Digital Transformation In BFSI Market Research, 2032

The global digital transformation in BFSI market was valued at $68.2 billion in 2022, and is projected to reach $310.7 billion by 2032, growing at a CAGR of 16.6% from 2023 to 2032.

Digital transformation in BFSI is a set of methodologies, tools and processes that is used by modern companies to improve their operational activities and to enhance their sales. The key objective of digital transformation in BFSI is to automate, and digitize processes in the banking & fintech organizations and to streamline critical process of the organization. Numerous benefits are associated with digital transformation in BFSI, which include enhanced security features, better risk management process, automation of repetitive tasks and others.

The key factors that drive the growth of the digital transformation in BFSI market include the increase in adoption of digital technology by various banks and surge in need of digital services among the fintech to improve the customer experience. Banks and fintech’s are digitizing their asset for increasing customer retention rate and to provide customers with enhanced services.

Furthermore, digital financial service helps banks to increase their productivity speed and to provide transparency of fund transactions to their clients. In addition, exploration of digital channels to roll out new services is considered as an important factor to boost the digital transformation in BFSI market growth.

However, high implementation and maintenance cost of digital technology and security & privacy concerns related to data theft and cyber-attacks is expected to hamper the growth of digital transformation in BFSI market. Cybersecurity risks facilitate consumer loss of privacy and financial threat, such as identity theft which negatively impacts the growth of the market. On the contrary, an increase in adoption of advanced technology such as AI and machine learning among the companies is expected to offer remunerative opportunities for the expansion of the global market during the forecast period. Many banks and financial institutions are adopting artificial intelligence-based banking solutions to provide customer with faster and more efficient customer services. In addition, to improve the security features in the banking platform, many banks are adopting machine learning to predict fraud even before it happens. These innovations are constantly being developed and account for numerous opportunities for the sector.

The report focuses on growth prospects, restraints, and trends of the digital transformation in BFSI market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the digital transformation in BFSI market.

Segment Review

The digital transformation in BFSI market is segmented on the basis of component, deployment model, enterprise size, technology, end user and region. In terms of component, the market is bifurcated into solution and service. By deployment model, the market is divided into on-premises and cloud. On the basis of enterprise size, the market is segregated into large enterprises and small and medium-sized enterprises. On the basis of technology, it is divided into artificial intelligence, cloud computing, blockchain, big data and business analytics, cyber security and others. As per end user, the market is categorized into banks, insurance companies and others. On the basis of region, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

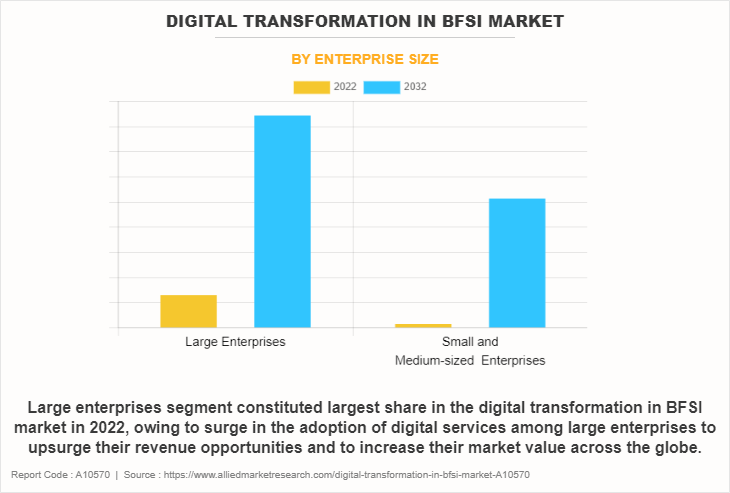

On the basis of enterprise size, the large enterprises segment attained the highest digital transformation in BFSI market size in 2022, owing to rise in different factors among the large enterprises which include assets protection, reputation management, supply chain risks, IP protection, and competitor analysis.

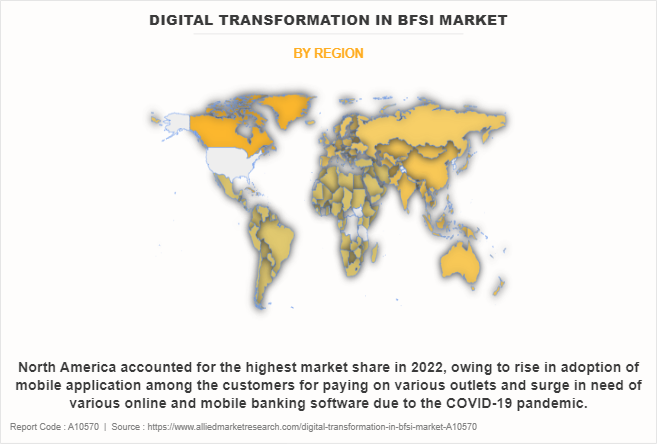

On the basis of region, North America held the highest digital transformation in BFSI market share in 2022. This is attributed to the increase in demand to transform traditional business operations into digital across the region and rapid adoption of IoT solutions, mobile devices, and cloud technology among the banking and fintech industries.

The report analyzes the profiles of key players operating in the digital transformation in BFSI market such as Accenture, Alphasense Inc., Cognizant, FUJITSU, Google, LLC, HID Global Corporation, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation and SAP SE. These players have adopted various strategies to increase their market penetration and strengthen their position in the digital transformation in BFSI market.

Market Landscape and Trends

The expansion of the digital transformation in BFSI market is driven by the development of artificial intelligence (AI) and machine learning (ML) to enhance various aspects of their operations. Open banking initiatives are gaining momentum, driven by regulatory mandates in some regions surging the growth of digital transformation in BFSI market. Banks are opening up their application programming interfaces (APIs) to third-party developers, encouraging collaboration, creating new financial products and services. In addition, digital payment solutions such as mobile wallets deliver payments without communicating with like-minded people together. The pandemic further accelerated the adoption of cashless transactions and online payments.

Moreover, BFSI companies are increasingly taking a customer-centric approach, focusing on delivering personalized experiences and designing their products and services to meet individual customer needs. Digital channels, data analytics and AI-driven insights will play a key role in understanding consumer preferences and underlying behaviors. Furthermore, the rise of mobile devices has reshaped how customers interact with BFSI services. Mobile banking apps and online platforms have become increasingly popular, leading BFSI companies to invest in digital channels to meet customer demands. These factors overall boosts the growth of digital transformation in BFSI market.

Top Impacting Factors

Increase in Customize IT Solutions for Specific Banking needs

IT solutions tailored to the specific and evolving requirements of banks are an important part of the digital transformation in BFSI market. Traditional banking solutions are unable to meet the changing needs of customers and organizations. As a result, banks are increasingly turning to customized IT solutions that meet their specific needs, delivering personalized experience and specialized functionality. Moreover, the main benefits of custom-written software are that it provides improved security for customers’ and organizations’ data and reduces the chances of system cyberattacks and phishing attacks, besides providing market access growth, banks often collaborate with fintech companies to develop customized solutions that integrate with new technologies. These partnerships result in customized solutions for specific banking needs. For instance, in January 2023, HDFC Bank, India’s largest private sector bank, partnered with Microsoft for its digital transformation journey and unlocking business value by transforming the application portfolio, modernizing the data landscape and securing the enterprise with Microsoft Cloud. Therefore, these are some of the major factors that drive the growth of the digital transformation in BFSI industry.

Exploration of Digital Channels to roll out New Services

Many banking and fintech organizations are adopting digital channels for upgrading their system to improve customer experience. In addition, most of the banking and fintech organizations are adopting digital channel that focuses on enhancing the speed of the transaction processing and improving user experience of financial services. Furthermore, the penetration of fifth generation wireless (5G) technology in the banking sector is providing customers with faster data transmission and uninterrupted connectivity at the payment processing time. Moreover, the increase in adoption of mobile and online banking apps among the general public is allowing them to transfer fund immediately and receive financial details instantly. This is becoming a permanent change as customers are comfortable using online/mobile banking channels and thereby reducing visits to branch. Therefore, exploration of digital channels to roll out new services is considered as an important factor to boost the digital transformation in BFSI market.

Surge in need of Digital Services Among the Fintech

Increase in need of digital service among the fintech solution providers is one of the most prominent ways to accelerate digital transformation in BFSI market. In addition, banks and fintechs are digitizing their asset for increasing customer retention rate and to provide customers with enhanced services. Furthermore, digital financial service helps banks to increase their productivity speed and to provide transparency of fund transactions to their clients. In addition, the increase in demand for digital service among fintech solution owing to the rise in need to understand the basic needs of the customers drives the growth of digital transformation in BFSI market. Therefore, these trends are driving the growth of the digital transformation in BFSI market.

Security and Privacy Concerns

The increasing risk of cyber-attacks and rise in house data theft issues across the organizations is the major factor restraining the growth of digital transformation in BFSI market. In addition, cybersecurity risks facilitate consumer loss of privacy and financial threat, such as identity theft, which negatively impacts the growth of digital transformation in BFSI market. Furthermore, almost all financial institutions have experienced cyberattacks in one form or another, and the number of attacks is only growing, negatively affecting the growth of digital transformation in BFSI market.

Financial institutions around the world strive to facilitate compliance by ensuring safe transactions. This resulted in new rules on tax reporting under the Foreign Account Taxation Act (FATCA). This rule has increased the compliance burden for banks, asset management companies, brokers and insurance companies. This rise in new rules have increased the need for transparency of banks and the financial regulators with customers or end users about the trade-off between convenience and security when it comes to digital banking functions.

Moreover, highly sophisticated cyber-attacks have exacerbated the decision of many financial institutions to deploy third party technological solutions for mobile or web applications. Furthermore, the rise in need for digital banking among individuals has led to rise in number of sophisticated cyber threats where phishing scams, fraudulent behaviors, and malwares are improvising with increasing number of attempts. To overcome these challenges, an increase in demand for automation and artificial intelligence (AI) security tools by regulators and financial institutions has been witnessed in recent years. Thus,these factors majorly hinders the growth of digital transformation in BFSI market.

Increase in Adoption of Advance Technology AI and Machine Learning

The banking and fintech industry have experienced a drastic change over centuries, owing to the emergence of disruptive technologies. In addition, rising adoption of artificial intelligence and machine learning in banking and fintech institutes is providing a lucrative opportunity for digital transformation in BFSI market. Furthermore, many banks and financial institutions are adopting artificial intelligence-based banking solutions to provide customer with faster and more efficient customer services. In addition, to improve the security features in the banking platform, many banks are adopting machine learning to predict fraud even before it happens. These innovations are constantly being developed and account for numerous opportunities for the sector. For instance, AI in digital banking solutions possess extreme capabilities to reduce loan processing time and operational costs. In addition, cognitive computing possesses capabilities to analyze huge amounts of data to create opportunities for lenders in risk analysis and management. More number of advanced technologies integration in the upcoming years are expected to create significant opportunities for digital transformation in BFSI market.

Rise in Adoption of Digital Services among Developing Nations of Asia-Pacific and LAMEA Countries

In Asia-Pacific and LAMEA region, fintech services are catching on. The fast-growing young economies, such as China and India, to mature markets, such as Australia and Japan, advanced FinTech systems are rapidly becoming part of the fabric of everyday life. In every market where consumers have smart phones – and, in Asia, the majority do – people are gaining access to a growing range of virtual financial services, and at a faster rate than in most of the world’s other markets.

Banking in the Middle East is undergoing a digital transformation. Business across the Asian countries are adopting efficient and streamlined solutions for enhancing their customers and to increase their customer base which is providing lucrative opportunity for digital transformation in BFSI market. In addition to this, the use of digital solutions has been reinforced by the pandemic. With the unprecedented global disruption prompting the “work from home” environment, paper-based processes have become impractical. This “new normal” has had the positive effect of further accelerating digitalization and pushing its importance to the fore. Therefore, these factors will enhance growth prospect for digital transformation in BFSI market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the digital transformation in BFSI market forecast from 2022 to 2032 to identify the prevailing digital transformation in BFSI market opportunity.

- Market research is offered along with information related to key drivers, restraints, and opportunities of digital transformation in BFSI market outlook.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the digital transformation in BFSI market segmentation assists in determining the prevailing digital transformation in BFSI market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global digital transformation in BFSI market trends, key players, market segments, application areas, and market growth strategies.

Digital Transformation in BFSI Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 310.7 billion |

| Growth Rate | CAGR of 16.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 530 |

| By Component |

|

| By Deployment Mode |

|

| By Enterprise Size |

|

| By Technology |

|

| By End User |

|

| By Region |

|

| Key Market Players | Google LLC, Oracle, AlphaSense Inc., Microsoft Corporation, Fujitsu, International Business Machines Corporation, SAP SE, Cognizant, Accenture, HID Global Corporation. |

Analyst Review

As per the insights of the top-level CXOs, the adoption of digital transformation in BFSI has increased over time to improve business insights of organizations and to reduce operational cost of the organization as well as to streamline the business process. In addition, digital transformation helps banks and financial institutions to know what the people actually want & help the organization to fulfil the customer requirement and to strengthen customer engagement with personalized offerings. Furthermore, many banking and insurance industries invest heavily in digital transformation to evaluate their current limitations & obstacles and reduce fraudulent activities in the organization. In addition, various financial institutions adopted digital transformation during the pandemic to carry out various routine issues, which include review of budget.

The CXOs further added that market players have adopted strategies such as partnership for enhancing their services in the market and improving customer satisfaction. For instance, in December 2022, Wipro Limited, a leading technology services and consulting company, announced a partnership with Finastra, a global provider of financial software applications and marketplaces, to drive digital transformation for corporate banks in the Middle East. This multi-year engagement, aligned with the region’s vision to rapidly digitize and bolster cross-border trade, is expected to make Wipro the exclusive implementation and go-to-market partner to deploy Finastra’s trade finance solutions in the region. Together with Finastra’s market-leading product suite, Wipro is projected to help banks transform and digitize the entire trade finance process, thereby enabling automation, optimization, faster time-to-market, and reduced customer response times. This partnership combines Wipro’s expertise, along with its fully-owned affiliates CAPCO and Designit, across Consulting, Digital Transformation, Customer Experience/User Experience (CX/UX), Data & Analytics, Cloud Migration/Adoption, Infrastructure, and Operations. Therefore, such strategies are expected to boost the growth of the digital transformation in BFSI market in the upcoming years.

Moreover, some of the key players profiled in the report are Accenture, Alphasense Inc., Cognizant, FUJITSU, Google, LLC, HID Global Corporation, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation and SAP SE. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Increase in customize IT solutions for specific banking needs, exploration of digital channels to roll out new services, and surge in need of digital services among the fintech companies contribute toward the growth of the market.

The digital transformation in BFSI market is projected to reach $310.67 billion by 2032.

The key players profiled in the report include digital transformation in BFSI market analysis includes top companies operating in the market such as Accenture, Alphasense Inc., Cognizant, FUJITSU, Google, LLC, HID Global Corporation, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation and SAP SE.

The digital transformation in BFSI market is estimated to grow at a CAGR of 16.6% from 2023 to 2032.

The key growth strategies of digital transformation in BFSI players include product portfolio expansion, mergers & acquisitions, agreements, business expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...