Dewatering Pumps Market Research, 2026

Dewatering Pumps Market Dynamics

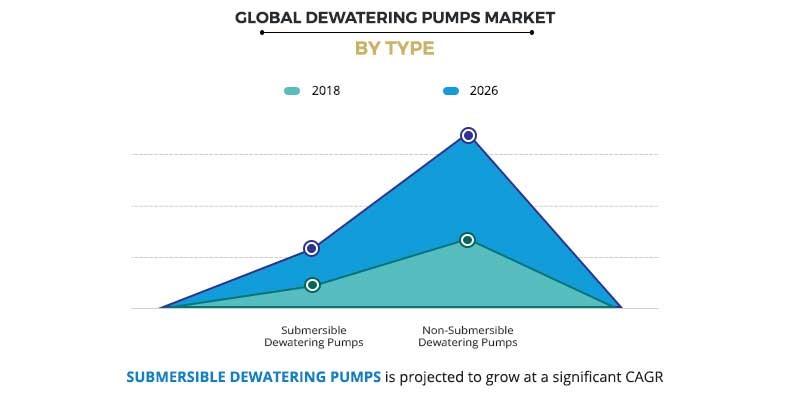

Two types of dewatering pumps are available in the market, which include submersible dewatering pumps and non-submersible dewatering pumps. Submersible dewatering pump is equipped with an airtight sealed motor, which is closely clamped to the machine. Non-submersible pumps are available in various types such as centrifugal dewatering pumps and wellpoint dewatering pumps. These pumps are a mechanical machine, which is positioned upon the surface that is used to bring the groundwater up to the dewatering pump unit present on the surface.

Increase in adoption of water removal pumps to eliminate the water which is accumulated in the excavated foundations or pit and surge in construction activities in urban areas are anticipated to fuel the growth of the global dewatering pumps market. One of the leading factors for the dewatering pumps market growth is focus of major vendors toward manufacturing pumps for dewatering applications.

For instance, ARO Fluid Management introduced P35A1-EU submersible dewatering pump, which is capable to handle a wide variety of debris-laden applications. In addition, upsurge in population and rapid urbanization & industrialization have led to the development of the construction industry, which in turn is anticipated to propel the growth of the dewatering pumps market. Moreover, several industries such as food & beverages, power generation, and others use these pumps, as they are highly efficient, have the large wear-resistant capacity, long service life, low maintenance, and wide flow-rate capacity. However, unstable prices of raw materials and high operating costs associated with its installation hamper the growth of the market.

Furthermore, rise in adoption of dewatering pumps in wastewater management and recycling is expected to create remunerative opportunities for market expansion. This is attributed to the fact that dewatering pumps help to pump fresh water and dirty water mixed with abrasives. In addition, manufacturers focus on designing energy-efficient pump systems to augment the growth of the market. For instance, BBA Pumps BV provides a series of PT wellpoint dewatering pumps that offer minimal maintenance, superior suction lift, and long service life. In addition, the demand for energy-efficient and environmental-friendly pumps are anticipated to offer significant growth opportunities for pump manufacturers in the near future.

Dewatering Pumps Market Segmentation

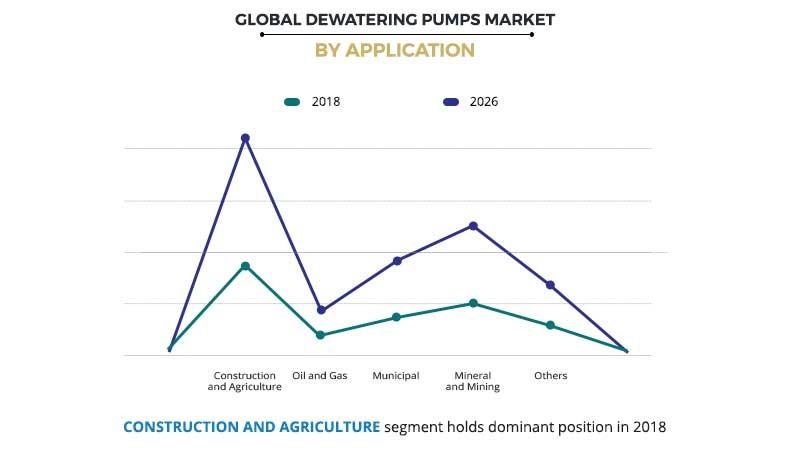

The global dewatering pumps market is segmented based on type, application, and region. Depending on type, the market is categorized into submersible dewatering pump and non-submersible dewatering pumps. In terms, of volume, the submersible dewatering pump segment is anticipated to dominate the global dewatering pumps market in the upcoming years. The applications covered in the market include construction & agriculture, oil & gas, municipal, mineral & mining, and others. The construction & agriculture segment is projected to dominate the global dewatering pumps market throughout the study period.

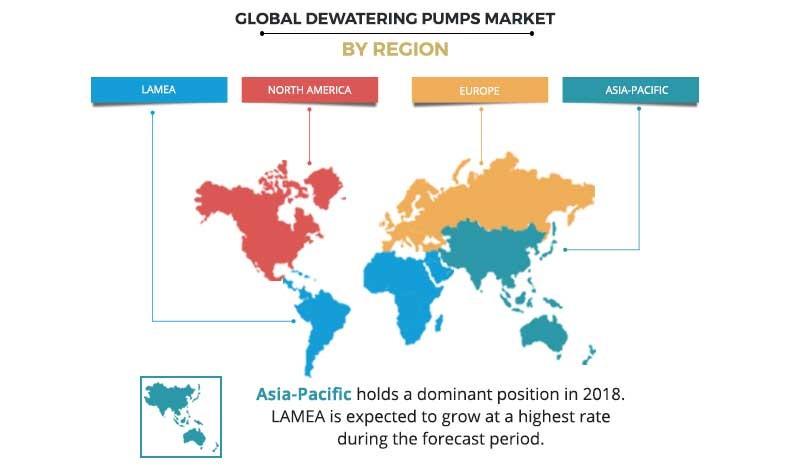

The global dewatering pumps market is analyzed across four geographical regions, which include North America (U.S., Canada, and Mexico), Europe (Germany, France, UK, Russia, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa). Asia-Pacific is expected to hold the largest market share throughout the study period, however, LAMEA region is expected to grow at the fastest rate.

Competition Analysis

Many competitors holds dominant position in the dewatering pumps market share. These companies have adopted product launch as their key developmental strategy to expand their product portfolio for business expansion. For instance, in January 2018, Gorman-Rupp introduced an innovative ValuPrime Line, which is an economical priming-assisted submersible dewatering pump. This line of pumps is suitable for dewatering demands of the agricultural, industrial, and construction sectors. Similarly, in March 2019, EBARA launched eDYNAMiQ particularly used for standard pump technology.

Key Benefits for Dewatering Pumps Market:

- The report provides an extensive analysis of the current and emerging dewatering pumps market trends and dynamics.

- In-depth analysis of the dewatering pumps market is conducted by constructing market estimations for the key segments between 2018 and 2026.

- Extensive analysis is conducted by following key product positioning and monitoring of the top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- Global dewatering pumps market forecast analysis from 2018 to 2026 is included in the report.

- Key market players within dewatering pumps market are profiled in this report, and their strategies are analyzed thoroughly, which help to understand the competitive outlook of the dewatering pumps industry.

Dewatering Pumps Market Report Highlights

| Aspects | Details |

| By TYPE |

|

| By APPLICATION |

|

| By Region |

|

| Key Market Players | Flowserve Corporation, Grundfos Holding A/S, The Gorman-Rupp Company, Sulzer Ltd., KSB SE & Co. KGaA, Atlas Copco AB, The Weir Group PLC, Xylem Inc., ITT Inc., EBARA CORPORATION |

Analyst Review

The global dewatering pumps market holds high potential in the construction and agriculture industry, due to the expansion of construction sector globally. The current business scenario experiences rapid development in the oil & gas sector, leading to increased adoption of dewatering pumps, particularly in the developed regions such as North America and Europe.

Improved efficiency and high durability of dewatering pumps are some of the major drivers for this market. However, high cost and unstable prices of raw material impede the growth of this market. In the near future, rise in demand for dewatering pumps is expected to be witnessed, due to expansion of construction industry globally. This factor is expected to create lucrative opportunities for the key players operating in the dewatering pumps market. Moreover, rise in demand for dewatering pumps in municipalities is expected to fuel the growth of the dewatering pumps market in the near future.

Based on study of the regions, Asia-Pacific is expected to account for the highest revenue in the global dewatering pumps market throughout the forecast period, followed by Europe, North America, and LAMEA.

The key companies have focused on product launch and joint venture to strengthen their foothold in the market. For instance, Grundfos Pumps Korea, ChungSuk, and Keum Jung Industrial, the subsidiaries of Grundfos, merged to form a joint venture company called Grundfos Pumps Korea. The joint venture was aimed at provide integrated design and development of dewatering pumps as well as to expand the business in the Republic of Korea.

Loading Table Of Content...