Digital Battlefield Market Overview, 2031

The global digital battlefield market size was valued at $38 billion in 2021, and is projected to reach $156.8 billion by 2031, growing at a CAGR of 15.7% from 2022 to 2031. Digital battlefield is a network of connected surveillance & communication systems, weapon systems and aerial platforms. The use of digital technology in defense sector has changed the perception of war. Digital battlefield in the future will rely on defense systems and weapons that cannot be heard or seen. The world is already in a digital war that creates a constant threat to defense data-based systems. Simultaneously, the digital threats to the crucial structure that supports those systems, and the greater economy has massively expanded the range of what must be defended like the power grid, communications, data, hardware, code, and all the opportunities that connect a modern weapons system.

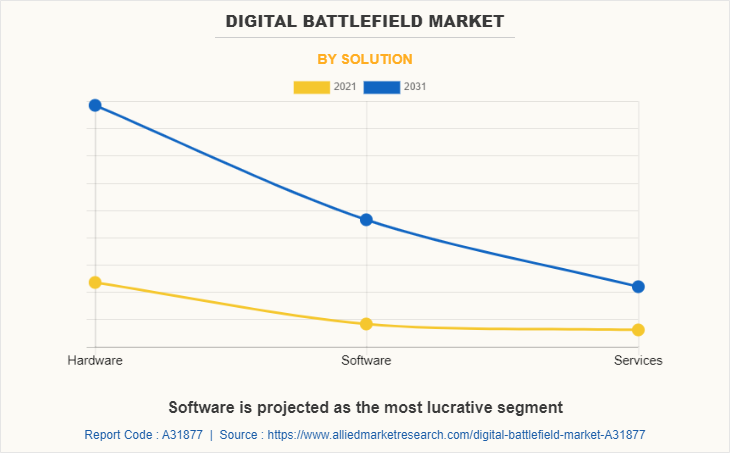

There are three types of solutions offered under digital Battlefields hardware, software, and solutions. The security and privacy of military communications in hardware is the fundamental necessity of the defense division. As military communication network and data infrastructure are important, safety infringes to the same may risk the citizens safety. To avoid this, the military sector is implementing safe and reliable military communications solutions. The surge in volume of IP-based data, such as remote sensor data and situational awareness video broadcast over standard interfaces, drives the demand for enhanced data network security. In addition, positioning army satellites hostile to cyberattacks has turned out even more crucial as cyber resources on the space, air, and ground are susceptible to several threats.

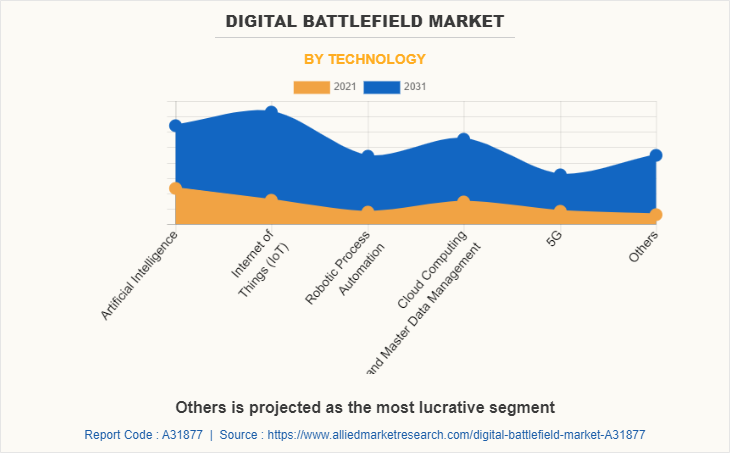

Factors such as increase in operation over 5G network for high-speed data collection, rapid developments in robotics technologies, big data analytics and artificial intelligence, strong budget for military and defense support the adoption of digital battlefield solutions. Moreover, the factors such as huge investment is required in early phase of digitization, concerns over possibility of errors in complex warfare situations are restraining the growth of digital battlefield market. Furthermore, factors like rise in requirement for digital battlefield devices in defense, and new generation missile & air defense system to create an immense opportunity for digital battlefield products for the key players operating in the digital battlefield market.

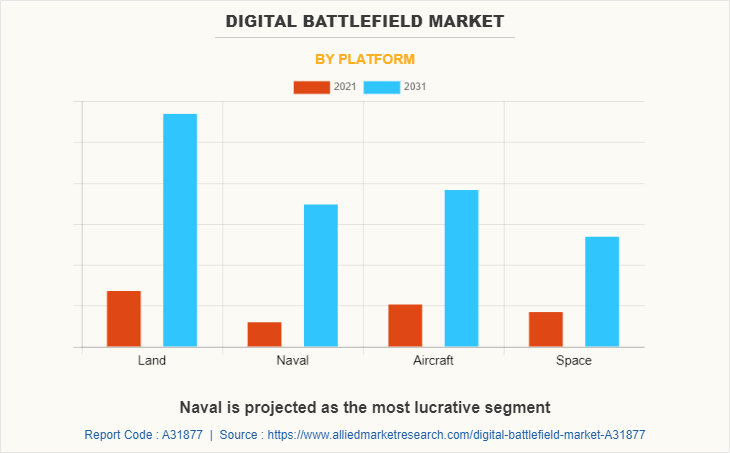

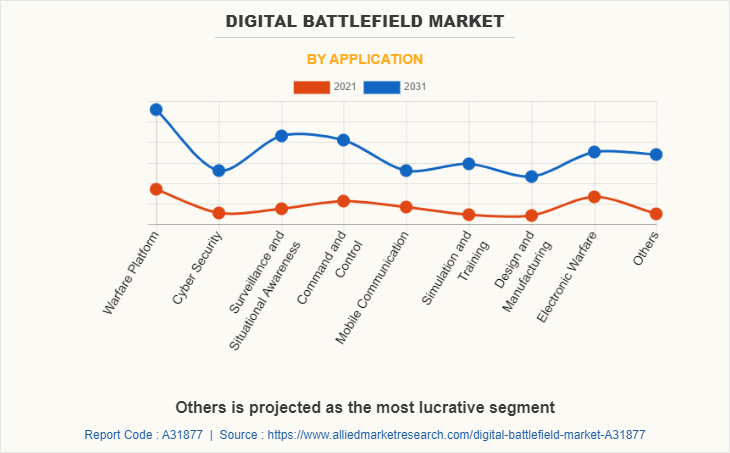

The digital battlefield market is segmented on the basis of solution, technology, application, platform, and region. By solution, it is divided into hardware, software, and services. By technology, it is classified into artificial intelligence, 3D printing, internet of things (IoT), big data analytics, robotic process automation, cloud computing & master data management, digital twin, blockchain, 5G, and AR & VR. By application, it is classified into warfare platform, cyber security, logistics & transportation, surveillance & situational awareness, command & control, mobile communication, health monitoring, simulation & training, design and manufacturing, predictive maintenance, threat monitoring, real-time fleet management, electronic warfare, and others. Based on the platform the global digital battlefield market is segmented into land, naval, aircraft and space. By region, the digital battlefield market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Growth drivers, restraints, and opportunities are explained in the study to better understand the market dynamics. This study further highlights key areas of investment. In addition, it includes Porter’s five forces analysis to understand the competitive scenario of the industry and the role of each stakeholder. The study features strategies adopted by key market players to maintain their foothold in the digital battlefield market.

The leading players operating in the digital battlefield market are ATOS SE, Booz Allen Hamilton Inc., Elbit Systems Ltd., L3Harris Technologies, Inc., Leonardo S.p.A., Lockheed Martin Corporation, Northrop Grumman Corporation, Raytheon Technologies Corporation, Rheinmetall AG and Teledyne FLIR LLC

In October 2022, Lockheed Martin Corporation has collaborated with Red Hat company to advance its artificial intelligence technology for military. This collaboration will enable both the companies to support missions of U.S. national security by applying and standardizing technologies of AI in geographically constrained environments.

In October 2022, Elbit Systems Ltd. partnered with the Latin-American army to supply a modernization solution, as part of their planned army-wide modernization program. The digitally interacted computerized solution will encompass of Paramount's 6X6 and Shaldot's 4X4 armored vehicles fortified with the mobile network solution.

In September 2022, Rheinmetall AG has partnered with Helsing to digitize the armed forces around the world. Through the joint ventures of defense software-based systems and retrofitting of current platforms, this partnership will offer the armed forces with future-proof and advanced abilities, supporting them to meet future and current challenges.

In May 2022, Teledyne FLIR LLC has partnered with the U.S. Army to supply for Black Hornet nano UAVs for the total value of $14 million. This seeks to improve reconnaissance and surveillance capabilities for the soldier on the battlefield, as well as help to keep situational awareness in near-real time.

Increasing operation over 5G network for high-speed data collection

The execution of robots and autonomous defense vehicles in the defense sector is increasing the demand around the world. Moreover, the surge in use of 5G networks in radars to track and detect multiple targets and the surging numbers of territorial conflicts and cross-border are improving the digital battlefield market growth. The high potential of 5G network, which can support more than 1 million devices in a range of square kilometer, is expected to push the sales for digital battlefield products around the world. Several devices including military products linked with smart sensors can be connected to each other over the 5G network.

All platforms or autonomous systems for the digital battlefield, such as unmanned ground vehicles and armored vehicles, can connect through 5G network which can transfer the data at high speeds in real time. This data is then interpreted over the network and used by autonomous platforms to take further action.

Strong budget for military and defense supporting the adoption of digital battlefield solutions

With total military spending of $261 bn by China, it had become the second-largest military spender after the U.S. in 2019. The country has seen several distant foes and neighboring in the past few years, which has led it to constantly increase its budget for military. Its clash with the U.S., Taiwan, Japan, India, South Korea, Malaysia, and Vietnam has pushed the country not only to invest in new technologies but also in traditional warfare mechanisms.

The China’s People’s Liberation Army (PLA) ranks among the prominent militaries armed with anti-ship ballistic missiles and artificial intelligence. There’s Strategic Support Force, which was founded in 2015, is now involved in channelizing psychological operations, cyber warfare, and electronic warfare.

U.S. is also having strong budget for its military and defense sector making significant investments in the digital battlefield to introduce pioneering technologies in the defense sector. The digital battlefield market has been more advancing from the immense use of cutting-edge technologies in the area. However, the US government is still working to enhance its capabilities in the land, sea, and air domains. The country is progressively putting an emphasis to modernization their soldier-level military. Such investments are supporting the adoption of digital battlefield solutions.

Rapid developments in robotics technologies, big data analytics and artificial intelligence

Robotics technologies, big data analytics and artificial intelligence are turning into a part of military organizations driven by the readiness of data from digital battlefield sources like C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance and Reconnaissance). Military and defense sector are gradually spending on analytics and information processing to improve artificial intelligence capabilities in the digital battlefield.

The advancement in big data technologies has undoubtedly been helpful to the defense sector of several countries including the US, China, and Russia. It has enabled the access to huge data volumes and the ability to scale ingestion. The strong network is needed to collect the data and keep all the military and defense devices connected. Militaries and defense can influence big data analytics on large datasets to provide meaningful results and insights.

Huge investment is required in early phase of digitization

Technologies like Artificial Intelligence (Al), Big Data Analytics, Robotics, Quantum Computing, Autonomous Weaponry, Hypersonic, Drones, and Missile Defense System requires heavy investment in manufacturing, testing and research & development so that countries which have low budget for defense are less interested in this kind of technology.

Systems for controlling the battlefield are vital in modern combat. However, combining up such advancement to a country's security assets comes at a major expense. Since it is a new idea, huge financing is needed for its research and development. Moreover, only a few of businesses can produce digital battlefield products, which boosts the price of the final product due to the detriment of intellectual property.

The process of digitizing the battlefield is difficult, expensive, and time-consuming. It calls for a very high level of concentration, dedication, and vision of the current and upcoming security technology and paradigm. It presents significant and unusual barriers, each of which calls for an organized response from various agencies. The high cost of maintenance linked with digital battlefield products may also limit the growth of digital battlefield market over the forecast period.

New generation missile and air defense system to create an immense opportunity for digital battlefield products.

The growth of new generation missile and air defense system like high-speed nuclear capable ballistic missiles and cruise missiles is a major threat to strategic locations and platforms such as airbases and military ships. Several countries are developing the weapons which are capable to defeat high end air defense systems like the S-400, Patriot Advanced Capability-3 (PAC-3), and medium extended air defense system (MEADS).

Governments around the world are focusing on the development of stealth aircraft, but, simultaneously, they are also investing strongly in advancing their surveillance systems to deal with stealth technology. Countries such as Russia, China and India have created hypersonic missiles that are not easy to capture the missile shields. Russia and India have mutually developed the BrahMos missile, which is difficult to catch the speed by older missile defense shields. Such advancements have led to the requirement for new generation digital battlefield products.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the digital battlefield market analysis from 2021 to 2031 to identify the prevailing digital battlefield market opportunities.

- The digital battlefield market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the digital battlefield digital battlefield market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global digital battlefield market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the digital battlefield market players.

- The report includes the analysis of the regional as well as global digital battlefield market trends, key players, market segments, application areas, and digital battlefield market growth strategies.

Digital Battlefield Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 156.8 billion |

| Growth Rate | CAGR of 15.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 317 |

| By Platform |

|

| By Solution |

|

| By Technology |

|

| By Application |

|

| By Region |

|

| Key Market Players | Atos SE, Lockheed Martin Corporation, Leonardo S.P.A., Teledyne FLIR LLC, Northrop Grumman Corporation, Rheinmetall AG, Booz Allen Hamilton Inc., Raytheon Technologies Corporation, Elbit Systems Ltd., L3Harris Technologies, Inc. |

Analyst Review

The digital battlefield market is expected to witness a steady growth due to advanced military combats and warfare technologies across various regions are being redefined. The flow of data across defense hierarchies has led to the progression of defined vertical and horizontal communication. The countries and budget planners around the globe have been expanding the proportion of digital battlefield technology share in their overall defense and military budgets.

A network connects communications, aerial platforms, weapon systems, and surveillance systems in the digitization of battlefield systems, permitting huge amounts of data to be traded. The army of United States has taken the advantage of exploiting and mixing these technologies under the banner of “digital battlefield.” The ability of soldier to overcome and meet the challenges has been renovated by the digital battlefield, which has become the primary tool for situation awareness.

Digital battlefield is widely used in land-based operations in order to have better control & command over the position during battle zone and reduce the chances of friendly fire. The growth in requirement of immediate deployment and dispatch of ground task soldiers in case of emergencies is promoting ground based digital battlefield system. The aging digital battlefield systems of several countries are pretending the requirement of system integration and technological upgrades, which will push the demand over the forecast period.

Northrop Grumman Corporation, Lockheed Martin Corporation, L3Harris Technologies, Inc., Raytheon Technologies Corporation, Elbit Systems Ltd., BAE Systems, Leonardo S.p.A., Rheinmetall AG, Teledyne FLIR LLC, Atos AG, Saab AB, Curtiss-Wright Corporation

The global digital battlefield market size was valued at $38 billion in 2021, and is projected to reach $156.8 billion by 2031, growing at a CAGR of 15.7% from 2022 to 2031.

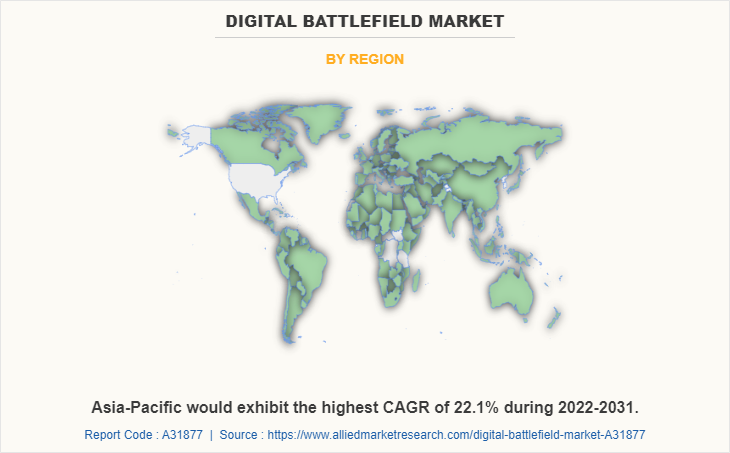

North America is the largest regional market for digital battlefield

Warfare Platform, Cyber Security, Surveillance and Situational Awareness, Command and Control, Mobile Communication, Simulation and Training, Design and Manufacturing, Electronic Warfare, and Others

Increasing operation over 5G network for high-speed data collection, Rapid developments in robotics technologies, big data analytics and artificial intelligence

Loading Table Of Content...