The global defense electronics market size was valued at $150.2 billion in 2022, and is projected to reach $254 billion by 2032, growing at a CAGR of 5.7% from 2023 to 2032.

Report Key Highlighters:

- The global defense electronics market studies more than 5 countries. The analysis includes a country-by-country breakdown analysis in terms of value ($million) available during the forecast period 2022- to 2032.

- The research combined high-quality data and, professional opinion and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

- The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the market.

- The global defense electronics market share is marginally fragmented, with players such as Lockhead Martin Corporation; North Grumman Corporation; Raytheon Technologies Corporation; Thales Group; BAE Systems; Aselsan AS; Curtis Wright Corporation; L3 Harris Technologies; Boeing, and Teledyne Defense Electronics. Major strategies such as contracts, agreements, partnerships, and other strategies of players operating in the market are tracked and monitored.

Surge in adoption of electronic warfare technologies

The significance of electronic communications and technologies is paramount for autonomous and remotely operated vehicles. As responsibilities assigned to unmanned systems increase, there is a concurrent rise in the demand for counter-unmanned aerial systems (UAS) and electronic warfare (EW) technologies to thwart them. Unmanned aerial vehicles have emerged as a crucial component in armed forces regionally. The integration of electronic warfare devices onto unmanned platforms has streamlined the processing of surveillance and imagery data.

For example, China and India ranked among the top military spenders in 2021, according to SIPRI, with other nations contributing 62% of the world's military spending. In addition, China military budget increased to $293 billion in 2021, which is anticipated to propel the creation and acquisition of electronic warfare equipment.

Rise in need for electronic warfare systems

The need for electronic warfare systems has grown significantly due to increased military spending in several countries, and this trend is anticipated to continue throughout the forecast period. For example, China and India ranked among the top military spenders in 2021, according to SIPRI, with other nations contributing 62% of the world's military spending. In addition, China military budget increased to $293 billion in 2021, which is anticipated to propel the creation and acquisition of electronic warfare equipment.

The ability to obtain a technological edge over competitors has made space based C4ISR capabilities crucial for the global armed forces. Investments in space based C4ISR systems are being driven by the development of tiny satellites, which can function on scale with traditional satellites while saving money.

Stringent Regulatory Compliance and Export Controls

Compliance with strict regulations and export controls imposed by governments can pose a significant challenge for defense electronics manufacturers. These regulations often involve complex licensing procedures, trade restrictions, and compliance with export control regimes, which can hinder defense electronics market demand expansion and international trade opportunities. Additionally, concerns about technology leakage and potential misuse of advanced defense electronics may lead to tighter regulations, further restricting market growth.

Growth in inflight passengers

The defense electronics market holds a great potential over the coming years backed by rise in inflight passengers across the globe, aircraft modernization contracts on commercial as well as military verticals, development of infrastructure related to aviation industry, and R&D practiced by global players to improve fuel efficiency of aircraft engines and reduce overall carbon footprint. The post pandemic situation where individuals across the globe are more inclined toward traveling and returning to their normal routine, aviation industry is experiencing a business surge.

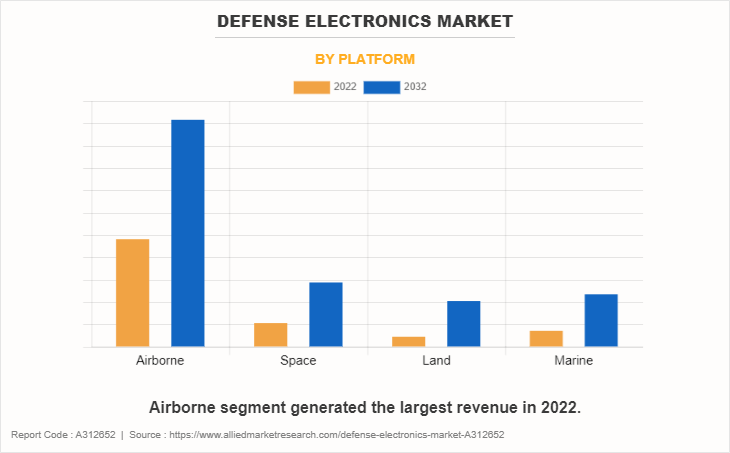

The defense electronics market is segmented into Platform and Vertical.

On the basis of platform, the market is divided into airborne, land, space and marine.The airborne segment generated the largest defense electronics market share in 2022. Electronic systems, tools, and technologies created and employed for military and national defense are referred to as defense electronics. With its ability to provide functions including surveillance, communication, navigation, and reconnaissance as well as countermeasure systems, these electronics are essential to contemporary military operations.

The development of pseudo-high-altitude satellites (HAPS), which combines the greatest features of satellite- and terrestrial-based communication systems, has also closed the coverage and cost gap between drones and satellites. These advancements are anticipated to improve the space-based electronics in the defense electronics market report during the forecast period.

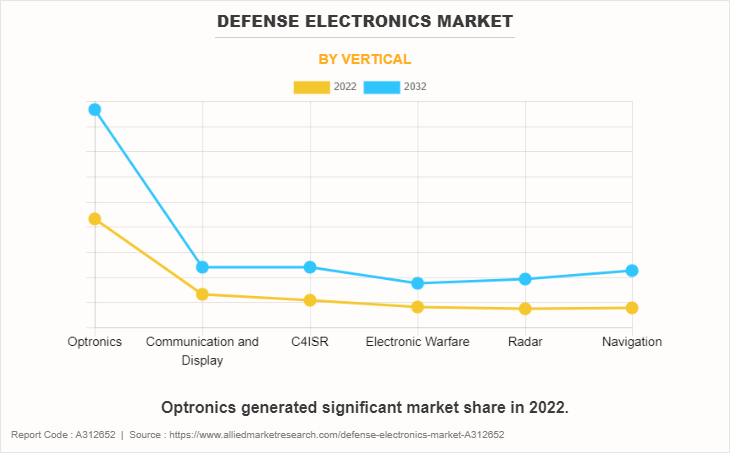

On the basis of vertical, the defense electronics market analysis is classified into communication and display, navigation, C4ISR, electronic warfare, radar and optronics.Electronic warfare systems, radar systems, sonar systems, guidance systems, communication systems, and a variety of sensors are only a few examples of equipment that falls under the broad category of defense electronics.

The primary objectives of defense electronics are to improve military forces effectiveness and efficiency by providing them with cutting-edge technological tools for strategic capabilities, communication, and situational awareness.The incorporation of unmanned systems with communication jammers or electronic surveillance equipment proves beneficial for various unmanned EW missions. In addition, unmanned electronic warfare aircraft eliminate the need for human presence, thereby reducing the risk of human casualties.

Region wise, the defense electronics trends are analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, Russia, Italy, Spain, and rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

On the basis of region, Asia-Pacific is expected to be the largest market shareholder due to the country constantly increasing military expenditure to integrate advance technologies across electronic warfare, C4ISR, navigation, communication, and display.Furthermore, the surge in need for improved communications, automation, situational awareness, and data sharing capabilities in military, government, and civilian operations. Technological developments in recent years have made it possible to create new goods and services to satisfy these demands.

Impact of Russia-Ukraine War on Defense Electronics Industry

The defence electronics market is significantly impacted by the conflict between Russia and Ukraine. Supply chains can be disrupted by geopolitical tensions and violence, which can have an impact on the delivery and manufacture of vital parts and technologies. Budgetary restrictions for defense solutions could result from economic uncertainty in the affected areas, which would affect government and defence contractor investment decisions.

Furthermore, projects related to defense infrastructure development, including upgrades and expansions, may be postponed or delayed due to the conflict, affecting the implementation of new defense electronics technologies. Security measures might receive additional focus, which could increase spending on defense electronics products that deal with threat detection, access control, and monitoring. The development and adoption of further defense electronics solutions may be impacted by the change in emphasis. The conflict can lead priorities and expenditure patterns to change, which could change the defense electronics market and affect whether technology advances and investment plans are made in the sector.

Competitive Analysis

Competitive analysis and profiles of the major global market players that have been provided in the defense electronics industry report include Lockhead Martin Corporation; North Grumman Corporation; Raytheon Technologies Corporation; Thales Group; BAE Systems; Aselsan AS; Curtis Wright Corporation; L3 Harris Technologies; Boeing, and Teledyne Defense Electronics. The key strategies adopted by the major players of the global market are product launch and mergers & acquisitions.

Top Impacting Factors

The global defense electronics market trends is expected to witness notable growth owing to growing adoption of integrated defense electronics technologies, technological innovation to improve the efficiency of C4ISR operations and improve operational revenues, customer centric approach, goal to achieve carbon net neutrality, the rise in the number of defense electronics vendors across the globe, increase in need for AI and IOT devices in military operations.

Historical Data & Information

The global defense electronics industry is highly competitive, owing to the strong presence of existing vendors. Vendors in the global market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to worsen as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Key Developments/ Strategies in Defense Electronics Industry

- In April 2022, Australia and the UK signed an agreement to cooperate on powerful weapons and electronic warfare capabilities, following the establishment of the AUKUS defense alliance in September 2021.

- In March 2022, BAE Systems launched a new Electronic Warfare (EW) package that provides offensive & defensive EW capabilities to various platforms. The Storm Electronic Warfare Module system can be customized for the U.S. and coalition forces, and can be integrated into fixed-wing aircraft, helicopters, unmanned aerial vehicles, and missiles.

- In February 2023, Northrop Grumman Corporation was awarded the initial production and operations contract for the Next Generation Handheld Targeting System (NGHTS) by the United States Marine Corps. The NGHTS is a portable targeting system that can operate in locations without GPS and provides high-precision targeting.

KEY BENEFITS FOR STAKEHOLDERS

- This study comprises analytical depiction of the global defense electronics market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall global market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current global market forecast is quantitatively analyzed from 2022 to 2032 to benchmark the financial competency.

- Porters five forces analysis illustrates the potency of the buyers and suppliers in the market.

- The report includes the market share of key vendors and the global defense electronics.

Defense Electronics Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 254 billion |

| Growth Rate | CAGR of 5.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 314 |

| By Platform |

|

| By Vertical |

|

| By Region |

|

| Key Market Players | Teledyne Defense Electronics, Lockhead Martin Corporation, L3 Harris Technologies, Raytheon Technologies Corporation, BAE Systems, Boeing, Aselsan A.S., Curtis Wright Corporation, Thales Group, North Grumman Corporation |

The upcoming trends in defense electronics market include growing adoption of integrated defense electronics technologies, technological innovation to improve the efficiency of C4ISR operations.

Optronics is the leading vertical of Defense Electronics Market.

Asia-Pacific is the largest regional market for defense electronics.

The global defense electronics market was valued at $150.2 billion in 2022.

Lockhead Martin Corporation, Raytheon Technologies Corporation, Thales Group, BAE Systems, and Aselsan AS are the top companies to hold the market share in Defense Electronics.

Loading Table Of Content...

Loading Research Methodology...