Digital Manufacturing Software Market Overview

The global digital manufacturing software market was valued at USD 6.9 billion in 2022, and is projected to reach USD 33.7 billion by 2032, growing at a CAGR of 17.4% from 2023 to 2032.

The rising use of technological advancements and industry 4.0 and the increase in complexity and globalization of supply chains are boosting the growth of the global digital manufacturing software market. In addition, the growing demand for improved operational efficiency and cost reduction positively impacts the growth of the market. However, the high cost of implementation, increasing security concerns, and data privacy hamper the digital manufacturing software market growth. On the contrary, increasing priority for sustainable manufacturing techniques is expected to offer remunerative opportunities for the expansion of the digital manufacturing software market during the forecast period.

The digital manufacturing software process in the industry involves the development, sale, and implementation of software solutions designed to enhance and optimize various aspects of the manufacturing process through digital technologies. This market encompasses a wide range of software applications and tools tailored to streamline, automate, and improve different stages of the manufacturing lifecycle. Digital manufacturing software includes solutions for product design, simulation, production planning, process optimization, quality control, and collaboration across the entire supply chain.

Segment Review

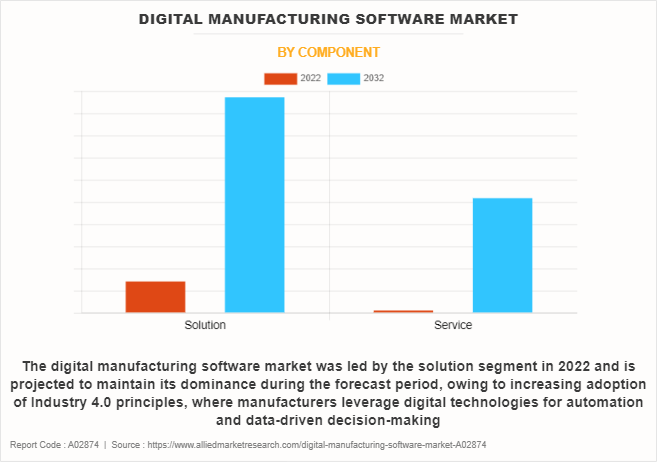

The digital manufacturing software market is segmented by component, deployment mode, enterprise size, application, and region. In terms of component, the market is fragmented into solution, and service. Depending on deployment mode, it is bifurcated into on-premise and cloud. As per enterprise size, the market is bifurcated into large enterprise, and small and medium enterprises. In terms of application, the market is segmented into automotive & transportation, aerospace & defense, consumer electronics, industrial machinery, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

.

By component, the digital manufacturing software market size was led by the solution segment in 2022, and is projected to maintain its dominance during the forecast period, owing to increasing adoption of Industry 4.0 principles, where manufacturers leverage digital technologies for automation and data-driven decision-making. However, the service segment is expected to grow at the highest rate during the forecast period, owing to growing complexity of digital manufacturing solutions and the need for specialized knowledge during implementation, which boost the global digital manufacturing software industry.

Region wise, the digital manufacturing software market share was dominated by North America in 2022, and is expected to retain its position during the forecast period. This is attributed to implementation of the Internet of Things (IoT) and Artificial intelligence (AI) in the manufacturing sectors such as automotive & transportation. However, Asia-Pacific is expected to witness significant growth during the forecast period. The growth of the manufacturing industry is mainly delivered by the rise in per capita income, increasing urbanization, and the high adoption of technologies.

Key Digital Manufacturing Software Companies

The key players profiled in the digital manufacturing software market industry are Autodesk Inc., Intel Corporation, Microsoft Corporation, Oracle Corporation, Rockwell Automation Inc., SAP SE, Schneider Electric SE, General Electric Co., Siemens AG, and IBM Corporation. These players have adopted various strategies to increase their market penetration and strengthen their position in the digital manufacturing software industry.

Top Impacting Factors

Drivers

The Rising Use of Technological Advancements and Industry 4.0

The rapid evolution of digital technologies, coupled with the widespread adoption of Industry 4.0 principles, serves as a major driver for the digital manufacturing software market. In addition, industry 4.0 emphasizes the integration of digital technologies, data-driven insights, and automation into manufacturing processes, contributing to the creation of 'smart factories.' Moreover, digital manufacturing software plays a pivotal role in smart factory transformation by enabling manufacturers to digitize and connect their entire value chain.

Furthermore, the implementation of technologies such as the Internet of Things (IoT), Artificial Intelligence (AI), and advanced analytics within the manufacturing ecosystem enhances operational efficiency, reduces downtime through predictive maintenance, and facilitates real-time decision-making. As manufacturers strive for greater agility, scalability, and responsiveness, the demand for digital manufacturing software continues to surge.

For instance, HCL Technologies (HCL) launched Industry NeXT, a transformational framework designed to help customers digitally reinvent their businesses. The Industry NeXT by HCL Technologies builds on the Industry 4.0 (I4.0) foundation and enables businesses globally to plan, prepare, and seamlessly change into a collaborative ecosystem. It allows this by facilitating connected experiences, resilient operations, and the delivery of blended physical and digital products and services powered by intelligent digital interventions. Hence, such growing strategies are expected to drive market growth during the forecast period.

Increase in Complexity and Globalization of Supply Chains

The globalization of supply chains and the complexity of modern manufacturing processes contribute significantly to the adoption of digital manufacturing software. In addition, to the interconnected global economy, manufacturers often operate across diverse geographical locations, necessitating efficient collaboration and coordination. Digital manufacturing software provides a unified platform for managing complex supply chain networks, ensuring seamless communication between different stages of production. The software's ability to create digital twins of physical assets allows for virtual simulations and optimizations, reducing the risk of errors and enhancing overall product quality. As supply chains become more intricate, manufacturers seek digital solutions that can enhance visibility, traceability, and the ability to respond swiftly to changes in demand or disruptions.

For instance, in October 2023, Nulogy, a leading provider of supply chain collaborated with Formic, a leading robotics company accelerating the adoption of automation across American manufacturing to jointly strengthen the world's manufacturing supply chains through their respective SaaS (Software as a Service) and RaaS (Robotics as a Service) product offerings. Hence, such growing strategies are expected to drive market growth during the forecast period.

Restraints

The High Cost of Implementation

The high cost of implementation and complexity of processes are major challenges impeding the market. The electronics industry is rapidly adopting and integrating modern technologies to increase operational efficiency and reduce overall development costs. DM has become an integral part of the overall design and development system, starting from product and process design to customer feedback. However, the high initial investment needed for infrastructure for DM and connectivity is posing a challenge to the vendors.

The deployment of DM software is an expensive process, which involves defining a clear set of business requirements. The software implementation may take months or even years in some cases. This makes the entire process critical, as any single change can be extremely expensive for the end user after the system deployment. Moreover, the growing use of multiple technologies has increased the complexity of the implementation process. This, in turn, has increased the requirement for additional infrastructure, IT professionals, and extra finances to ensure efficient data integration. Thus, the high cost of implementation and complexity of processes will negatively impact the growth of the global market during the forecast period.

Increasing Security Concerns and Data Privacy

Privacy and data security issues are significant challenges impeding the market growth during the forecast period. As digital manufacturing software facilitates the collection, analysis, and sharing of vast amounts of sensitive data across interconnected systems, cybersecurity concerns, and data privacy issues emerge as significant restraints for market growth. The interconnected nature of Industry 4.0 and digital manufacturing exposes manufacturers to potential cyber threats, ranging from data breaches to disruptions in production processes.

The integration of IoT devices and the use of cloud-based solutions introduce new vulnerabilities that malicious actors may exploit. Ensuring robust cybersecurity measures and maintaining compliance with data protection regulations become critical considerations for organizations adopting digital manufacturing software. The need to safeguard intellectual property, trade secrets, and sensitive production data requires continuous investment in cybersecurity infrastructure and practices. Hence, such factors are expected to hinder market growth during the forecast period.

Opportunities

Increasing Priority for Sustainable Manufacturing Techniques

The increasing focus on sustainable manufacturing methods presents an emerging opportunity for the market growth. In addition, manufacturers are looking for solutions that might help optimize resource utilization, minimize‐¯waste, and lessen the overall environmental effect of production processes as environmental consciousness becomes a concern for industries worldwide. Moreover, with the use of digital manufacturing software, businesses may simulate and assess the environmental impact of their operations, facilitating the adoption of environmentally friendly procedures.

The software's capacity to maximize material use, energy use, and manufacturing efficiency is in line with manufacturers' larger environmental objectives. Furthermore, offering such solutions that improve operational effectiveness and support the growth of sustainable and ecologically conscious manufacturing ecosystems is a business opportunity for digital manufacturing software suppliers, which in turn is expected to provide lucrative opportunity for the growth of the market.

Market Landscape and Trends

The digital manufacturing software market comprises a diverse range of solutions catering to different stages of the manufacturing process. This includes Computer-Aided Design (CAD), Computer-Aided Manufacturing (CAM), Product Lifecycle Management (PLM), Manufacturing Execution Systems (MES), and more.

Moreover, the adoption of digital manufacturing software is prevalent across various industry verticals, including automotive, aerospace, electronics, healthcare, and consumer goods. Each sector has specific needs, leading to the development of specialized software solutions. There is a growing trend towards the adoption of cloud-based digital manufacturing solutions. Cloud platforms offer scalability, accessibility, and collaboration features, allowing manufacturers to manage and analyze data from anywhere, facilitating remote collaboration and real-time decision-making.

Key Industry Development

Recent Partnerships in the Market

November 29, 2023: ModuleWorks partnered with Mitsubishi Electric to drive the development of intelligent, integrated manufacturing solutions by fostering collaboration and innovation between ModuleWorks and key technology providers.

Recent Product Launches in the Market

In December 16, 2022, Authentise launched Flows & FlowsAM Digital Manufacturing Software. Flows incorporates many tools that stretch beyond the capabilities of a traditional Manufacturing Execution System, including real-time quoting, machine-data driven status updates, material genealogy, supplier management and more. These features are already used to manage post processing such as heat treatment, machining and more.

Recent collaboration in the Market

On August 22, 2023, GE Vernova’s Digital business collaborated with AWS to help manufacturers and utilities accelerate digital transformation using cloud-based Proficy® software solutions.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the digital manufacturing software market forecast from 2023 to 2032 to identify the prevailing digital manufacturing software market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the digital manufacturing software market analysis segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the digital manufacturing software industry players.

The report includes the analysis of the regional as well as global digital manufacturing software market trends, key players, market segments, application areas, and market growth strategies.

Digital Manufacturing Software Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 33.7 billion |

| Growth Rate | CAGR of 17.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 260 |

| By Component |

|

| By Deployment Mode |

|

| By Enterprise Size |

|

| By Application |

|

| By Region |

|

| Key Market Players | General Electric Co., Rockwell Automation Inc., IBM Corporation, Siemens AG, Intel Corporation, Schneider Electric SE, Oracle Corporation, Microsoft Corporation, Autodesk Inc., SAP SE |

Analyst Review

Industrial machinery refers to equipment, machines, and tools that are used in the manufacturing, processing, and production of goods in different industries. Industrial machinery can be categorized into various types, such as material handling equipment, industrial robots, packaging machinery, machine tools, and printing equipment. These machines and equipment are designed to increase productivity, efficiency, and accuracy in production processes, leading to cost savings and improved quality of goods.

The digital manufacturing software market has been growing steadily over the years, driven by the demand for automation and the modernization of production processes. The market growth is also fueled by the growth of the manufacturing sector, especially in developing countries. The market growth of digital manufacturing software is also being driven by technological advancements in the industry. With the growth in demand for digital manufacturing software solutions, various companies have established partnership strategies to increase their offerings in digital solutions. For instance, In November 2023, Ansys partnered with Materialise, a global leader in 3D printing software and service solutions to deliver integrated digital solutions to help overcome workflow challenges in the AM industry. The partnership will seamlessly integrate Ansys Additive Suite into Materialise's data and build preparation tool, Magics. Thus, such strategies drive market growth.

In addition, with the surge in demand for digital manufacturing software, several companies have expanded their current product portfolio to continue with the rise in demand in the market. For instance, in July 2023, Fujitsu launched Digital Factory on Microsoft's commercial marketplace. Fujitsu's Digital Factory solution is designed to optimize enterprise operations and enhance availability, performance, and quality for customers in the manufacturing industry.

Also, in August 2020, Accenture acquired Turin-based boutique systems integrator PLM Systems. This acquisition helped to boost PLM Systems capabilities and presence in the market for digital engineering services.

Increase in adoption of industry 4.0, AI, and ML technologies in digital manufacturing industry are the upcoming trends of Digital Manufacturing Software Market in the world.

Automotive and Transportation is the leading application of Digital Manufacturing Software Market in 2022.

Asia-Pacific is the largest regional market for Digital Manufacturing Software.

the estimated industry size of Digital Manufacturing Software is $33,729.68 million by 2032.

The key players profiled in the digital manufacturing software market analysis are Autodesk Inc., Intel Corporation, Microsoft Corporation, Oracle Corporation, Rockwell Automation Inc., SAP SE, Schneider Electric SE, General Electric Co., Siemens AG, and IBM Corporation. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Loading Table Of Content...

Loading Research Methodology...