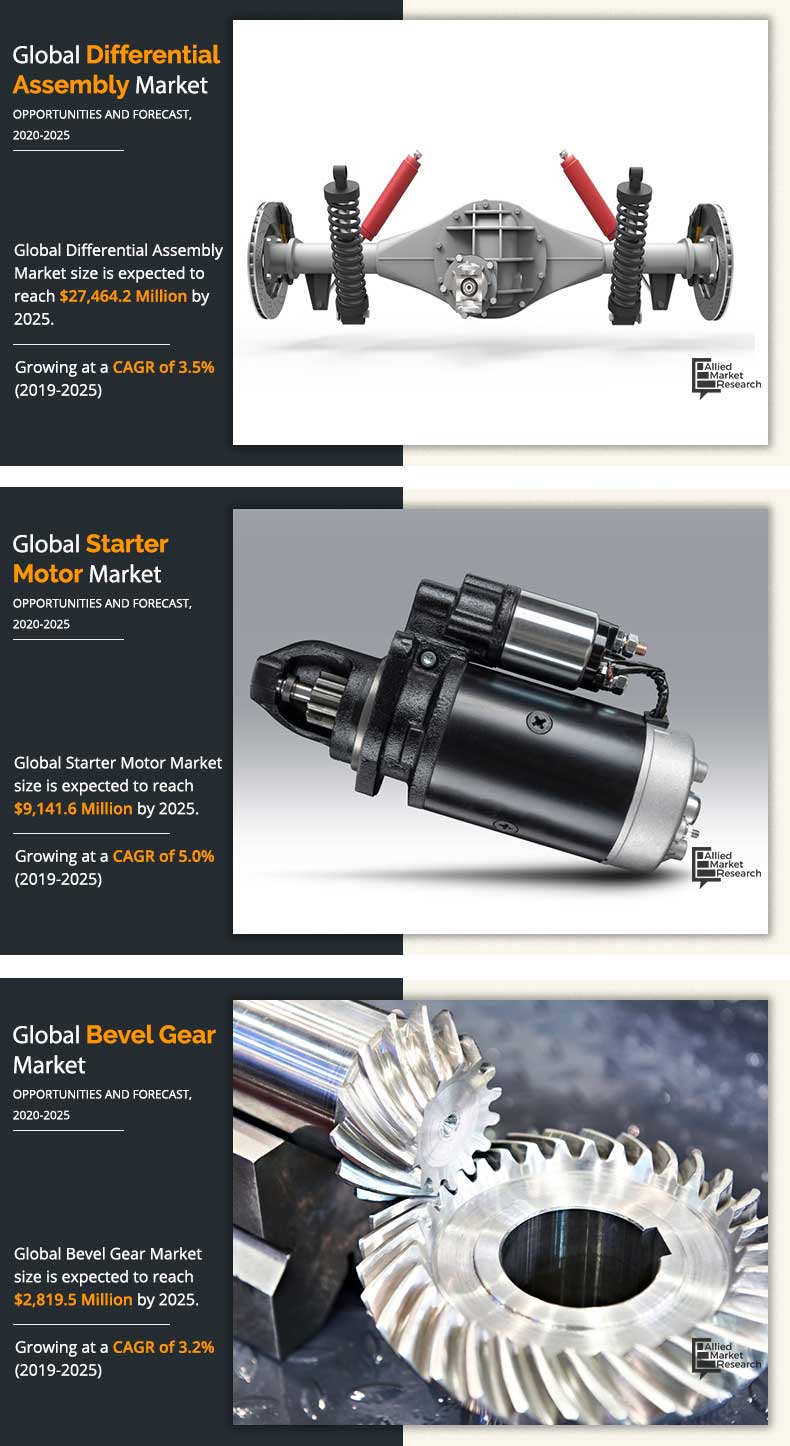

Differential Assembly Market, Starter Motor Market, and Bevel Gear Market Outlook 2020-2025:

The global differential assembly market was reached 121.7 million units and valued at $22,390.8 million in 2019, and is projected to attain the demand for 145.6 million units and reach $27,464.2 million by 2025, registering a CAGR of 3.0% in terms of volume and 3.5% in terms of value from 2019 to 2025.

Differential assembly is an integral part of the automotive drivetrain, which has primary function of providing proportional RPMs between two connected wheels. It is a part of front and/or rear axle assembly that plays an integral in a vehicle and is designed to allow moving of wheels at different speeds. Sale of differential assemblies is directly driven by the automotive production activities across the globe. Increase in penetration of the AWD and 4WD vehicles are estimated to support the growth of differential assembly market. Procurement of differential assembly is carried out through long-term contracts and agreements between original equipment manufacturer and differential assembly manufacturer.

The differential assembly market is segmented by vehicle type into passenger car, light commercial vehicles, heavy commercial vehicles, and tractors. On the basis of region, differential assembly market is analyzed across North America, Europe, China, India, and RoW.

The key players operating in the differential assembly market include BorgWarner Inc., JTEKT Corporation, Dana Limited, American Axle & Manufacturing Holdings, Inc., GKN, Hyundai WIA Corporation, Eaton, Schaeffler Technologies AG & Co. KG., ZF Friedrichshafen AG, Linamar Corporation, and others.

The global starter motor market was reached to 132.5 million units and valued at $6,837.8 million in 2019, and is projected to attain the demand for 171.4 million units and reach $9,141.6 million by 2025, registering a CAGR of 4.4% in terms of volume and 5.0% in terms of value from 2019 to 2025.

Starter motor is an electrical system utilized for rotating the crank of the engine to generate the desired output power. Integral part of the vehicle starting system as it is used in internal combustion and hybrid powered vehicles. Increase in vehicle electrification activities is anticipated to drive the demand for starter motor in the near future.

To gain the competitive advantage, the manufacturers need to align their product offering to the current requirement of the end consumers.

The starter motor market is segmented by vehicle type into passenger car, light commercial vehicles, heavy commercial vehicles, and tractors. On the basis of region, the differential assembly market is analyzed across North America, Europe, China, India, and RoW.

The key players operating in the automotive starter motor market include Denso Corporation, BorgWarner Inc., SEG Automotiv, Hitachi, Ltd. (Hitachi Astemo Ltd), Mitsubishi Electric Corporation., Valeo SA, Mitsuba Corp., ASIMCO Technologies Ltd., Nikko Electric Industry Co., Ltd., Prestolite Electric Inc., SAWAFUJI ELECTRIC CO., LTD., Hella KGaA Hueck & Co and others.

The global bevel gear market was reached to 127.1 million units and valued at $ 2,337.1 million in 2019, and is projected to attain the demand for 149.9 million units and reach $2,819.5 million by 2025, registering a CAGR of 2.8% in terms of volume and 3.2% in terms of value from 2019 to 2025.

The bevel gear is normally fitted to the end of driveshaft that delivers the output power from the engine via transmission. Under the scope of research, one unit of bevel gear is referred to a set of bevel gear in single differential assembly. Winning long-term contracts and agreement with differential assemblies’ manufacturer or original equipment manufacturer create long-term business opportunities for the bevel gear market players. The demand for bevel gear is directly driven by the differential assembly outlook across the globe.

The bevel gear market is segmented by vehicle type into passenger car, light commercial vehicles, heavy commercial vehicles, and tractors. On the basis of region, the differential assembly market is analyzed across North America, Europe, China, India, and RoW.

The key players operating in the automotive bevel gear market includes American Axle & Manufacturing, Inc., Showa Corporation, Musashi Seimitsu Industry Co., Ltd., Meritor, Inc, GKN Sinter Metals Engineering GmbH, Sona BLW, Bharat Gears Ltd., GNA Group, Richmond, Motive Gear, AmTech International and others.

Growth in adoption of fuel-efficient mobility solution along with effective performance requirements

In the recent years, the automotive industry has witnessed drastic change in the front of technological evolution as majority of the automotive are installed with high-end electrical and electronics technology driven system. To cater the changing demand of end consumers, original equipment manufacturers (OEMs) are relying on electrical and electronics components, owing to their output efficiency along with significant weight reduction of the respective component that leads to the fuel economic solution. Moreover, emission from the vehicle is a crucial factor as it emits harmful greenhouse gases which cause the long-term environmental impact. Many governments across the globe are taking initiative for the vehicle emission norms standard to control the greenhouse emissions and environmental balance. Manufacturers need to align with these regulations to control the emission level. For instance, from April 2020, the Government of India has implemented the BS6 emission standard to control the outflow of the air pollutants from the vehicles. In addition, end consumers/drivers are demanding technologically advanced electrical components and systems for ease and comfort in the driving experience. The increase in need for electrical and electronics components is driving the demand for starter motors. Furthermore, the change in preference of the end consumers is expected to fuel the demand for vehicle electrification, which in turn drives the demand for starter motor in the near future

Increase in penetration of the AWD and 4WD vehicles

The automotive manufacturing has technologically evolved in the area of drivetrain, powertrain, safety, and stability to improve the operational efficiency of the vehicle. The automotive consumers are demanding more output efficient and optimum performance high-end driving operations. Moreover, end users demand outlook has shifted more toward added luxury, comfort, and driving dynamics. The changing demand of the end consumers is gaining traction for four-wheel drive and all drive wheel vehicles to attain the safety and vehicle dynamic levels. Moreover, Original Equipment Manufacturers (OEMs) are pushed toward these drive systems to cater the changing requirement of the end users. In the recent years, AWD and 4WD vehicles’ penetration has increased drastically and it is expected to maintain the momentum in the upcoming years. These drive systems require two or three differential assemblies to perform the driving activities. Therefore, increase in penetration of the AWD and 4WD vehicles is expected to drive the demand for differential as well as bevel gear in the near future.

By Vehicle Type

Global Starter Motor Market - Opportunities and Forecasts, 2020-2025 (Million Units) & ($Million)

Decrease in production and sales of automotive from past two years

Since the past two years, the automotive industry has witnessed considerable downfall in the overall growth due to declining sales as well as production of the automotive. The decrease in automotive production is mainly due to low consumer confidence and changing manufacturing standards of the automotive. After 8 successful years of increasing sales till 2017, the global automotive production has witnessed decrease in vehicle sales (passenger vehicles as well as commercial vehicles). As compared to 2017, the overall vehicle sales in 2018 decreased by 1%, which was the highest ever in the history. Moreover, the vehicle sales statistics in 2019 is not positive and vehicle sale is on a continuous declining rate, especially in developing countries, such as India, China, and others, which hamper the growth of the automotive motors market. Further, Asia-Pacific, which accounts for more than half of the global production, witnessed decrease in vehicle production of around 2% in 2018. Moreover, according to the IMF (International Monetary Fund), the industry represented around 20% of GDP slowdown in the previous year and around 30% of the year's drop in global trade. The differential assembly bevel gear and starter motor market movement is totally dependent on the vehicle production and sales activities. The declining production and sales of the automotive is expected to hamper the overall growth of the market.

COVID-19 impact analysis

The COVID-19 crisis is creating uncertainty in the differential assembly, starter motor, and bevel gear market by slowing down the supply chains, hampering business growth, and increasing panic among the customer segments. This decreasing automotive production, owing to COVID-19 health crisis leads to decreasing sales for differential assemblies and bevel gear. Attributed to the financial downturn and decreasing automotive sales, majority of the original equipment manufacturers are expected to cut down the production activities in the next three quarters. By the start of 2021, there is expected to be positive recovery of the production of the vehicle, which in turn is expected to support the sales of differential assembly, bevel gear, and starter motors.

By Region

India would exhibit the highest value CAGR of 7.5% during 2019-2025.

Key Benefits For Stakeholders

- This study presents the analytical depiction of the global differential assembly, starter motor, and bevel gear market analysis along with the current trends and future estimations to depict imminent investment pockets.

- The overall differential assembly, starter motor, and bevel gear market opportunity is determined by understanding profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities of the global differential assembly, starter motor, and bevel gear market with a detailed impact analysis.

- The current market is quantitatively analyzed from 2019 to 2025 to benchmark the financial competency.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Differential Assembly Market: Key Market Segments

By Vehicle Type

- Passenger Car

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Tractors

By Region

- North America

- Europe

- China

- India

- RoW

Starter Motor Market: Key Market Segments

By Vehicle Type

- Passenger Car

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Tractors

By Region

- North America

- Europe

- China

- India

- RoW

Bevel Gear Market: Key Market Segments

By Vehicle Type

- Passenger Car

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Tractors

By Region

- North America

- Europe

- China

- India

- RoW

Differential Assembly, Starter Motor, And Bevel Gear Market: Key Players

- American Axle & Manufacturing Inc

- BorgWarner Inc.

- Dana Incorporated

- Denso Corporation

- Eaton

- Hitachi Automotive Systems, Ltd.

- JTEKT Corporation

- Meritor, Inc.

- Valeo

- ZF Friedrichshafen AG

Differential Assembly, Starter Motor and, Bevel Gear Market Report Highlights

| Aspects | Details |

| By Vehicle Type |

|

| By Region |

|

| Key Market Players | JTEKT CORPORATION, .MERITOR, INC., DENSO CORPORATION, VALEO, ZF FRIEDRICHSHAFEN AG, AMERICAN AXLE & MANUFACTURING, INC., DANA INCORPORATED, HITACHI AUTOMOTIVE SYSTEMS, LTD., BORGWARNER INC, EATON |

Analyst Review

Differential assembly is the integral part of the automotive driveline, which transmits the input from drive shaft and transmit the power through the right angle toward the wheels. The global differential assembly market is expected to grow at a remarkable rate in future. The automotive production across the globe has declined from past two years and COVID-19 impact is expected to slow down the overall automotive production in 2020. The automotive production activities directly influence the demand for the differential assembly in the near future.

The differential assembly market is segmented by vehicle type into passenger car, light commercial vehicles, heavy commercial vehicles, and tractors. On the basis of region, the differential assembly market is analyzed across North America, Europe, China, India, and RoW.

As per the current automotive production scenario and existing on road automotive fleet, the starter motor is estimated to hold the significant position in the vehicle starter motor market throughout the forecast period. However, increase in penetration of the battery electric vehicles, the threat of substitute is expected to experience by starter motor manufacturers. The manufacturers need to align their product offering to the current requirement of the end consumers.

The starter motor market is segmented by vehicle type into passenger car, light commercial vehicles, heavy commercial vehicles, and tractors. On the basis of region, the differential assembly market is analyzed across North America, Europe, China, India, and RoW.

Bevel gears are the significant component of the differential assembly responsible to transmit the power from shaft assembly to wheel axles. Bevel gear sale directly drives through production activities of differential assembly. In global bevel gears market, wining agreements and contracts with differential manufacturers are anticipated to create long-term business opportunities across the global market.

The bevel gear market is segmented by vehicle type into passenger car, light commercial vehicles, heavy commercial vehicles, and tractors. On the basis of region, the differential assembly market is analyzed across North America, Europe, China, India, and RoW.

Loading Table Of Content...