Decorative Coatings Market Research, 2033

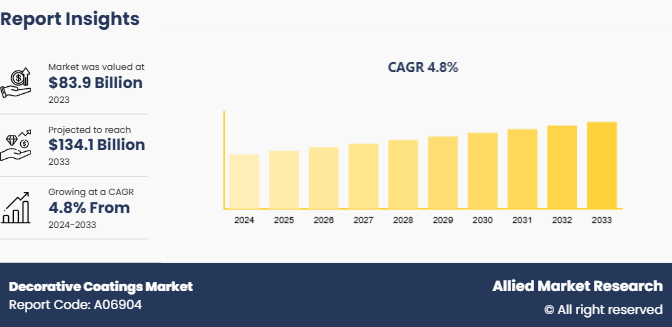

The global decorative coatings market size was valued at $83.9 billion in 2023, and is projected to reach $134.1 billion by 2033, growing at a CAGR of 4.8% from 2024 to 2033.

Market Introduction and Definition

Decorative coatings are specialized coatings applied to surfaces to enhance their aesthetic appeal while also offering protection. These coatings are widely used across various industries, such as architecture, automotive, consumer goods, and interior design. Their primary purpose is to improve the visual appearance of surfaces by adding color, texture, and design elements. Decorative coatings come in many forms, such as paints, varnishes, lacquers, and specialty finishes, each tailored to achieve a specific look or effect.

Key Takeaways

- The decorative coatings market share covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2023-2033.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major decorative coatings industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

Innovations in formulation and application techniques have led to the development of more durable, aesthetically appealing, and environmentally friendly coatings. These advancements cater to the evolving needs of both residential and commercial sectors, where consumers increasingly seek high-quality finishes that offer enhanced protection against wear and tear, weather conditions, and UV radiation. The growing trend towards sustainable and green building practices has also accelerated the demand for eco-friendly decorative coatings.

In addition to environmental considerations, advancements in coating technologies have improved the functionality and versatility of decorative coatings. For instance, the introduction of nanotechnology and smart coatings has allowed for the development of self-cleaning, anti-microbial, and scratch-resistant surfaces. All these factors are expected to drive the demand for the decorative coatings market. However, the production of decorative coatings relies heavily on raw materials such as resins, pigments, solvents, and additives, many of which are derived from petrochemical sources. Fluctuations in the prices of crude oil and other essential raw materials lead to unpredictable costs for manufacturers. These cost variations are often difficult to absorb, especially in a highly competitive market where price sensitivity is high. All these factors are expected to hamper the growth of the decorative coatings market forecast.

Smart coatings, which respond to environmental stimuli such as temperature, light, and moisture, are revolutionizing the way surfaces are treated and protected. In the decorative coatings sector, these advanced materials are not only enhancing aesthetic appeal but also adding functional value to coatings. For instance, self-cleaning coatings that repel dirt and grime, and thermochromic coatings that change color with temperature variations, are gaining traction in both residential and commercial applications. This growing interest in smart coatings is driven by a desire for more innovative and multifunctional solutions that go beyond traditional decorative roles. All these factors are anticipated to offer new growth opportunities for the decorative coatings market during the forecast period.

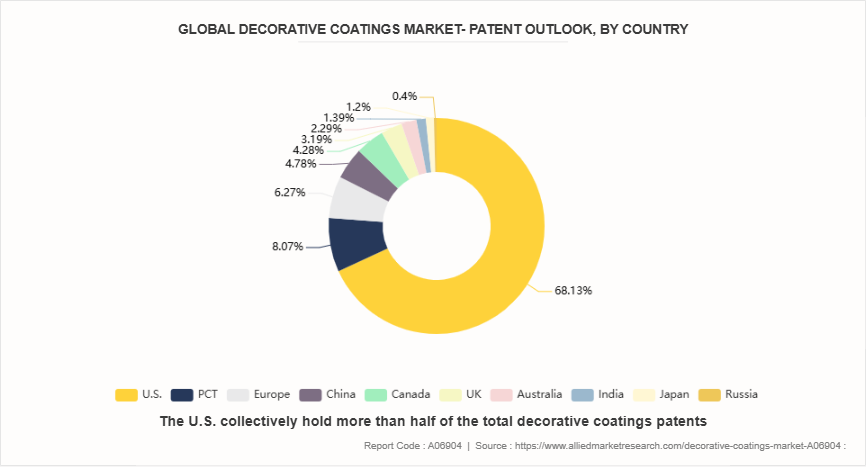

Patent Analysis for Decorative Coatings Market

The U.S. collectively hold more than half of the total decorative coatings patents that indicate strong innovation and investment in this technology in U.S. countries. This suggests fierce competition and a significant focus on decorative coatings R&D in these leading economies. U.S. has the highest patent filed those accounts for 68.4% of the total global patents related to the decorative coatings market. Europe and PCT, although holding smaller percentages of decorative coatings patents individually, collectively contribute to the overall Asian dominance in decorative coatings. This reflects the region's strong presence in materials science and engineering R&D.

Market Segmentation

The decorative coatings market is segmented by resin type, product type, application, and region. By resin type, the market is classified into acrylic, alkyd, epoxy, polyurethane, fluoropolymer, vinyl, polyester, and others. By product type, the market is classified into external, and internal. By application, the market is divided into residential, commercial, and industrial. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The Asia-Pacific region is dominating the decorative coatings market. This dominance is driven by rapid urbanization, boom in construction industry, and increase ing consumer spending on home improvement in countries such as China, India, and Southeast Asian nations. In addition, the growing middle class and rising disposable incomes in this region contribute to the strong demand for decorative coatings, making Asia-Pacific the largest and most influential market.

Competitive Landscape

The major players operating in the decorative coatings market include AkzoNobel N.V., PPG Industries, Inc, Sherwin-Williams Company, BASF SE, Nippon Paint Holdings Co., Ltd., Axalta Coating Systems, Asian Paints Ltd., Jotun Group, RPM International Inc., Kansai Paint Co., Ltd.

Industry Trends

- Advances in technology are leading to the development of high-performance coatings with enhanced durability, weather resistance, and ease of application. Innovations such as nanotechnology and smart coatings that respond to environmental changes are also emerging.

- Increasing consumer awareness and regulatory pressures are pushing manufacturers towards eco-friendly and low-volatile organic compound coatings. Water-based coatings are gaining popularity as they are less harmful to the environment compared to solvent-based alternatives.

Key Sources Referred

- Invest India

- International Renewable Energy Agency (IREA)

- India brand Equity foundation (IBEF)

- International Energy Agency (IEA)

- The Essential Chemical Industry

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the decorative coatings market analysis from 2024 to 2033 to identify the prevailing decorative coatings market growth and opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the decorative coatings market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global decorative coatings market trends, key players, market segments, application areas, and market growth strategies.

Decorative Coatings Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 134.1 Billion |

| Growth Rate | CAGR of 4.8% |

| Forecast period | 2024 - 2033 |

| Report Pages | 340 |

| By Resin Type |

|

| By Product Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | PPG INDUSTRIES, INC, Nippon Paint Holdings Co., Ltd, AkzoNobel N.V., RPM International Inc, Sherwin-Williams Company, Jotun Group, Kansai Paint Co., Ltd., Asian Paints Ltd., BASF SE, Axalta Coating Systems |

| Other Key Market Players | Benjamin Moore, Axalta Coating Systems |

Advancements in coating technologies, rising urbanization and infrastructure development are the upcoming trends of Decorative Coatings Market in the world.

Residential is the leading application of Decorative Coatings Market

Asia-Pacific is the largest regional market for Decorative Coatings

$134.1 is the estimated industry size of Decorative Coatings by 2033.

AkzoNobel N.V., PPG Industries, Inc, Sherwin-Williams Company, BASF SE, Nippon Paint Holdings Co., Ltd., Axalta Coating Systems, Asian Paints Ltd., Jotun Group, RPM International Inc., Kansai Paint Co., Ltd are the top companies to hold the market share in Decorative Coatings

Loading Table Of Content...

Loading Research Methodology...