Device as a Service Market Insights, 2031

The global device as a service market size was valued at USD 51.7 billion in 2021, and is projected to reach USD 1.8 trillion by 2031, growing at a CAGR of 42.6% from 2022 to 2031.

The rapid adoption of the subscription-based services model driving the device as a service market growth. In addition, increasing adoption of DaaS due to its adaptability, cost savings, and data security drive the growth of the device as a service market share. However, lack of awareness regarding the benefits offered by the device-as-a-service model, and security & data protection risks associated with device as a service industry hampering the growth of the device-as-a-service market size. On the contrary, the emergence of the wearable-as-a-service (WaaS) model will provide major lucrative opportunities for growth of the device as a service industry.

Major device as a service market players are undertaking various strategies to increase the competition and offer enhanced services to their customers. For instance, in April 2021, Lenovo Infrastructure Solutions Group (ISG) with Nutanix announces an As-a-Service solution for Hosted Desktops to help IT decision-makers thrive in the new remote hybrid workforce model. Lenovo TruScale, Lenovo’s first solution for Hosted Desktops with Nutanix, provides companies with a complete and more secure remote work solution. A choice of Lenovo client devices is offered, such as thin clients and PCs, a choice of Citrix and other virtual desktop environments, and ThinkAgile HX Series (powered by Nutanix), all licensed to the end user and managed as-a-service. The complete Hosted Desktops solution provides cloud-like simplicity and on-premises performance, with the convenience of a single monthly payment and a single point of contact for support.

The device as a service market has been witnessing significant growth, mainly owing to the rising demand for subscription-based models that help customers to convert the high cost of acquiring new technology from a capital expenditure (CapEx) to an operating expense (OpEx) and the ability to use the latest technologies and access customized services, including device configuration, installation, data migration, on-site support, and technology recycling, increasing demand.

Furthermore, the COVID-19 outbreak has further resulted in an increase in the demand for device-as-a-service solutions, especially in 2020 and 2021, and has resulted in the increasing growth rate of the device-as-a-service market. Moreover, the pandemic has forced companies to rapidly adopt remote working practices. The DaaS model is gaining popularity among organizations as it provides pre-configured hardware such as desktops, laptops, tablets, and smartphones, and customized software.

Top Impacting Factors

Rising Adoption of Cloud Services & Subscription-based Devices

Typically, small and medium-sized businesses do not have a substantial capital for updating their devices. DaaS enables businesses to convert their IT budgets into more manageable cash flows by utilizing subscription-based hardware devices. It reduces repair and ownership costs, allowing customers to make more strategic business decisions. Since DaaS is a subscription-based model that provides services at a low cost, organizations can quickly scale up or down based on their current business requirements. As a result, consumers worldwide are increasingly opting for DaaS due to its adaptability, cost savings, and data security.

The rapid adoption of the subscription-based services model is one of the key factors driving the market for device-as-a-service. Subscription-based device-as-a-service models enable clients to convert the high cost of acquiring new technology from a capital expenditure (CapEx) to an operating expense (OpEx) (OpEx). This allows small, medium, and large businesses to free up capital for investment in revenue-driving strategic initiatives.

In addition, additional benefits, such as policy compliance and the ability to use the latest technologies and access customized services, such as device configuration, installation, data migration, on-site support, and technology recycling, are gained. As a subscription service, the device-as-a-service model enables a company to quickly scale up or down based on its current operating environment and business requirements. Whether expanding or contracting, organizations can pay for precisely what they require when they need it. Therefore, these benefits of device-as-a-service propel the growth of the device as a service market.

The Emergence of BYOD & CYOD Technologies

BYOD and CYOD can slow down the growth of the global DaaS market because it prevents manufacturers from entering into contracts and maintaining long-term relationships. It is also possible to harm DaaS providers due to customers selecting their collaboration models and software to use with their teams and clients. Bring-Your-Own-Device, also known as BYOD, is a concept that is gaining popularity worldwide due to its many benefits, including lower hardware and services costs, increased user satisfaction, and the convenience of not requiring organizations to use a specific wireless carrier.

On the other hand, the Choose-Your-Own-Device (CYOD) model allows companies to give their employees access to a pre-approved selection of mobile devices from which they can make their selection. These devices are owned by the company or the employees who have paid for them. In addition to that, the mobile plan's expenses are taken care of by the model. As a result, the swift adoption of these models is a barrier to expanding the DaaS market.

The Emergence of the Wearable-as-a-Service (WaaS) Model

Wearable devices like smartwatches, virtual reality headsets, augmented reality glasses, and medical patches are convenient and are gaining popularity among end-users, including business enterprises. These businesses are primarily trying to benefit from the mobility and interoperability of wearable devices and the vast amount of data they generate. Wearable devices include smartwatches, VR headsets, AR glasses, and medical patches. In recent years, many businesses have initiated the production of wearable technology to market solutions known as wearables as a service (WaaS).

For instance, Omate is a Chinese company that provides a solution for wearables offered as a service. Similarly, the French banking and insurance company Arkéa recently introduced its WaaS model, enabling end-users or institutions to rent wearable devices. Because of this, there is no longer a requirement for an initial purchase of wearable devices, which removes a potential additional barrier during the sales process. As a result, some device manufacturers have begun developing smartwatches with the end-user demographics of recreational athletes, children, and the elderly in mind.

Segment Review

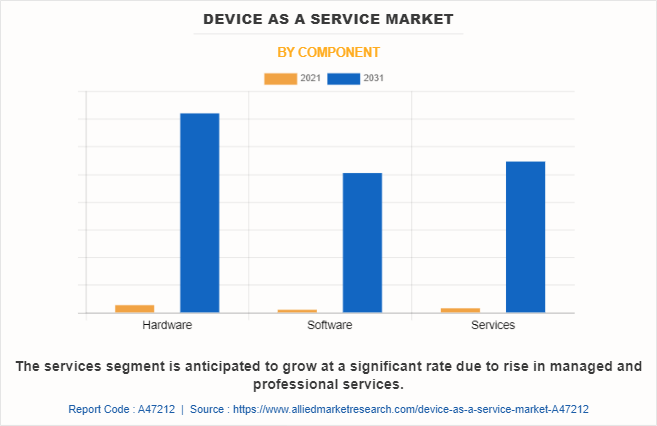

The DaaS market is segmented on the basis of component, device type, enterprise size, and industry vertical. By component, it is divided into hardware, software, and services. By device type, it is classified into desktop; laptop, notebook and tablet; and smartphone and peripheral. By enterprise size, it is bifurcated into larger enterprises and small & medium enterprises. By industry vertical, it is categorized into BFSI, IT & telecom, healthcare, retail, education, manufacturing, and others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of component, the hardware segment is the highest revenue contributor in device as a service market analysis in 2021. This is attributed to the increasing need of businesses to reduce capital expenditure (CAPEX) and operational expenditure (OPEX). However, the software segment is highest growing segment during the forecast period due to high rate of adoption of managed and professional services for device management.

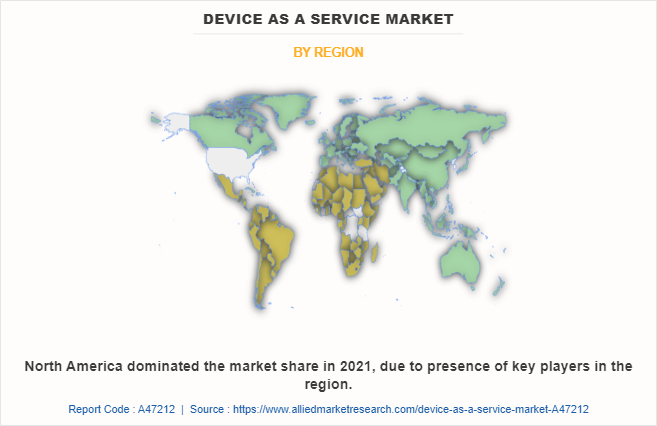

Based on region, North America attained the highest growth in 2021. This is attributed to the rise in adoption of the latest technologies such as cloud computing, the IoT, and new service models such as device-as-a-service. However, Asia-Pacific is the highest growing region due to rise in digital infrastructure and presence of number of SMEs.

Market Landscape & Trends

DaaS offers a spectrum of benefits to startup firms as well as giant organizations. This includes scaling up & improving the device ability, reducing the workload of IT employees of device configuration, and automating patch management activities. All these aforementioned aspects will steer device-as-a-service industry trends. In addition, the necessity of availing of customized solutions, data migration services, and on-site support will proliferate the size of the device as a service market over the forecast timeline. Furthermore, acceptance of subscription-based service models, the need for enhancing the productivity of the firms, and the need for security compliance will proliferate the expansion of the device-as-a-service industry size in the upcoming years.

Moreover, an escalating requirement of cost-efficient services and the need of highly secured equipment with exceptional stability will generate lucrative growth opportunities for the device as a service market during 2020-2026. Apart from this, technological breakthroughs, the surge in acceptance of connected things, and the huge penetration of high-speed web networks across the globe will help the market expand leaps & bounds over the assessment period. Nonetheless, data loss during disasters and huge monthly charges can prove detrimental to the growth of the device-as-a-service industry. Therefore, these are the trends attributed to increasing the growth of the device-as-a-service market.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the device as a service market forecast from 2021 to 2031 to identify the prevailing market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities of device-as-a-service market overview.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the device-as-a-service market segmentation assists in determining the prevailing device-as-a-service market opportunity.

Major countries in each region are mapped according to their revenue contribution to the global device as a service market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes an analysis of the regional as well as device as a service market trends, key players, market segments, application areas, and market growth strategies.

Device as a Service Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 1.8 trillion |

| Growth Rate | CAGR of 42.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 240 |

| By Device Type |

|

| By Enterprise Size |

|

| By Component |

|

| By Industry Vertical |

|

| By Region |

|

| Key Market Players | Hewlett Packard Enterprise Development LP, Intel Corporation, Accenture, Lenovo, Dell Inc., Cisco Systems Inc., Microsoft, CompuCom Systems, Inc. , Apple Inc., Cognizant |

Analyst Review

DaaS enables timely upgrade and maintenance of software and hardware, allowing companies to reduce the IT burden; moreover, the model helps avoid technological obsolescence, ultimately enhancing productivity. Flexible structuring of device-as-a-service offers businesses to scale up/scale down device count and attached services. These factors are expected to drive the market growth during the forecast period. Furthermore, the device-as-a-service model is gaining popularity among large as well as small and medium enterprises as it allows them to lease hardware such as laptops, desktops, smartphones, and tablets with preconfigured software or services. Moreover, the increased adoption of IoT is also expected to drive the demand for the model. Technological advancements, increasing penetration of high-speed networks, and growing advancements in web services are other factors expected to drive the growth of the Device-as-a-Service market.

Furthermore, market players are adopting strategies for enhancing their services in the market and improving customer satisfaction. For instance, in November 2022, Hewlett Packard Enterprise announced a next-generation compute portfolio that delivers a cloud operating experience designed to power hybrid environments and digital transformation. The new HPE ProLiant Gen11 servers provide organizations with intuitive, trusted, and optimized compute resources, ideally suited for a range of modern workloads, including AI, analytics, cloud-native applications, graphic-intensive applications, machine learning, Virtual Desktop Infrastructure (VDI), and virtualization. Furthermore, in February 2022, Cisco introduces new technologies to help businesses rapidly scale networks and digitize operations to redefine the campus experience to support hybrid work. It unveils the industry's first high-end Wi-Fi 6E access points, Private 5G for the enterprise as a managed service, and new high-powered Catalyst 9000X series switches with Cisco Silicon One to deliver top speeds and performance with the security needed for hybrid work.

The global device as a service market was valued at $51.73 billion in 2021, and is projected to reach $1,768.01 billion by 2031

The device as a service market is projected to grow at a compound annual growth rate of 42.6% from 2022 to 2031.

Accenture, Apple Inc., Cisco Systems Inc., Cognizant, CompuCom Systems, Inc., Dell Inc., Hewlett Packard Enterprise Development LP, Intel Corporation, Lenovo, and Microsoft.

North America is the largest regional market for Device as a Service market.

The rapid adoption of the subscription-based services model and increasing adoption of DaaS due to its adaptability, cost savings, and data security drive the growth of the device-as-a-service market size.

Loading Table Of Content...

Loading Research Methodology...