Digital Remittance Market Overview

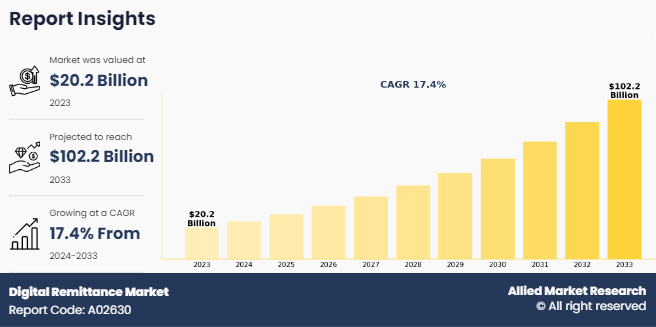

The global digital remittance market size was valued at USD 20.2 billion in 2023, and is projected to reach USD 102.2 billion by 2033, growing at a CAGR of 17.4% from 2024 to 2033. The widespread adoption of smartphone and internet access, along with fintech innovations such as blockchain and mobile wallets, enabling faster, secure, and convenient fund transfers, contribute toward the growth of the market.

Market Dynamics & Insights

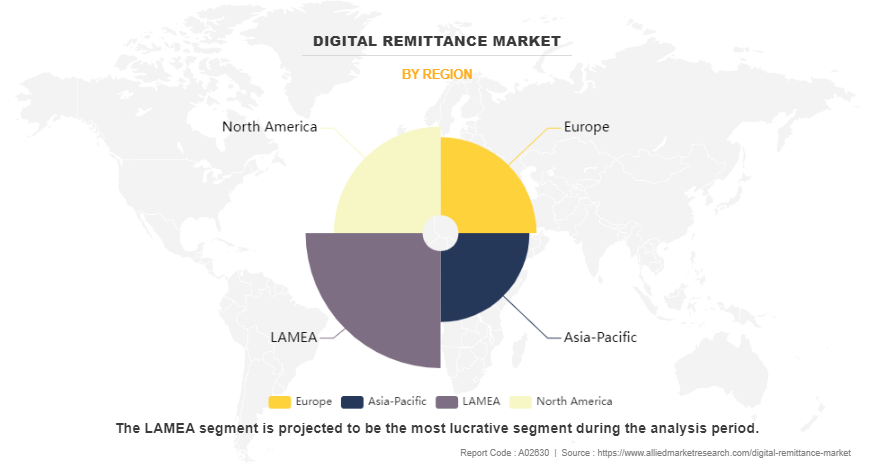

- The digital remittance industry in LAMEA held a significant share of 33% in 2023.

- The digital remittance industry in India is expected to grow significantly at a CAGR of 24.4% from 2024 to 2033.

- By channel, the money transfer operators segment is one of the dominating segment in the market, accounting for the revenue share of over 72% in 2023.

- By end user, the personal segment dominated the industry in 2023 and accounted for the largest revenue share of 71%.

Market Size & Future Outlook

- 2023 Market Size: USD 20.2 Billion

- 2033 Projected Market Size: USD 102.2 Billion

- CAGR (2022-2031): 17.4%

- LAMEA: Dominated the market in 2023

- Asia Pacific: Fastest growing market

What is Meant by Digital Remittance

Digital remittance refers to the electronic transfer of money from one individual or entity to another using online platforms or mobile applications. It is a efficient method of sending funds across borders while eliminating the need for traditional methods such as cash or checks. With the help of digital remittance, users can initiate transactions through secure online channels, thus providing convenience, speed, and cost-effectiveness. The process involves the sender initiating the transfer by providing the recipient's details, such as bank account information or mobile wallet details, and specifying the amount to be sent. The funds are then electronically transferred and deposited into the recipient's account, making it accessible for immediate use.

Digital remittance services often offer competitive exchange rates and lower fees compared to traditional money transfer methods, making it a popular choice for individuals, businesses, and even expatriates sending money back to their home countries. In addition, digital remittance platforms provide features such as real-time location tracking, ensuring transparency and enabling senders to monitor the progress of their transactions. Digital remittance industry has revolutionized the way money is sent globally, by providing a secure, fast, and convenient solution for transferring funds across borders in the digital economy.

The digital remittance market growth has experienced significant growth due to the widespread adoption of smartphones and internet connectivity. The increasing accessibility of affordable smartphones and internet services has empowered individuals to utilize digital platforms and mobile applications for their financial transactions, including remittances. This shift has made digital remittance the preferred choice for many, enabling convenient cross-border money transfers, which is expected to drive market growth. Further, technological advancements in fintech and digital payment solutions, such as blockchain, mobile wallets, and instant payment systems, have further fueled the market by making global money transfers faster and more convenient.

However, regulatory challenges and compliance requirements pose hindrances for digital remittance market opportunity providers. Governments and regulatory bodies implemented stringent rules to combat illegal activities, necessitating costly compliance measures and robust reporting systems. On the contrary, there is untapped potential in emerging markets, where large populations with limited access to traditional banking services can benefit from affordable digital remittance solutions. By catering to underserved populations, companies can tap into a vast customer base and contribute to financial inclusion and economic empowerment. Expanding into these markets will provide major lucrative opportunities for the growth of the digital remittance market outlook.

The report focuses on growth prospects, restraints, and trends of the digital remittance market analysis. The study provides Porter's five forces analysis to understand the impact of various factors, such as the bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, the threat of substitutes, and bargaining power of buyers, on the digital remittance market forecast.

Key Findings:

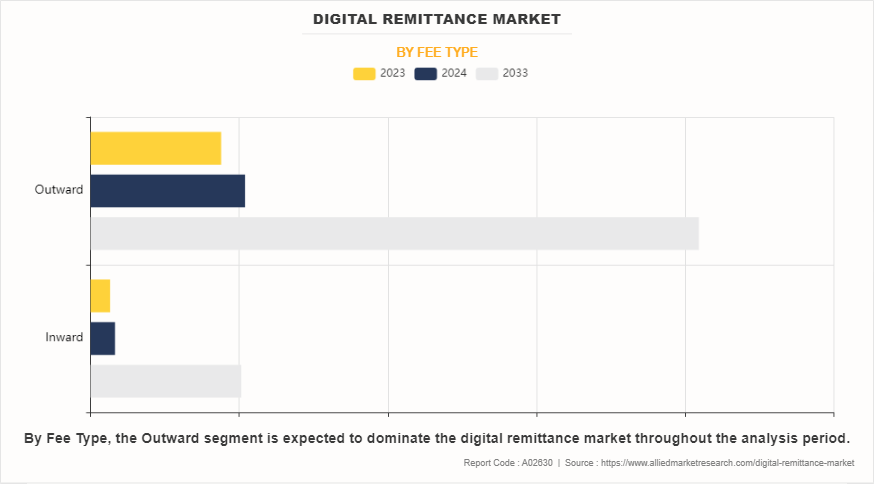

- By fee type, the outward segment accounted for the largest digital remittance market share in 2023.

- By channel, the money transfer operators segment accounted for the largest market share in 2023.

- By end user, the personal segment accounted for the largest digital remittance market share in 2023.

- Region-wise, LAMEA generated the highest revenue in 2023.

Digital Remittance Market Segment Review

The digital remittance market is segmented on the basis of fee type, channel, end user, and region. On the basis of fee type, the market is bifurcated into inward and outward. Based on channel, the market is segmented into banks, money transfer operators, and others. By end user, it is bifurcated into personal and business. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA .

On the basis of fee type, the outward segment dominated the digital remittance market in 2023, as outward remittances involve individuals in developed nations sending funds to their home countries, primarily for personal and family support. This drives the volume of transactions in the outward segment. However, the inward segment is projected to attain the highest CAGR during the forecast period, as governments and international organizations are promoting financial inclusion, enabling unbanked populations in developing nations to access digital payment.

By region, LAMEA dominated the market share in 2023, driven by the region's well-established gaming infrastructure, widespread adoption of digital technologies, and a large base of digital remittance enthusiasts. However, the Asia-Pacific is projected to attain the highest CAGR during the forecast period. This growth is driven by the increasing popularity of digital remittance in countries like China, South Korea, and Japan, where security culture is deeply embedded. The region is also witnessing significant investments in security infrastructure.

Competition Analysis

Competitive analysis and profiles of the major players in the digital remittance market share include Remitly, Inc., Wise Payments Limited, Western Union Holdings, Inc., Ria Financial Services, Digital Wallet Inc., TransferGo Ltd., WorldRemit, MoneyGram., PayPal Holdings Inc. and Nium Pte. Ltd. These major players have adopted various key development strategies such as business expansion, new product launches, and partnerships, which help to drive the growth of the digital remittance market globally.

What are the Recent Developments in Digital Remittance Industry

In June 2024, Ventia launched Digital remittance, a generative AI solution to streamline how employees query Ventia's document library for information about internal standards, compliance, and operating procedures. The solution designed as an AI chatbot handles employee requests for information and searches for answers within Ventia's online document system delivering these to employees quickly and efficiently.

What are the Top Impacting Factors in Digital Remittance Market

Increasing adoption of smartphones and internet connectivity

The widespread adoption of smartphones and the availability of affordable internet connectivity have played a significant role in driving the growth of the digital remittance market. As more people gain access to smartphones and the internet, they are able to leverage digital platforms and mobile applications for their financial transactions, including remittances. The convenience and accessibility offered by these technologies have encouraged individuals to choose digital remittance solutions, which further expected to propel the growth of digital remittance market.

In addition, security features, including encryption and multi-factor authentication, further enhance consumer confidence in digital remittance services, which drives the market growth. The combination of technological advancements and the growing trust in digital platforms fosters a shift away from traditional remittance methods. This trend is particularly evident in emerging economies where smartphone adoption is growing. Thus, the smartphone proliferation and improved internet access is driving the digital remittance market toward unprecedented growth, reshaping global money transfer dynamics.

Regulatory constraints and compliance requirements

The digital remittance market is subject to various regulatory frameworks and compliance requirements, both at the national and international levels. Governments and regulatory bodies impose rules to prevent money laundering, terrorism financing, and other illicit activities. Adhering to these regulations can be complex and costly for remittance service providers, requiring them to implement robust compliance measures, conduct customer due diligence, and maintain extensive reporting systems. Therefore, compliance challenges and regulatory uncertainties further expected to hamper the growth and expansion of digital remittance market.

Untapped potential in emerging markets

One significant opportunity for the digital remittance market lies in the untapped potential of emerging markets. Many developing countries have large populations with limited access to traditional banking services. The availability of affordable smartphones and increasing internet penetration present an opportunity to reach these underserved populations with digital remittance solutions. By providing convenient and affordable remittance services to these markets, companies can tap into a vast customer base and establish themselves as key players in the growing digital economy. This can lead to increased financial inclusion and economic empowerment for individuals in these regions, while also driving the growth of the digital remittance market.

In addition, governments in some emerging markets are also adopting policies to encourage financial inclusion, further supporting the expansion of digital remittance services. By tapping into these underserved populations and providing seamless cross-border payment options, digital wallets platforms can foster greater financial inclusion and economic growth, creating a substantial market opportunity for service providers.

What are the Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the digital remittance market forecast from 2024 to 2033 to identify the prevailing market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities of digital remittance market outlook.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the digital remittance industry segmentation assists in determining the prevailing digital remittance market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as digital remittance market trends, key players, market segments, application areas, and market growth strategies.

Digital Remittance Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 102.2 billion |

| Growth Rate | CAGR of 17.4% |

| Forecast period | 2023 - 2033 |

| Report Pages | 276 |

| By Fee Type |

|

| By Channel |

|

| By End User |

|

| By Region |

|

| Key Market Players | PayPal Holdings Inc., Nium Pte. Ltd., Ria Financial Services, MoneyGram., TransferGo Ltd., Remitly, Inc., Wise Payments Limited, Western Union Holdings, Inc., WorldRemit, Digital Wallet Inc. |

Analyst Review

The digital remittance market has experienced significant developments, transforming the way people send and receive money across country. One major development is the widespread adoption of mobile technology and internet connectivity, which has facilitated the growth of digital remittance platforms and services. Mobile apps and online platforms have made it easier for individuals to initiate remittance transactions, eliminating the need for physical visits to brick-and-mortar locations.

Moreover, advancements in financial technology have enabled faster and more secure remittance processes. Blockchain technology has gained prominence in the remittance industry, providing transparent and efficient transaction tracking while ensuring data security. In addition, the rise of digital wallets and mobile payment systems has revolutionized the remittance landscape by offering convenient and low-cost solutions. These platforms allow users to store and transfer funds digitally, reducing reliance on traditional banking infrastructure. Further, regulatory developments have played a crucial role in shaping the digital remittance market.

Many countries have recognized the potential of digital remittances and implemented supportive regulations to foster innovation and competition while ensuring consumer protection. Thus, the digital remittance market has seen remarkable advancements driven by mobile technology, fintech innovations, blockchain integration, and regulatory frameworks, making cross-border money transfers faster, more accessible, and cost-effective for individuals worldwide. Furthermore, market players are adopting various strategies for enhancing their services in the market and improving customer satisfaction.

For instance, on February 2023, Fintivpartnered with Geoswiftthe partnership will provide Fintiv’s customers the unique capability of making person-to-person or business-to-business payments into China, India, and many other Asian countries, directly from wallet accounts. With Geoswift’s superior geographical reach through its “GeoRemit” product line, Fintiv’s payment platform can connect to an extensive number of domestic banks or mobile wallets in Asian countries and territories.

The digital remittance market has witnessed significant growth and transformation in recent years, driven by technological advancements, increased internet and smartphone penetration, and the growing demand for seamless, cost-effective money transfers.

Money transfer operators are the leading channel of the Digital Remittance Market.

LAMEA will be the largest regional market for Digital Remittance in 2023.

$102.2 billion is the estimated industry size of Digital Remittance in 2033.

Remitly, Inc., Wise Payments Limited, Western Union Holdings, Inc., Ria Financial Services, Digital Wallet Inc., TransferGo Ltd., WorldRemit, MoneyGram., PayPal Holdings Inc., and Nium Pte. Ltd. are the top companies to hold the market share in Digital Remittance.

Loading Table Of Content...

Loading Research Methodology...