety Bonds, Great American Insurance Group, Chubb, AC Star Insurance Company, Allegheny Corporation, Allied Property and Casualty Insurance Company, Allied World Insurance Company, and European Investment Bank. are the top companies to hold the market share in debt security market.

Loading Table Of Content...

Loading Research Methodology...