Delivery Robot Market Insights, 2030

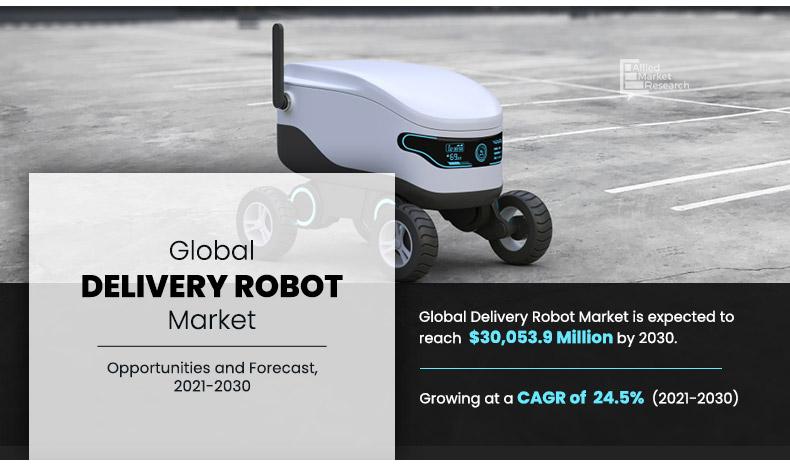

The global delivery robot market size was valued at $3.53 billion in 2020, and is projected to reach $30.05 billion by 2030, registering a CAGR of 24.5% from 2021 to 2030.

Delivery robot is an automated robot that brings delivery directly to customer’s doorstep without involving any human intervention in the entire process. Delivery robots can navigate around people and public spaces without a human driver. The increased use of internet along with the expansion in e-commerce industry has increased the demand for products to be purchased online which requires a better and efficient means to deliver the product to the customer. Thus, various product delivery services, such as delivery robots, have been adopted by the companies.

The growth of the global delivery robot market is anticipated to be majorly driven by developments in the e-commerce sector, and demand contactless delivery. The growing demand for better and efficient delivery service for the products has increased with the advent in online shopping along with the customer’s inclination toward buying products through an online source. In addition, online grocery stores and retailers, such as Big Basket, Flipkart, and Amazon, are developing delivery robots to perform last-mile delivery of goods. However, limited range of operation of ground delivery robots and stringent regulations pertaining to operations of delivery robots act as a key growth restraint for the delivery robots market.

By Load Carrying Capacity

Up to 10 kg segment is projected as the most lucrative segment

COVID-19 has created short-term disruption and long-term structural changes due to which the e-commerce industry is experiencing considerable growth especially in groceries and homecare categories. For instance, due to the COVID-19 pandemic, the overall sales of e-commerce businesses in the U.S. have increased by over 30%. In addition, DHL in Germany registered an increase in parcel shipments from 5.3 million parcels to 9.0 million parcels per day, which is similar to deliveries during Christmas time. Moreover, during the pandemic, people across the globe preferred to self-isolate them and opted for the method of contactless delivery for their daily necessities, which create the scope of opportunity for delivery robots.

By Number Of Wheels

4 Wheels segment is projected as the most lucrative segment

The increased adoption of newer last-mile options such as curbside pickup, parcel lockers, and delivery is further foreseen to boost the demand for delivery robot. Further, the e-commerce sector experienced increase in the number of orders, and to fulfill the same companies have entered into collaborations and partnerships with different delivery robot manufacturers to introduce robot for package delivery, during the pandemic. For instance, in September 2020, Ottonomy Inc. collaborated with snapdeal, an e-commerce company to provide automated delivery robots to make contactless last-mile deliveries to customers. Further, snapdeal has successfully tested Ottonomy automated delivery robot for last-mile delivery using robots in select locations of Delhi-NCR in India. Furthermore, many companies have started using the robots especially for food and medical door to door deliveries as the delivery robots offer contactless delivery.

By End-user

Food and Beverages segment is projected as the most lucrative segment

Besides logistics and e-commerce sectors, the hospitality and food industries are also adapting delivery robots to deliver food to the customer's doorstep or to provide room service in hotels. Moreover, the food industry players are entering into a collaboration and partnership with delivery robot manufacturers to food deliveries without any human involvement. For instance, in April 2021, Domino’s, a multi-national pizza restaurant chain collaborated with Nuro, Inc., an autonomous delivery robot manufacturer, for providing driverless deliveries. Under this collaboration, Nuro, Inc. is delivering domino’s orders to customers through its autonomous delivery robot. Also, In March 2021, the AIN pharmacy in town began autonomous delivery of medication to patients' homes. In 2020, Starship Technologies started delivering food during the pandemic. Factors such as rise in demand for contactless delivery from customers, growth of the e-commerce sector during pandemics, and partnership and collaboration between various companies and delivery robots manufacturers, are expected to boost the market growth.

By Region

Asia-Pacific would exhibit the highest CAGR of 27.5% during 2021-2030.

The delivery robots market is segmented on the basis of load carrying capacity, number of wheels, end user, and region. By load carrying capacity, the market is categorized into up to 10 kg, more than 10 kg to 50 kg, and more than 50 kg. By number of wheels, it is segregated into 3 wheels, 4 wheels, and 6 wheels. By end user, it is classified into food & beverages, retail, healthcare, postal, and others. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players operating in the global delivery robot market include Boxbot, Cleveron AS, Kiwibot, Ninebot, Nuro, Inc., Panasonic Corporation, Piaggio & C.SpA, Robby Technologies, ST Engineering and Starship Technologies.

Developments in the e-commerce sector

The demand for better and efficient delivery service for the products has increased with the advent in online shopping along with the customer’s inclination toward buying products through an online source. Over the past few years, e-commerce industry has witnessed astonishing growth in various regions around the world. The factors such as access to multiple products, availability of a wide range of options for a single product, expected delivery time, and a variety of shipping options, including tracking options and easy returns drive the growth of the e-commerce industry. In addition, online grocery stores and retailers, such as Big Basket, Flipkart, and Amazon, are developing delivery robots to perform last-mile delivery of goods. For instance, both Amazon and FedEx are developing delivery robots. Where FedEx’s bot Roxo, which looks like a small refrigerator, has completed on-road tests in four cities.

Reduction in Delivery Costs in Last-mile Deliveries

Over the years, the cost of last-mile delivery has been reported to be a major concern for shipping & logistics and e-commerce companies, which covers more the 50% cost of shipping. Besides, the introduction of delivery robots to do last-mile deliveries has significantly reduced the cost of last-mile delivery. In addition, by using delivery robots, shipping and last-mile delivery providing companies can save salary paid to the delivery driver and others costs like warehousing, fuel, and vehicle maintenance cost. Further, the creation and integration of delivery robots into businesses is expensive but once they are up and running, robots are typically cheaper than human workers.

Key Benefits For Stakeholders

- This study presents analytical depiction of the delivery robot market analysis along with the current trends and future estimations to depict the imminent investment pockets.

- The overall market potential is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities of the market with a detailed impact analysis.

- The current delivery robot market size is quantitatively analyzed from 2020 to 2030 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the delivery robot industry.

Delivery Robot Market Report Highlights

| Aspects | Details |

| By LOAD CARRYING CAPACITY |

|

| By NUMBER OF WHEELS |

|

| By END USER |

|

| By Region |

|

| Key Market Players | CLEVERON AS, BOXBOT, ST ENGINEERING, PANASONIC CORPORATION, STARSHIP TECHNOLOGIES, KIWIBOT, Piaggio & C.SpA, ROBBY TECHNOLOGIES, NINEBOT LIMITED, NURO, INC. |

Analyst Review

The market is expected to witness significant growth due to rise in demand for contactless deliveries from the consumer-end across the globe. The market in developing countries, such as China, Japan, and South Korea is projected to report a significant growth rate as compared to the developed regions. This is attributed to increased demand from retail, food & beverages, healthcare, and postal sectors in Asia-Pacific.

Numerous partnerships and collaborations have been carried out by top companies, such as Nuro, Inc., Ottoonomy Inc., Starship Technologies, TeleRetail, and others, which have supplemented the growth of the delivery robot market. For instance, in September 2020, the save Mart Companies of the U.S. announced the launch of an on-demand grocery delivery service in partnership with Starship Technologies, a leading robot delivery company. In addition, the save mart companies are the first grocers in the U.S. to partner with Starship Technologies

The regional governments have played a vital role in driving the delivery robot market by considering autonomous delivery robot use for commercial services. For instance, the German parliament in Belin has approved a new law on autonomous driving in the country. The new law allows companies to start making money from autonomous driving services which include robot package delivery and automated valet parking and further, aimed to increase future development in autonomous technology.

The market growth is supplemented by the developments in the e-commerce sector and reduction in delivery costs in last-mile deliveries. Moreover, stringent regulations pertaining to operations of delivery robot and a limited range of operations of ground delivery robots are the factors that hamper the growth of the delivery robot market. However, the rise in penetration of food and groceries delivery platforms and rise in demand for contactless delivery are the factors that fuel the growth of the delivery robot market across the globe during the forecast period.

Among the analyzed regions, North America has the presence of the highest number of players. Moreover, North America held majority of the market share in 2020 and is expected to register a suitable growth rate during the forecast period.

The global delivery robot market was valued at $3,532.15 million in 2020, and is projected to reach $30,053.9 million by 2030, registering a CAGR of 24.5% from 2021 to 2030.

Growing adoption of AI and machine learning is foreseen to reinforce the delivery robot market growth.

The sample for global delivery robot market report can be obtained on demand from the AMR website. Also, the 24*7 chat support and direct call services are provided to procure the sample report.

The delivery robot cost vary over the wide range depending on load carrying capacity and type of application.

The delivery robot market has witnessed significant growth in pasr few years. However, demand for contactless delivery is boldtering the demand for delivery robots.

The company profiles of the top market players of delivery robot market can be obtained from the company profile section mentioned in the report. This section includes analysis of top ten player’s operating in the delivery robot market.

The demand for better and efficient delivery service for the products has increased with the advent in online shopping. Also, the demand for contactless delivery is growing considerably. Thus, the Importance of delivery robot is increasing across the globe

Delivery robot is a robot that brings delivery directly to customer’s doorstep without involving any human intervention in the entire process

North America region is leading the market presently in terms of revenue and foreseen to maintain it's dominance over the forecast period.

Factors such as increased demand of contactless delivery is bolstering the demand for delivery robot. However, stringent regulations pertaining to operations of delivery robots and limited range of operation of delivery robots acts as a potential growth restraint for the market.

Loading Table Of Content...