Dermal Filler Market Research, 2033

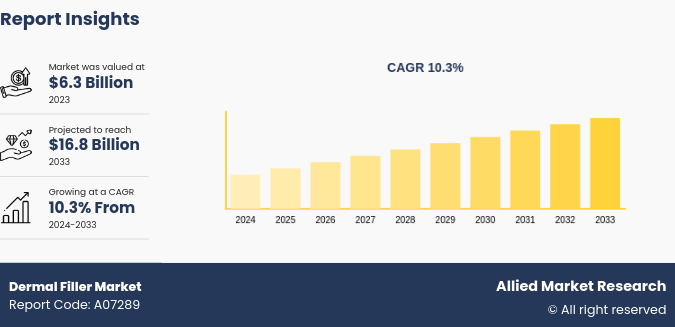

The global dermal filler market size was valued at $6.3 billion in 2023, and is projected to reach $16.8 billion by 2033, growing at a CAGR of 10.3% from 2024 to 2033. The rising demand for minimally invasive cosmetic procedures, rise in aging population seeking anti-aging treatments, advancements in filler technologies improving safety and efficacy which drives the market growth.

Market Introduction and Definition

Dermal fillers represent a non-surgical and minimally invasive cosmetic procedure wherein a tissue-friendly gel is injected into specific areas, typically the face, to address lines, wrinkles, and volume loss. Dermal filler encompasses a range of products used in cosmetic and medical procedures to restore volume, smoothen wrinkles, and rejuvenate skin. These fillers typically consist of various substances such as hyaluronic acid, calcium hydroxylapatite, and poly-L-lactic acid, injected into the skin to enhance facial contours and reduce the signs of aging. As an increasingly popular non-surgical solution, dermal fillers offer patients minimally invasive options for facial rejuvenation and enhancement. Their versatility, effectiveness, and relatively low risk profile contribute to the growing demand for these products, making the dermal filler market a pivotal segment within the broader cosmetics and aesthetics industry.

Key Takeaways

The dermal filler market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major dermal filler industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The global dermal filler market growth is driven by increase in prevalence of age-related concerns such as wrinkles, fine lines, and volume loss, particularly among aging populations worldwide. Rise in number of dermal filler procedures, increased acceptance of cosmetic procedures, well developed healthcare infrastructure, and rise in medical tourism are some of the key factors driving the growth of the market. In addition, advancements in filler technology represent another significant driver of dermal filler market size. Manufacturers are constantly innovating to develop new and improved formulations that offer better outcomes, longer-lasting results, and enhanced safety profiles. For example, the introduction of hyaluronic acid-based fillers with varying degrees of cross-linking has revolutionized the market, providing practitioners with greater flexibility and control over treatment outcomes. Similarly, the development of biodegradable and bioresorbable fillers addresses sustainability concerns and appeals to environmentally conscious consumers.

Moreover, the growing acceptance of minimally invasive procedures is contributing to the popularity of dermal fillers which is expected to drive the growth during the dermal filler market forecast period. Unlike traditional surgical interventions, which often entail significant downtime and recovery periods, dermal filler treatments are quick, convenient, and require minimal to no downtime. This appeal to busy lifestyles and the desire for subtle, natural-looking results has led to an increase in the adoption of dermal fillers among a broad demographic range.

However, the high cost of dermal fillers and stringent regulations can hinder market entry for new products and limit the availability of certain formulations, thereby constraining market growth. On the other hand, the rise of minimally invasive techniques and advanced delivery methods, including microcannulas and injection devices, enhances treatment precision, safety, and patient comfort, driving demand for dermal fillers which provides lucrative dermal filler market opportunity.

Non-Surgical Cosmetic Procedures Data for Global Dermal filler Market

In cosmetic procedures, dermal fillers stand as a prominent choice alongside various treatments. According to report of International Society of Aesthetic Plastic Surgery (ISAPS) in 2022, Botulinum toxin emerges as the most prevalent cosmetic intervention, with a substantial preference observed among females, with 7, 850, 924 procedures compared to 1, 370, 495 among males. Similarly, Hyaluronic Acid injections are more commonly sought after by females, with 3, 740, 777 procedures, compared to 571, 260 among males. Hair Removal procedures also exhibit a notable gender discrepancy, with 1, 517, 217 conducted on females compared to 281, 036 on males. Chemical peels, non-surgical fat reduction, and non-surgical skin tightening procedures show a similar trend, with significantly higher numbers among females compared to males. Conversely, cellulite treatment sees higher numbers among females, while males show a preference for full field ablative procedures. Calcium Hydroxylapatite procedures also demonstrate a higher incidence among females. This diverse landscape reflects the inclusive nature of cosmetic enhancement, where dermal fillers play a central role in addressing various aesthetic concerns for both men and women.

Non-Surgical Cosmetic Procedures in 2022

Non-Surgical Cosmetic Procedures | Female | Male |

Botulinum Toxin | 7850924 | 1370495 |

Hyaluronic Acid | 3740777 | 571260 |

Hair Removal | 1517217 | 281036 |

Chemical Peel | 701864 | 142752 |

Non-Surgical Fat Reduction | 642067 | 136650 |

Non-Surgical Skin Tightening | 601729 | 132527 |

Cellulite Treatment | 433487 | 15827 |

Full Field Ablative | 294277 | 73706 |

Calcium Hydroxylapatite | 291263 | 59454 |

Source : Aesthetic Plastic Surgery (ISAPS)

Market Segmentation

The dermal filler market is segmented into type, gender, service provider, and region. On the basis of type, the market is categorized into Hyaluronic acid (HA) , Calcium Hydroxylapatite (CaHA) , Poly L lactic Acid, and others. Hyaluronic acid (HA) segment is further classified on the basis of age group 13 to 39, 40 to 54, and 55 to 69. On the basis of gender, the market is bifurcated into male and female. On the basis of service provider, the market is segregated into specialty and dermatology clinics, hospitals, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

The North America has significant dermal filler market share in 2023 owing to rise in demand for cosmetic procedures and a well-established healthcare infrastructure. Europe follows suit, with countries such as the UK, Germany, and France witnessing steady growth fueled by increasing awareness about cosmetic procedures and acceptance of aesthetic treatments. In the Asia-Pacific region, markets including South Korea and Japan lead in innovation and adoption of dermal fillers, driven by cultural emphasis on youthfulness and beauty. Emerging economies such as China and India offer significant growth potential due to rising disposable incomes, rise in number of minimally invasive procedures and growth in demand for dermal fillers.

According to American Society of Plastic Surgeons, there were 26.2 million surgical and minimally invasive cosmetic and reconstructive procedures performed in the U.S. in 2022.

According to Aesthetic Society, Americans spending over $14.6 billion dollars on aesthetic procedures in 2021 with surgical revenues increasing by 63%.

Data published by the International society of Plastic Surgery (ISAPS) , stated that a total of 77, 924 non-surgical procedures were performed in the UK in 2022.

In December 2023, SYMATESE enters into an exclusive licensing agreement with EVOLUS. SYMATESE broadens its commercial territories in Europe and UK for ESTYME FILLERS, based on its Next-Generation generation HA technology EVOLUS neurotoxin, NUCEIVA will be marketed in France by SYMATESE subsidiary.

According to a report of American Society of Plastic Surgeons, around 4.8 million cosmetic minimally invasive procedures performed in the U.S. in 2022.

Industry Trends

According to report of Aesthetics Society, 649, 176 dermal fillers non-surgical procedures performed in the U.S. in 2022 and dermal filler procedures accounted for 14% of the total nonsurgical revenue in the U.S. in 2022.

According to a report of International Society of Aesthetic Plastic Surgery (ISAPS) , a total 521, 169 Hyaluronic acid procedures were performed in the U.S. in 2022.

According to a report of International Society Of Aesthetic Plastic Surgery (ISAPS) , a total 793, 934 injectables procedures were performed in Brazil in 2022.

A data published by the International society of Plastic Surgery (ISAPS) , a total of 571, 661 non-surgical procedures performed in Germany in 2022.

An article published by National Center for Biotechnology and Information (NCBI) in June 2023, according to the International Society of Aesthetic Plastic Surgery 2021 statistics, dermal fillers are the second most popular non-surgical procedure after onabotulinum toxin A, accounting for 30% of all non-surgical operations.

According to a data of International Society of Aesthetic Plastic Surgery (ISAPS) report, a total 1, 882 Calcium Hydroxylapatite procedures performed in Japan in 2022.

Competitive Landscape

The major players operating in the dermal filler market include Teoxane Laboratories, Cutera Inc, Elan aesthetics Inc, Bioxis pharmaceutical, AbbVie Laboratories, Sinclair Pharma, ?Sosum Global, Revance Therapeutics, Galderma SA, and Merz Pharma. Other players in dermal filler market include BIOPLUS CO., LTD., Suneva Medical., Prollenium Medical Technologies and so on.

Recent Key Strategies and Developments in Dermal Filler Industry

In March 2024, Allergan Aesthetics, an AbbVie company announced the U.S. FDA approval of JUVÉDERM VOLUMA XC for injection in the temple region to improve moderate to severe temple hollowing in adults over the age of 21. JUVÉDERM VOLUMA XC is the first and only hyaluronic acid (HA) dermal filler to receive U.S. FDA approval for the improvement of moderate to severe temple hollowing with results lasting up to 13 months with optimal treatment.

In April 2022, Sinclair Pharma announced the company received European CE mark for Perfectha Lidocaine in the treatment of wrinkle correction, facial contouring and volume restoration. This CE certificate resulted in the launch of Perfectha Lidocaine in the UK and all major European markets.

Key Sources Referred

National Center for Biotechnology and Information (NCBI)

Centers for Medicare & Medicaid Services (CMS)

National Health Service (NHS)

Australian Government Department of Health and Aged Care

Government of Canada's Health and Wellness

Ministry of Health and Family Welfare (MoHFW)

National Health Mission (NHM)

Ayushman Bharat - Health and Wellness Centers (AB-HWCs)

Centers for Disease Control and Prevention (CDC)

Food and Drug Administration (FDA)

National Institutes of Health (NIH)

World Health Organization (WHO)

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the dermal filler market analysis from 2024 to 2033 to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the dermal filler market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global dermal filler market trends, key players, market segments, application areas, and market growth strategies.

Dermal Filler Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 16.8 Billion |

| Growth Rate | CAGR of 10.3% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Type |

|

| By Gender |

|

| By Service Provider |

|

| By Region |

|

| Key Market Players | Elan aesthetics Inc, Merz Pharma, Teoxane Laboratories, Bioxis pharmaceutical, Revance Therapeutics, Galderma SA, Sinclair Pharma, Cutera Inc, Sosum Global, AbbVie Laboratories |

The global dermal filler market is driven by rising demand for minimally invasive cosmetic procedures, shift towards longer-lasting and biocompatible fillers, increased adoption among younger demographics, and advancements in technology leading to more precise application techniques.

North America holds the largest share in the global dermal filler market, driven by high consumer awareness, significant adoption of cosmetic procedures, and advanced healthcare infrastructure supporting aesthetic treatments.

The leading application of dermal fillers is in facial line correction and wrinkle treatment, addressing issues such as nasolabial folds, marionette lines, and facial volume loss.

Dermal fillers refer to injectable substances used to smooth wrinkles, add volume, and improve facial contours. They are commonly used in cosmetic procedures to rejuvenate and enhance the appearance of the skin, providing a temporary solution to aging-related changes and facial asymmetries.

The global dermal filler market is estimated to reach $16.8 billion by 2033.

The total market value of dermal filler market is $6.3 billion in 2023.

The top companies that hold the market share in dermal filler market are AbbVie Laboratories, Bioxis pharmaceutical, Cutera Inc., Elan aesthetics Inc., Galderma SA, and Merz Pharma GmbH & Co. KGaA.

Loading Table Of Content...