Digital Utility Market Research, 2032

The global digital utility market was valued at $214.2 million in 2022 and is projected to reach $594.2 million by 2032, growing at a CAGR of 10.8% from 2023 to 2032.

Report Key Highlighters:

- The digital utility market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The digital utility market is highly fragmented, with several players including ABB Ltd., General Electric Company, Siemens AG, SAP SE, Oracle Corporation., Cisco Systems Inc., Accenture plc, Capgemini SE, Microsoft Corporation, and Schneider Electric SE.

Digital utility refers to the digital transformation of the utility industry through the adoption of digital working methods, typically with business objectives in mind. Common business objectives include more streamlined operations, enhanced consumer interactions, increased efficiencies, and the hope of generating new business models. Investments in the cloud, big data, mobile, biometrics, and modernizing the grid using communication infrastructure, sensors, automation, IT/IoT integration, artificial intelligence, and integrated operation centers are a few examples of the diverse forms that current efforts take.

The power generation, transmission, and distribution industries are rapidly adopting digital devices to enhance plant productivity, dependability, and protection. Smart grids, sensors, and smart meters are digital systems that provide a more accurate and real-time accounting of power consumption to businesses and consumers. These technologies contribute to the enhancement of the productivity, performance, safety, enforcement, and dependability of power generation and distribution. This results in enhanced asset management, planning, and execution, as well as increased customer satisfaction and quality.

Industrialization and urbanization increase the demand for energy.

Global production of renewable energy is now required to satisfy increased energy demand and the depletion of fossil fuels. In 2020, renewable capacity investments were three times greater than coal and gas-fired capacity investments. According to the Energy Information Administration of the United States (EIA), by 2050, renewable energy is expected to account for nearly half of global electricity production. The global demand for electricity has increased due to rise in population, disposable income, and urbanization rates. By 2050, approximately 68% of the global population is expected to reside in urban areas, according to a report by the United Nations. Consequently, the market is anticipated to boost during the forecast period by the growth in the potential for renewable energy in a variety of industries. The need for a massive influx of funds is anticipated to present a challenge to the main players in the industry.

Institute of Energy Economics (IEE) and Financial Analysis estimate that India will need to invest between $60 and $80 billion to enhance its grid infrastructure over the next five years. Globally, electric utilities are expected to invest $3.2 trillion in transmission and distribution infrastructure replacement and expansion. Transformation to digital or modernization of existing infrastructure is expected to necessitate significant capital expenditures, which restricts market expansion. However, the transformation of extant infrastructures and the enhancements and efficiencies of electricity delivery systems support the growth of the digital utility market size.

Increase in investments in renewable energy

The growing focus on renewable energy projects and energy storage devices, thermally activated technologies, and transmission & distribution systems have allowed an increase in investments in renewable energy projects. The United Nations Environment Program published a report indicating that global investment in renewable energy projects increased to $272.9 billion in 2018, signifying the fifth year in a row that the investment exceeded $250 billion. In addition, stringent regulatory standards and an increase in distributed and renewable power generation initiatives drive the expansion of the digital utility industry. Digital utility solutions are in high demand due to the benefits provided by technologies such as digital asset management, digital utility maturity assessment, and digital utility enterprise architecture.

An increase in distribution and renewable power generation initiatives is a key factor that contributes to the expansion of the digital utility market growth. As the resource combines distributed energy resources and new options for delivering and consuming electricity services emerge in the distribution system, power systems around the globe have become less centralized. However, smart energy use and DER deployment are on the rise. DERs are minor players in most power systems when it comes to providing electricity services. Small wind turbines, solar photovoltaic panels, natural gas-powered fuel cells, and emergency backup generators are common forms of distributed energy generation in the residential sector.

The implementation of advanced metering infrastructure and other network sensing infrastructure in the U.S., as well as Europe, reflects the growing digitalization of the power sector owing to the implementation of ICTs, which provides significant opportunities for the growth of the digital utility market. In the U.S., approximately 59 million smart meters have been installed, representing more than 40% of metered sites. Installations of advanced meters in Europe reached 72% by 2020.

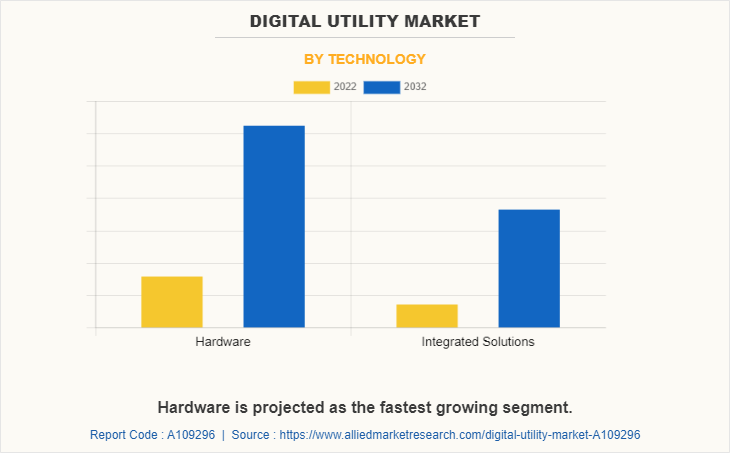

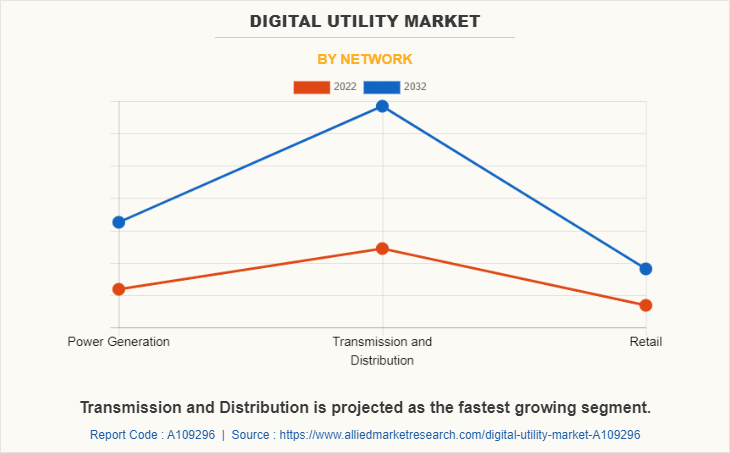

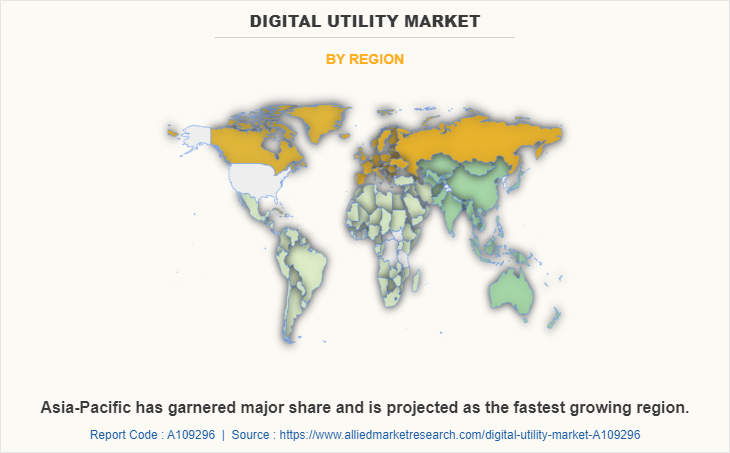

The digital utility market is segmented on the basis of technology, network, and region. By technology, the market is divided into hardware and integrated solutions. On the basis of the network, it is categorized into power generation, transmission and distribution, and retail. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The major players operating in the global digital utility market are ABB Ltd., General Electric Company, Siemens AG, SAP SE, Oracle Corporation., Cisco Systems Inc., Accenture plc, Capgemini SE, Microsoft Corporation, and Schneider Electric SE

The hardware segment accounted for the largest share of nearly three-fifth of the global Digital Utility market revenue and is the fastest-growing segment with a CAGR of 10.9%. Due to substantial investments in smart metering and EV charging, the hardware segment dominated the global market. Furthermore, the hardware is widely used in the apparatus of the next generation. The declining demand for conventional metering systems has increased the preference for technology and smart meters.

The transmission and distribution segment accounted for the largest share of nearly three-fifth of the global Digital Utility market revenue and is the fastest-growing segment with a CAGR of 10.9%. New digital devices and communications and control systems increase the efficacy of assets and enable efficient monitoring and management of electric transmission and distribution systems. Due to the increasing significance of monitoring and management of electric transmission and distribution systems, transmission and distribution solutions are extensively utilized in the utility industry.

Asia-Pacific garnered the largest share more than one-third of the global Digital Utility market revenue. The demand for digital utility solutions is anticipated to be driven by rising domestic electricity demand and altering regional regulatory norms. Increasing infrastructure development activities and energy demand in Asia-Pacific also contribute to the expansion of the regional market. In addition, the China digital utility market held the highest market share, while the Indian digital utility market was the fastest-growing market in the Asia Pacific.

Key development strategies undertaken by key players

On 24th March 2021, ABB reached a milestone in supplying digital utility solutions for 5GW of solar energy projects in India. ABB has significantly scaled up digital utility solutions for renewable energy production.

On 4th June 2019, General Electric, an American multinational corporation, signed a three-year agreement with Enel green power to provide centralized data collection, remote monitoring services, on-site sensor assessment, and predictive analytics solutions to advance its operation and maintenance service.

Market trends

The development of digitalization has made everything more accessible and expedient. In the energy and utility sector, the Industrial Internet of Things (IIoT) has digitized a variety of industrial processes, including power generation, distribution, and transmission. The combination of digital and physical infrastructure is revolutionizing business processes. Digital transformation of utilities has increased the effectiveness of electricity generation, transmission, and distribution. The digital utility market share has expanded capabilities by making physical systems more productive and self-sufficient and by providing more energy usage options.

The entire energy value chain is undergoing digital transformation due to a rise in customer satisfaction concerns in the utility industry. The digital utility market forecast is rapidly implementing cutting-edge digital technologies such as blockchain, artificial intelligence, and machine learning to transform, serve customers, operate, and interact with supply chain partners. Market vendors are emphasizing superior customer service and the introduction of new products to acquire more customers and obtain a competitive advantage.

Digital utility solutions have enabled users to effectively manage energy generation and distribution. The solutions offer capabilities including predictive maintenance, improved safety and efficiency, and increased customer satisfaction. A growing number of renewable power generation initiatives and energy efficiency mandates contribute to the expansion of the digital utility market. The increase in demand for renewable energy and accelerated digitalization contribute to the expansion of the digital utility market scope.

The expanding use of renewable energy sources is anticipated to generate new growth opportunities for the digital utility market. New renewable power generation initiatives have been established owing to the expanding use of renewable energy. Digitalization and connected devices create new growth opportunities in the utility sector. Companies operating in the utility market are on the edge of undergoing a digital transformation and, as a result, are implementing new digital utility solutions that provide consumers with clean energy. Green energy is essential for reducing carbon footprint and maintaining ecological balance.

Impact Of Russia Ukraine War On The Digital Utility Market

The conflict between Russia and Ukraine had significant impacts on the digital utility market. Infrastructure disruption was a major consequence, as utility infrastructure such as power grids, communication networks, and water management systems were damaged or disrupted. This caused interruptions in the operations of digital utility systems and impeded the implementation of new technologies.

Security concerns were heightened due to the conflict, particularly in terms of cybersecurity. Utilities faced increased risks of cyberattacks and data breaches, necessitating the implementation of stronger security measures to safeguard critical infrastructure and customer data.

The conflict also led to delays in utility modernization efforts. Investments and projects related to smart grids, energy management systems, and data analytics were put on hold or delayed due to the uncertainty caused by the geopolitical situation.

Energy supply disruptions were observed as well, affecting natural gas pipelines and electricity transmission networks. These disruptions had a direct impact on the reliability and availability of digital utility services. Regulatory uncertainty emerged because of the conflict, with changing regulatory dynamics and policies. Utilities adapted their digital utility strategies to meet new requirements imposed by the evolving regulatory frameworks.

Collaboration and cooperation within the region's utility sector faced challenges. Joint initiatives and projects aimed at harmonizing digital utility standards, sharing best practices, or integrating cross-border utility systems were impacted or delayed due to the strained regional relations caused by the conflict.

Economically, the conflict had a negative impact, affecting utility budgets and investments. Reduced funding for digital utility projects and slower adoption of new technologies were observed in the market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the digital utility market analysis from 2022 to 2032 to identify the prevailing digital utility market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the digital utility market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global digital utility market trends, key players, market segments, application areas, and market growth strategies.

Digital Utility Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 594.2 million |

| Growth Rate | CAGR of 10.8% |

| Forecast period | 2022 - 2032 |

| Report Pages | 450 |

| By Technology |

|

| By Network |

|

| By Region |

|

| Key Market Players | Accenture plc, ABB Ltd., Capgemini, General Electric Company, Oracle Corporation., Microsoft Corporation, Cisco Systems Inc., Schneider Electric SE., Siemens, SAP SE |

Analyst Review

According to the insights of the CXOs of leading companies, digital utility solutions are in high demand due to the rise in the need for renewable energy and accelerated digitalization. An increase in digital technology adoption and a rise in domestic electricity demand in countries such as China and India are anticipated to drive market growth. An increase in renewable energy production and environmental concerns contribute to the expansion of the market. In addition, the expanding number of government initiatives supporting digital transformation is anticipated to contribute to the expansion of the market. Digital utility solutions aid power facilities to manage their operations more efficiently and reduce their glasshouse gas emissions. In addition, stringent regulatory standards are anticipated to hamper the digital utility market scope during the forecast period.

The digital utility market attained $214.2 million in 2022 and is projected to reach $594.2 million by 2032, growing at a CAGR of 10.8% from 2023 to 2032.

Digital Utility Market is studied across North America, Europe, Asia-Pacific, and LAMEA.

ABB Ltd., General Electric Company, Siemens AG, SAP SE, Oracle Corporation., Cisco Systems Inc., Accenture plc, Capgemini SE, Microsoft Corporation, and Schneider Electric SE are the top companies to hold the market share in Digital Utility.

Increase in digital power plants and digital buildings are the upcoming trends of Digital Utility Market in the world.

Asia-Pacific is the largest regional market for Digital Utility.

The rise in focus on energy utility operations efficiency and the increase in investments in renewable energy are the driving factor of the Digital Utility Market.

Transmission and distribution is the leading Network of Digital Utility Market.

Loading Table Of Content...

Loading Research Methodology...