Die Attach Machine Market Research: 2031

The global die attach machine market size was valued at $1.2 billion in 2021, and is projected to reach $2.1 billion by 2031, growing at a CAGR of 5.9% from 2022 to 2031.

Die attach machine, also known as die bond machine or die mount, is used for the attachment of the silicon chip to the die cavity or die pad in the semiconductor package process. Moreover, dies are attached using various kinds of techniques, including epoxy, soft solder, sintering, eutectic, and others. Die attach machines are employed in various sectors for aid in manufacturing RF and MEMS, optoelectronics, logic, memory, CMOS image sensors, LED, and others.

Market Dynamics

The semiconductor industry is witnessing extensive growth owing to technological developments that have brought high end electronic devices to the common people; this in turn is driving the growth of the die attach machine market. In the last few decades, electronics products have become very small, enabling smaller, lighter, and more portable devices. In addition to this, all electronic devices have transitioned from analog to digital. Such factors have made electronic devices cheaper. Thus, the demand for consumer electronic products such as smartphones, tablets, PCs, wearables, augmented and virtual reality devices, consumer appliances, and other electronics has increased by many folds in the last few decades.

Furthermore, growth in wireless connectivity such as Wi-Fi, Bluetooth, 5G networks, and others, have increased demand for highly sophisticated semiconductors. Furthermore, other advancements such as rise of automation in industries that have helped in improving industrial processes such as manufacturing, warehousing, industrial data management, and other industry 4.0 technologies are propelling the semiconductor industry. Moreover, advancements of artificial intelligence and its adoption in devices such as smartphones, CCTV cameras, smart home devices, vehicles, and others are driving the demand for sophisticated semiconductors and its specialized production equipment including die attach machines.

In addition to this, according to the United Nations projections, at the end of 2022, the global population reached 8 billion, and is expected to increase to 8.5 billion by 2030, and in just 20 years after that it is expected to become 9.7 billion in 2050. The rising population and urbanization will help in increasing the number of households, which is anticipated to drive demand for consumer appliances, smart devices, CCTV cameras, and others. For instance, the Indian Electronics and Semiconductor Association (IESA) estimates that the Indian electronic sector will grow with a CAGR of 20% to $400 billion by 2025.

Moreover, more that 70% U.S. households own smart speaker such as Amazon Alexa. Moreover, the increase in demand for hybrid circuits in medical equipment, owing to increase in the number of patients is propelling the demand for semiconductor chips. Thus, witnessing the increasing demand for products that are completely dependent on semiconductors, governments, and key players in the semiconductor industry are investing heavily to improve their share and contribution in the semiconductor industry.

For instance, in May 2022, International Semiconductor Consortium (ISMC) announced investing $3 billion in India for setting up a chip-making plant in India. In addition, in November 2021, the Japanese government approved a $5.4 billion package for the semiconductor industry, including a $2.8 billion subsidy for Taiwan Semiconductor Manufacturing Company’s (TSMC) new foundry in Kumamoto city of Japan.

In addition, according to the data published by the Semiconductor Industry Association (SIA) in February 2022, semiconductor sales in 2021 were valued at $555.9 billion, which is 26.2% higher than the total sales in 2020, which totaled $440.4 billion. This is largely attributed to increased demand for semiconductors for devices that were essential for work from home and study from home culture, which boosted during the COVID-19 period. The rise in demand for electronics products is driving the demand for die attach machines, as these machines play an instrumental role in bonding the die to the chip substrate.

However, factors such as fluctuating cost of raw materials required to construct die attach machines and shortage of essential materials such as silicon, are anticipated to restrain the die attach machine market growth.

Moreover, an increase in government funding in the development of the domestic semiconductor industry, and the growth in usage of LED circuits is a major die attach machine market opportunity for the growth of the key players. Various countries such as the U.S., China, India, Japan, South Korea, UAE, and others, have unveiled many funding policies for the growth of the domestic semiconductor industry.

The market for die attach machines witnessed a decline in 2020, owing to low demand from different industries due to lockdowns imposed by the government of many countries. The COVID-19 pandemic shut down various factories including the ones involved in producing electronic products all across the world, leading to a halt in demand for die attach machines.

Moreover, the semiconductor shortage caused by the COVID-19 led to lockdowns and severely hampered the semiconductor industry. This has hampered the growth of the die attach machine market significantly during the pandemic. The major demand for die attach machines was previously noticed from major countries including the U.S., Germany, Italy, the UK, South Korea, Taiwan, and developing countries such as India, and China.

These countries were severely affected by the spread of coronavirus, thereby halting demand for die attach equipment. However, owing to the introduction of various vaccines, the severity of the COVID-19 pandemic has significantly reduced. This has led to the full-fledged reopening of businesses involved in the die attach machine market and also led to increased activities in the industrial sector.

Furthermore, it has been more than two and a half years since the outbreak of this pandemic, and many companies have already shown notable signs of recovery. Contrarily, as of the beginning of 2023, the number of COVID-19 infection cases is surged again, especially in China, this brought negative sentiments in the market, which may have a negative affect the die attach machine market for a short duration. Thus, businesses involved in die attach machines as well as semiconductor manufacturing must focus on protecting their workforce, operations, and supply chains to respond to any looming crises and find new ways of working to remain competitive.

Segmental Overview

The die attach machine market is segmented on the basis of type, technique, application, and region. By type, the die attach machine market is bifurcated into flip chip bonder and die bonder. By technique, the market is divided into epoxy, soft solder, sintering, eutectic, and others. By application, it is categorized into RF and MEMS, optoelectronics, logic, memory, CMOS image sensors, LED, and others. By region, it is analyzed across North America (U.S., Canada, and Mexico), Europe (Germany, France, Italy, UK, and rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

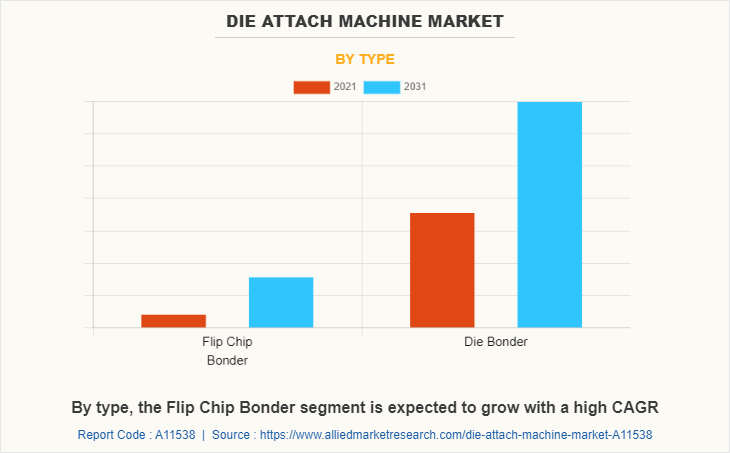

By Type:

The die attach machine market is divided into flip chip bonder and die bonder. In 2021, the die bonder segment dominated the die attach machine market, in terms of revenue, and the flip chip bonder is expected to grow with a higher CAGR during the forecast period. Flip chip bonders are suitable for new technologies such as 2.5D and 3D, which are used in new gadgets such as laptops, desktops, CPU, and GPU with features like sensors and networking connections, thereby driving the flip chip industry.

In addition, the die bonder segment is witnessing growth with the emerging market of the latest technologies such as UHD TVs, hybrid laptops, and smartphones, which has integrated circuits is one of the major causes that accelerate the die bonder market.

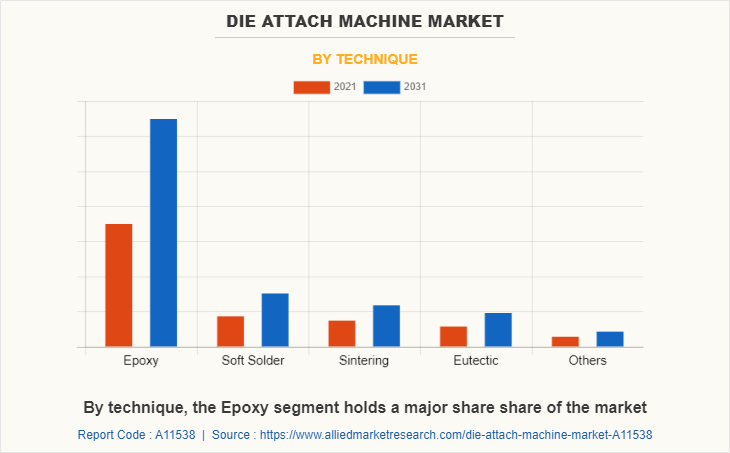

By Technique:

The die attach machine market is classified into epoxy, soft solder, sintering, eutectic, and others. The epoxy segment accounted for a higher market share in 2021, and the same segment is anticipated to grow with the highest CAGR during the forecast period. The high growth of the epoxy segment is attributed to its excellent resistance to both thermal cycling and mechanical shock and vibrations.

Thermal cycling, mechanical shock and vibrations are a few serious issues with modern chips, which can reduce the productivity and overall lifetime of the chip. Moreover, the soft solder segment accounted for the second highest market share in terms of revenue in 2021. This is largely owing to its ability to provide good heat dissipation of typically 35W/mK is ductile and exhibits desirable thermal expansion properties and avoid joint failure due to thermal stress.

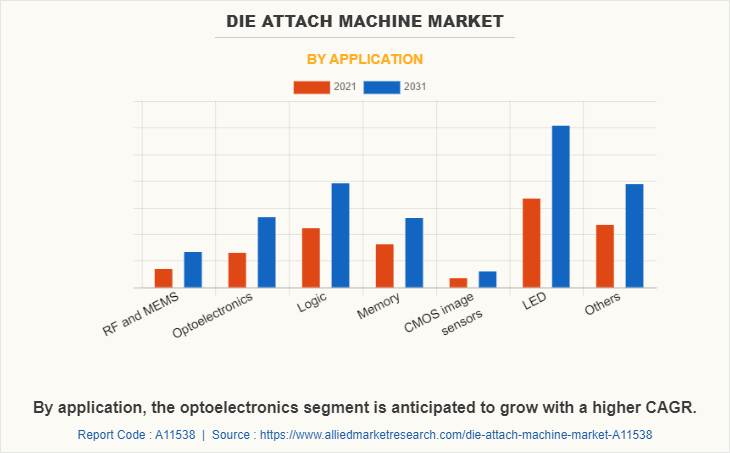

By Application:

The die attach machine market is categorized into RF and MEMS, optoelectronics, logic, memory, CMOS image sensors, LED, and others. Among these, the LED segment accounted for a larger die attach machine market share in 2021. Moreover, the optoelectronics segment is anticipated to grow with the highest CAGR during the forecast period. Furthermore, RF & MEMS segment is anticipatewd to grow with a second highest CAGR during the forecast. Demand for RF & MEMS components such as reference oscillators, MEMS switches, electronically scanned (sub)arrays, reconfigurable antennas, and other filters.

Moreover, the MEMS technology is used to fabricate sensors such as accelerometers, gyroscopes, digital compasses, inertial modules, pressure sensors, humidity sensors, and microphones, which fuels the market growth. Moreover, rise of usage of LED chips in the fields of fishing lighting, healthcare, marine, horticulture, and others offer lucrative growth opportunities for the manufacturer of die attach machines during the forecast period.

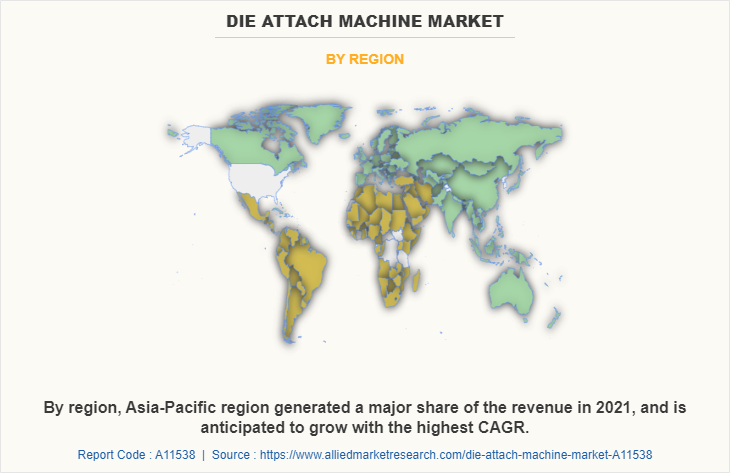

By Region:

The die attach machine market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, Asia-Pacific had the highest die attach machine market share and is anticipated to secure the leading position during the forecast period. The high concentration of IC makers is expected to drive the demand for die bonder equipment in Asia-Pacific. According to the Financial Times, China currently holds 15% of global semiconductor production capacity, with the percentage expected to rise to 24% in the next ten years. Since 2015, China launched more than 80 semiconductor projects through FDI, compared to 45 in the U.S., 37 in India, 36 in the UK, and 29 in Taiwan.

Moreover, India is emerging as a significant player in the semiconductor and electronics industry. In December 2021, India announced a $10 billion dollar production-linked incentive (PLI) scheme to encourage semiconductor and display manufacturing in the country. Moreover, South Korea has been the second largest semiconductor-producing country since 2013, as per the Korea Trade-Investment Promotion Agency (KOTRA). In 2020, its contribution to the global semiconductor market was 18.4% and is expected to rise significantly in the coming years. Such factors are driving the growth of the die attach machine market in the region as well as in the world.

Competition Analysis

Competitive analysis and profiles of the major players in the die attach machine market is provided in the report. Companies included are ASM Pacific Technology Limited, BE Semiconductor Industries N.V, Dr. Tresky AG, Fasford Technology Co. Limited, Inseto UK Limited, Kulicke And Soffa Industries, microassembly technologies limited, Palomar Technologies, Shinkawa Limited, Panasonic Industry Co., Ltd,. Major players in order to remain competitive adopt development strategies such as product launch, acquisition, business expansion, and others. For instance, in September 2021, Palomar Technologies, a global leader in total process solutions for advanced photonics and microelectronic device packaging, launched 3880-II Die Bonder. Its unique feature includes reducing programming time by up to 95%.

Key Benefits for Stakeholders

The report provides an extensive analysis of the current and emerging die attach machine market trends and dynamics.

In-depth die attach machine market analysis is conducted by constructing market estimations for key market segments between 2021 and 2031.

Extensive analysis of the die attach machine market is conducted by following key product positioning and monitoring of top competitors within the market framework.

A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

The die attach machine market forecast analysis from 2022 to 2031 is included in the report.

The key players within the die attach machine market are profiled in this report and their strategies are analyzed thoroughly, which helps understand the competitive outlook of the die attach machine industry.

Die Attach Machine Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 2.1 billion |

| Growth Rate | CAGR of 5.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 259 |

| By Type |

|

| By Technique |

|

| By Application |

|

| By Region |

|

| Key Market Players | Inseto UK Limited, Palomar Technologies, Dr. Tresky AG, BE Semiconductor Industries N.V, ASM Pacific Technology Limited, Kulicke and Soffa Industries, Shinkawa Limited, Fasford Technology Co. Limited, MicroAssembly Technologies Limited, Panasonic Industry Co., Ltd. |

Analyst Review

According to the insights of the CXOs of leading companies, the die attach machine market has witnessed significant growth in the past few years, owing to the growing semiconductor industry and rise in demand for consumer electronic products.

With an increasing LED penetration rate, the demand for die-attach equipment is increasing. In coming years there will be an increase in demand for LED chips which is expected to propel the market growth in the near future. Countries such as China, Europe, and Japan are leading manufacturers of die attach LED. China has the highest number of companies producing die attach LED followed by Japan and Europe. Japanese companies are quite strong in terms of technology and have massive experience of die attach LED development.

However, the geo-politics over semiconductor industry is anticipated to negatively affect the market growth. For example, the U.S. has imposed strict restriction and sanctions on China. License will be needed to export certain chips to China to be used in advanced AI calculations and supercomputing.

Moreover, an increase in government initiatives for development of industries such as automotive, electronics, and others is anticipated to provide lucrative opportunities for the growth of the die attach machine market.

Growth in semiconductor manufacturing across the world, rise in demand for electronics products, and growth in demand for hybrid circuits from medical, military, photonics, and wireless electronics applications are few of the upcoming trends in the die attach machine market.

Die attach machines are widely utilized for manufacturing LED and logic circuits.

Asia-Pacific dominated the market in 2021, by generating highest revenue among all the regions.

The global die attach machine market was valued at $1,185.7 million in 2021.

Companies profiled in report are Companies included are ASM Pacific Technology Limited, BE Semiconductor Industries N.V, Dr. Tresky AG, Fasford Technology Co. Limited, Inseto UK Limited, Kulicke And Soffa Industries, microassembly technologies limited, Palomar Technologies, Shinkawa Limited, Panasonic Industry Co., Ltd.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Epoxy segment accounted for the largest revenue share in 2021.

The global die attach machine market is projected to reach $2,103.6 million by 2031, registering a CAGR of 5.9% from 2022 to 2031.

Loading Table Of Content...

Loading Research Methodology...