Desiccant Market Size & Insights: 2032

The global desiccant market size was valued at $1.1 billion in 2022 and is projected to reach $1.8 billion by 2032, growing at a CAGR of 5.1% from 2023 to 2032.

Report Key Highlighters:

- The desiccant market study covers 20 countries. The research includes a segment analysis of each country in terms of both value ($million) and volume (kilotons) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The desiccant market is highly fragmented, with several players including Fuji Silysia Chemical Ltd., Hengye, Inc., TROPACK Packmitel GmbH, CLARIANT, Capitol Scientific, Inc. Multisorb, OKER-CHEMIE, Evonik Industries AG, Desicca Chemical Pvt. Ltd., and W. R. Grace & Co.-Conn.

Introduction

"Desiccants" are products or materials that are hygroscopic. Desiccants absorb moisture from the surrounding environment. By absorbing moisture, they reduce humidity and aid in preventing the damage that moisture causes to products. Physical absorption is the process whereby desiccants absorb moisture and trap it within surfaces or capillaries without modifying the properties of the water. However, certain desiccants absorb moisture and generate a new substance through a chemical reaction with it. This is referred to as chemical assimilation. Chemical absorption is irreversible, whereas physical absorption of moisture is reversible. Desiccants such as zeolites, silica gel, and others absorb moisture physically, while magnesium sulfate, calcium chloride, and others absorb moisture chemically.

Desiccants play a crucial role in the shipment of food and pharmaceuticals by absorbing moisture and maintaining a controlled atmosphere in order to preserve product quality during transport. Desiccants are used in the production of insulated windows to prevent moisture condensation on the panes. As drying components, air conditioning systems use desiccants such as zeolites to preserve the efficacy of the refrigerant. Zeolites are used as dehydrating agents in the Grignard reaction, which requires the removal of water from solvents.

Increasing demand for desiccants from the food industry will drive the growth of the market.

In the food industry, desiccants are employed to reduce moisture-related concerns that could lead to spoilage, degradation of taste, texture, and nutritional value, as well as the growth of harmful microorganisms. This is particularly crucial in products such as cereals, snacks, and dried fruits. In addition, the increase in demand for packaged and processed foods, coupled with the globalization of the food supply chain, illustrates the need for effective moisture control to prolong shelf life and prevent economic losses.

Many foods and supplements contain desiccant to prevent clumping, allowing easier packaging, shipping, flow-ability, and eventual consumption. India’s food processing sector stood at $393.41 million in 2020-21, which is expected to reach $ 470 billion by 2025. Moreover, the total agricultural and allied products exports stood at $41.25 billion in FY21. As the food industry is expanding, the demand for desiccants is expected to rise, thus driving the growth of the desiccant market during the forecast period.

Increase in demand for desiccants from the pharmaceutical industry

The pharmaceutical industry is witnessing a substantial surge in demand for desiccants, driven by their pivotal role in maintaining the quality and efficacy of pharmaceutical products. Desiccants are crucial in preventing moisture-related damage to medicines, vaccines, and medical devices, which are highly sensitive to even slight fluctuations in humidity. As pharmaceutical products often undergo long journeys through various climatic conditions, the risk of degradation due to moisture absorption remains a significant concern. Desiccants help to counteract this risk by effectively absorbing excess moisture and maintaining the stability and integrity of the products.

Moreover, advancements in pharmaceutical R&D have led to the production of more intricate and delicate medications, many of which are prone to deterioration when exposed to moisture. As precision and efficacy become paramount in drug formulations, the demand for enhanced moisture control solutions intensifies. This has prompted pharmaceutical manufacturers to prioritize the integration of desiccant technologies into their packaging and storage processes to ensure the longevity and effectiveness of their products. According to the National Bureau of Statistics, in 2021, China’s pharmaceutical industry’s value-added increased by 24.8% over the previous year.

Furthermore, according to the India Brand Equity Foundation (IBEF), in 2021, India’s pharmaceutical industry was worth $42 billion. It is expected to grow to $65 billion by 2024 and to more than $120 billion by 2030. The pharmaceutical industry in India is currently valued at $41 billion. The growth of the pharmaceutical industry coupled with investments such as the Production Link Incentive (PLI) scheme in India by the Government of India for enhancing India’s manufacturing capabilities and enhancing exports is driving the desiccant market in the Asia-Pacific region. These initiatives by the government and the growing concern for health are contributing to the growth of the desiccant market in the Asia-Pacific region.

In addition to safeguarding product quality, regulatory standards, and compliance play a critical role in driving the demand for desiccants in the pharmaceutical sector. Thus, the expanding pharmaceutical sector with its increasing demand for desiccant is expected to drive the growth of the desiccant market during the forecast period.

Chemical absorption is more effective than physical absorption. However, chemical absorption is significantly more expensive than physical absorption desiccants, which is precisely why physical absorption desiccants are currently in greater demand in the market, owing to which there is a significant market demand for desiccants such as silica gel and zeolites. While handling desiccants, care must be taken to avoid contact with the human body, as desiccants absorb water and may produce adverse effects. Therefore, particular packing materials must be used to ensure the safety of desiccants. However, high investment costs for the installation of machinery and high maintenance costs are major restraints of the desiccant market.

Furthermore, due to the rise in global population and disposable income, the electronic industry is undergoing a period of rapid expansion. According to Statista, revenue in the consumer electronics market amounts to $1,028.0 Bn in 2023. The downsizing of electronic components and packaging is a progressive process. Sensitive electronic equipment must be handled carefully during transportation and storage. Even the smallest amount of moisture or humidity can cause irreparable harm to electronic devices. If the equipment is costly to purchase and produce, this leads to substantial losses. As a result, producers in the electronic industry are exerting significant effort to minimize the effect of moisture on their products. This factor is anticipated to offer a lucrative opportunity for the desiccant market.

Segments Overview

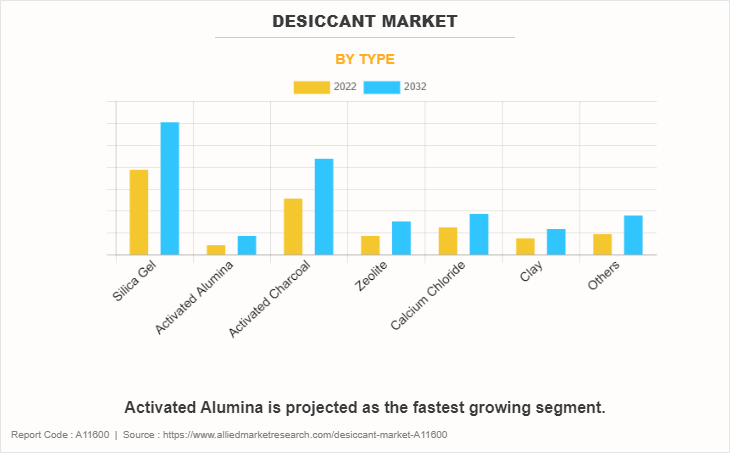

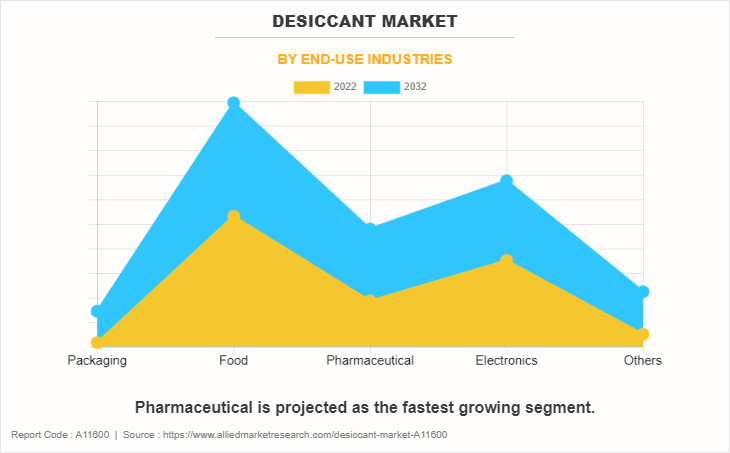

The desiccant market is segmented into type, end-use industry, and region. Depending on the type, the market is divided into silica gel, activated alumina, activated charcoal, zeolite, calcium chloride, clay, and others. On the basis of the end-use industry, it is categorized into packaging, food, pharmaceutical, electronics, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, And LAMEA.

On the basis of type, the silica gel segment held the highest market share in 2022, accounting for more than one-third of the global desiccant market revenue. Silica gel serves as a desiccant due to its high surface area and strong affinity for water molecules. Its porous structure absorbs moisture, making it a reliable choice for preserving dryness in various applications, such as food packaging, electronics, and pharmaceuticals.

The activated alumina segment is the fastest-growing segment with a CAGR of 7.3%. Activated alumina is a widely used desiccant due to its high surface area, porous structure, and strong water adsorption capabilities. It's employed in drying gases and liquids, purifying industrial processes, and removing moisture in compressed air systems, making it essential for various industrial applications.

On the basis of the end-use industry, the food segment held the highest market share in 2022, accounting for more than one-third of the global Desiccant market revenue. Desiccants are vital in the food industry to maintain product quality and safety. They absorb moisture, preventing spoilage, mold growth, and clumping in products like spices, dried fruits, and packaged goods. Desiccants also extend shelf life, enhance flavor, and prevent caking, ensuring food products remain fresh and palatable.

The pharmaceutical industry is the fastest-growing industry with a CAGR of 5.8%. Desiccants play a crucial role in the pharmaceutical industry by absorbing moisture and maintaining product stability. They are used in packaging to prevent the degradation of sensitive drugs, extend shelf life, and maintain efficacy. Desiccants also help prevent mold growth, ensuring the safety and quality of pharmaceutical products.

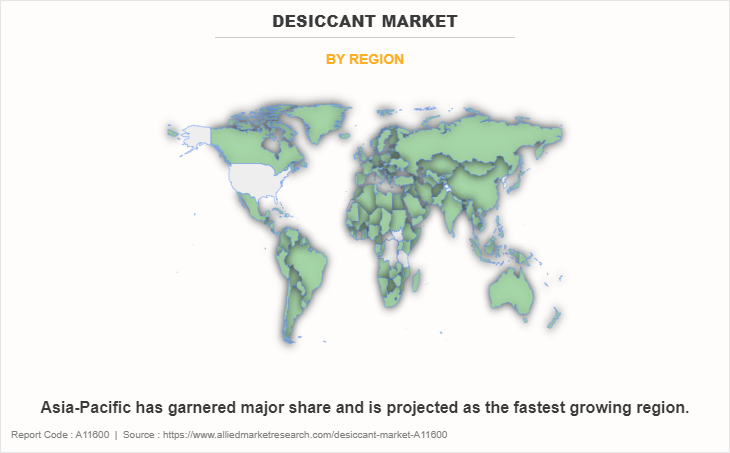

Based on region, Asia-Pacific held the highest market share in terms of revenue in 2022, accounting for nearly two-fifths of the global Desiccant market revenue The Asia-Pacific desiccant market is being driven by the expansion of the pharmaceutical industry in countries such as China, India, and Japan. India's pharmaceutical industry is presently worth $41 billion. The Asia-Pacific desiccant market is being driven by the expansion of the pharmaceutical industry as well as government investments such as the Production Link Incentive (PLI) scheme in India, which aims to improve exports and manufacturing capabilities in the country. The desiccant market in the Asia-Pacific region is expanding as a result of these government initiatives and the increased concern about health.

Competitive Analysis

The major players operating in the global desiccant market are Fuji Silysia Chemical Ltd., Hengye, Inc., TROPACK Packmitel GmbH, CLARIANT, Capitol Scientific, Inc. Multisorb, OKER-CHEMIE, Evonik Industries AG, Desicca Chemical Pvt. Ltd., and W. R. Grace & Co.-Conn. Other players include Porocel Corporation, The Dow Chemical Company, INEOS Corporation, Qingdao Makll Group, Zeotec Adsorbents Private Limited,AGM Container Controls, Delta Adsorbents, and others.

Public Policies:

- Desiccants used in the pharmaceutical and food industries must adhere to regulations set forth by the U.S. Food and Drug Administration (FDA). These regulations ensure that desiccants do not contaminate the products they are intended to protect and that they maintain the safety and quality of medications and food items.

- Desiccant manufacturers need to comply with environmental regulations enforced by the Environmental Protection Agency (EPA) Guidelines. This includes considerations related to the materials used in desiccants, waste disposal, and potential impacts on air and water quality.

- U.S. Pharmacopeia / National Formulary (USP/NF) Monograph for Silicon Dioxide.

- U.S. 21 CFR 172 food additives permitted for direct addition to food for human consumption.

- Hazardous substance requirements under European Regulation (EC) 1272/2008 on classifications, labeling, and packaging of substances and mixtures (REACH).

- European Regulation (EC) 1935/2004 and its amendments to materials and articles intended to come into contact with food.

- European Regulation (EC) 2023/2006 on good manufacturing practices for materials and articles intended to come into contact with food.

- European Directive 76/768/EEC and its amendments (listed as coloring agent 77004 in Annex IV Part 1), allow for use in cosmetic products with no restrictions.

- REACH Regulation (EC) 1907/2006 aims to assess and manage potential risks associated with desiccant substances while promoting their safe use.

- Under REACH regulations, desiccants such as silica gel sachets and calcium chloride sachets are considered substances within an article (the sachet). This means that the contents of the sachet must be registered under REACH.

Russia-Ukraine War Impact Analysis:

The Russia-Ukraine war can potentially impact the desiccant market in several ways. The conflict may disrupt the supply chains of desiccant manufacturers and raw material suppliers located in the region, leading to potential shortages and price fluctuations. With pharmaceuticals and other essential goods being transported to affected areas, there could be an increased demand for desiccants in packaging to protect products from moisture-related damage. Furthermore, the political instability and trade tensions resulting from the conflict can affect international trade, potentially impacting the desiccant market's global distribution and pricing. Moreover, the currency devaluation and economic instability in the region can affect the cost of imports and exports, influencing desiccant prices. Overall, the impact on the desiccant market will depend on the duration and severity of the conflict and its consequences on regional and global trade dynamics.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the desiccant market analysis from 2022 to 2032 to identify the prevailing desiccant market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the desiccant market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global desiccant market trends, key players, market segments, application areas, and desiccant market growth strategies.

Desiccant Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 1.8 billion |

| Growth Rate | CAGR of 5.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 327 |

| By Type |

|

| By End-use industries |

|

| By Region |

|

| Key Market Players | OKER-CHEMIE, Capitol Scientific, Inc., Desicca Chemical Pvt. Ltd., CLARIANT, Fuji Silysia Chemical Ltd., Multisorb, TROPACK Packmitel GmbH, Hengye, Inc., Evonik Industries AG, W. R. Grace & Co.-Conn. |

Analyst Review

According to the insights of the CXOs of leading companies, the growing demand for desiccants across industries such as pharmaceuticals, electronics, and food preservation, plays a crucial role in maintaining product quality by reducing moisture levels. The expansion of these industries, coupled with increasing awareness about the detrimental effects of moisture on sensitive goods, fuels the market growth. In addition, the increase in e-commerce and international trade increases the demand for effective moisture control during storage and transportation, thereby driving the expansion of the desiccant market during the forecast period. However, the environmental concerns surrounding traditional desiccants, often made of non-biodegradable materials, raise sustainability issues. This has led to rise in demand for eco-friendly alternatives. Moreover, pricing fluctuations of raw materials used in desiccant production can hamper the growth of the desiccant market.

The CXO further added that with the growing global focus on environmental responsibility, there is a growing need for biodegradable and reusable desiccants. Manufacturers can participate by developing eco-friendly options that align with consumer values and contribute to a greener future. This will offer a lucrative opportunity for the desiccant market.

Desiccant Market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Increase in demand for desiccants from the pharmaceutical industry and increase in demand for activated alumina from the oil and gas industry are the driving factors of the Desiccant Market.

Increase in use of desiccant in chemical sector and air conditioning system is the upcoming trend of Desiccant Market in the world.

Asia-Pacific is the largest regional market for Desiccant.

ROPACK Packmitel GmbH, CLARIANT, Capitol Scientific, Inc. Multisorb, OKER-CHEMIE, Evonik Industries AG, Desicca Chemical Pvt. Ltd., and W. R. Grace & Co.-Conn are the top companies to hold the market share in Desiccant.

The global desiccant market was valued at $1.1 billion in 2022 and is projected to reach $1.8 billion by 2032, growing at a CAGR of 5.1% from 2023 to 2032.

Food is the leading End-Use Industry of Desiccant Market.

Loading Table Of Content...

Loading Research Methodology...