The global defense cyber security market size was valued at $21.3 billion in 2021, and is projected to reach $43.4 billion by 2031, growing at a CAGR of 7.7% from 2022 to 2031.

Cybersecurity includes the safety of assets from cybercrime, terrorism, and other network service disruptions, which can possibly affect everyday operations. It can be accomplished through active monitoring of IT assets, exposure of outages or malicious movement, and prompt response to interruptions. Similarly, defense industry is also heading towards the digital world with a growing digital data generation, storage, and also transmission. Cybersecurity solutions help a defense organization to monitor, detect, report, and counter cyber threats that are internet-based attempts to damage or disrupt information systems and hack critical information using spyware and malware, and by phishing, to maintain data confidentiality.

Currently, cyber threats are more persistent, smarter, and more focused on high-value assets, which are projected to drive the defense cyber security market over the forecast period. Hence, the growing risk of the cyber threat to critical infrastructures by structured criminal groups followed by technological improvement in the cyber security industry is the major driver for this market.

Moreover, expansion in spending on services programs for R&D of cyber safety solutions for the battle-ground communication systems is also expected to fuel the growth of the market during the forecast period. For instance, in January 2019, General Dynamics Information Technology (GDIT) a business unit of General Dynamics Corporation signed the Navy Cyber Mission Engineering Support contract with the U.S. Navy’s Space and Naval Warfare Systems Center (SPAWARSYSCEN) Atlantic. Through this contract, GDIT supports SPAWARSYSCEN Atlantic by providing complex engineering and technical services in support of national security mission capabilities.

It includes research, development, test, evaluation, production, and fielding for command; control; communications; computers; combat systems; and intelligence, surveillance, & reconnaissance (C5ISR), information operations (IO), identity operations (IdOps), enterprise information services (EIS) and space capabilities.

In addition, surge in advancements in information technology, upgradation of existing weapons with intelligence, surveillance, and increase in volume of classified data gathered from various systems have demanded the use of reliable and enhanced cyber security solutions for the defense industry. For instance, in April 2022, Thales entered into partnership with TheGreenBow, a French provider of VPN solutions to provide a secure remote access solution. The solution includes TheGreenBow’s Windows Enterprise VPN client and Thales’s Gateways IPsec Mistral encryption technology. The latest version has been certified by French information security agency ANSSI to offer civil and military organizations top-notch protection for their information systems.

While factors such as growing severity of cyber attacks on military/government organizations and increasing government initiatives to secure critical data are driving the market growth. For instance, in 2020, the Japanese Ministry of Defense plans to invest some $237.12 million for the development of cyber security, including development of application of artificial intelligence (AI) to the cyber security defense system. The defense budget for the AI-powered anti-cyber-attack system can automatically detect harmful emails and judge the level of cyber-attack threats. Such initiatives are expected to support the growth of the defense cyber security market during the forecast period.

The factors such as increase in demand for defense IT expenditure, transition, of conventional military aircraft into autonomous aircraft, and growth in cyber-attacks on the regulatory, trade and individuals supplement the growth of the defense cyber security market. However, limited awareness related to cyber security and lack of cyber security professionals or workforce are the factors expected to hamper the growth of the defense cyber security market. In addition, increase in threats and warnings related to cyber-attack on officials and adoption of IoT in cyber security technology creates market opportunities for the key players operating in the defense cyber security market.

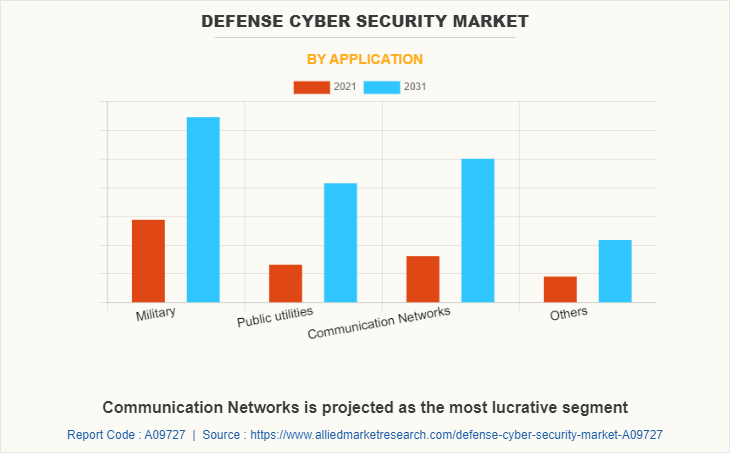

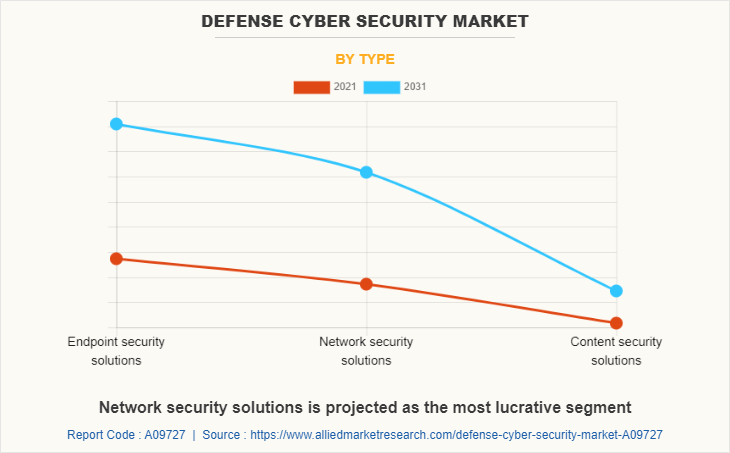

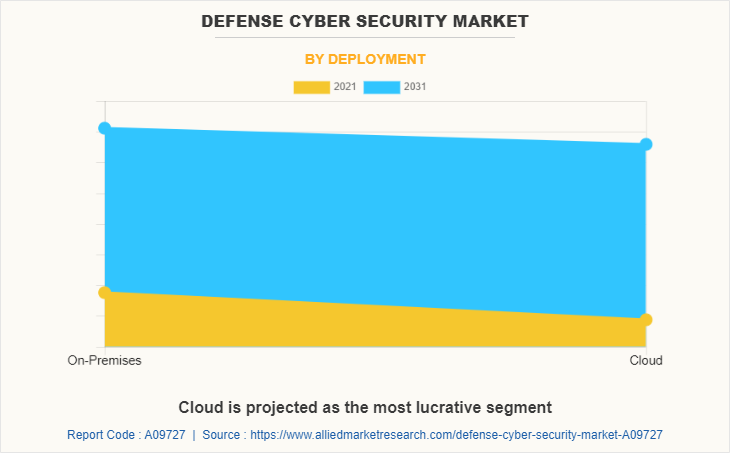

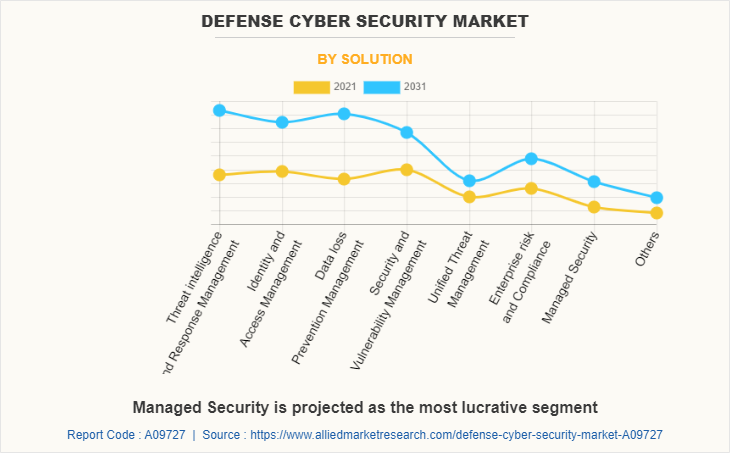

The defense cyber security market is segmented into application, type, deployment, solution and and region. By type, the market is divided into endpoint security solutions, network security solutions, and content security solutions. By deployment, the market is fragmented into on-premise and cloud. By solution, it is categorized into threat intelligence & response management, identity & access management, data loss prevention management, security & vulnerability management, unified threat management, enterprise risk & compliance, managed security, and others. By application, the market is classified into military, public utilities, communication networks, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The leading players operating in the defense cyber security market are AT&T, BAE Systems, Boeing, Cisco Systems, Inc., DXC Technology Company, EclecticIQ B.V., IBM Corporation, Intel Corporation, Lockheed Martin Corporation, Northrop Grumman Corporation, Privacera, Inc., Raytheon Technologies Corporation, SentineIOne, Secureworks, Inc., and Thales Group.

Increase in demand for defense IT expenditure

Defense IT expenses are on the surge across various developed economies such as U.S., France, UK, and China. According to an analysis from Govini, a data science firm, in July 2021, the U.S. department of defense requested a 7.8% increase in its 2022 fiscal year budget for IT. The total defense IT expenditure in the U.S. has been growing since 2019. Thus, growth in the use of IT hardware, software, and services have implemented several changes in the defense sector, including real-time combat surveillance, superiority in air & space, smart weapons and battlefield management in a network-centric environment, and force multipliers-related software.

Furthermore, implementing IT solutions in defense operations has become significant, owing to the growing evolution in the type and occurrence of attacks across the globe. This is anticipated to surge in demand for innovative and modern technologies such as 5G, artificial intelligence, cloud computing, data analytics, cyber security, and autonomous systems across various defense systems. Such initiatives lead to the increase in demand for defense IT expenditure, which in turn propels the defense cyber security market.

Transition of conventional military aircraft into autonomous aircraft

Various countries infrastructure operators, law enforcement, and all levels of government are increasingly using autonomous aircraft such as unmanned combat aerial vehicles into their operational functions. Although, autonomous aircraft offer benefits to their operators, they can also pose cybersecurity risks. Meanwhile, cyber security help commercial operators protect their networks, information, and personnel.

Thus, the adoption of artificial intelligence and internet of things in aircraft provides ease in performing missions by supporting pilots in critical judgement during warfare, real time navigation & surveillance, and optimized route detection. The combination of advanced technology reduces the threat of mission failures. Moreover, next generation advanced aircraft are equipped with the integrated cutting-edge avionics equipment, advanced technology-based electronics and software systems.

The increasing IoT and AI applications in military aircraft may lead to requirement of reliable and advanced defense cyber security solutions. For instance, in October 2022, BAE Systems introduced a new maintenance capability, Viper Memory Loader Verifier II (MLV II), to defend the onboard systems of F-16 fighter aircraft from cyber-attacks. The new system helps increase the aircraft defense against cyber threats and provides the flight-critical ability to install and verify various software and mission data files onto the aircraft. Such enhancement in conventional military aircraft into autonomous aircraft is expected to drive the defense cyber security market.

Limited awareness related to cybersecurity

The government workforce is the first line of defense against intrusion by criminals, offenders, or antagonistic nations. The internet has made it simpler for antagonists worldwide to attack even the municipality, department, or agency. Countries with archaic IT technology are easy targets for ransomware attacks or malware infections. Thus, hackers hit under-prepared government bureaucrats with malware, email phishing scams, or stolen passwords to break in and steal confidential and vital government data or lock up critical systems required for operations and services. For example, phishing scams are the act of using fake text messages or emails to trick people into clicking on sketchy website links to steal personal information.

Government officials must be conscious of the precise ways to avoid cyber attacks and are constantly kept aware of and involved in the topic. Without suitable training, any government official can make the silly but possibly disturbing error of clicking on a deceitful email or website link. Hence, owing to the limited awareness related to cyber security is expected to hamper the defense cyber security market.

Adoption of IoT in cyber security technology

Several countries use IoT in military and defense applications to resolve difficulties during conflict and combat. The internet of military things (IoMT), or internet of battlefield things (IoBT), is a kind of IoT used in current warfare and information warfare. IoMT is taking off a lot of physical and mental stress, in the field, by building a small ecosystem of smart technology that can process sensory data and handle many tasks at once.

Its main objective is to solve difficulties that come up during modern conflict. For instance, in July 2022, the Government of India (GoI) launched 75 newly-developed artificial intelligence (AI) products or technologies. The government has already set up the defense artificial intelligence council (DAIC) and targets to give the defense the correct structure to implement IoT applications. Such technology will further enhance the needs and importance of IoT in current problems and challenges and fulfill the gaps in existing methods and ideas for improving surveillance & reconnaissance cyber security in the Indian defense ecosystem and operations. Thus, increasing adoption of IoT and AI will further help in creating market opportunity for the defense cyber security in the forecast period.

Key Benefits For Stakeholders

- This study presents analytical depiction of the global defense cyber security market analysis along with current trends and future estimations to depict imminent investment pockets.

- The overall defense cyber security market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to the key drivers, restraints, and opportunities of the global defense cyber security market with a detailed impact analysis.

- The current defense cyber security market is quantitatively analyzed from 2022 to 2031 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Defense Cyber Security Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 43.4 billion |

| Growth Rate | CAGR of 7.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 327 |

| By Application |

|

| By Type |

|

| By Deployment |

|

| By Solution |

|

| By Region |

|

| Key Market Players | Privacera, Inc., BAE Systems plc, EclecticIQ B.V., Boeing, Intel Corporation, Raytheon Technologies Corporation, Cisco Systems, Inc., Lockheed Martin Corporation, Northrop Grumman, Secureworks, Inc., AT&T Inc., IBM Corporation, Thales, SentinelOne, DXC Technology Company |

Analyst Review

This section provides the opinions of various top-level CXOs in the global defense cyber security market. Many emerging countries, such as India, China, Singapore, and Japan, face increasing cyber security-related issues. India ranks third in the number of DNS hijacks, indicating a sharp rise in cyber-crime registration. Additionally, Asia received 26% of all worldwide attacks in 2021, according to IBM X-Force Threat Intelligence Index 2022, making it the most attacked area globally. Meanwhile, the defense companies, such as BAE Systems PLC, Atos, General Dynamics Corporation, Finmeccanica S.p.A., are engaged in developing cyber security solutions in the defense industry, especially in designing network security solutions and software, to prevent cyber-attacks on military software systems, proving the increasing demand from the sector.

For instance, in July 2021, Atos and IBM announced their plans to collaborate and build a new, highly advanced digital infrastructure for the Dutch ministry of defense. The Dutch ministry of defense planned to use innovative expertise, technologies, and infrastructure services from Atos and IBM Global technology services to build new data centers, which defend its IT system, and construct a proprietary broadband mobile network to help safeguard classified government data to remain protected and secured.

Furthermore, increased adoption of machine-to-machine technologies in the aerospace domain and the focus of the governments on enhancing cyber security to counter cyber terrorism has led to the growth of the cyber security market in this sector in the past decade. For instance, in October 2020, SAIC won the US Air Force Modeling and Simulation Support Services (AFMS3) 2.0 contract to implement, integrate, and develop modeling and simulation (M&S), training, and analysis standards for the Air Force, Department of defense, and other organizations. Released by General Service Administration (GSA) FEDSIM on the GSA OASIS contract vehicle, the total potential value of the single-award contract has a ceiling of $737 million.

The market growth is supplemented by factors such as increase in demand for defense IT expenditure, transition, of conventional military aircraft into autonomous aircraft, and growth in cyber-attacks on the regulatory, trade and individuals supplement the growth of the defense cyber security market. However, limited awareness related to cyber security and lack of cyber security professionals or workforce are the factors expected to hamper the growth of the defense cyber security market. In addition, increasing threats and warnings related to cyber-attack on officials and adoption of IoT in cyber security technology creates market opportunities for the key players operating in the defense cyber security market.

Among the analyzed regions, North America is the highest revenue contributor, followed by Europe, Asia-Pacific, and LAMEA. On the basis of forecast analysis, Asia-Pacific is expected to lead during the forecast period, due to the increased activity towards establishing strong cyber defense system among the Asian countries.

The leading players operating in the defense cyber security market are AT&T, BAE Systems, Boeing, Cisco Systems, Inc., DXC Technology Company, EclecticIQ B.V., IBM Corporation, Intel Corporation, Lockheed Martin Corporation, Northrop Grumman Corporation, Privacera, Inc., Raytheon Technologies Corporation, SentineIOne, Secureworks, Inc., and Thales Group.

The global defense cyber security market was valued at $21,274.4 million in 2021, and is projected to reach $43,437.6 million by 2031, registering a CAGR of 7.7% from 2022 to 2031

North America is the largest regional market for Defense Cyber Security

Military s the leading application of Defense Cyber Security Market

Cloud based deployment are the upcoming trends of Defense Cyber Security Market in the world

Loading Table Of Content...