Dental Lab Market Research, 2033

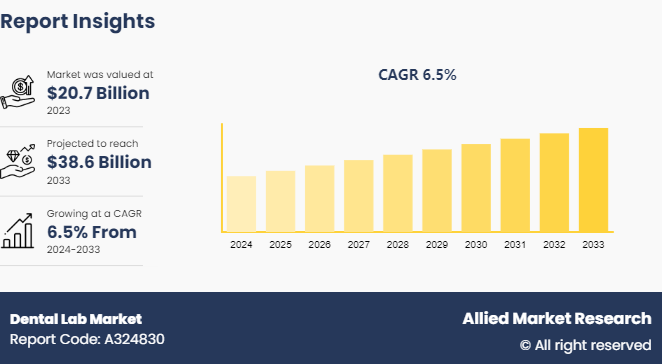

The global dental lab market size was valued at $20.7 billion in 2023, and is projected to reach $38.6 billion by 2033, growing at a CAGR of 6.5% from 2024 to 2033.

Market Introduction

Dental laboratories play a crucial role in dental care, specializing in the creation of dental prosthetics, including crowns, bridges, dentures, and orthodontic appliances. These laboratories use advanced technologies like CAD/CAM (Computer-Aided Design and Computer-Aided Manufacturing) to ensure precision and quality in their products. Dental technicians in these labs work closely with dentists to customize and fabricate these devices to meet the specific needs of patients. The integration of digital dentistry has significantly improved the efficiency and accuracy of dental lab work. Therefore, dental laboratories not only enhance the functional and aesthetic aspects of dental care but also contribute to better overall patient outcomes by providing advanced solutions. This combination of skilled workforce and technological innovation ensures that dental laboratories remain essential in the field of modern dentistry.

Key Takeaways

- The dental lab market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($billion) for the projected period from 2024 to 2033.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major dental lab treatment industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach intends to provide a balanced view of global markets and assist stakeholders in making informed decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The rising demand for cosmetic dental procedures is anticipated to significantly boost the growth of dental labs. As more individuals seek aesthetic enhancements such as teeth whitening, veneers, and smile makeovers, the need for specialized dental lab services is projected to increase. This trend is driven by a growing focus on personal appearance and advancements in dental technology, making cosmetic treatments more accessible and effective. Consequently, dental labs are expected to experience increased business opportunities, necessitating expansion and innovation to meet the increase in demand for high-quality, custom dental products and services.

However, the high cost of technological integration poses a significant challenge for dental labs. Keeping pace with rapid advancements, such as digital impressions and 3D printing, is expensive and necessitates continuous training for lab technicians. This financial strain is expected to hamper the growth of dental labs, as they struggle to afford the latest equipment and maintain a skilled workforce.

Partnerships between dental clinics and dental labs are expected to boost market expansion in the upcoming years. These collaborations ensure a steady stream of business for labs while keeping them updated on the latest cosmetic procedures. By fostering mutual growth and innovation, both dental practices and labs can enhance their offerings and improve patient outcomes. Such strategic alliances not only provide a consistent workflow but also enable both parties to stay at the forefront of advancements in dental technology and techniques, driving the overall growth of the industry.

Dental Market Analysis

The dental industry is closely regulated by bodies ensuring standards and safety, with recent trends emphasizing innovative technologies and patient-centric care. The FDA and ADA in the U.S., and the European Medicines Agency (EMA) in Europe, are responsible for overseeing product approvals and maintaining quality standards. A notable development occurred in May 2023, when the American Dental Association established a canvass committee to evaluate the 2023 revision of the Systemized Nomenclature of Dentistry (SNODENT) . This evaluation adheres to ANSI/ADA Standard No. 2000.6, recognized by the American National Standards Institute. Annual updates to this vital dental terminology system involve significant contributions from dental experts, ensuring its relevance and accuracy in the evolving dental landscape. These regulatory and standardization efforts reflect a commitment toward enhancing dental practices and patient outcomes globally.

Governments of various countries, including the U.S., are prioritizing advanced healthcare infrastructure, notably expanding dental services. This initiative aligns with broader efforts to enhance public health and ensure medical access. By investing in dental expenditure within government programs, policymakers aim to improve preventive and treatment services, catering to diverse population needs. This strategic allocation reflects a commitment toward holistic healthcare, recognizing oral health as integral to overall well-being. Such initiatives not only address immediate dental concerns but also contribute to long-term health outcomes, fostering healthier communities and reducing healthcare disparities.

U.S. National Dental Expenditures, 2018-2022 ($ Billion)

Year | U.S. National Dental Expenditures, 2018-2022 ($ Billion) |

2018 | 158 |

2019 | 163 |

2020 | 156 |

2021 | 176 |

2022 | 165 |

Source : American Dental Association, AMR Analysis, Secondary Research

Market Segmentation

The dental lab market is segmented into product type, material, equipment, and region. On the basis of product type, the market is divided into prosthetics, endodontics, oral care, therapeutics/orthodontics, restoration & cosmetic, and others. As per material, the market is classified into metal ceramics, glass ceramics, metals, and others. Based on equipment the market is divided into dental radiology equipment, dental lasers, system & parts, dental scanners, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

North America is expected to secure a substantial share in the market owing to numerous factors. The region's leading position can be attributed to a combination of factors such as advanced technological infrastructure, a robust healthcare system, and a high prevalence of dental disorders. Moreover, North America has a high geriatric population, which often requires extensive dental care, further driving the demand for dental lab services. In addition, the presence of key market players and a strong emphasis on R&D activities contribute to the region's prominence.

- In February 2024, Carbon, a product development and manufacturing technology company, unveiled its Automatic Operation (AO) suite, designed to revolutionize dental lab automation. This innovative suite aims to address the unique demands of dental labs, supporting in a new era of efficiency and productivity. By integrating the AO suite into existing workflows, labs can make use of Carbon's unique precision and efficiency, significantly cutting down on print turnover times and labor-intensive processing tasks. With Carbon's AO suite, dental labs would benefit from streamlined operations and enhanced output quality, setting a new standard in the field of lab automation.

Competitive Landscape

The major players operating in the dental lab market include Envista Holdings Corporation, Dentsply Sirona, A-dec Inc., Straumann AG, SHINING 3D, Apex Dental Laboratory Group, Knight dental design, National Dentex Corporation, 3M Health Care, and Dental Services Group.

Other players in the dental lab market include ZimVie and Ultradent Products Inc.

Recent Key Strategies and Developments

- In December 2023, SHINING 3D unveiled significant enhancements to its AccuFab-L4D, aiming to strengthen its precision, efficiency, and longevity. The updates include the incorporation of a small ceramic platform, a compact resin tank, and various software refinements. These improvements not only improve printing accuracy and speed but also extend the system's operational lifespan. Notably, the introduction of the small ceramic platform is expected to revolutionize biocompatibility, particularly for Class II and higher-grade resins. Crafted with thorough engineering, this platform features durability, promising a lifespan exceeding two years. Its high-hardness surface not only ensures stability during model printing but also enhances resistance against damage during cutting procedures. With these advancements, the AccuFab-L4D emerges as a more robust and versatile solution, catering to diverse professional needs in additive manufacturing and beyond.

Industry Trends

- In June 2024, Sheffield-based laboratory S4S Dental launched the Smilelign product, available with new features benefiting both dentists and patients. The new Smilelign product offers a premium aligner material, luxury packaging, faster turnaround times, free retention, and free Boutique Whitening.

In August 2023, the new MGF X Line range of oil-free compressors was launched by MGF Compressors and distributed in the UK by FPS Air Compressors. It offers dental labs using CAD/CAM-driven milling machines and 3D printers a reliable source of clean, dry compressed air, eliminating contamination risks. This innovative technology ensures precise and high-integrity production of dental prosthetics, essential for CAD/CAM milling processes. In addition, the MGF X Line compressors provide increased air capacity, leading to reduced energy bills, thus enhancing both operational efficiency and cost-effectiveness for dental labs.

Key Sources Referred

- National Association of Dental Laboratories (NADL)

- American Dental Association (ADA) - Laboratory Registration Program

- SHINING 3D

- Envista Holdings Corporation

- Dentsply Sirona

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the dental lab market analysis from 2023 to 2033 to identify the prevailing dental lab market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the dental lab market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global dental lab market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the dental lab marketplayers.

Apart from the points mentioned above, the report includes the analysis of the regional as well as global dental lab market trends, key players, market segments, application areas, and market growth strategies.

Dental Lab Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 38.6 Billion |

| Growth Rate | CAGR of 6.5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 295 |

| By Product Type |

|

| By Material |

|

| By Equipment |

|

| By Region |

|

| Key Market Players | Dentsply Sirona, Straumann AG, Apex Dental Laboratory Group, SHINING 3D, Knight dental design, Dental Services Group, Envista Holdings Corporation, A-dec Inc., 3M Health Care, National Dentex Corporation |

Partnerships between dental clinics and dental labs are expected to boost market expansion in the upcoming years.

The system & parts sub-segment is projected to dominate during the forecast period. This growth is driven by integration of advanced equipment and sophisticated systems in dental labs owing to improved efficiency and enhanced capabilities.

North America region to dominate the dental lab market.

The dental lab market was valued at $20.70 billion in 2023.

The major players operating in the dental lab market include Envista Holdings Corporation, Dentsply Sirona, A-dec Inc., Straumann AG, SHINING 3D, Apex Dental Laboratory Group, Knight dental design, National Dentex Corporation, 3M Health Care, and Dental Services Group.

Loading Table Of Content...