Digital Radiology Market Research, 2030

The global digital radiology/radiography market was valued at $3.9 billion in 2020, and is projected to reach $8.3 billion by 2030, growing at a CAGR of 6.6% from 2021 to 2030.Digital radiology is a radiographic technique that uses X-ray sensitive plates to capture data directly while patient examination. Digital radiology is an advanced technique of X-ray inspection that produces radiographic image on a computer. Picture is replaced by sensor that collects the data in digital radiology. The digital radiology is used in medical imaging. Digital radiology is recommended as a significant choice for clinical diagnosis, owing to high-quality picture processing and less radiation exposure. Manufacturers focus on increasing qualities, including contrast, sharpness, and ability to inspect injuries in real time. Technological advancements in X-ray imaging improved diagnostic accuracy and minimized radiation dosages.

.

The growth of digital radiology/radiography market is driven by surge in the frequency of chronic diseases, sports-related injuries, and cancer. Every year, many patients, particularly in underdeveloped countries undergo imaging testing. In addition, growth in population boost demand for digital radiology detectors in future and thus boosts the digital radiology market growth. Furthermore, senior citizens develop age-related disorders, necessitating use of variety of radiographic examinations is one of the major digital radiography market trends. However, high costs of these tests and scarcity of competent professionals hinder growth of the market. Furthermore, major manufacturers focus on providing new technologies to end customers, particularly for C-arms and fluoroscopy devices, which flourish the digital radiology market opportunity in future.

The World Health Organization (WHO) on January 30, 2020 declared COVID-19 as pandemic. COVID-19 impacted 210 countries across the globe. State-run administrations across the globe declared inescapable lockdowns and social distancing measures to prevent the healthcare system from collapsing, owing to COVID-19 pandemic. In addition, state governments implemented constraints and restrictions on ongoing medical procedures and elective surgeries. These restrictions continue to hinder the growth of various industries. The distribution, production, and supply networks have been impacted, due to implementation of lockdown across the globe.

Market Segmentation

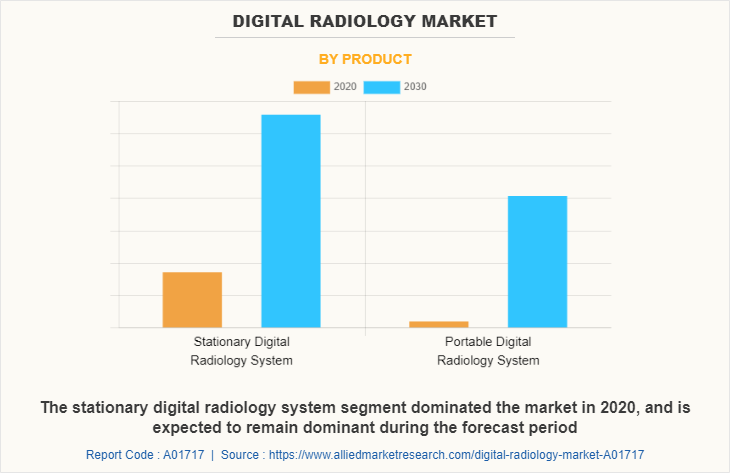

The global digital radiology/radiography market is segmented on the basis of product, application, technology, end user, and region. On the basis product the market is segmented into stationary digital radiology system and portable digital radiology system. Depending on stationary digital radiology system segment, it is classified into ceiling-mounted and floor-to-ceiling mounted digital radiology systems. As per portable digital radiology system segment, it is divided into handheld radiology systems and mobile radiology systems.

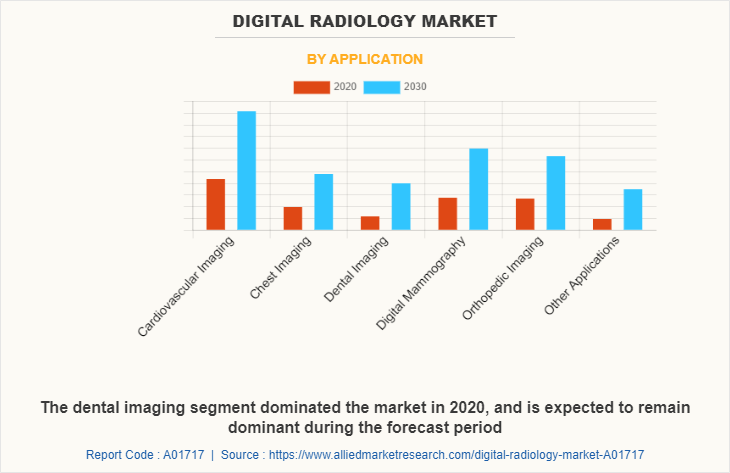

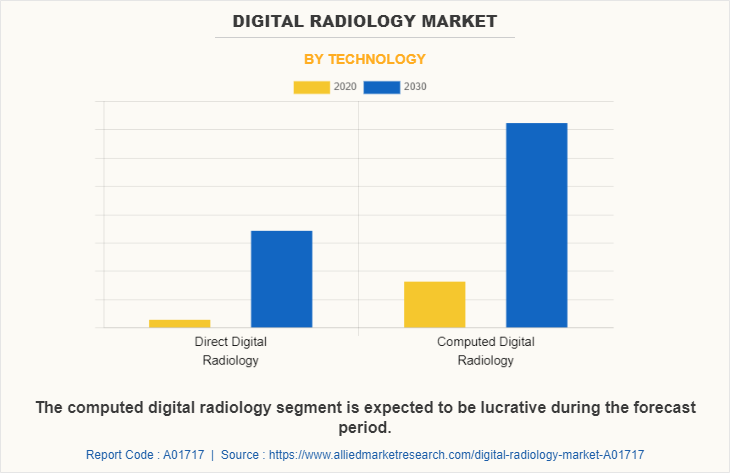

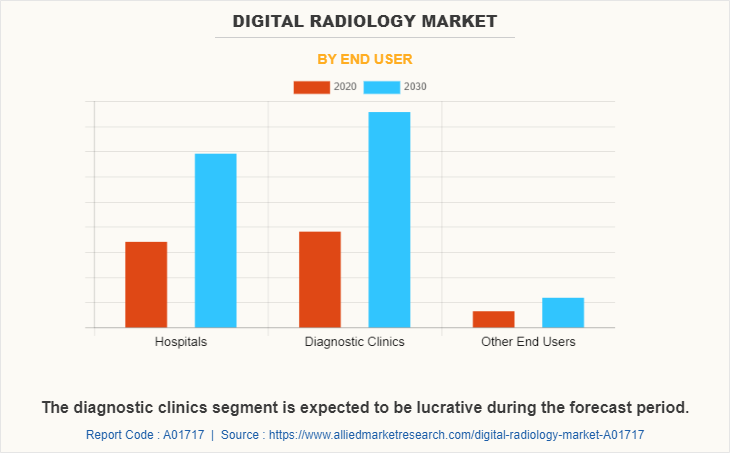

According to application, it is fragmented into cardiovascular imaging, chest imaging, dental imaging, digital mammography, orthopedic imaging, and other applications. By technology, it is bifurcated into computed radiography and direct digital radiography. On the basis of end user, it is categorized into diagnostic center and hospital. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Application

Dental radiology segment accounted as the largest segment, which is attributed to the surge in demand of high quality imaging and lowered radiation exposures for dental procedures.

By Technology

According to technology, direct digital radiology segment accounted for the largest share in the market, which attributed to increase in efficiency and quality criteria in digital radiology market.

By End User

Diagnostic clinics segment accounted for the largest share in the market, owing to surge in the patient pools and rising awareness for early diagnosis.

By Region

North America dominated the digital radiography market size, which attributed to surge in healthcare settings shifting from computed radiology based X-Ray systems to DR-based X-Ray systems have been accounted as a prominent reason for the dominance of this region. However, LAMEA digital radiography market share is expected to grow with highest CAGR during the forecast periods owing to the rising investments. Moreover, Brazil and South Africa are expected to grow at high CAGR in LAMEA digital radiography market forecast.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the digital radiology market analysis from 2020 to 2030 to identify the prevailing digital radiology market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the digital radiology market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global digital radiology market trends, key players, market segments, application areas, and market growth strategies.

Digital Radiology Market Report Highlights

| Aspects | Details |

| By Product |

|

| By Application |

|

| By Technology |

|

| By End User |

|

| By Region |

|

| Key Market Players | , Koninklijke Phillips, Hitachi,Ltd, Detection Technology, Samsung Electronics Co Ltd, Agfa-Gevaert group, Cannon Inc., Medtronics, Fujifilm Holdings, General Electrics |

Analyst Review

Direct conversion of transmitted X-ray photons into a digital image, utilizing an array of solid-state detectors, including amorphous selenium or silicon, followed by computer processing and display of the image, is known as digital radiology (DR). Mobile DR or portable DR systems are moved between rooms for imaging and are utilized for both fixed base room installations and mobile or portable DR systems. Benefits of digital X-ray equipment aided their acceptance, owing to speed, accuracy, and rapid processing times, allowing for substantially higher patient screening numbers than previously possible.

Factor such as technological developments is a critical driver in the digital radiology market's growth. Digital radiology systems are in high demand, due to factors such as image quality, acquisition time, portability, detector form, and software. Benefits such as ability to analyze massive amounts of data and evaluate patients instantly are driving demand for improved digital radiology equipment. Therefore, digital radiology equipment are more expensive and need significant upfront investments, which raises the procedure cost for patients. This has an impact on the rate at which new systems are adopted, particularly in developing nations. In addition, one of the most promising areas of health innovation is use of artificial intelligence (AI), particularly in medical imaging. In this sense, many ongoing R&D activities aided the industry.

In addition, North America accounted for largest share of digital radiology market, followed by Europe. The large share of North America can be attributed to the surge in healthcare settings shifting from computed radiography-based X-Ray systems to direct radiography -based X-Ray systems.

The global digital radiology market was valued at $3,942.72 million in 2020, and is projected to reach $8,319.38 million by 2030, registering a CAGR of 6.6%.

Dental imaging is the leading application of the market owing to surge in dental procedures among the children as well as the adults.

Growth in cardiac, orthopedic, dental disorders, advancement in technology and adaptation of better healthcare facilities fuel the growth of market.

North America is the largest regional market for digital radiology owing to the rising number of patients suffering from chronic diseases, the presence of key players, and availability of standard healthcare infrastructure.

Agfa-Gevaert group, Cannon Inc., Detection Technology, Fujifilm, General Electrics, Medtronics, Koninklijke Phillips, Samsung,Hitachi, and Varex Imaging corporation are the top companies of digital radiology market.

Loading Table Of Content...