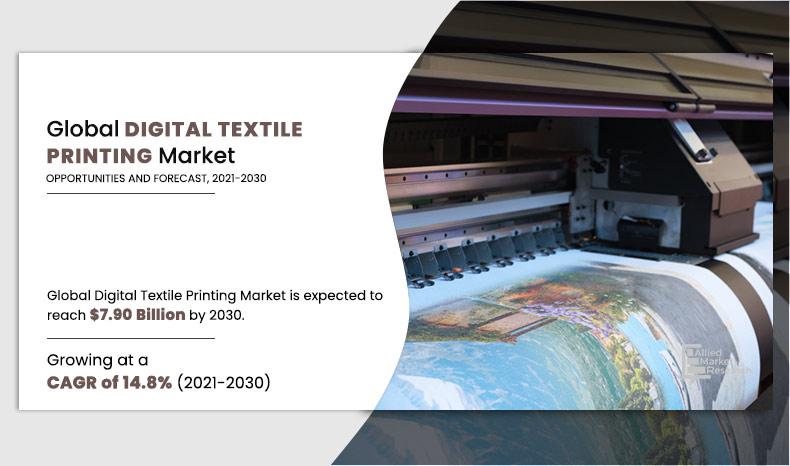

Digital Textile Printing Market Outlook - 2021-2030

The global digital textile printing market size was valued at $2.0 billion in 2020, and expected to reach $7.9 billion by 2030, at a CAGR of 14.8% from 2021 to 2030.

Digital textile is an inkjet-based method that allows manufacturers to print different design that can be virtually made on any kind of fabric. The inks used in digital printing are manufactured according to type of fiber, such as cotton, silk, or polyester. During digital printing, the fabric is fed into the printing device using a roller. The process involves adding ink to the surface in the form of small droplets. After that the fabric is then finished by using either or steam or heat treatment increasing the efficiency. In addition, some inks need washing and drying. Due to technology changes, manufacturers are showing more interest in digital printing rather than dyed fabrics.

The market is anticipated to witness significant growth, owing to increase in demand for printed textiles. Furthermore, rise in per capita disposable income in emerging nations coupled with rapid change in fashion trends with new printed garments are anticipated to boost the market growth during the forecast period. Moreover, surge in application of textile printing in vehicle wrapping, automotive interior decoration is anticipated to boost the segment growth in the automotive sector. However, volatile prices of raw materials and hazardous effects of digital printing inks on infants and old people are expected to hamper the market growth. Nonetheless, technology developments, such as hot melt printing for textile application and 3D printing (additive manufacturing) is anticipated to create new opportunities penetrating new segment growth in the upcoming time.The digital textile printing market is segmented on the basis of substrate, ink type, application and region.

On the basis of substrate, the global digital textile printing market is categorized into cotton, silk, polyester, and others. On the basis of ink type, the market is segmented into reactive, acid, direct disperse, sublimation, pigment, and others. The application segment is classified into clothing, households, technical textiles, display & others. By region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The major players operating in the global digital textile printing market focused on new product launch and partnerships due to shift in trend toward eco-friendly and quality-based products. Some of the major companies profiled in this report are Huntsman Corporation, AGS Transact Technologies Limited, Am Printex Solutions, China Dyeing Holdings Ltd., Hollander B.V, Dazian LLC, Dickson Coatings, Digitex India Inc., Fisher Textiles Inc., and Mehler Technologies GmbH. Rapid increase in demand for digital textiles led the key manufacturers to expand their production capacities to meet the market demand across the globe, which led to surge in the demand for digital textile machinery. Additional growth strategies such as acquisition, partnership and product launch, are also adopted to attain increased market share in the digital textile printing market trends.

Global Digital Textile Printing Market, By Region

Europe dominates the global digital textile printing market. Italy garners maximum share of the European digital textile printing market, due to presence of major manufacturers. Italy dominates the European region, owing to rise in demand for digital textile printing in fashion industries in Italy. Moreover, the presence of large number of fashion industries in Milan, Rome, Palermo, and Venice fuels the demand for digital textile printing growth throughout the forecast period.

By Region

Europe holds a dominant position in 2020

Global Digital Textile Printing Market, By Substrate

Cotton segment dominates the global digital textile printing market. Cotton is a natural fiber that is widely used in fashion and sportswear digital textile printing, due its high moisture control and prolonged durability. Owing to high wash fastness, reactive ink is mostly used for cotton fabric substrate, which drives the growth of the segment.

By Substrate

Others is projected to create abundant $ opportunity till 2030

Digital Textile Printing Market, By Ink Type

Sublimation dominates the global digital textile printing market sublimation segment is expected to witness significant growth in the Europe digital textile printing market, owing to increase in demand for dye-sublimation in customized printing service. Moreover, sublimation ink becomes a part of the fabric rather than adding a layer on top, making it highly durable as compared to conventional printing process, such as heat transfer paper. Furthermore, low production and raw material cost of sublimation printing is expected to fuel the market demand in the near future.

By Ink Type

Sublimation segment is projected as the most lucrative segment.

Digital Textile Printing Market, By End Use

Display and others segment dominates the global digital textile printing market. Integrated electronic circuits can be incorporated into washable fabric for wearable electronics and other display devices. Such circuits are printed with eco-friendly inks using digital textile printing techniques. Researchers from China and Italy are focusing on introducing superior inks for high-quality printing. For instance, Italy made Kiian Digistar Hi-PRO Sublimation Ink, a water-based piezo ink, which is used for digital textile printing for polyester fabrics that can be used in electronic display and other integrated circuits. Such printed components require low cost and are required to be highly flexible and washable in nature. However, due to high wash fastness, such products offer limited compatibility with skin.

By End Use

Display & others is projected to create abundant $ opportunity till 2030

Key benefits for stakeholders

- This report provides a detailed quantitative analysis of the current global digital textile printing market trends and estimations from 2020 to 2030, which assists to identify the prevailing opportunities.

- An in-depth global digital textile printing market analysis of various countries in this region is anticipated to provide a detailed understanding of the current trends to enable stakeholders formulate specific plans.

- A comprehensive analysis of the factors that drive and restrain the growth of the global digital textile printing market is provided.

- Europe region-wise and country-wise market conditions are comprehensively analyzed in this report.

- The projections in this report are made by analyzing the current trends and future market potential from 2020 to 2030 in terms of value and volume.

- An extensive analysis of various regions provides insights that are expected to allow companies to strategically plan their business moves.

- Key market players within the market are profiled in this report and their strategies are analyzed thoroughly, which help to understand the competitive outlook of the global digital textile printing market.

Digital Textile Printing Market Report Highlights

| Aspects | Details |

| By Substrate Type |

|

| By Ink Type |

|

| By End Use |

|

| By Region |

|

| By Key Market Players |

|

Analyst Review

The global digital textile printing market is expected to witness increased demand during the forecast period, due to rapid increase in demand for clothing and households across the region, which is expected to surge the growth of the digital textile printing market throughout the forecast period.

Various methods of textile printing, such as direct print, discharge print, pigment print, resist print, and specialty print, have evolved to cater to the increasing demand for digital textile printing market. With the development of dye sublimation printer, it is possible to print with low-energy sublimation inks and high-energy disperse inks directly onto textile media by the heat press process. Moreover, increase in investments on R&D activities to develop novel methods of digital textile printing and rise in per capita disposable income, especially in the developing economies, such as India, Russia, and Poland are anticipated to accelerate the demand for digital textile printing technology during the forecast period.

The increase in innovation in the field of developing various inks, dyes, and additives to improve the efficiency and automation of the textile printing machine coupled with increase in awareness among the people regarding the advantages of the digital textile printers on the environment, fashion designers, and retailers are the major factors that provide opportunities for the growth of the digital textile printing market during the forecast period.

Factors such as surge in raw material costs along with high equipment costs of wet-post treatment and harmful environmental impact of digital textile printing are some of the key challenges expected to hamper the sales of global digital textile printing market during the forecast period.

Surge in demand for 3D printing technologies and change in fashion trends are the key factors boosting the Global Digital Textile Printing market growth

Market value of Global Digital Textile Printing in 2030 is expected to be US$ 7.9 billion

Huntsmann Corporation, Ags Transact Technologies Limited, Am Printex Solutions, China Dyeing Holdings Ltd., Hollander B.V, Dazian LLC, Dickson Coatings, Digitex India Inc., Fisher Textiles Inc., and Mehler Texnologies GmbH

Display & others is projected to increase the demand for Global Digital Textile Printing market

The digital textile printing industry market is segmented on the basis of substrate, ink type, end use and region. On the basis of type of substrate, the Europe Global Digital Textile Printing market is segmented into cotton, silk, polyester, and others. On the basis of ink type, Europe Global Digital Textile Printing market is introduced as reactive, acid, direct dispense, sublimation, pigments, and others. By end use, the study includes clothing, household, technical textiles, and display & others. By region, the market is studied across North America, Europe, Asia-Pacific and LAMEA.

Rapidly shifting trend toward automation in textile industry is the main driver of Global Digital Textile Printing market

Clothing and display end users are expected to drive the adoption of Global Digital Textile Printing

COVID-19 pandemic negatively impacted the Global Digital Textile Printing market in 2021

Loading Table Of Content...