Digital Signage Market Research, 2032

The Global Digital Signage Market was valued at $23.6 billion in 2022 and is projected to reach $50.6 billion by 2032, growing at a CAGR of 8% from 2023 to 2032. Digital signage deploys electronic display systems, such as LED media boards, digital display panels, video walls, or projectors, to exhibit multimedia content in public areas. These high-tech signboards leverage computerized systems and software to showcase dynamic information such as text, images, videos, and interactive features. In contrast to traditional static signs, digital signage enables real-time content updates and remote management, creating a versatile and adaptable communication platform.

Segment Overview

The digital signage market is segmented into Product, Offering, Location, and End User.

Digital signage functions as a contemporary and flexible communication tool, revolutionizing the presentation and dissemination of information in various environments, including retail establishments, airports, hotels, restaurants, corporate offices, and transportation centers as video walls. This technology provides numerous benefits, including the ability to captivate audiences with vibrant visuals, convey information more effectively, and tailor messages to specific audiences or time-sensitive situations.

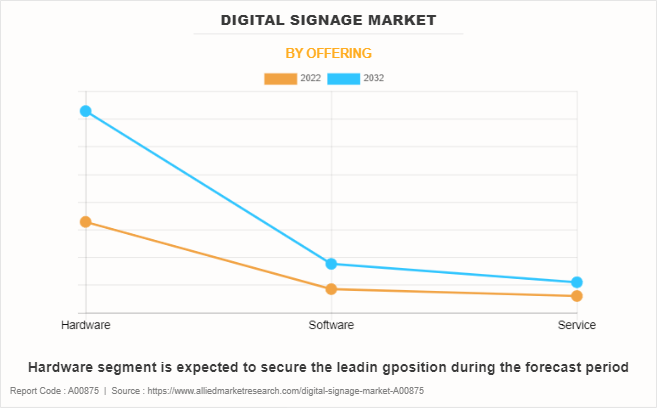

Based on the offering, the market is divided into hardware, software, and services. In 2022, the hardware segment dominated the market, and it is expected to acquire a major market share by 2032, owing to an increase in the use of digital signage for retail and education end users.

Decrease in cost of displays and improved customer experience are the factors that drive the digital signage market growth globally. In addition, the development of government offices as well as fast fast-growing educational sector contribute toward the growth of the market. Technological developments, including near-field communication, are expected to create greater opportunities. The advent of touchscreen technology is expected to open new avenues.

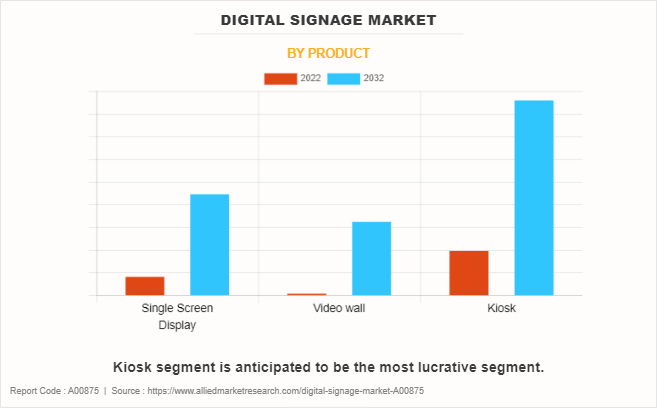

Based on product, the market is categorized into single-screen displays, video walls, and kiosks. In 2022, the kiosk segment dominated the market, and it is expected to acquire a major market share by 2032 due to an increase in investment by government and private companies in airports, public transport, and other vital sectors.

The rise in demand for bright and power-efficient display panels, rapid digitalization, and the decline in demand for traditional billboards are the factors that drive the growth of the market. However, the deployment of widescreen alternatives such as projectors and screenless displays, a lack of standard policy, and power problems hamper the digital signage market growth to a certain extent. Furthermore, emerging display technologies such as micro-LED and quantum dots, and an increase in preference of electronic giants toward large screen displays offer lucrative opportunities for the market in the country for digital signage growth projections.

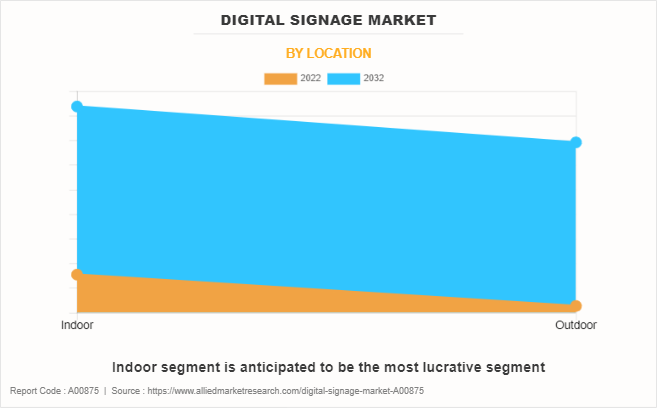

Based on location, the market is divided into indoor and outdoor. In 2022, the indoor segment dominated the market, and the outdoor segment is expected to acquire a major market share by 2032, owing to an increase in the use of digital signage for retail and education end users.

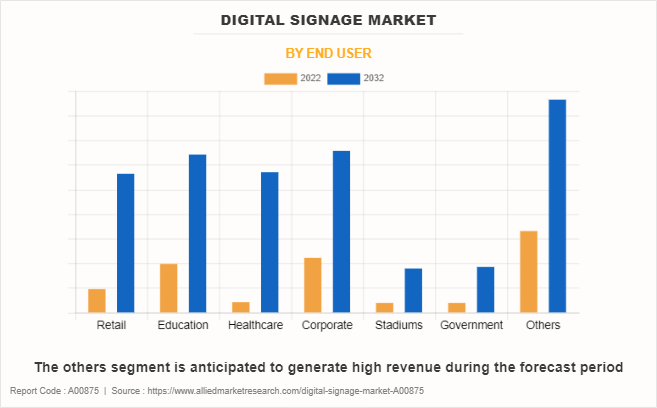

Based on end-user, the market is divided into retail, education, healthcare, corporate, stadiums, government, and others. In 2022, the other segment dominated the market, and the healthcare segment is expected to acquire a major market share by 2032.

Based on region, the digital signage market trends are analyzed across digital signage market size by Country North America (the U.S., Canada, and Mexico), Europe (Germany, UK, France, Spain, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

Competitive Analysis

Competitive analysis and profiles of the major digital signage market share by company that have been provided in the report include ISEMC (HHSD TECHNOLOGY), Koninklijke Philips N.V., LG Electronics, NEC Corporation, Panasonic Corporation, Planar Systems, Inc., Sony Corporation, Samsung Electronics Co., Ltd., Viewsonic Corporation, and VOLANTI DISPLAYS. The key strategy adopted by the major players in the market is product launch.

Country Analysis

Country-wise, Canada acquired a prime share in the Digital Signage market in the North American region, and it is expected to grow at a significant CAGR during the forecast period of 2023-2032.

In Europe, the Rest of Europe dominated the Digital Signage market share, in terms of revenue, in 2022 and is expected to follow the same trend during the forecast period. The UK is expected to emerge as the fastest-growing country in Europe's Digital Signage market with a CAGR of 8.58%.

In Asia-Pacific, Japan and India are expected to emerge as significant markets for the industry, owing to a rise in demand for interactive displays and a thriving retail sector, indicating substantial opportunities for digital signage market expansion in the region.

In the LAMEA region, Latin America garnered a significant market share in 2022. The LAMEA digital signage market growth is attributed to increased investments in digital advertising, rising demand for interactive displays, and the adoption of modern communication technologies, fostering a positive trajectory in the region's digital signage market. Moreover, the Africa region is expected to grow at a high CAGR of 9.09% from 2023 to 2032.

Top Impacting Factors

The significant impacting factors in the digital signage market are the rise in demand for bright and power-efficient display panels, rapid digitalization, and decline in demand for traditional billboards, and increase in demand for 4K and Ultra-HD devices. However, the deployment of widescreen alternatives such as projectors is expected to hinder market growth. Conversely, emerging display technology such as micro-LED & quantum dots and an increase in preference of electronic giants toward large-screen displays are projected to offer remunerative opportunities to the digital signage market. Each of these factors is anticipated to have a definite impact on the market during the forecast period.

Historical Data & Information

The global digital signage industry is highly competitive, owing to the strong presence of existing vendors. Vendors in the digital signage market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors as they cater to market demands. The competitive environment in this market is expected to worsen as technological innovations, product extensions, and different strategies adopted by key vendors increase in the digital signage industry.

Key Developments / Strategies

In January 2024, Samsung Electronics America announced its partnership with Buona Beef, a 40-year-old, family-owned and operated Italian Beef restaurant chain based in the Chicago area, to supply Samsung kiosks and LED digital menu boards for restaurant locations.

In December 2023, Black Rifle Coffee, a coffee brand that has branched into retail coffee locations, announced its partnership with Creative Realities, a technology firm offering digital signage, experiential, and SaaS services, to revitalize in-store digital signage at physical Black Rifle Coffee locations.

Key Benefits For Stakeholders

This report provides a quantitative analysis of the digital signage market report, current trends, estimations, and dynamics of the digital signage market from 2022 to 2032 to identify the prevailing digital signage market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the digital signage market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global digital signage market overview.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global digital signage market trends, digital signage companies, market segments, application areas, and market growth strategies.

Digital Signage Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 50.6 billion |

| Growth Rate | CAGR of 8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 233 |

| By Product |

|

| By Offering |

|

| By Location |

|

| By End User |

|

| By Region |

|

| Key Market Players | ISEMC (HHSD TECHNOLOGY), NEC Corporation, Sony Corporation, VOLANTI DISPLAYS, LG Electronics, Panasonic Corporation, Koninklijke Philips N.V., Viewsonic Corporation, Samsung Electronics Co., Ltd., Planar Systems, Inc. |

Analyst Review

The digital signage market is projected to depict a prominent growth during the forecast period, owing to a rise in demand for bright and power-efficient display panels and rapid digitalization and decline in demand for traditional billboards. Digital signage is an emerging technology, which offers high image resolution and better picture quality over traditional displays. It offers enhanced contrast over the traditional OLED and LED display technologies. In addition, the consumption of power by digital signage is less as compared to other technologies such as LEDs and OLEDs. Thus, the rise in demand for such brighter and power-efficient devices fuels the growth of the digital signage market.

Major vendors such as Samsung, Apple, Sony, and others adopt digital display technology on a large scale, owing to less power consumption, enhanced response time, and superior contrast over traditional display systems such as OLED, LED, and others. For instance, Samsung Electronics is expected to launch a modular technology The Wall, a self-emitting 146-inch Micro LED TV, which does not require color filters to produce perfect black and accurate colors unlike other display technologies. Thus, the increase in preference of the electronic giants for large screen display format boosts the growth of the market.

The key players profiled in the report include NEC Corporation, Sony Corporation, LG Electronics, Samsung Electronics, Panasonic Corporation, ViewSonic Corporation, Volanti Displays, iSEMC (HHSD), Koninklijke Philips N.V., and Planer System Inc. These key players have adopted strategies, such as product launch, expansion, and partnership to enhance their position in the digital signage market.

The digital signage market is expected to witness growth in interactive content, AI integration, IoT utilization, and enhanced data analytics for personalized and engaging customer experiences.

Retail and others segments

Asia-Pacific

The global digital signage market was valued at $23,600.0 million in 2022, and is projected to reach $50,601.54 million by 2032, registering a CAGR of 7.96% from 2023 to 2032.

ISEMC (HHSD TECHNOLOGY), Koninklijke Philips N.V., LG Electronics, NEC Corporation, Panasonic Corporation, Planar Systems, Inc., Sony Corporation, Samsung Electronics Co., Ltd., Viewsonic Corporation, and VOLANTI DISPLAYS

Loading Table Of Content...

Loading Research Methodology...