Digital Insurance Platform Market Overview

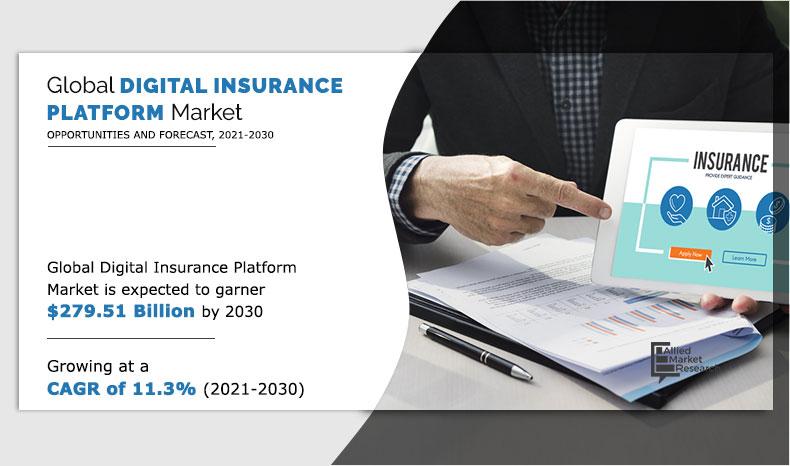

The global digital insurance platform market size was valued at $96.34 billion in 2020, and is projected to reach $279.51 billion by 2030, growing at a CAGR of 11.3% from 2021 to 2030. Growing demand for cloud-based insurance solutions, AI-enabled automation, real-time analytics, improved customer experience, streamlined underwriting, regulatory compliance, and increasing adoption of digital transformation in insurers contribute to the growth of the market.

Market Dynamics & Insights

- The digital insurance platform industry in North America held the largest share for 2020.

- By application, the automotive transportation & logistics segment accounted for the largest market share in 2020.

- By enterprises size, the small & medium-sized enterprises (SMEs) segment accounted for the largest market share in 2020.

- By component, the solution segment dominated the market in 2020.

Market Size & Future Outlook

- 2020 Market Size: $96.34 Billion

- 2030 Market Size: $279.51 Billion

- CAGR (2021-2030): 11.3%

- North America: Dominated market share in 2020

- Asia-Pacific: Highest CAGR during the forecast period

What is Meant by Digital Insurance

Digital insurance platform enables insurers to shift from complex core systems to a greater technical agility and flexibility, digital fluency, and innovation in the existing business model. In addition, it helps a company to create, manage, monitor, and control the digital insurance ecosystem. The digital insurance platform involves several technologies such as APIs, artificial intelligence, cloud-native computing, and machine learning, and other insurance specific capabilities and content.

The digital insurance platform enables the personalization of insurance products, thereby allowing insurers to price and underwrite policies more accurately for individual customers. In addition, enables more meaningful customer engagement through multiple channels & allows to provide personalized experiences to the customers, which is propelling the digital insurance platform market growth. However, digital transformation is time consuming and privacy & security concern are major factor that limits the market growth. On the contrary, developing economies offer significant opportunities for digital insurance platform companies as banks increasingly rely on these digital insurance platforms to determine credit worthiness of consumers due to high chances of consumers turning bad debts for banks. Moreover, digital insurance platform allows to improve market share & profitability for the insurers and urges to apply digital technologies in new ways and offer tangible value to customers, which is anticipated to provide a potential growth opportunity for the digital insurance platform market in the upcoming years.

The report focuses on growth prospects, restraints, and trends of the digital insurance platform market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the digital insurance platform market outlook.

Digital Insurance Market Segment Overview

The digital insurance platform market is segmented on the basis of component, deployment model, enterprise size, application, end user, and region. Based on component, the market is bifurcated into solution and services. The services segment is further segregated into professional and managed. By deployment model, the market is bifurcated into on-premise and cloud. By enterprise size, it is divided into large enterprises and small & medium enterprises (SMEs). Application covered in the report include automotive transportation & logistics, life & health, commercial & residential buildings, business & enterprise, agriculture, and others. Based on end user, the market is segmented into insurance companies, aggregators, and third-party administrators & brokers. Region-wise, it is analysed across North America, Europe, Asia-Pacific, and LAMEA.

Competitive Analysis

The digital insurance platform market analysis includes top companies operating in the market such as DXC Technology Company, EIS Software Limited, Lemonade Insurance Company, Majesco, Oscar Insurance, OutSystems, Quantemplate, Shift Technology, Wipro Limited, and Zhongan Insurance. These key players have adopted strategies, such as product portfolio expansion, mergers & acquisitions, agreements, regional expansion, and collaboration, to enhance their market penetration.

By Component

Solution segment accounted for the highest market share in 2020.

What are the Top Impacting Factors in Digital Insurance Market

Digital Insurance Platforms Help to Earn Customer Loyalty

Digital insurance platforms enable more meaningful customer engagement through multiple channels, provides personalized experiences, and above all, enables online claims processing within minutes. In insurance, it generally costs five times more to acquire a new customer versus converting an existing one. In addition, customers satisfied with the insurance offerings are 80% more likely to renew their policies than unsatisfied ones. Digital policy application and renewal can be quick, hassle-free and available 24/7, making the process seamless for insurance buyers. Therefore, digital insurance platforms help to earn customer loyalty which is further boosting the digital insurance platform market growth.

By Application

Automotive Transportation & Logistics segment accounted for the highest market share in 2020.

Privacy & Security Concern

Data and payment security are major concerns when it comes to digitizing insurance. Identity thefts and hacking can increase with greater digital interventions. An insurance company that is adopting digital insurance platforms will have to ensure that background checks are thorough, claims are genuine, and that their online infrastructure has the best protection against needless attacks. While digital insurance platform market offers benefits for consumers, they also introduce potential risks. For instance, consumers need to be assured that the information provided by digital platforms is in their best interests. Over-simplification and biased information would imply that search results, rankings or other information generated by these platforms may not necessarily reflect individual user preferences. Additionally, the use of large amounts of personal data by online platforms raises concerns about intrusiveness, fairness and discrimination. Therefore, this is a major factor limiting the growth of the market.

Increasing Adoption of Digital Solutions

The digital boom in the insurance sector is driven by the need to build direct bridges with the end consumer through the smart phone in order to survive in an era where the customer is using the phone as the primary medium of communication. The trend has been fast paced driven partly due to the large base of phone users and partly due to lesser weight of legacy systems. Digitalization presents a growing digital insurance platform market opportunity to improve market share and profitability for the insurers. It also urges insurers to apply digital technologies in new ways and offer tangible value to customers. Therefore, it presents the possible opportunities of digitalization for insurers & customers as adoption of digital solutions for insurance policies will keep increasing in the future. Therefore, this factor will provide major lucrative opportunities for the growth of the digital insurance platform market in upcoming year.

By Region

Asia-Pacific would exhibit the highest CAGR of 12.8% during 2021-2030

What are the Key Benefits for Stakeholders

- The study provides in-depth analysis of the global digital insurance platform market share along with current trends and future estimations to illustrate the imminent investment pockets.

- Information about key drivers, restrains, and opportunities and their impact analysis on the global digital insurance platform market size are provided in the report.

- Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the digital insurance platform market.

- An extensive analysis of the key segments of the industry helps to understand the digital insurance platform market trends.

- The quantitative analysis of the global digital insurance platform market forecast from 2021 to 2030 is provided to determine the market potential.

Digital Insurance Platform Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Deployment Model |

|

| By Enterprise Size |

|

| By Application |

|

| By End User |

|

| By Region |

|

| By Key Market Players |

|

Analyst Review

With becoming a data-driven industry, companies operating in the insurance sector are continuing to adopt, implement, and invest in digital insurance platform, which has become a major trend in the market. Owing to COVID-19 outbreak, government mandated lockdowns & business shutdowns have caused serious disruptions in value chain of businesses. Therefore, insurance companies have changed their business model and are switching toward completely online mode of channels. Therefore, these are some of the fluctuating trends among insurance companies & digital insurance platform providers during the pandemic situation. Moreover, digital insurance platform is evolving rapidly and helps insurers to satisfy the consumer needs and changing the insurance industry’s reputation from conservative & inflexible to highly personalized and user-friendly.

Furthermore, the COVID-19 global health crisis has accelerated the adoption of digital insurance platform among insurers to emphasize their digital transformation efforts and help accelerate virtual interactions in sales & claim settlements and reducing overall operating expenses. In addition, advanced digital insurance platform helps insurance carriers to create new & innovative offerings and sustain in the competitive business environment.

The digital insurance platform market is fragmented with the presence of regional vendors such as Majesco, Zhongan Insurance, and DXC Technology Company. Some of the key players profiled in the digital insurance platform market report include EIS Software Limited, Lemonade Insurance Company, Oscar Insurance, OutSystems, Quantemplate, Shift Technology, and Wipro Limited. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. With increase in awareness & demand for digital insurance platform across the globe, major players are collaborating their product portfolio to provide differentiated and innovative products.

The digital insurance platform market is estimated to grow at a CAGR of 11.3% from 2021 to 2030.

The digital insurance platform market is projected to reach $279.51 billion by 2030.

To get the latest version of sample report

Digital transformation is time consuming and privacy & security concern.

The key players profiled in the report include DXC Technology Company, EIS Software Limited, Lemonade Insurance Company, Majesco, and many more.

On the basis of top growing big corporations, we select top 10 players.

The digital insurance platform market is segmented on the basis of component, deployment model, enterprise size, application, end user, and region.

The key growth strategies of digital insurance platform market players include product portfolio expansion, mergers & acquisitions, agreements, regional expansion, and collaboration.

Business & Enterprise segment would grow at a highest CAGR of 13.8% during the forecast period.

North America region will dominate the market by the end of 2030.

Loading Table Of Content...