Dental Alloys Market Research, 2031

The global dental alloys market was forecast valued at $1.9 billion in 2021, and is projected to reach $3.1 billion by 2031, growing at a CAGR of 4.9% from 2022 to 2031.

Alloy is a combination of metals and other chemical elements. Dental alloys are custom precision-cast for restoration of missing tooth structure. The global dental alloys market growth is driven by increase in use of dental alloys in partial denture and dental implant application. Selection and usage of appropriate base metal or alloy is crucial for ensuring longevity of dental implants. In addition, alloys used in dental implants need to be bio-compatible. Titanium based metal used for production of dental alloys are bio-compatible making it widely adopted alloy in dental implants, which is the key market trend. In addition, in order to replace broken tooth and missing tooth structure, several dental implants are being used.

Growth in demand for dental implants is anticipated to drive the demand for dental alloys intended to be used for dental implant application. The quality of dental implants is utmost important and key-players in the dental implant market have adopted new production technologies. This factor is further anticipated to offer new growth opportunities for dental alloys market. The surface chemistry is a considerable factor for using dental alloys in implant application. Titanium base metal offer high surface chemistry characteristics making it widely chosen for production of dental alloys that are further used in dental implants, which further drives the demand in the global market. Partial dentures are dental devices that are used to replace missing teeth or tooth. Chromium alloys are widely used for making framework for removable partial dentures.

Dental bridgework is used to fill the gap that if formed owing to missing of two or more teeth. Mainly, nickel-based alloys are used for dental bridgework application. Strength and lightweight characteristics of chromium alloys make them viable to be used in partial dental dentures applications, which is the key market trend. In addition, use of chromium alloys minimizes risk associated with casting of partial dentures as compared to other alloys. In addition, chromium is cost effective solution making it most widely used alloy for dental application drives the demand for dental alloys. Growing geriatric population has further increased the risk of partial edentulism. This in turn has escalated the demand and use of partial dentures for treating edentulism. All these factors are anticipated to increase the growth of dental alloys in partial denture application.

For instance, according to study conducted by American College of Prosthodontists, more than 120 million people across U.S. are suffering from partial edentulism. This is another considerable factor that is anticipated to offer new growth opportunities in the dental alloys market. Alloys used in dental bridgework application are generally formulated from noble metals and mainly includes use of gold-based alloys. Gold based dental bridgework is proven to be effective and has longer shelf life as compared with other alloys. All these factors collectively drive the demand in the global market.

However, some basic alloys used in dentistry application have high hardness property, thus making them difficult for formulation and finishing of prosthetic parts and restorative materials. In addition, other factors such as porcelain pigmentation and low corrosion resistance make them difficult to cast dental prosthesis. All these factors are anticipated to hamper the market growth.

Conversely, nickel-based alloys are widely used in prosthodontics application. Factors such as corrosion inhibition, potentiodynamic polarization, and surface morphology of nickel make it suitable to be used in dental applications. Nickel based alloys are used for production of denture bases and partial denture structures. Nickel-based dental alloys are used for making dental prosthesis owing to its economic benefits and mechanical strength, which is the key market trend. In addition, titanium-based alloys are used in for manufacturing of casted dental rods, dental ignots, dental polished ignots, and dental filler powder drives the demand for dental alloys.

In addition, nickel-based metal alloys are considered as important dental restorative material owing to its mechanical property, which is driving the demand for dental alloys. Nickel-based dental alloys are used in direct filling restorative application and technological development has led to rise in use of nickel-based dental alloys for tooth restorative application. All these factors collectively surge the demand for dental alloys. Fixed dental prostheses application require use of alloys that are bio-compatible and offer resistance with saliva. Nickel-based alloys are proven to offer high resistance toward pH of saliva, thus making it viable to be used for production of dental prostheses.

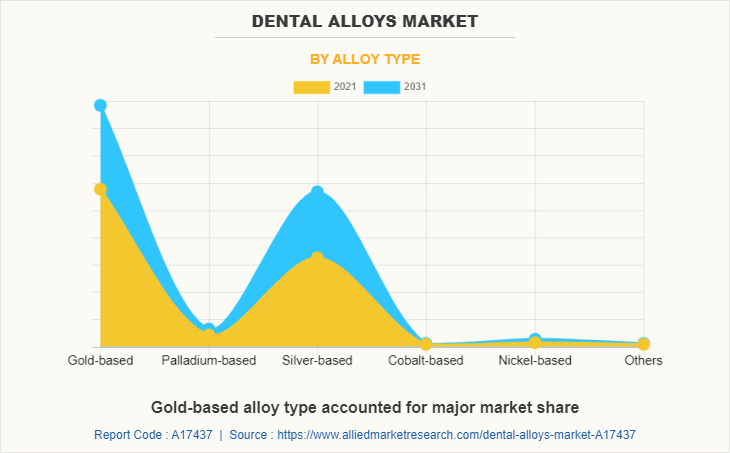

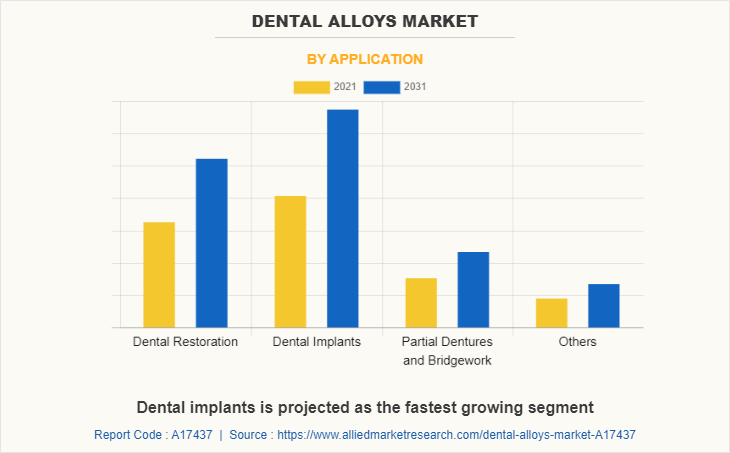

The dental alloys market is segmented on the basis of alloy type, application, and region. On the basis of alloy type, the market is categorized into gold-based, palladium-based, silver-based, cobalt-based, and others. By application, the market is classified into dental restoration, dental implants, partial dentures & bridgework, and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The global dental alloys industry profiles leading players that include Alba Dent Inc., Argen Corporation, Aurident Inc., 88Dent, Dentsply Sirona, Heraeus Holding, Ivoclar Vivadent, Jensen Dental, Kennametal Inc., Kerr Corporation, Kulzer GmbH, Kuraray Europe GmbH, Sterngold Dental LLC, Success Dental Co., and Yamamoto Precious Metal Co. Ltd.

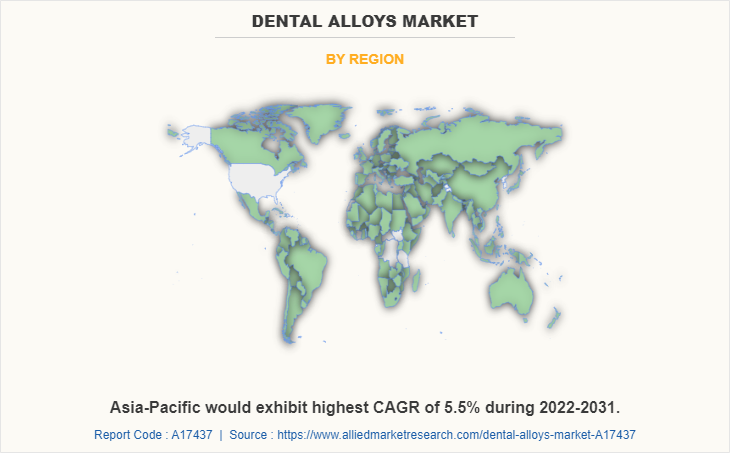

The Asia-Pacific dental alloys market size is projected to grow at the highest CAGR of 5.48% during the forecast period and accounted for 31% dental alloys market share. The dental industry in India is growing owing to presence of large number of dental laboratories, dental institutes, and growing dental healthcare awareness among people. This in turn has escalated the demand and use of dental alloys thereby driving the demand for dental alloys. In addition, the demand for dental tourism is also growing that is further anticipated to drive the growth of dental alloys marker across Asia-Pacific. Selecting and using of appropriate base metal or alloy is crucial for ensuring longevity of dental implants. In addition, alloys used in dental implants should be bio-compatible. Titanium base metal used for production of dental alloys are bio-compatible making it widely adopted alloy in dental implants. In addition, in order to replace broken tooth and missing tooth structure several dental implants are being used. Growing demand for dental implants is anticipated to drive the demand for dental alloys intended to be used for dental implant application.

In 2021, the gold-based alloy type was the largest revenue generator, and is anticipated to grow at a CAGR of 4.38% during the forecast period. Gold metal is flexible and ductile thus making it easy to be molded into different shapes making it viable to be used in dental applications such as dental crowns, bridges and inlays. In addition, gold alloy can also be used in conservative, restorative, and other orthodontic dentistry applications. However, pure gold metal is not suitable to be used for filling of small occlusal cavities. On the contrary, technological developments such as electroforming process has widen the use of gold alloy for cementing cavities. Tooth restoration is mainly done with help of porcelain veneered copings. Moreover, dental crowns and bridgework dentistry application is carried with help of porcelain veneered copings and electroformed gold.Majority of dentistry crowns are made up of 65 - 75% gold, thus making it largely adopted alloy for inlays and onlays cavity applications. Inlays, onlays, and partial dental crowns should offer high marginal fit and durability for long time. Gold alloys are largely preferred for production of dental crowns and other cavity lay products owing to its malleability and ductility.

In 2021, the dental implants application was the largest revenue generator, and is anticipated to grow at a CAGR of 5.2% during the forecast period. Titanium alloys are widely used in dental alloys owing to its physio chemical properties. Selecting and using of appropriate base metal or alloy is crucial for ensuring longevity of dental implants. In addition, alloys used in dental implants should be bio-compatible. Titanium base metal used for production of dental alloys are bio-compatible making it widely adopted alloy in dental implants. In addition, in order to replace broken tooth and missing tooth structure several dental implants are being used. Growing demand for dental implants is anticipated to drive the demand for dental alloys intended to be used for dental implant application.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the dental alloys market analysis from 2021 to 2031 to identify the prevailing dental alloys market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the dental alloys market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global dental alloys market trends, key players, market segments, application areas, and market growth strategies.

Dental Alloys Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 3.1 billion |

| Growth Rate | CAGR of 4.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 290 |

| By Alloy Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | 88Dent, Jensen Dental, Kuraray Europe GmbH, Sterngold Dental LLC, Kulzer GmbH, Aurident Inc., Success Dental Co., Kerr Corporation, Ivoclar Vivadent, Dentsply Sirona, Argen Corporation, Kennametal Inc., Yamamoto Precious Metal Co. Ltd., Heraeus Holding, Aalba Dent Inc. |

Analyst Review

The global dental alloys market is expected to exhibit high growth owing to its use in dental restoration and dental implants application. Selection and usage of appropriate base metal or alloy is crucial for ensuring longevity of dental implants. In addition, alloys used in dental implants should be bio-compatible. Titanium-based metal used for production of dental alloys are bio-compatible making it widely adopted alloy in dental implants. In addition, in order to replace broken tooth and missing tooth structure, several dental implants are being used. Growth in demand for dental implants is anticipated to drive the demand for dental alloys, intended to be used for dental implant application. The quality of dental implants is utmost important and key-players in the dental implant market have adopted new production technologies. This factor is further anticipated to offer new growth opportunities for dental alloys market. The surface chemistry is considerable factor for using dental alloys in implant application. Titanium based metal offer high surface chemistry characteristics making it widely chosen for production of dental alloys that further used in dental implants drives the demand for dental alloys.

Nickel-based alloys are widely used in prosthodontics application. Factors such as corrosion inhibition, potentiodynamic polarization, and surface morphology of nickel make it suitable to be used in dental applications. Nickel based alloys are used for production of denture bases and partial denture structures. Nickel-based dental alloys are used for making dental prosthesis owing to its economic benefits and mechanical strength. These are the upcoming trends of dental alloys market in the world

Dental implants is the leading application of dental alloys market

Europe is the largest regional market for dental alloys

The global dental alloys market forecast was valued at $1.9 billion in 2021, and is projected to reach $3.1 billion by 2031, growing at a CAGR of 4.89% from 2022 to 2031.

Alba Dent Inc., Argen Corporation, Aurident Inc., and Kennametal Inc. are the top companies to hold the market share in dental alloys

Loading Table Of Content...