Diagnostics and Imaging Assistance Market Research, 2033

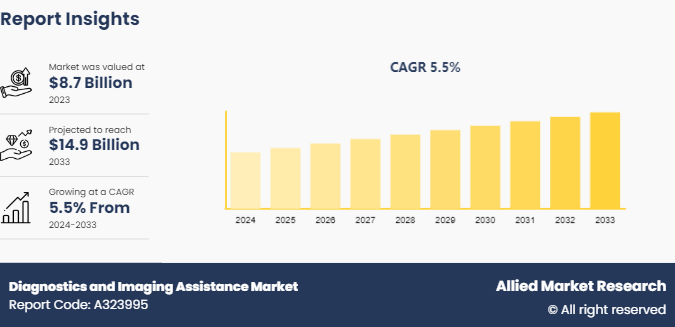

The global diagnostics and imaging assistance market size was valued at $8.7 billion in 2023, and is projected to reach $14.9 billion by 2033, growing at a CAGR of 5.5% from 2024 to 2033. Advancements in imaging technologies and diagnostic tools, the increasing prevalence of chronic diseases and cancer, and the growing demand for precision medicine and early detection are the major factors which drives the market growth.

Market Introduction and Definition

Diagnostics and imaging assistance refers to the use of advanced technologies and tools to enhance the accuracy and efficiency of diagnosing medical conditions. It includes a range of modalities such as X-rays, MRI, CT scans, ultrasound, and PET scans, which provide detailed images of the body's internal structures. These technologies aid in early detection, monitoring, and treatment planning by offering precise visual information. In addition, AI and machine learning algorithms are increasingly integrated to assist radiologists in interpreting images, identifying anomalies, and improving diagnostic outcomes. This synergy of technology and expertise significantly enhances patient care and clinical decision-making.

Key Takeaways

- The diagnostics and imaging assistance market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major diagnostics and imaging assistance industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The diagnostics and imaging assistance market growth is driven by increasing prevalence of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions which necessitates advanced diagnostic tools for early detection and effective management, thereby boosting demand for diagnostic and imaging assistance products. In addition, technological advancements, including the integration of artificial intelligence (AI) and machine learning, have revolutionized the accuracy and efficiency of imaging systems, enabling faster and more precise diagnosis, which in turn propels diagnostics and imaging assistance market size. AI-powered diagnostic tools aid radiologists in interpreting complex imaging data, reducing the chances of human error and improving diagnostic outcomes.

Furthermore, the rising geriatric population, which is more susceptible to chronic illnesses, further fuels the need for sophisticated diagnostic and imaging solutions. Moreover, governmental and organizational initiatives play a crucial role in market development. Substantial investments in healthcare infrastructure, especially in developing regions, coupled with supportive policies and funding for research and development, encourage the adoption of advanced diagnostic technologies which thereby supports the growth during diagnostics and imaging assistance market forecast period.

However, the high costs associated with advanced imaging equipment and diagnostic tools can limit their adoption, especially in low-income regions. Regulatory challenges and the lengthy approval process for new technologies can delay market entry and innovation. In addition, shortage of skilled professionals trained to operate sophisticated diagnostic systems and interpret imaging data poses a significant barrier.

On the other hand, expanding remote diagnostic services offer new market opportunities, especially in underserved regions. In addition, increasing healthcare expenditure and improved insurance coverage enhance market accessibility and adoption which further provides diagnostics and imaging assistance market opportunity.

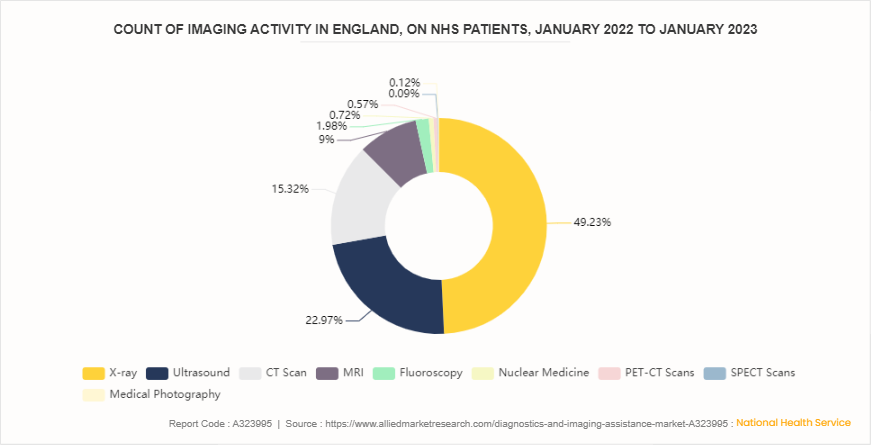

NHS Imaging Activity (January 2022 - January 2023)

The data from National Health Service (NHS) England for the period January 2022 to January 2023 highlights significant imaging activity among NHS patients. X-ray procedures dominate with 21, 366, 520 scans, accounting for 49.2% of the total imaging activities. Ultrasound follows with 9, 966, 770 scans (23.0%) , CT scans with 6, 647, 255 (15.3%) , and MRI with 3, 904, 805 scans (9.0%) . Fluoroscopy, nuclear medicine, PET-CT scans, SPECT scans, and medical photography constitute smaller proportions, ranging from 0.1% to 2.0%.

This extensive utilization of diverse imaging modalities emphasizes the critical role of diagnostic imaging in modern healthcare. The substantial numbers reflect a robust demand for diagnostic services, directly influencing the diagnostics and imaging assistance market. Advanced imaging technologies, coupled with AI-driven diagnostic tools, are essential to manage the high volume and complexity of scans efficiently. The integration of AI enhances the accuracy and speed of image interpretation, reducing diagnostic errors and improving patient outcomes. Furthermore, the significant reliance on imaging for diagnosis and treatment planning highlights opportunities for innovation and investment in imaging assistance technologies, driving market growth and technological advancement in healthcare diagnostics.

Market Segmentation

The diagnostics and imaging assistance market is segmented into type, end user, and region. On the basis of the type, the market is segmented into X-ray, magnetic resonance imaging (MRI) , ultrasound, computed tomography (CT) , and others. By end user, the market is divided into hospitals and clinics, ambulatory surgical centers, diagnostic centers, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America has a significant diagnostics and imaging assistance market share during the forecast period, owing to its advanced healthcare infrastructure, which supports the widespread use of cutting-edge diagnostic technologies. In addition, high levels of healthcare spending, enabling hospitals and clinics to invest in state-of-the-art imaging and diagnostic devices thereby drives the market growth. Furthermore, the presence of major market players and ongoing research and development efforts further bolster market growth. The Asia-Pacific region offers immense potential due to increasing healthcare investments and a rising geriatric population. LAMEA experiences growth driven by improving healthcare infrastructure and rising demand for advanced diagnostic tools.

Industry Trends

- The UK government announced that it would open 160 community diagnostic centers (CDCs) a year earlier than planned, by March 2024. This initiative represents the largest central investment in MRI and CT scanning capacity in National Health Service (NHS) history, aimed at reducing waiting lists and improving access to essential diagnostic services. Over 5 million tests have already been performed, with the new centers expected to provide capacity for an additional 9 million tests by 2025. This surge in capacity necessitates robust support systems to manage and analyze the increased volume of imaging data, thereby fueling market.

- In August 2023, the Union Minister Dr. Jitendra Singh launched India's first indigenously developed, affordable, and lightweight MRI scanner in New Delhi. This initiative aims to reduce the cost of MRI scans, making them more accessible to the general population. The project was developed under the National Biopharma Mission and involved a public-private partnership, with substantial funding from the Department of Biotechnology (DBT) . By lowering financial barriers and promoting technological advancement, this project enhances early disease detection, and accelerates the adoption of diagnostic imaging tools.

Competitive Landscape

The major players operating in the diagnostics and imaging assistance market include Koninklijke Philips N.V., Canon Medical Systems Corporation, Subtle Medical, Inc., Samsung Healthcare, GE HealthCare, Digital Diagnostics Inc., Quibim, Lunit Inc., Aidence, and NVIDIA Corporation.

Recent Key Strategies and Developments in Diagnostics and Imaging Assistance Industry

- In May 2024, Canon Medical Systems Corporation announced the debut installation of the Aquilion Serve SP CT scanner with INSTINX, AI-driven workflow automation, in the United States at Steinberg Diagnostic Medical Imaging (SDMI) .

Key Sources Referred

- National Center for Biotechnology and Information (NCBI)

- Centers for Medicare & Medicaid Services (CMS)

- National Health Service (NHS)

- Australian Government Department of Health and Aged Care

- Government of Canada's Health and Wellness

- Ministry of Health and Family Welfare (MoHFW)

- National Health Mission (NHM)

- Ayushman Bharat - Health and Wellness Centres (AB-HWCs)

- Centers for Disease Control and Prevention (CDC)

- Food and Drug Administration (FDA)

- National Institutes of Health (NIH)

- World Health Organization (WHO)

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the diagnostics and imaging assistance market analysis from 2024 to 2033 to identify the prevailing diagnostics and imaging assistance market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the diagnostics and imaging assistance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global diagnostics and imaging assistance market trends, key players, market segments, application areas, and market growth strategies.

Diagnostics and Imaging Assistance Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 14.9 Billion |

| Growth Rate | CAGR of 5.5% |

| Forecast period | 2024 - 2033 |

| Report Pages | 230 |

| By Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | Aidence, Canon Medical Systems Corporation, Samsung Healthcare, Digital Diagnostics Inc., GE HealthCare, Lunit Inc., Subtle Medical, Inc. , Koninklijke Philips N.V., Quibim, NVIDIA Corporation |

The total market value of diagnostics and imaging assistance market was $8.7 billion in 2023.

The market value of diagnostics and imaging assistance market is projected to reach $14.9 billion by 2033.

The forecast period for diagnostics and imaging assistance market is 2024 to 2033.

Key drivers include advancements in imaging technologies, increasing prevalence of chronic diseases and cancer, growing demand for precision medicine, and the integration of AI and machine learning to enhance diagnostic accuracy and efficiency.

The base year is 2023 in diagnostics and imaging assistance market.

Key applications include cancer detection and monitoring, cardiovascular diagnostics, neurological imaging, musculoskeletal assessments, and general health screening.

The diagnostics and imaging assistance market encompasses technologies and solutions that support medical diagnostics and imaging processes. This includes tools for improving diagnostic accuracy, efficiency, and workflow in medical imaging and diagnostics.

Loading Table Of Content...